Coupang has gotten torched over the last six months - since August 2025, its stock price has dropped 35.7% to $17.79 per share. This might have investors contemplating their next move.

Following the drawdown, is now a good time to buy CPNG? Find out in our full research report, it’s free.

Why Does CPNG Stock Spark Debate?

Founded in 2010 by Harvard Business School student Bom Kim, Coupang (NYSE:CPNG) is an e-commerce giant often referred to as the "Amazon of South Korea".

Two Positive Attributes:

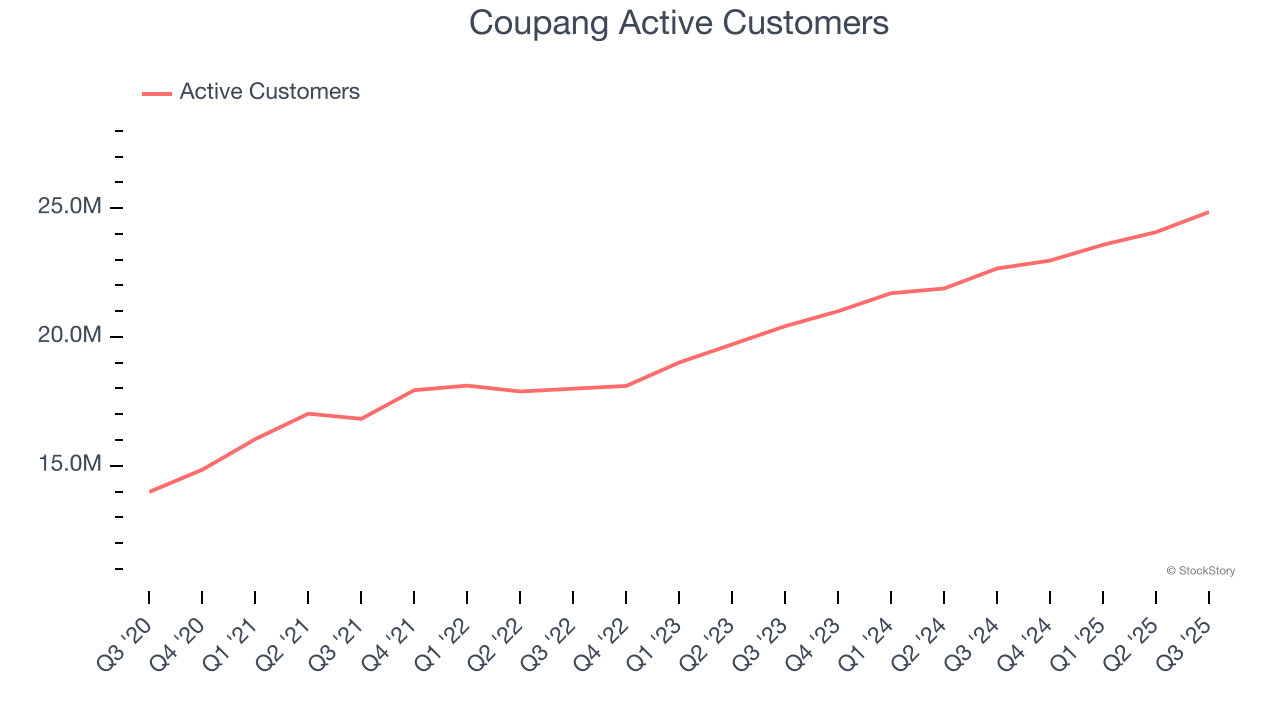

1. Active Customers Skyrocket, Fueling Growth Opportunities

As an online retailer, Coupang generates revenue growth by expanding its number of users and the average order size in dollars.

Over the last two years, Coupang’s active customers, a key performance metric for the company, increased by 11.2% annually to 24.85 million in the latest quarter. This growth rate is strong for a consumer internet business and indicates people love using its offerings.

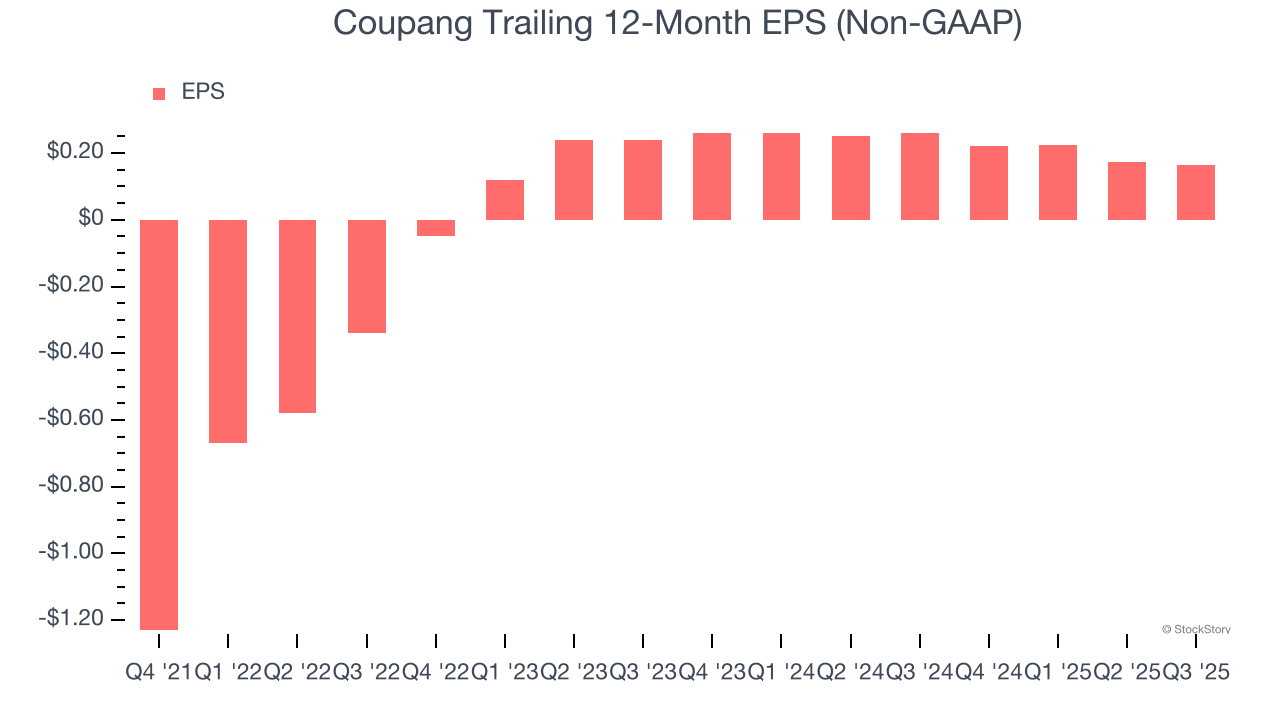

2. Outstanding Long-Term EPS Growth

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Coupang’s full-year EPS flipped from negative to positive over the last three years. This is a good sign and shows it’s at an inflection point.

One Reason to be Careful:

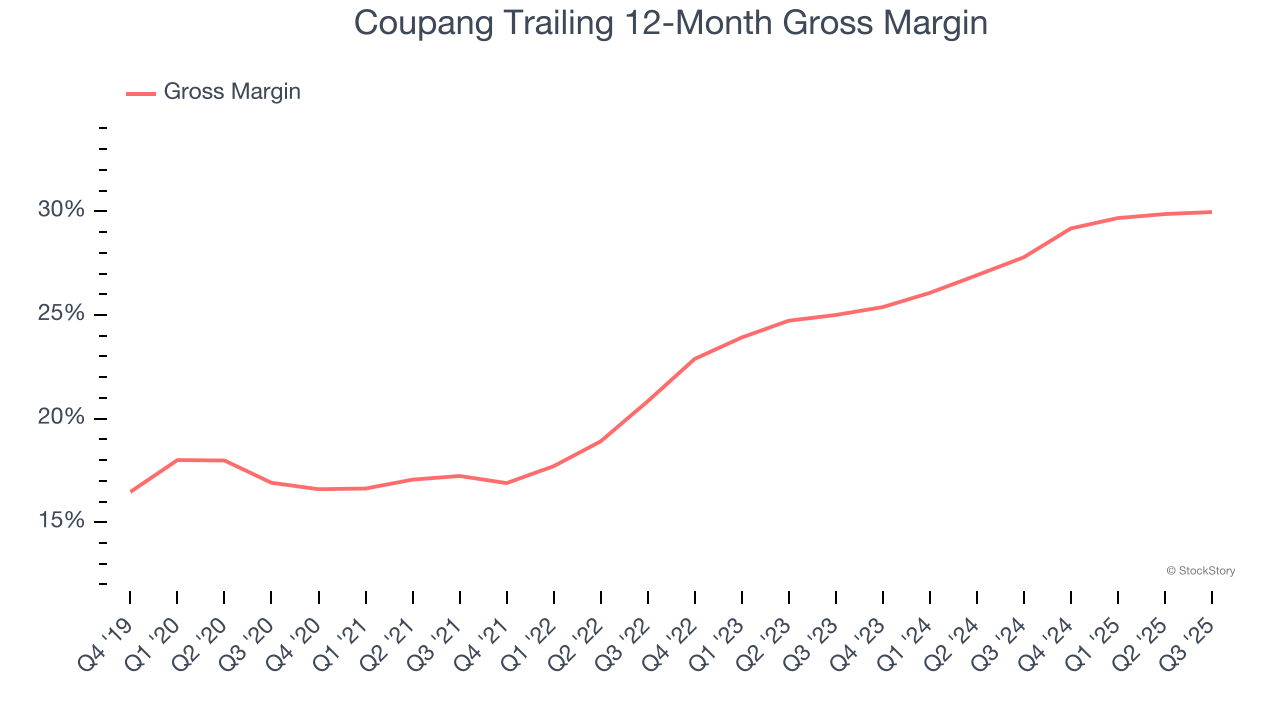

Low Gross Margin Reveals Weak Structural Profitability

For online retail (separate from online marketplaces) businesses like Coupang, gross profit tells us how much money the company gets to keep after covering the base cost of its products and services, which typically include the cost of acquiring the products sold, shipping and fulfillment, customer service, and digital infrastructure.

Coupang’s unit economics are far below other consumer internet companies because it must carry inventories as an online retailer. This means it has relatively higher capital intensity than a pure software business like Meta or Airbnb and signals it operates in a competitive market. As you can see below, it averaged a 29% gross margin over the last two years. That means Coupang paid its providers a lot of money ($71.04 for every $100 in revenue) to run its business.

Final Judgment

Coupang has huge potential even though it has some open questions. After the recent drawdown, the stock trades at 14.5× forward EV/EBITDA (or $17.79 per share). Is now the time to initiate a position? See for yourself in our in-depth research report, it’s free.

Stocks We Like Even More Than Coupang

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.

/NVIDIA%20Corp%20logo%20on%20phone-by%20Evolf%20via%20Shutterstock.jpg)

/Micron%20Technology%20Inc_%20logo%20on%20building-by%20vzphotos%20vis%20iStock.jpg)

/A%20Palantir%20office%20building%20in%20Tokyo_%20Image%20by%20Hiroshi-Mori-Stock%20via%20Shutterstock_.jpg)