Life sciences company Avantor (NYSE:AVTR) reported Q4 CY2025 results exceeding the market’s revenue expectations, but sales fell by 1.4% year on year to $1.66 billion. Its non-GAAP profit of $0.22 per share was in line with analysts’ consensus estimates.

Is now the time to buy Avantor? Find out by accessing our full research report, it’s free.

Avantor (AVTR) Q4 CY2025 Highlights:

- Revenue: $1.66 billion vs analyst estimates of $1.64 billion (1.4% year-on-year decline, 1.5% beat)

- Adjusted EPS: $0.22 vs analyst estimates of $0.22 (in line)

- Adjusted EBITDA: $252.2 million vs analyst estimates of $260.5 million (15.2% margin, 3.2% miss)

- Operating Margin: 7.6%, down from 37.8% in the same quarter last year

- Free Cash Flow Margin: 7%, down from 8.6% in the same quarter last year

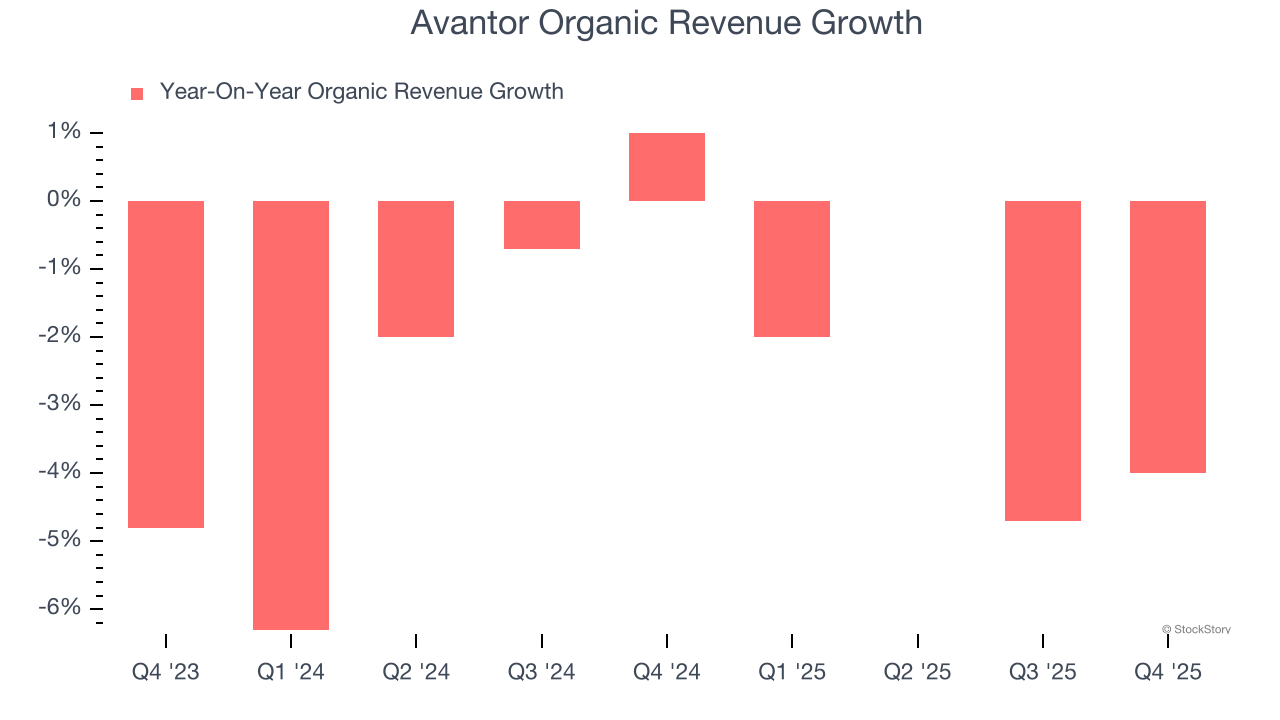

- Organic Revenue fell 4% year on year (beat)

- Market Capitalization: $7.61 billion

RADNOR, Pa., Feb. 11, 2026 /PRNewswire/ -- Avantor, Inc. (NYSE: AVTR), a leading global provider of mission-critical products and services to customers in the life sciences and advanced technology industries, today reported financial results for its fourth fiscal quarter and year ended December 31, 2025."Through the Revival program we initiated last quarter, we are building a more agile company that is better organized around the needs of our customers. The entire team is energized around a clear set of strategic priorities, and we have already made important changes to how we run the business, including optimizing our go-to-market strategy, relaunching the VWR brand, implementing critical improvements, and upgrading our e-commerce channel," said Emmanuel Ligner, President and Chief Executive Officer.

Company Overview

With roots dating back to 1904 and embedded in virtually every stage of scientific research and production, Avantor (NYSE:AVTR) provides mission-critical products, materials, and services to customers in biopharma, healthcare, education, and advanced technology industries.

Revenue Growth

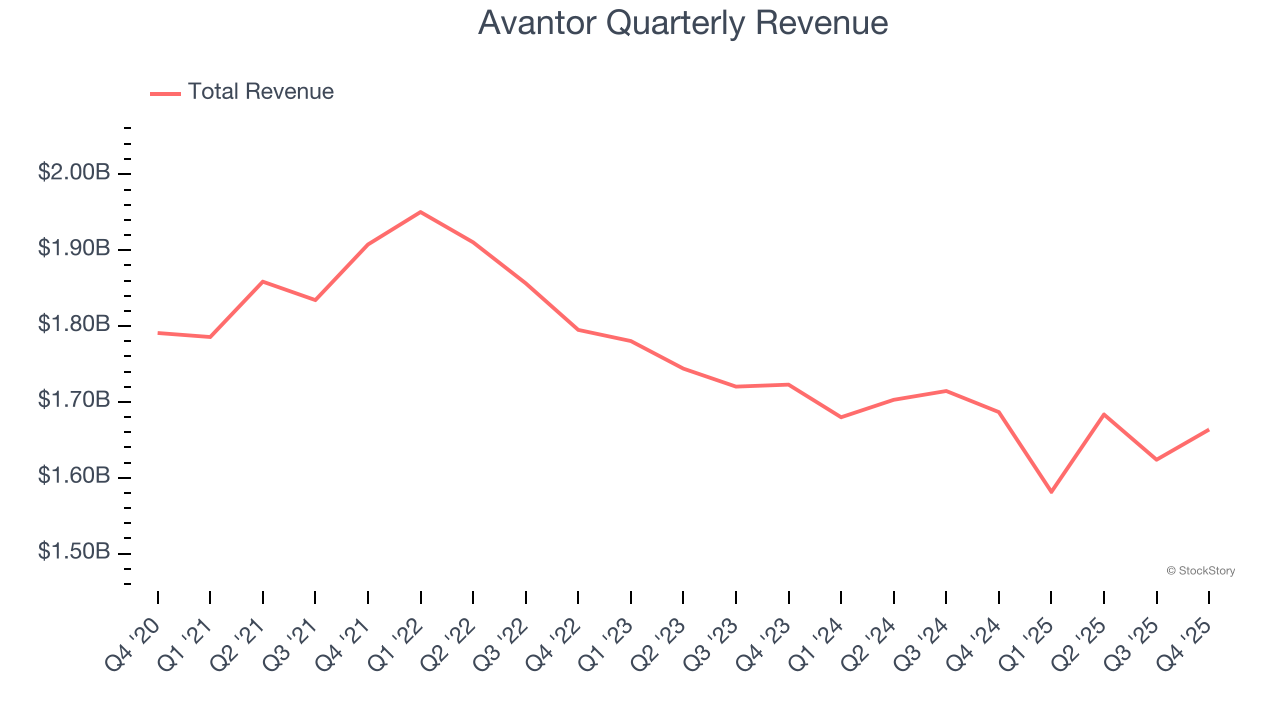

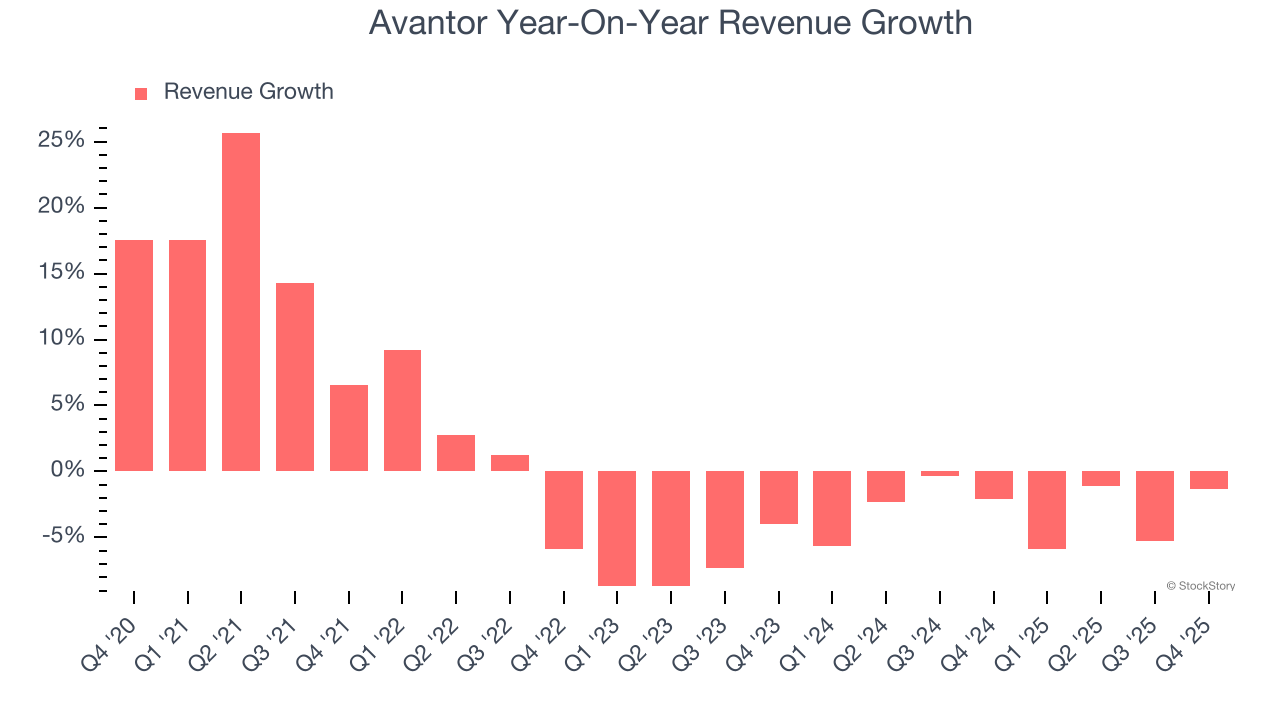

Examining a company’s long-term performance can provide clues about its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Unfortunately, Avantor struggled to consistently increase demand as its $6.55 billion of sales for the trailing 12 months was close to its revenue five years ago. This was below our standards and suggests it’s a low quality business.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Avantor’s recent performance shows its demand remained suppressed as its revenue has declined by 3% annually over the last two years.

We can better understand the company’s sales dynamics by analyzing its organic revenue, which strips out one-time events like acquisitions and currency fluctuations that don’t accurately reflect its fundamentals. Over the last two years, Avantor’s organic revenue averaged 2.3% year-on-year declines. Because this number aligns with its two-year revenue growth, we can see the company’s core operations (not acquisitions and divestitures) drove most of its results.

This quarter, Avantor’s revenue fell by 1.4% year on year to $1.66 billion but beat Wall Street’s estimates by 1.5%.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months. While this projection suggests its newer products and services will catalyze better top-line performance, it is still below average for the sector.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Adjusted Operating Margin

Adjusted operating margin is a key measure of profitability. Think of it as net income (the bottom line) excluding the impact of non-recurring expenses, taxes, and interest on debt - metrics less connected to business fundamentals.

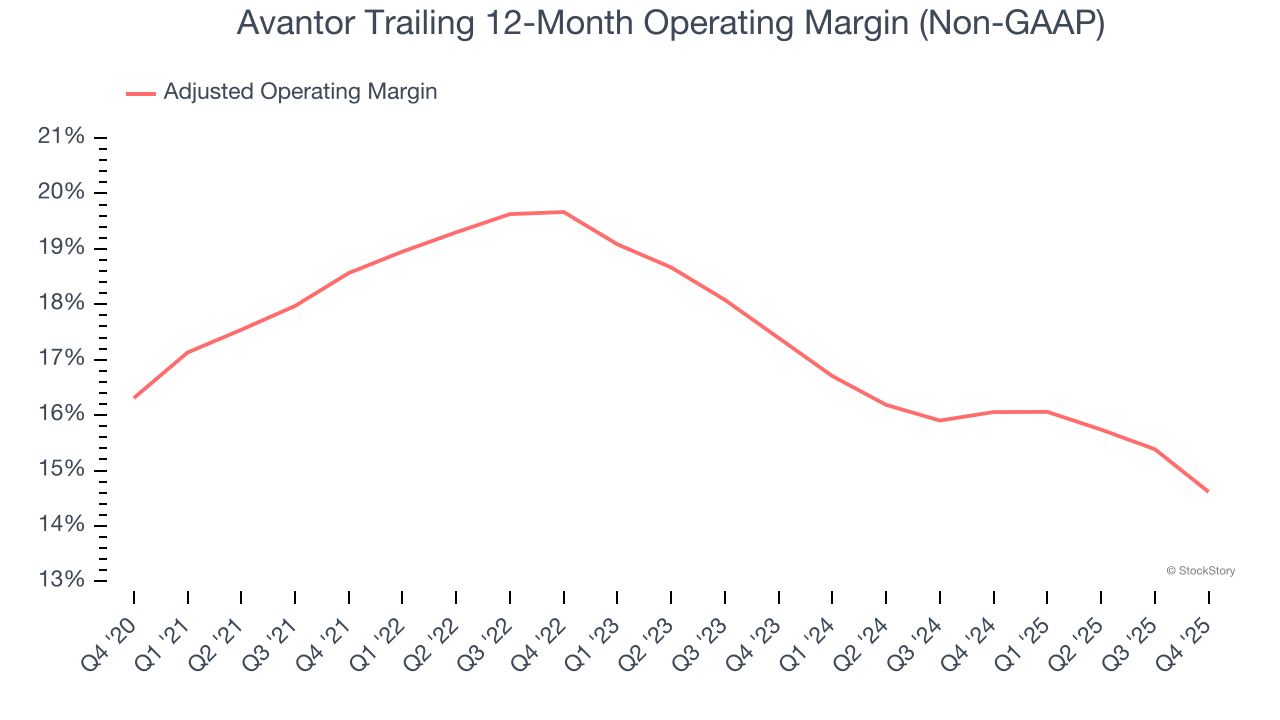

Avantor has managed its cost base well over the last five years. It demonstrated solid profitability for a healthcare business, producing an average adjusted operating margin of 17.3%.

Analyzing the trend in its profitability, Avantor’s adjusted operating margin decreased by 3.9 percentage points over the last five years. The company’s two-year trajectory also shows it failed to get its profitability back to the peak as its margin fell by 2.8 percentage points. This performance was poor no matter how you look at it - it shows its expenses were rising and it couldn’t pass those costs onto its customers.

In Q4, Avantor generated an adjusted operating margin profit margin of 13.5%, down 3 percentage points year on year. This contraction shows it was less efficient because its expenses increased relative to its revenue.

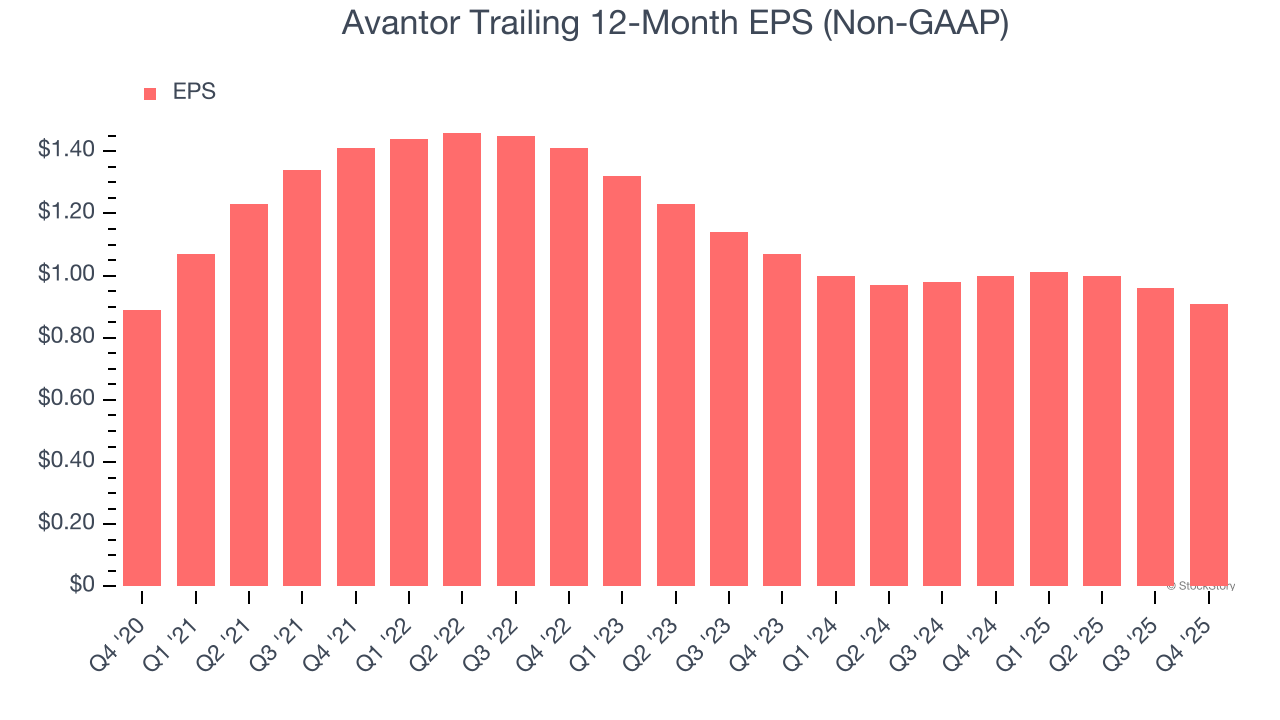

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Avantor’s EPS was flat over the last five years, just like its revenue. This performance was underwhelming across the board.

In Q4, Avantor reported adjusted EPS of $0.22, down from $0.27 in the same quarter last year. Despite falling year on year, this print beat analysts’ estimates by 1.5%. Over the next 12 months, Wall Street expects Avantor’s full-year EPS of $0.91 to stay about the same.

Key Takeaways from Avantor’s Q4 Results

It was good to see Avantor narrowly top analysts’ organic revenue expectations this quarter. We were also happy its revenue outperformed Wall Street’s estimates. Overall, this print had some key positives. Investors were likely hoping for more, and shares traded down 7.6% to $10.32 immediately after reporting.

Is Avantor an attractive investment opportunity right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here (it’s free).

/Amazon%20-%20Image%20by%20bluestork%20via%20Shutterstock.jpg)

/NVIDIA%20Corp%20logo%20outside%20building-by%20BING-JHEN_HONG%20via%20iStock.jpg)

/Amazon%20pickup%20%26%20returns%20building%20by%20Bryan%20Angelo%20via%20Unsplash.jpg)