/Technology%20-%20daniel-josef-AMssSjUaTY4-unsplash.jpg)

Cisco Systems (CSCO) reported excellent earnings on Nov. 16 with good revenue and earnings outlook. CSCO stock moved up as a result, and the stock is starting to look cheap based on its outlook. Moreover, out-of-the-money call and put options can provide good additional income plays.

The stock rose over 6% in the last week and is now up over 14% over the previous month. However, year-to-date (YTD) CSCO is still down over 24% and off almost 11% in the past year.

The network and switching equipment and software company reported that its revenue was up 6% year-over-year (YoY). In addition, its non-GAAP (Generally Accepted Accounting Principles) earnings were actually up 5% to 86 cents per share.

Strong Free Cash Flow Funds Shareholder Returns

Moreover, the company has strong free cash flow (FCF) which funds its dividends and buyback activities on behalf of shareholders.

For example, after capex spending, FCF for the quarter ending Oct. 29 came in at $3.786 billion. That compares to $3.305 billion in the prior year's quarter, up by $481 million or almost 15% (+14.6%).

It also rose from $3.588 billion last quarter, or up 5.5% on a QoQ basis. The good news with that is the company's FCF is on a run rate growth of over 22% in terms of FCF.

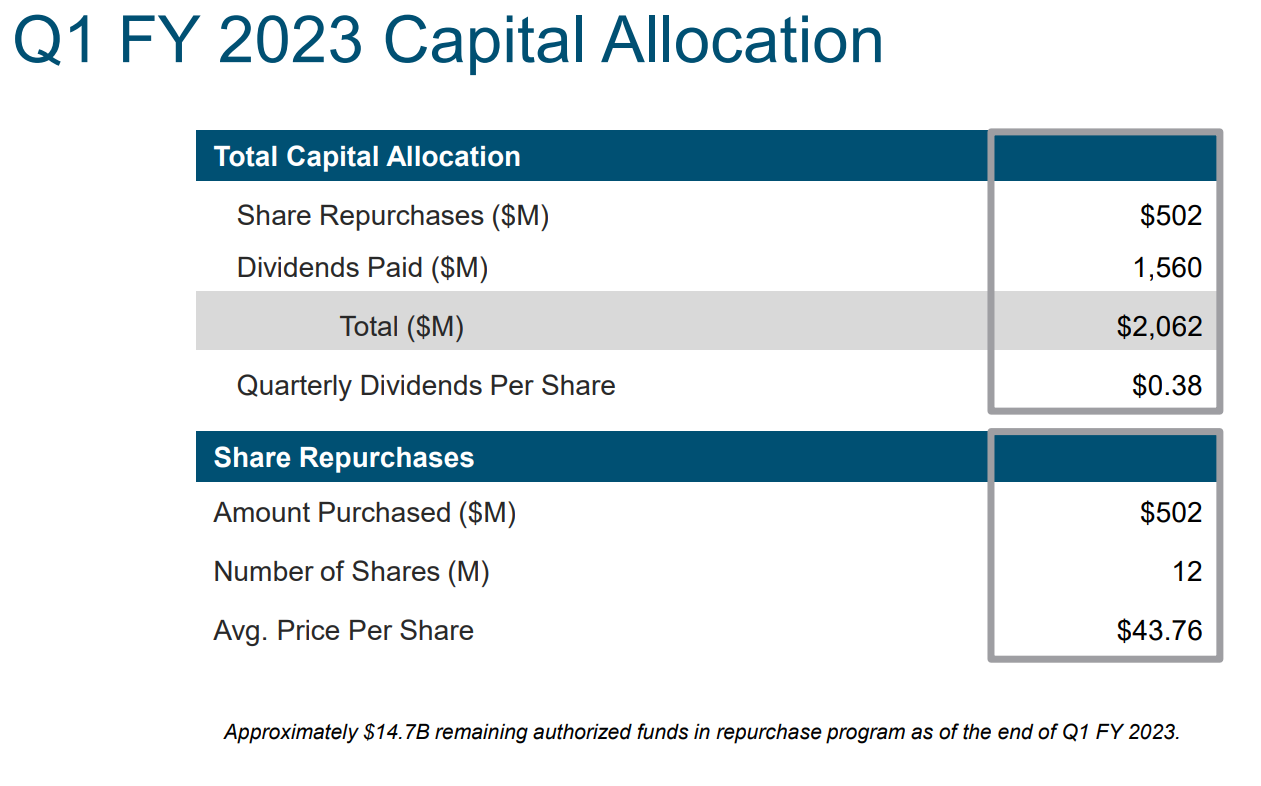

As a result, the company said it returned $2.1 billion to stockholders through share buybacks and dividends. This included $1.6 billion in dividends at 38 cents per share and $0.5 billion in 12 million shares it repurchased.

The stock now has an annual dividend yield of 3.18% (i.e., $1.52/$47.79). Moreover, its annual buyback rate of $2.0 billion works out to a buyback yield of 1.0%, given its $191 billion market value. That gives shareholders a total yield of over 4.18%.

Option Income Plays Look Attractive

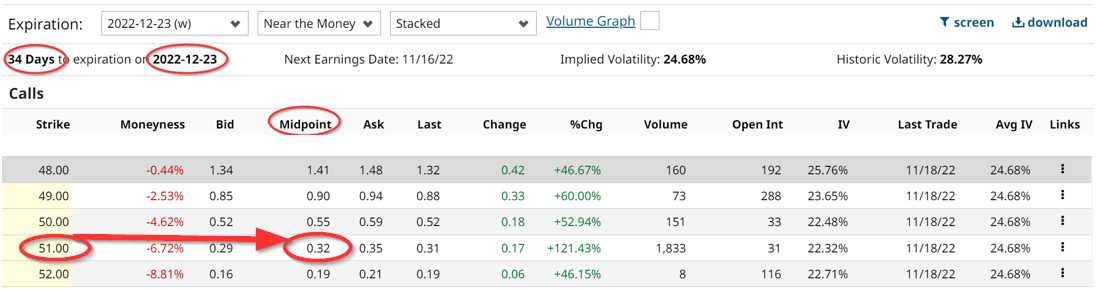

Investors who sell covered calls and puts at out-of-the-money (OTM) strike prices can bring attractive income opportunities. For example, the call options expiring Dec. 23 at the $51.00 strike price offer a premium of 32 cents per call contract.

That represents a potential income yield of 0.67% for a strike price that is 6.7% above today's price. For example, if an investor buys 100 shares at $47.79 for $4,779, they can sell the $51 strike price expiring on Dec. 23 and immediately receive $32.00. If this is done every month, the investor makes an annualized yield of over 8.06% (i.e., assuming the stock stays level, which it likely won't).

Moreover, even if CSCO stock rises to $51.00 by Dec. 23, the covered call investor gets to keep both the $32 already received as well as the proceeds from the $5,100 sale of 100 shares. That represents a total return of 7.39% (i.e., $5,132/$4,779-1). However, the investor misses out if the stock rises above $51.32 per share by Dec. 23. Nevertheless, a one-month return of 7.39% is a very high annualized ROI, if it can be repeated each month.

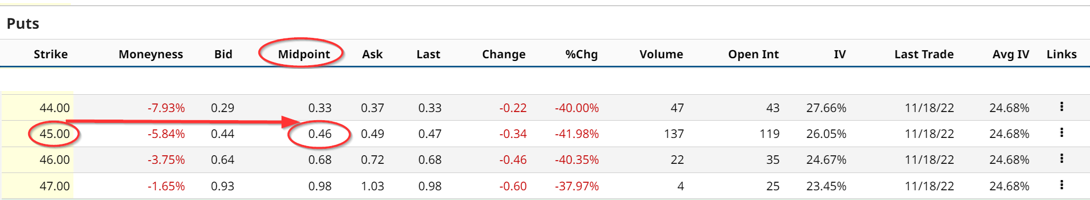

The same is true with OTM puts that an investor sells short on a cash-secured basis. For example, if the investor were to put up $4,500 with their brokerage firm (or use up their margin to do so), they can sell one put contract at $45.00 per share for the same Dec. 23 expiration period. This is almost 6.0% below today's price.

As a result, the investor receives $0.46 per put contract or $46 for the $4,500 in cash put up with the brokerage firm. That represents a full 1.0% yield for the cash-secured put investor or 12% on an annualized basis. However, keep in mind that this OTM short put investment cannot make a capital gain as the covered call investor can. As a result, often the investor will do both of these OTM income plays at the same time to maximize the return possibilities.

Of course, the risk to the short-put income investor is that CSCO stock could fall much further than $45.00, where the investor has to purchase the stock. However, his breakeven is $44.54 (i.e., $45.00-$0.46 received), which is 6.8% below today's price. Nevertheless, at that point, the investor could then sell covered calls to make up for the unrealized loss.

The bottom line is that investors can increase their total return, on top of the 3.18 dividend yield and 1% buyback yield by creating option income opportunities with their CSCO shares.

More Stock Market News from Barchart

- Stocks See Support from Retailer and Trade News

- Stock Market Seasonals Improve in December

- Stocks See Support from Retailer and Trade News

- There’s One Detail About Macy’s (M) Earnings You Shouldn’t Ignore

/A%20concept%20image%20of%20space_%20Image%20by%20Canities%20via%20Shutterstock_.jpg)

/A%20concept%20image%20of%20a%20flying%20car_%20Image%20by%20Phonlamai%20Photo%20via%20Shutterstock_.jpg)