Suncor Energy (SU), the Canadian oil sands producer, declared a 23.8% hike in its dividend on February 14. This is attracting value buyers with its 4.37% dividend yield plans to buy back 10% of its shares. It also makes shorting OTM puts and calls attractive.

At $35.12 per share, SU stock has a 4.35% annual dividend yield, based on its quarterly C$0.52 dividend rate. That works out to an annual U.S. dollar dividend of just less than $1.53 (i.e., C$0.52 x $0.7335 FX rate x 4 = $1.5288).

This makes the stock very attractive to value investors. This is because its underlying business, extracting energy from oil sands, is stable and its fields have a low decline rate, according to one analyst.

Moreover, the company announced it expects to buy back up to 10% of its shares outstanding. In 2022, it repurchased a record 116.9 million common shares, or 8.1% of its shares as of December 31, 2021.

This is exactly what value investors like to see. I pointed this out in a recent article about share buybacks. The net result is that the dividend per share rises more quickly over time than otherwise would be the case.

Shorting Out-of-the-Money Puts and Calls Are Attractive

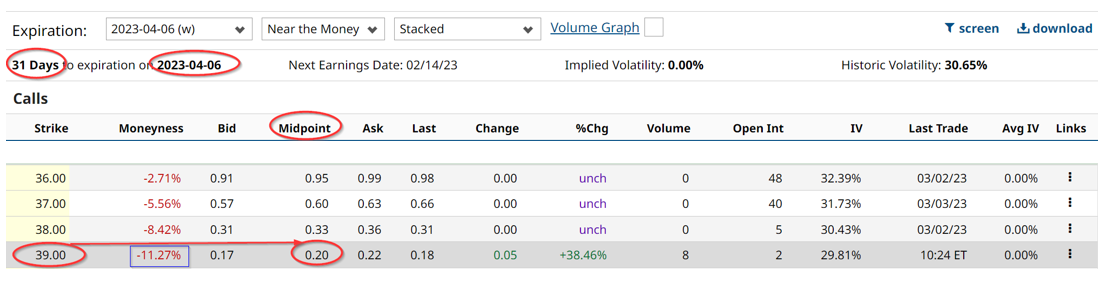

This makes shorting out-of-the-money (OTM) puts and calls to create extra monthly income. For example, the $39.00 strike price calls for the period ending April 6, 2023, trade for 20 cents per call option. This is ideal for a value investor since the strike price is over 11% higher than today's price.

Moreover, that works out to an average yield of 0.56% based on today's price. On an annualized basis, assuming this is repeated each month, the investor makes a 6.81% return.

Another way to play this for additional income is to short OTM puts. For example, the April 6, 2023 expiration puts show that the $31 strike price also trades for 20 cents. This is also 11% away from today's price.

But, in this case, the yield is higher since the investor only has to put up $31.00 x 100 shares, or $3100 to make this trade. That means that the yield is 0.645% (i.e., $0.20/$31), or 7.7% on an annualized basis. The reason is the investor has a lower denominator or less money at risk for the same return.

The bottom line here is that value investors can make extra income on top of Suncor Energy's ample 4.35% dividend yield by conservatively shorting puts and calls.

More Stock Market News from Barchart

- Tesla’s Price Cuts Spark Price War with Chinese Electric Vehicle Makers

- Stocks Rise on Strength in Apple and Lower Bond Yields

- Markets Today: Stock Indexes Push Higher on Weaker Bond Yields

- Option Volatility And Earnings Report For Mar 6 - 10

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20sign%20at%20the%20headquarters%20by%20VDB%20Photos%20via%20Shutterstock.jpg)

/2d%20illustration%20of%20Cloud%20computing%20by%20Blackboard%20via%20Shutterstock.jpg)