Global tire manufacturer Goodyear (NYSE:GT) reported Q4 CY2025 results beating Wall Street’s revenue expectations, but sales were flat year on year at $4.92 billion. Its GAAP profit of $0.36 per share was 41% below analysts’ consensus estimates.

Is now the time to buy Goodyear? Find out by accessing our full research report, it’s free.

Goodyear (GT) Q4 CY2025 Highlights:

- Revenue: $4.92 billion vs analyst estimates of $4.86 billion (flat year on year, 1.3% beat)

- EPS (GAAP): $0.36 vs analyst expectations of $0.61 (41% miss)

- Operating Margin: 6.6%, up from 5.3% in the same quarter last year

- Free Cash Flow Margin: 27.2%, up from 20.5% in the same quarter last year

- Market Capitalization: $3.02 billion

"We delivered another strong quarter, driven by execution of our Goodyear Forward plan," said Mark Stewart, chief executive officer and president.

Company Overview

With its iconic blimp floating above major sporting events since 1925, Goodyear (NYSE:GT) is one of the world's largest tire manufacturers, producing and selling tires for automobiles, trucks, aircraft, and other vehicles, along with related services.

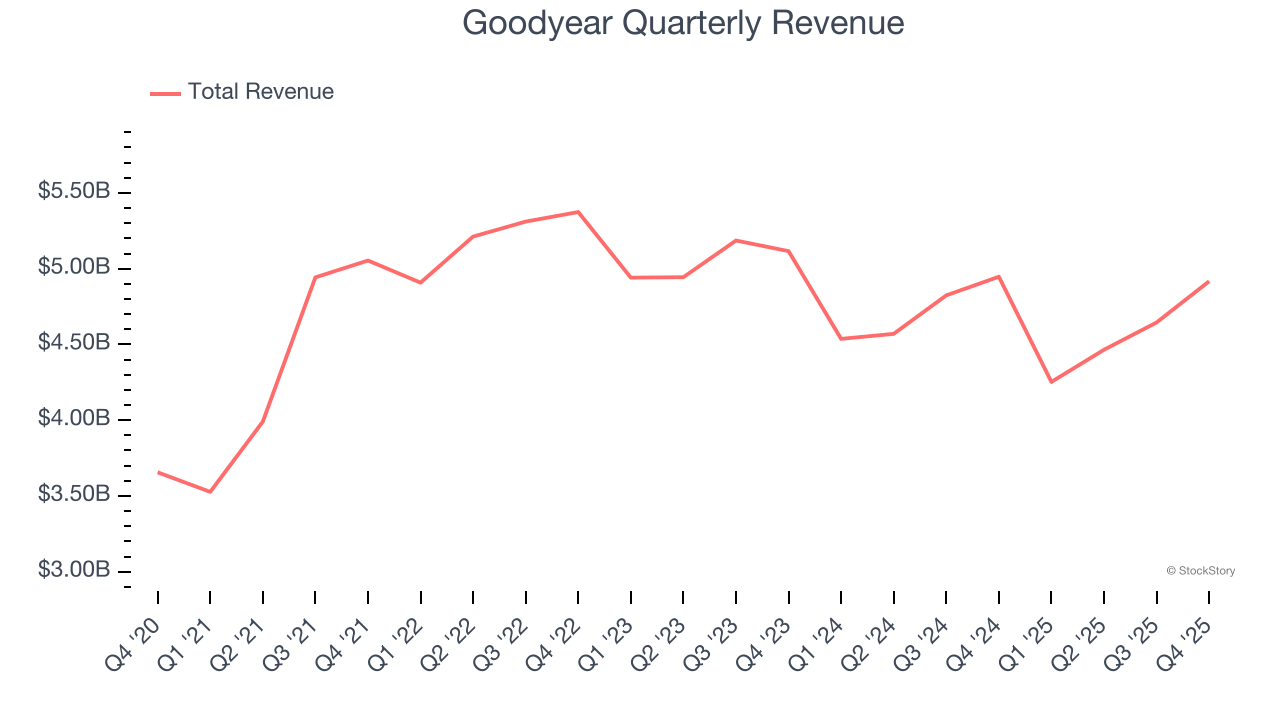

Revenue Growth

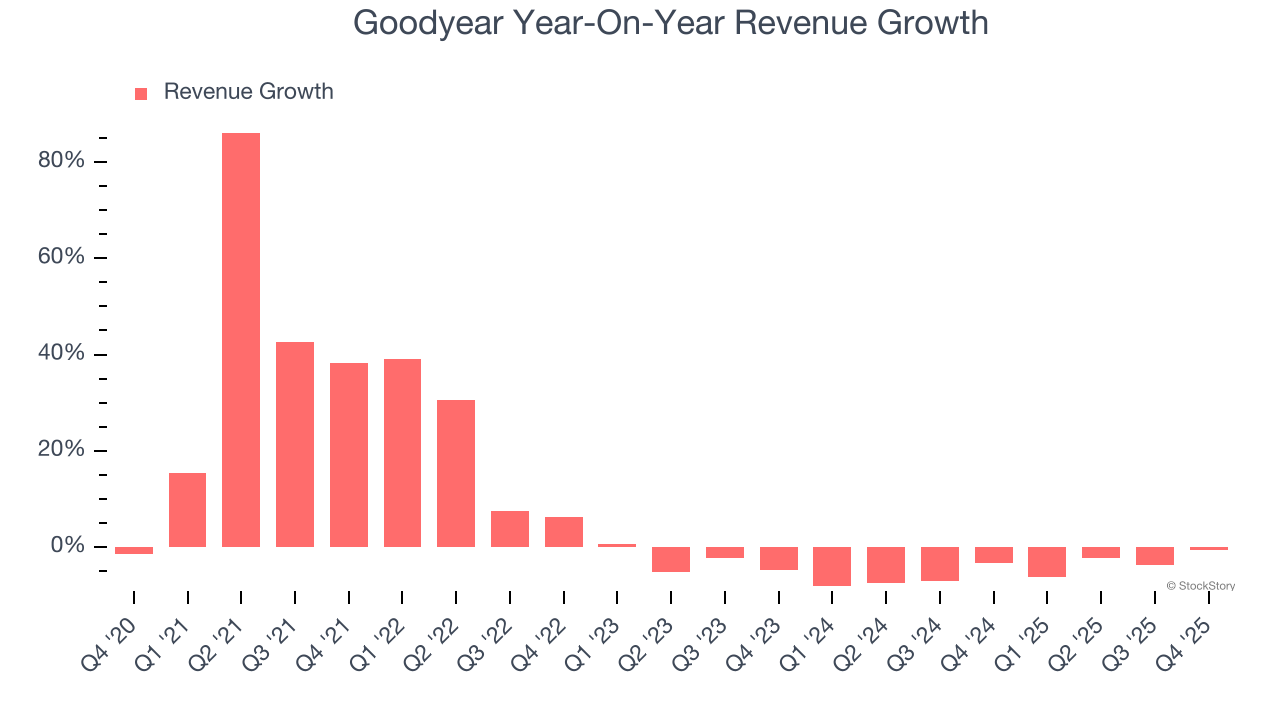

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Luckily, Goodyear’s sales grew at a decent 8.2% compounded annual growth rate over the last five years. Its growth was slightly above the average industrials company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Goodyear’s recent performance marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 4.8% over the last two years. Goodyear isn’t alone in its struggles as the Automobile Manufacturing industry experienced a cyclical downturn, with many similar businesses observing lower sales at this time.

This quarter, Goodyear’s $4.92 billion of revenue was flat year on year but beat Wall Street’s estimates by 1.3%.

Looking ahead, sell-side analysts expect revenue to grow 2% over the next 12 months. While this projection implies its newer products and services will spur better top-line performance, it is still below average for the sector.

The 1999 book Gorilla Game predicted Microsoft and Apple would dominate tech before it happened. Its thesis? Identify the platform winners early. Today, enterprise software companies embedding generative AI are becoming the new gorillas. a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

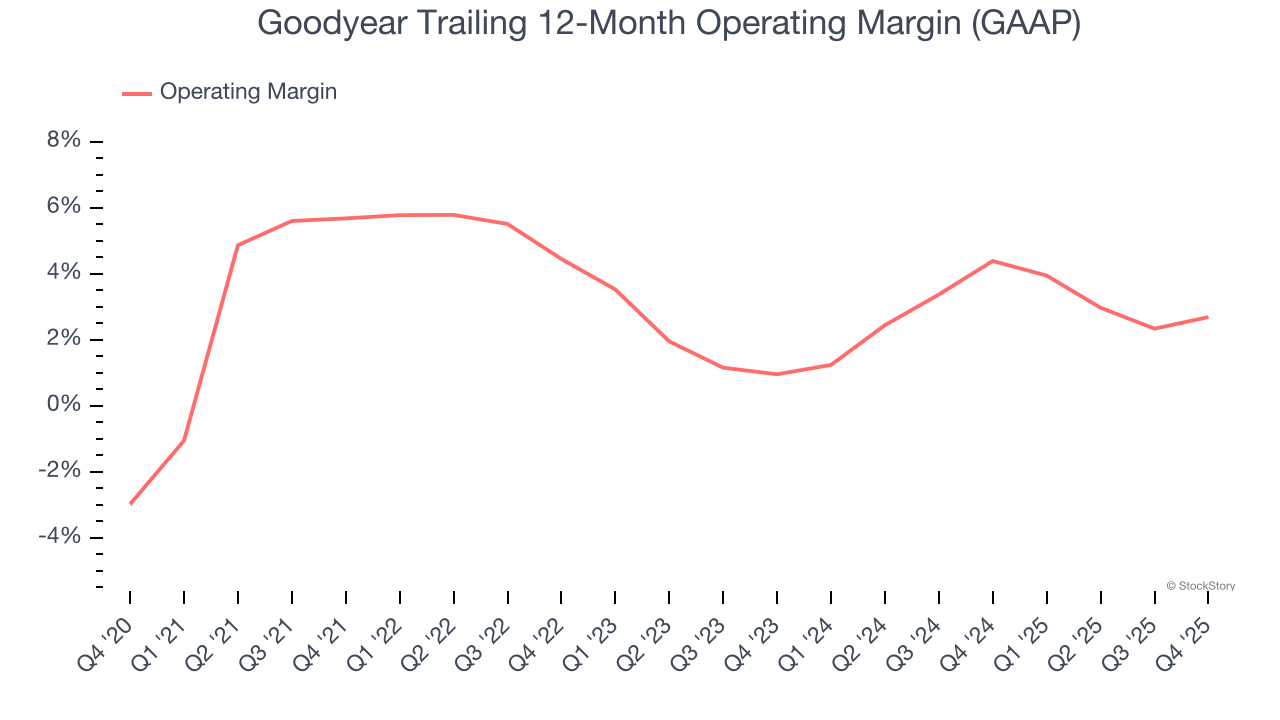

Operating Margin

Goodyear was profitable over the last five years but held back by its large cost base. Its average operating margin of 3.6% was weak for an industrials business. This result isn’t too surprising given its low gross margin as a starting point.

Analyzing the trend in its profitability, Goodyear’s operating margin decreased by 3 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. We’ve noticed many Automobile Manufacturing companies also saw their margins fall (along with revenue, as mentioned above) because the cycle turned in the wrong direction, but Goodyear’s performance was poor no matter how you look at it. It shows that costs were rising and it couldn’t pass them onto its customers.

In Q4, Goodyear generated an operating margin profit margin of 6.6%, up 1.3 percentage points year on year. Since its gross margin expanded more than its operating margin, we can infer that leverage on its cost of sales was the primary driver behind the recently higher efficiency.

Earnings Per Share

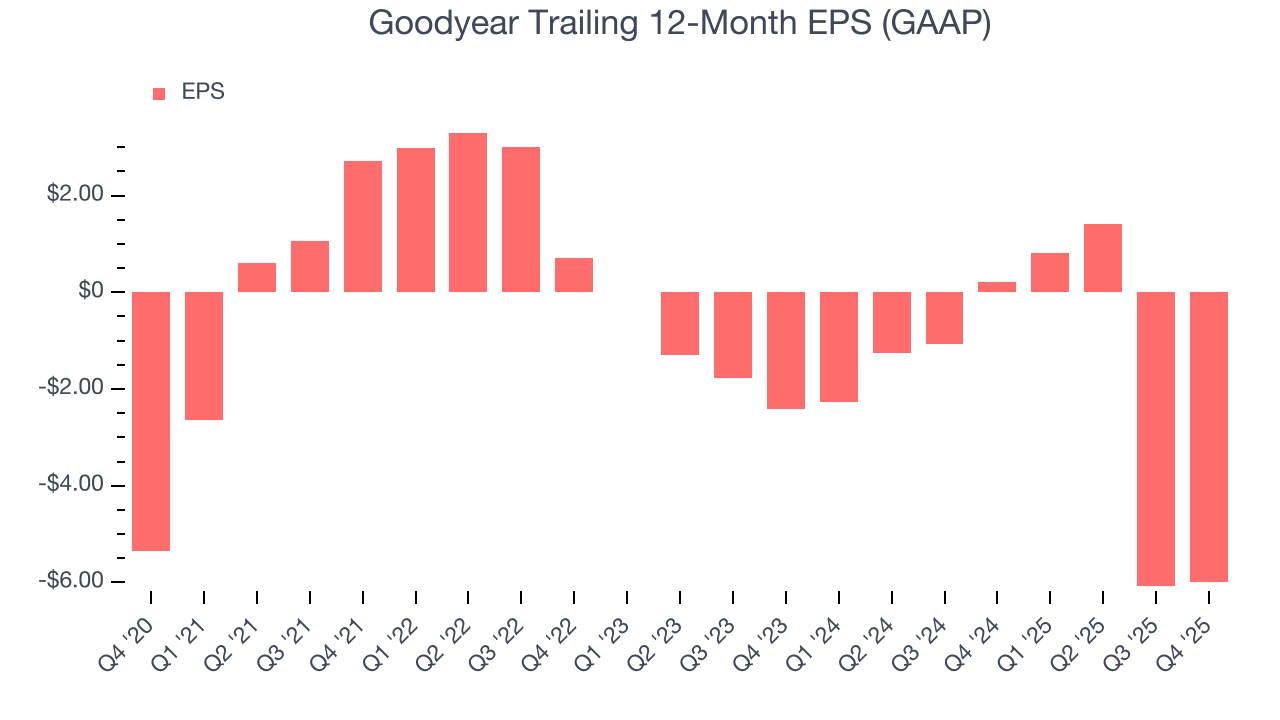

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Goodyear’s earnings losses deepened over the last five years as its EPS dropped 2.3% annually. We tend to steer our readers away from companies with falling EPS, where diminishing earnings could imply changing secular trends and preferences. If the tide turns unexpectedly, Goodyear’s low margin of safety could leave its stock price susceptible to large downswings.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Goodyear, its two-year annual EPS declines of 57.4% show it’s continued to underperform. These results were bad no matter how you slice the data.

In Q4, Goodyear reported EPS of $0.36, up from $0.26 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates. Over the next 12 months, Wall Street is optimistic. Analysts forecast Goodyear’s full-year EPS of negative $5.99 will flip to positive $1.02.

Key Takeaways from Goodyear’s Q4 Results

It was good to see Goodyear narrowly top analysts’ revenue expectations this quarter. On the other hand, its EPS missed. Overall, this quarter could have been better. The stock traded down 2.1% to $10.29 immediately following the results.

Goodyear may have had a tough quarter, but does that actually create an opportunity to invest right now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here (it’s free).

/Alphabet%20(Google)%20Image%20by%20Piotr%20Swat%20via%20Shutterstock.jpg)