Rare earth metals are a group of seventeen metallic elements located in the middle of the periodic table, with unusual fluorescent, conductive, and magnetic properties. Rare earth metals are the commodities of today and tomorrow as technology depends on their availability. Smartphones, computers, flat panel televisions, computer drive motors, batteries in hybrid and electric vehicles, and new generation light bulbs all require rare earth metals, as do a host of military and other high-tech products.

I last wrote about rare earth metals and the VanEck Rare Earth Strategic Metals ETF product (REMX) on Barchart in mid-September 2022. At that time, the ETF was trading at the $102.81 level. The price has declined to below $90 per share, which could make REMX a bargain given the growing importance of these metals.

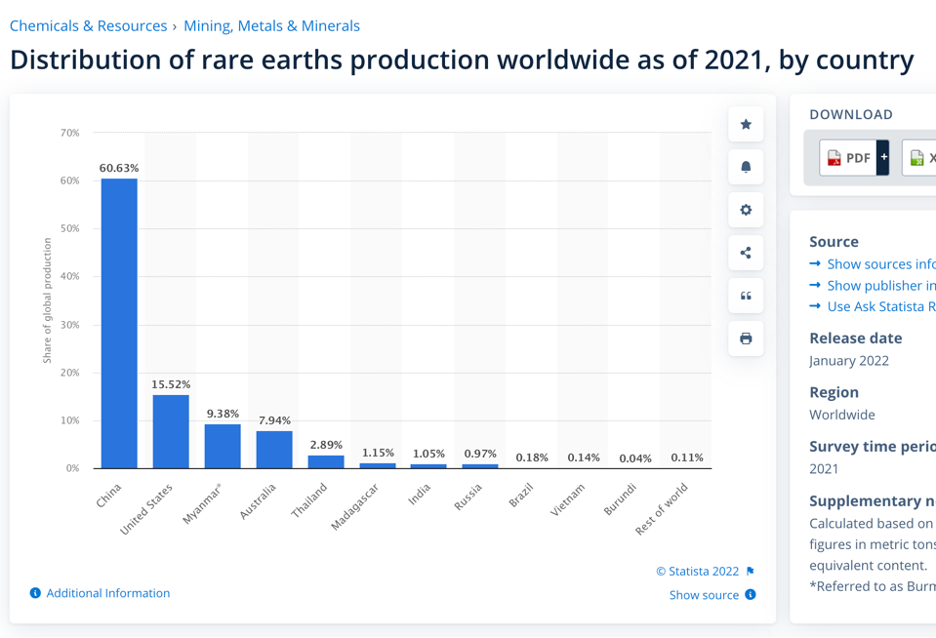

China remains the 800-pound REM gorilla

China dominates the worldwide distribution of rare earth metals.

Source: Statista

The chart shows that China distributed nearly four times as many rare earth metals as the US, the second-leading producing and distributing country, in 2021. China has reached its dominating position through its domestic output and strategic investments in other producing countries worldwide, and China is the leading refiner and processor.

The geopolitical landscape is tense

The US tech sector depends on rare earth metals, which is an issue given the deterioration of trade and other relations between Washington, DC, and Beijing. Trade relations between the US and China became strained under the previous US administration as it levied tariffs on China. In February 2022, the relations went from bad to worse as the “no-limits” alliance between China and Russia paved the way for Russia’s invasion of Ukraine.

While Russia considers Ukraine nothing more than western Russia, China believes Taiwan is an island under its umbrella and has long advocated for reunification. The US, Europe, Japan, and allies worldwide believe Ukraine is a sovereign country in Eastern Europe and Taiwan is an independent Asian nation.

The bottom line is that the geopolitical temperature has risen in 2022. Russia has used commodities, including oil, gas, fertilizers, and others, as economic weapons against “unfriendly” countries supporting Ukraine. A continuation of deteriorating relations between the US and China could cause Beijing to limit rare earth metal exports and supplies.

Rare earth metals are not that rare, but the mining and processing is far from green

The term “rare” in rare earth metals is misleading. A 2019 article in Scientific American pointed out that a US Geological Survey describes the metals as “relatively abundant in the Earth’s crust.” Meanwhile, the extraction process is complicated as the elements are jumbled together with many other minerals in different concentrations, and the refining process makes them a challenge. The article provided a valuable chart that outlined the uses of the 17 metals, the control of the world market, and the countries dependent on them.

Source: Scientific American

The issue with processing rare earth metals is that they can be environmentally hazardous. China dominates refining and processing because it has most of the world’s separation facilities.

The US and Europe are scrambling to secure supplies

Realizing that rare earth metals are critical for technology, the US Biden-Harris administration has taken action to ensure the metals and develop a secure supply chain that meets future US requirements. The administration has earmarked $200 million to support rare earth metal production.

Meanwhile, in a 2015 report from the European Commission, the European Union is also working on rare earth metal deposits in Sweden, Finland, Greece, and Spain to shore up its tech industry. While the US and Europe have acknowledged the importance of REM supplies, the environmentalists will be a roadblock as the processing and refining during the separation process continues to pose significant threats.

REMX holds non-Chinese REM mining and processing companies

The fund summary for the REMX ETF states:

The latest top holdings include:

At $88.72, REMX had over $722 million in assets under management and trades an average of over 104,000 shares daily. REMX charges a 0.53% management fee and it pays a $5.89 dividend, translating to a 6.64% yield, more than compensating for the ETF’s expense ratio.

There are few diversified investment choices for the rare earth metals sector. REMX is a liquid ETF that provides exposure to the commodities required for technological advances.

More Metals News from Barchart

- Stocks Lower on Chinese Covid Concerns

- Copper Attempts To Break Higher- The Prospects Remain Bullish

- Dollar Gains on Higher T-note Yields

- Stocks See Support from Retailer and Trade News

/Microsoft%20sign%20at%20the%20headquarters%20by%20VDB%20Photos%20via%20Shutterstock.jpg)