Home-building design and manufacturing company Masco Corporation (NYSE:MAS) fell short of the market’s revenue expectations in Q4 CY2025, with sales falling 1.9% year on year to $1.79 billion. Its non-GAAP profit of $0.82 per share was 3.2% above analysts’ consensus estimates.

Is now the time to buy Masco? Find out by accessing our full research report, it’s free.

Masco (MAS) Q4 CY2025 Highlights:

- Revenue: $1.79 billion vs analyst estimates of $1.82 billion (1.9% year-on-year decline, 1.5% miss)

- Adjusted EPS: $0.82 vs analyst estimates of $0.79 (3.2% beat)

- Adjusted EBITDA: $298 million vs analyst estimates of $294.8 million (16.6% margin, 1.1% beat)

- Adjusted EPS guidance for the upcoming financial year 2026 is $4.20 at the midpoint, in line with analyst estimates

- Operating Margin: 13.8%, down from 15.9% in the same quarter last year

- Free Cash Flow Margin: 20.7%, up from 19.2% in the same quarter last year

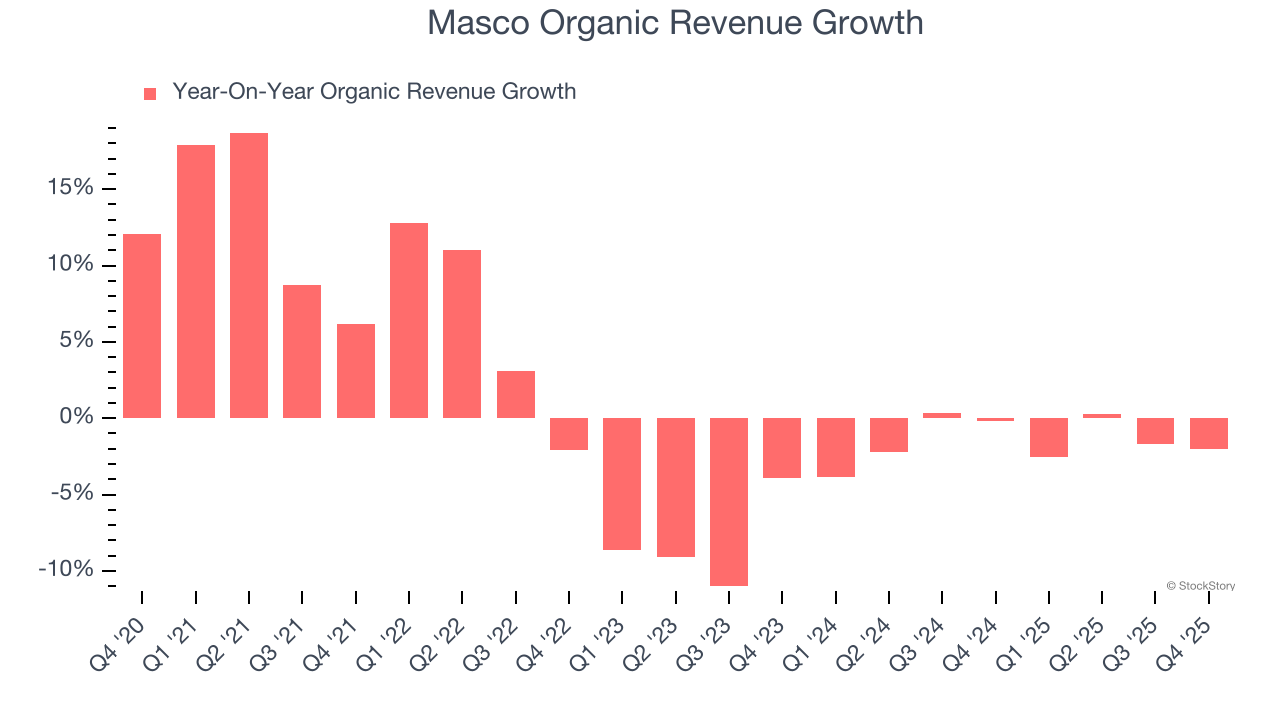

- Organic Revenue fell 2% year on year (miss)

- Market Capitalization: $14.87 billion

Company Overview

Headquartered just outside of Detroit, MI, Masco (NYSE:MAS) designs and manufactures home-building products such as glass shower doors, decorative lighting, bathtubs, and faucets.

Revenue Growth

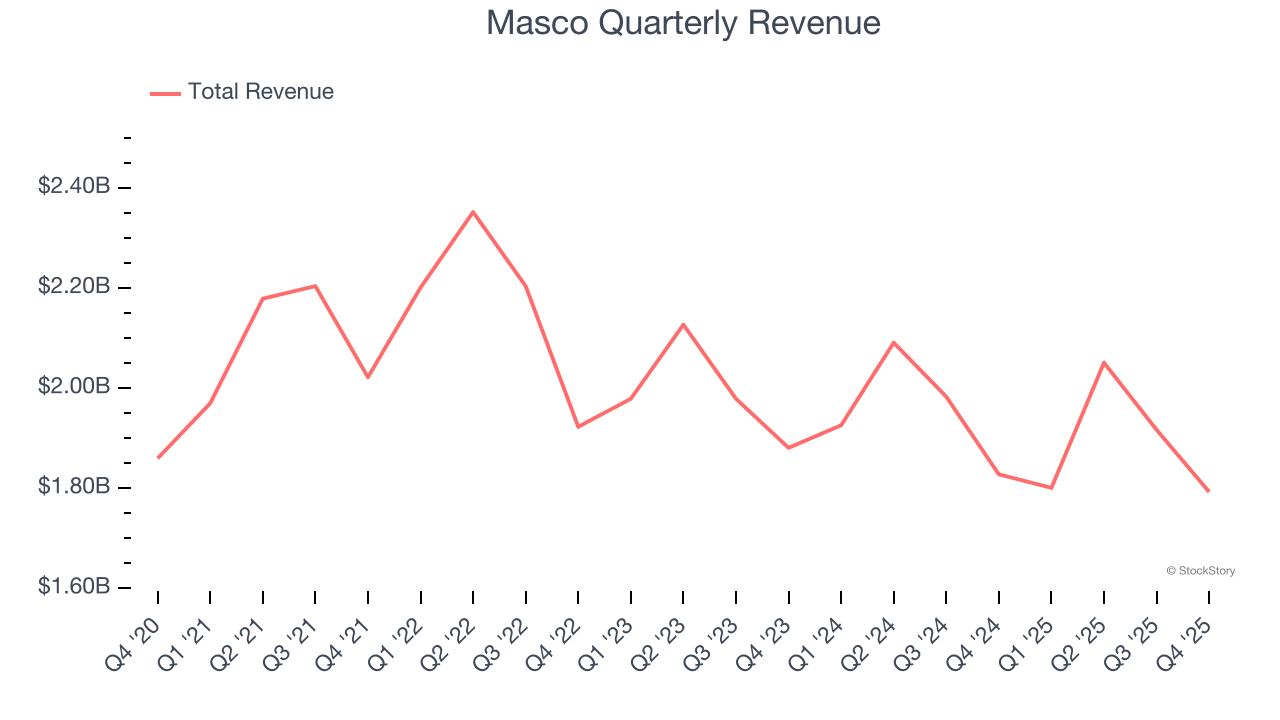

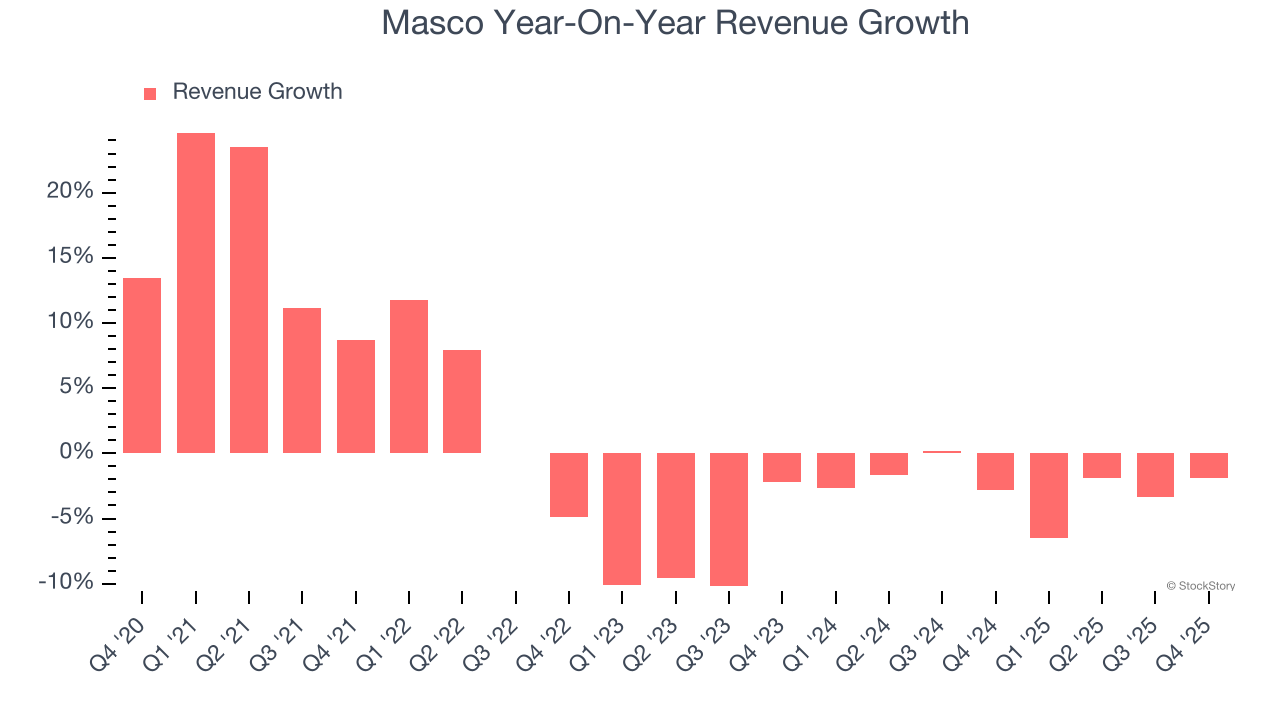

A company’s long-term sales performance can indicate its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Unfortunately, Masco’s 1% annualized revenue growth over the last five years was weak. This was below our standards and is a rough starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Masco’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 2.6% annually.

We can dig further into the company’s sales dynamics by analyzing its organic revenue, which strips out one-time events like acquisitions and currency fluctuations that don’t accurately reflect its fundamentals. Over the last two years, Masco’s organic revenue averaged 1.5% year-on-year declines. Because this number aligns with its two-year revenue growth, we can see the company’s core operations (not acquisitions and divestitures) drove most of its results.

This quarter, Masco missed Wall Street’s estimates and reported a rather uninspiring 1.9% year-on-year revenue decline, generating $1.79 billion of revenue.

Looking ahead, sell-side analysts expect revenue to grow 3.2% over the next 12 months. Although this projection suggests its newer products and services will catalyze better top-line performance, it is still below the sector average.

Microsoft, Alphabet, Coca-Cola, Monster Beverage—all began as under-the-radar growth stories riding a massive trend. We’ve identified the next one: a profitable AI semiconductor play Wall Street is still overlooking. Go here for access to our full report.

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

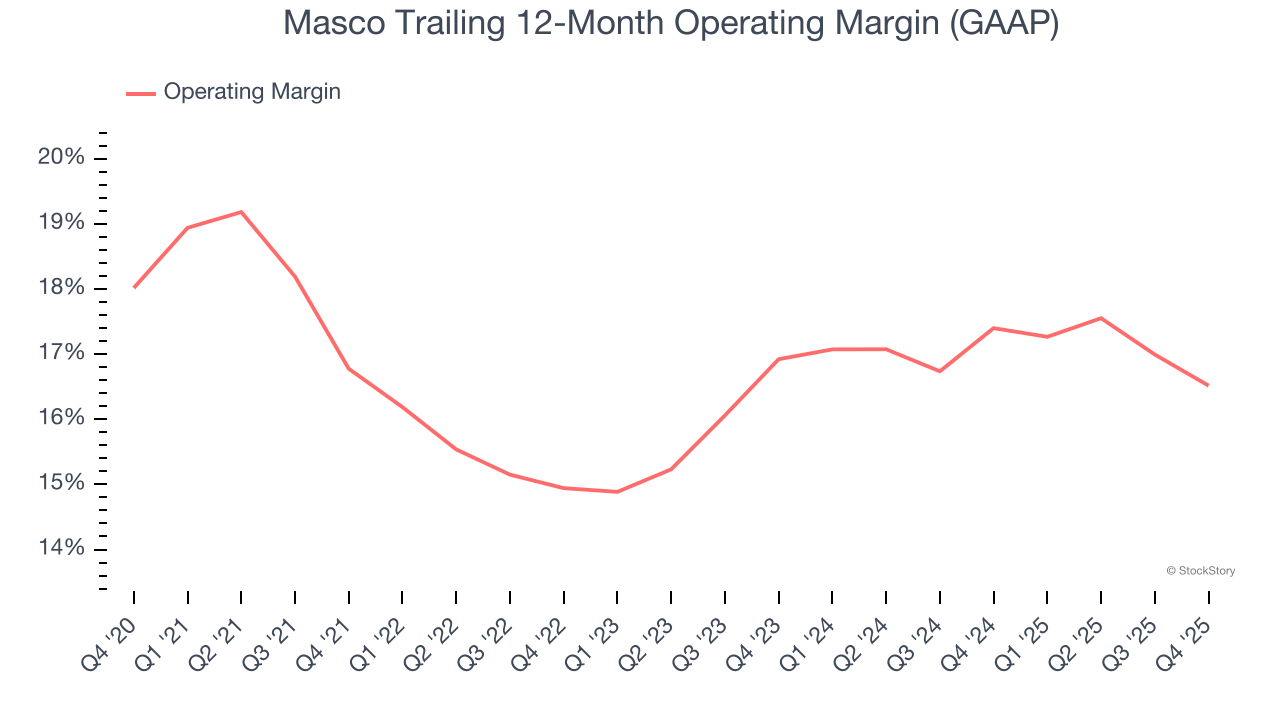

Masco’s operating margin might fluctuated slightly over the last 12 months but has generally stayed the same, averaging 16.5% over the last five years. This profitability was elite for an industrials business thanks to its efficient cost structure and economies of scale. This result isn’t too surprising as its gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, Masco’s operating margin might fluctuated slightly but has generally stayed the same over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, Masco generated an operating margin profit margin of 13.8%, down 2 percentage points year on year. Since Masco’s operating margin decreased more than its gross margin, we can assume it was less efficient because expenses such as marketing, R&D, and administrative overhead increased.

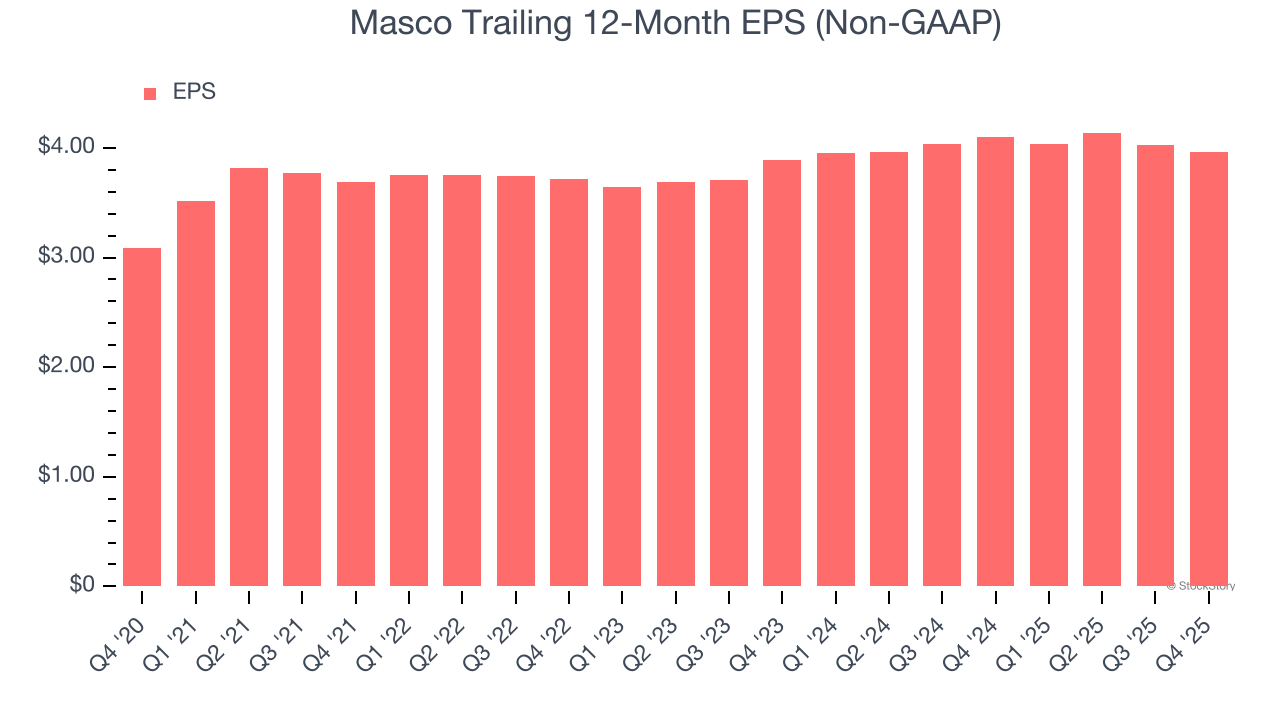

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

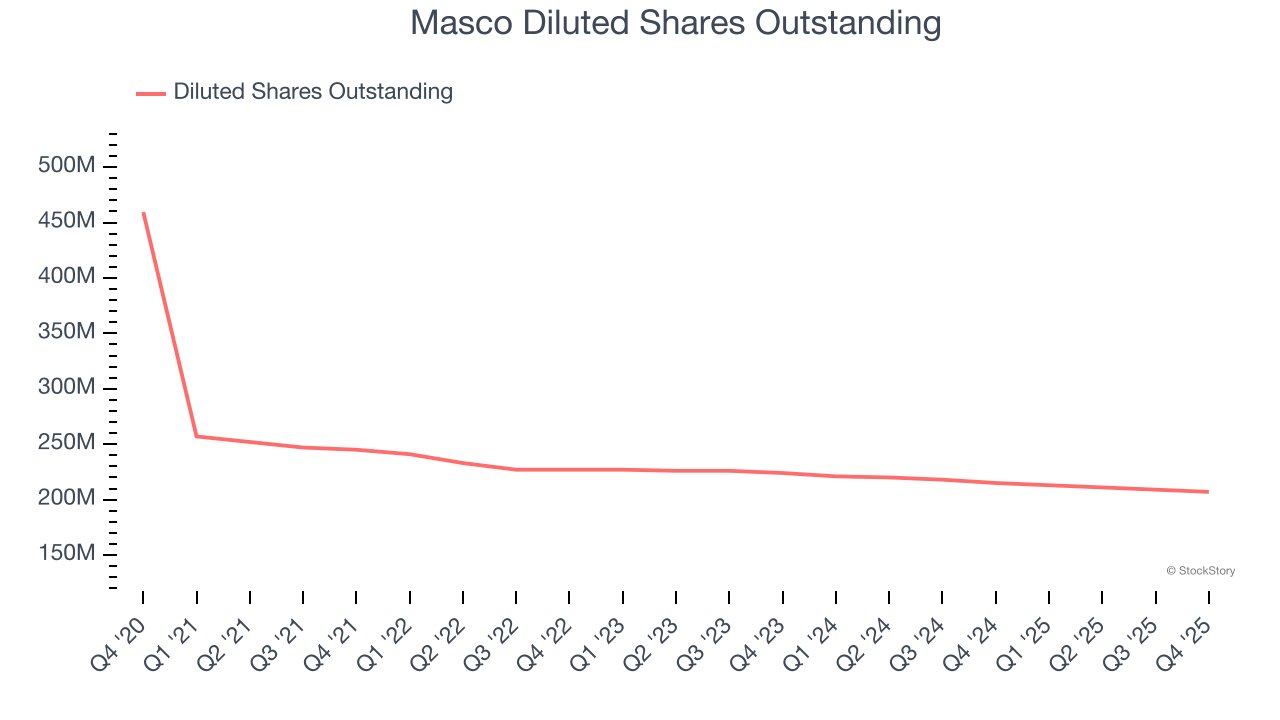

Masco’s EPS grew at an unimpressive 5.1% compounded annual growth rate over the last five years. This performance was better than its flat revenue but doesn’t tell us much about its business quality because its operating margin didn’t improve.

We can take a deeper look into Masco’s earnings to better understand the drivers of its performance. A five-year view shows that Masco has repurchased its stock, shrinking its share count by 54.9%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Masco, EPS didn’t budge over the last two years, a regression from its five-year trend. We hope it can revert to earnings growth in the coming years.

In Q4, Masco reported adjusted EPS of $0.82, down from $0.89 in the same quarter last year. Despite falling year on year, this print beat analysts’ estimates by 3.2%. Over the next 12 months, Wall Street expects Masco’s full-year EPS of $3.96 to grow 5.7%.

Key Takeaways from Masco’s Q4 Results

It was good to see Masco narrowly top analysts’ EBITDA expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. On the other hand, its revenue slightly missed and its organic revenue fell slightly short of Wall Street’s estimates. Overall, this quarter was mixed. The stock traded up 4.7% to $74.98 immediately after reporting.

So do we think Masco is an attractive buy at the current price? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here (it’s free).