Online study and academic help platform Chegg (NYSE:CHGG) reported Q4 CY2025 results exceeding the market’s revenue expectations, but sales fell by 49.4% year on year to $72.66 million. On the other hand, next quarter’s revenue guidance of $61 million was less impressive, coming in 5.5% below analysts’ estimates. Its non-GAAP loss of $0.01 per share was 90.3% above analysts’ consensus estimates.

Is now the time to buy Chegg? Find out by accessing our full research report, it’s free.

Chegg (CHGG) Q4 CY2025 Highlights:

- Revenue: $72.66 million vs analyst estimates of $71 million (49.4% year-on-year decline, 2.3% beat)

- Adjusted EPS: -$0.01 vs analyst estimates of -$0.10 (90.3% beat)

- Adjusted EBITDA: $12.89 million vs analyst estimates of $10.76 million (17.7% margin, 19.8% beat)

- Revenue Guidance for Q1 CY2026 is $61 million at the midpoint, below analyst estimates of $64.58 million

- EBITDA guidance for Q1 CY2026 is $11.5 million at the midpoint, above analyst estimates of $7.23 million

- Operating Margin: -47.2%, down from -2.3% in the same quarter last year

- Free Cash Flow was -$15.48 million compared to -$943,000 in the previous quarter

- Market Capitalization: $86.37 million

Company Overview

Started as a physical textbook rental service, Chegg (NYSE:CHGG) is now a digital platform addressing student pain points by providing study and academic assistance.

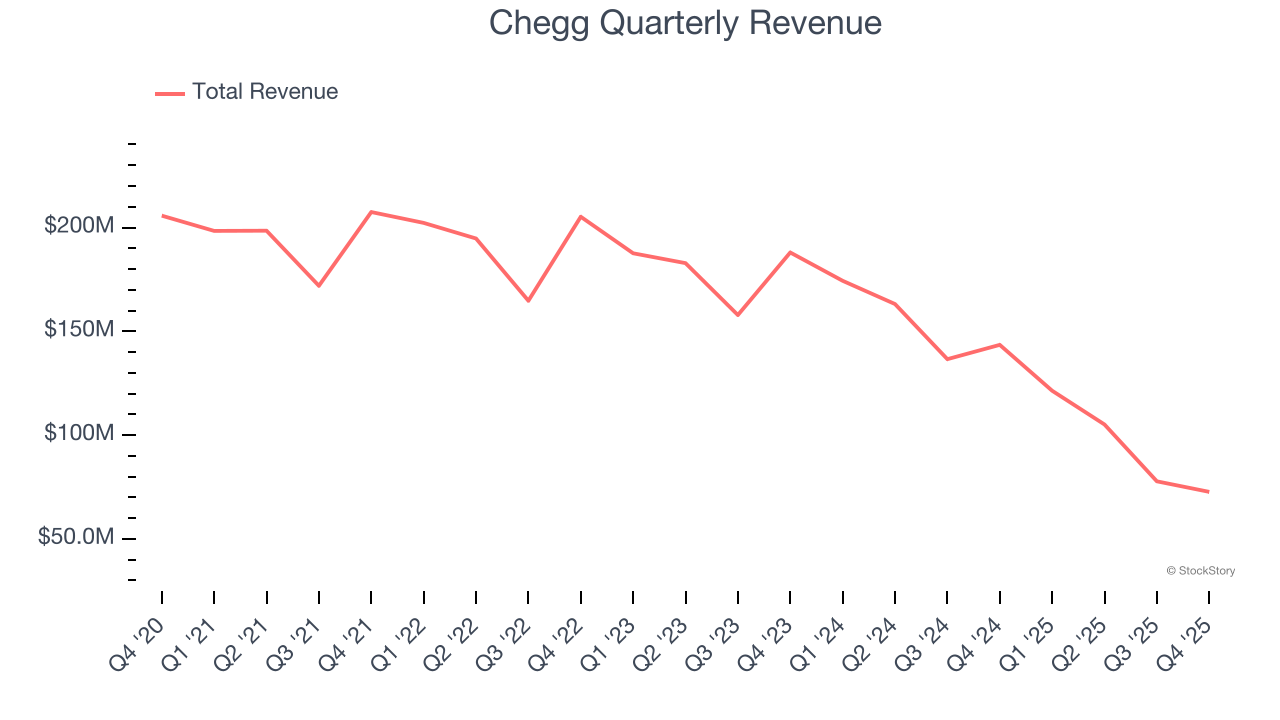

Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Chegg’s demand was weak over the last three years as its sales fell at a 21.1% annual rate. This wasn’t a great result and is a sign of poor business quality.

This quarter, Chegg’s revenue fell by 49.4% year on year to $72.66 million but beat Wall Street’s estimates by 2.3%. Company management is currently guiding for a 49.7% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to decline by 42.3% over the next 12 months, a deceleration versus the last three years. This projection doesn't excite us and implies its products and services will face some demand challenges.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

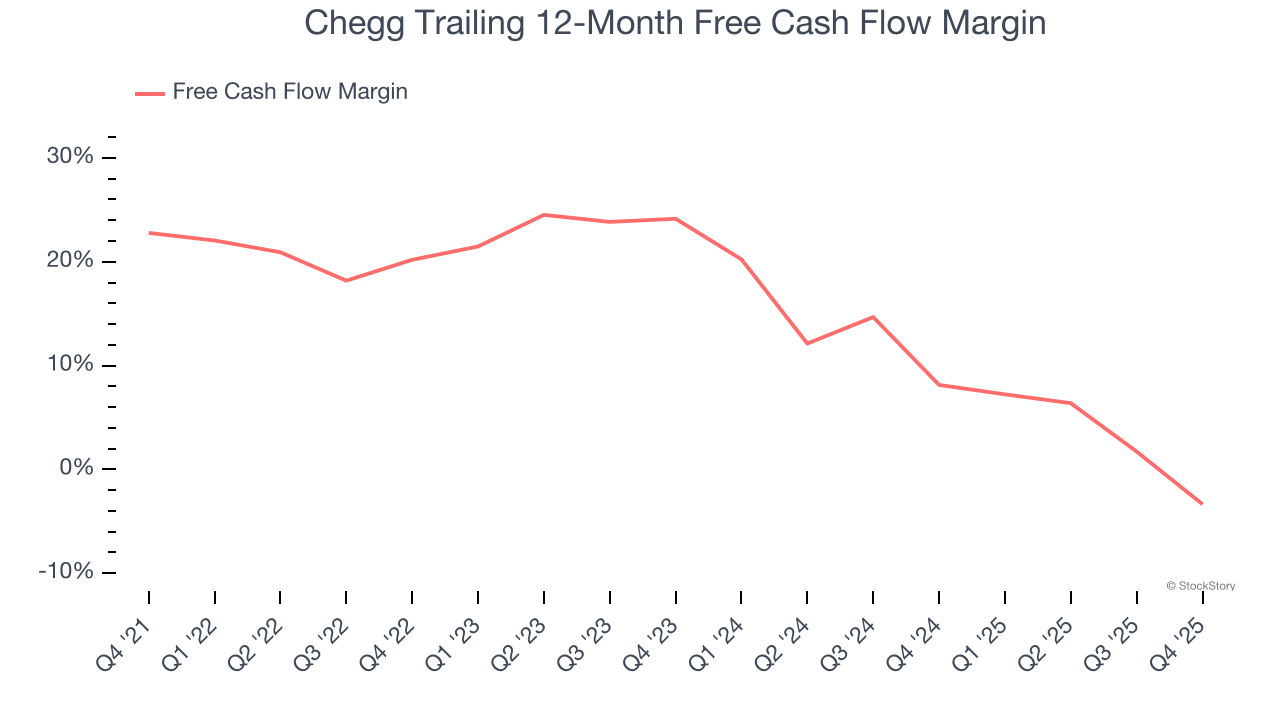

Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Chegg has shown mediocre cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 3.8%, subpar for a consumer internet business. The divergence from its good EBITDA margin stems from its capital-intensive business model, which requires Chegg to make large cash investments in working capital (i.e., stocking inventories) and capital expenditures (i.e., building new facilities).

Taking a step back, we can see that Chegg’s margin dropped by 23.5 percentage points over the last few years. This along with its unexciting margin put the company in a tough spot, and shareholders are likely hoping it can reverse course. If the trend continues, it could signal it’s becoming a more capital-intensive business.

Chegg burned through $15.48 million of cash in Q4, equivalent to a negative 21.3% margin. The company’s cash flow turned negative after being positive in the same quarter last year, suggesting its historical struggles have dragged on.

Key Takeaways from Chegg’s Q4 Results

We were impressed by Chegg’s optimistic EBITDA guidance for next quarter, which blew past analysts’ expectations. We were also excited its EBITDA outperformed Wall Street’s estimates by a wide margin. On the other hand, its revenue guidance for next quarter missed. Overall, we think this was a solid quarter with some key areas of upside. The market seemed to be hoping for more, and the stock traded down 3.1% to $0.73 immediately after reporting.

So do we think Chegg is an attractive buy at the current price? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here (it’s free).

/Alphabet%20(Google)%20Image%20by%20Piotr%20Swat%20via%20Shutterstock.jpg)