MGP Ingredients has been treading water for the past six months, recording a small loss of 3.6% while holding steady at $26.24. The stock also fell short of the S&P 500’s 9.1% gain during that period.

Is there a buying opportunity in MGP Ingredients, or does it present a risk to your portfolio? Get the full stock story straight from our expert analysts, it’s free.

Why Do We Think MGP Ingredients Will Underperform?

We're cautious about MGP Ingredients. Here are three reasons we avoid MGPI and a stock we'd rather own.

1. Revenue Spiraling Downwards

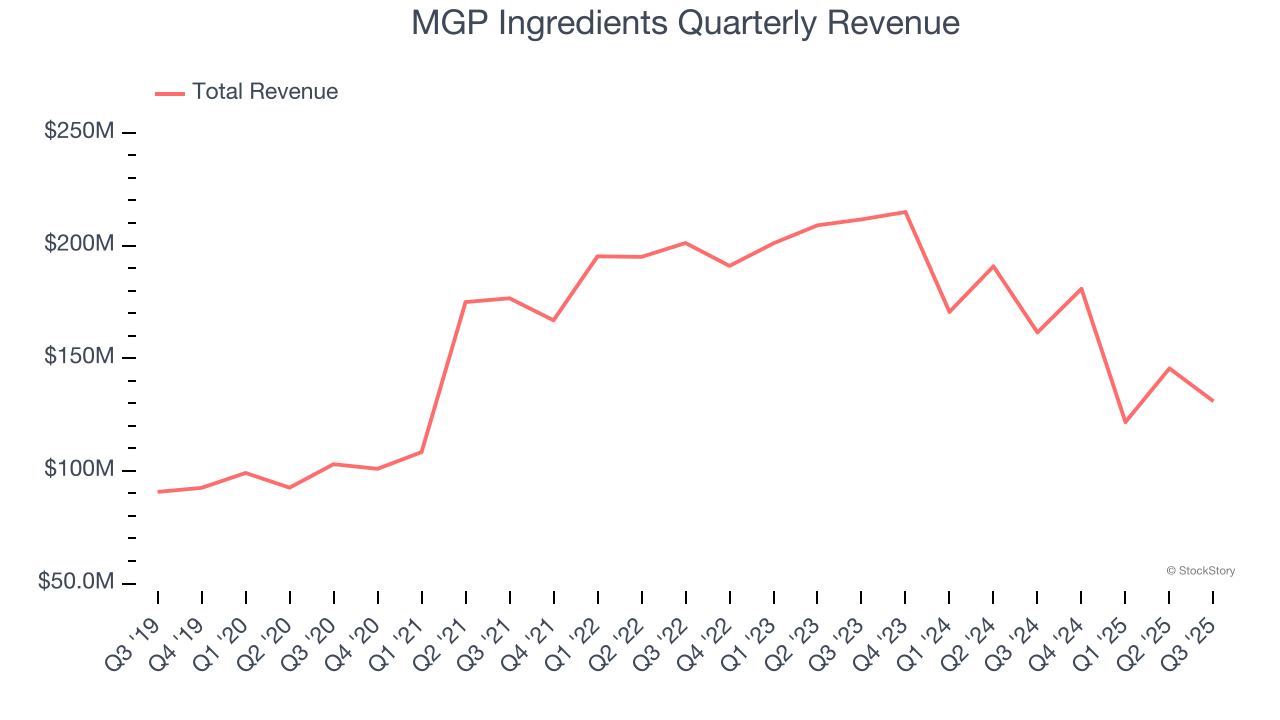

A company’s long-term sales performance can indicate its overall quality. Any business can have short-term success, but a top-tier one grows for years. Over the last three years, MGP Ingredients’s demand was weak and its revenue declined by 8.6% per year. This wasn’t a great result and signals it’s a low quality business.

2. Revenue Projections Show Stormy Skies Ahead

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect MGP Ingredients’s revenue to drop by 11.3%, a decrease from This projection is underwhelming and suggests its products will face some demand challenges.

3. Shrinking Operating Margin

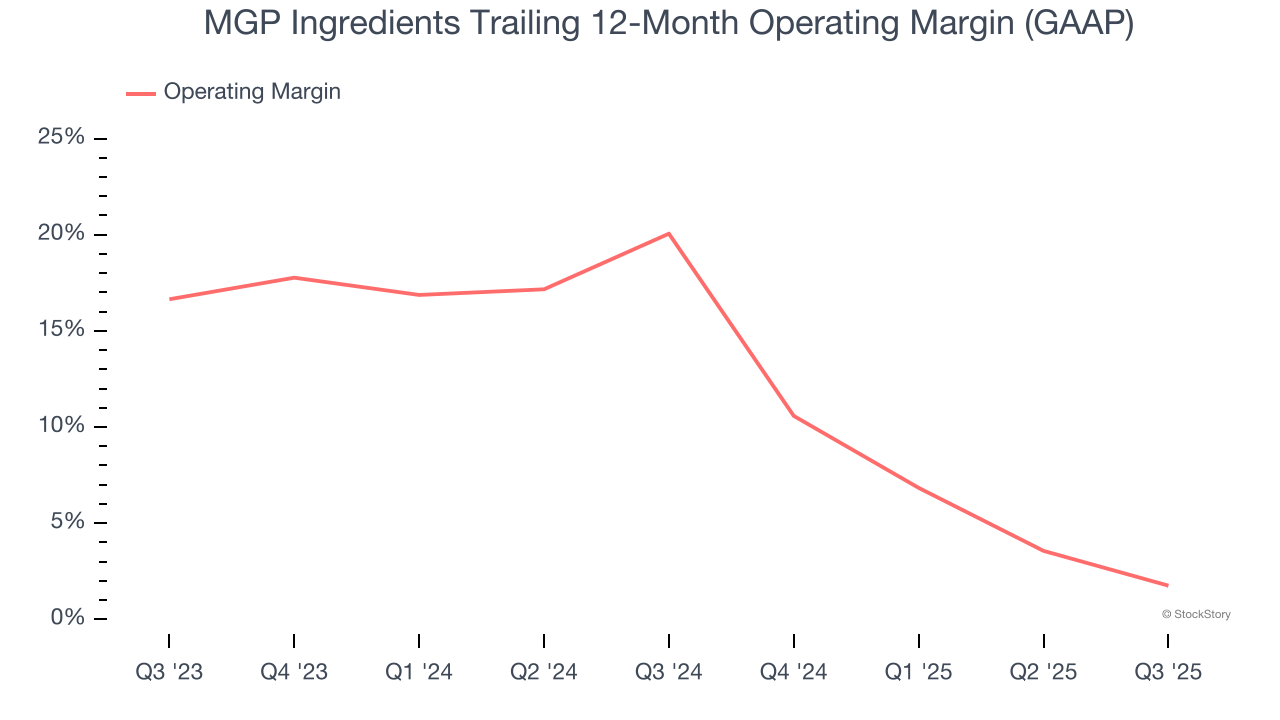

Operating margin is an important measure of profitability accounting for key expenses such as marketing and advertising, IT systems, wages, and other administrative costs.

Analyzing the trend in its profitability, MGP Ingredients’s operating margin decreased by 18.3 percentage points over the last year. Even though its historical margin was healthy, shareholders will want to see MGP Ingredients become more profitable in the future. Its operating margin for the trailing 12 months was 1.8%.

Final Judgment

MGP Ingredients doesn’t pass our quality test. With its shares underperforming the market lately, the stock trades at 11.2× forward P/E (or $26.24 per share). While this valuation is fair, the upside isn’t great compared to the potential downside. There are more exciting stocks to buy at the moment. We’d recommend looking at a dominant Aerospace business that has perfected its M&A strategy.

Stocks We Like More Than MGP Ingredients

Your portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily.

The names generating the next wave of massive growth are right here in our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.

/Microsoft%20sign%20at%20the%20headquarters%20by%20VDB%20Photos%20via%20Shutterstock.jpg)