/AI%20(artificial%20intelligence)/AI%20Infrastructure%20by%20FOTOGRIN%20via%20Shutterstock.jpg)

While high-profile chipmakers and software leaders have fueled much of the artificial intelligence (AI) rally, some of the most important enablers of AI growth have remained largely under the radar.

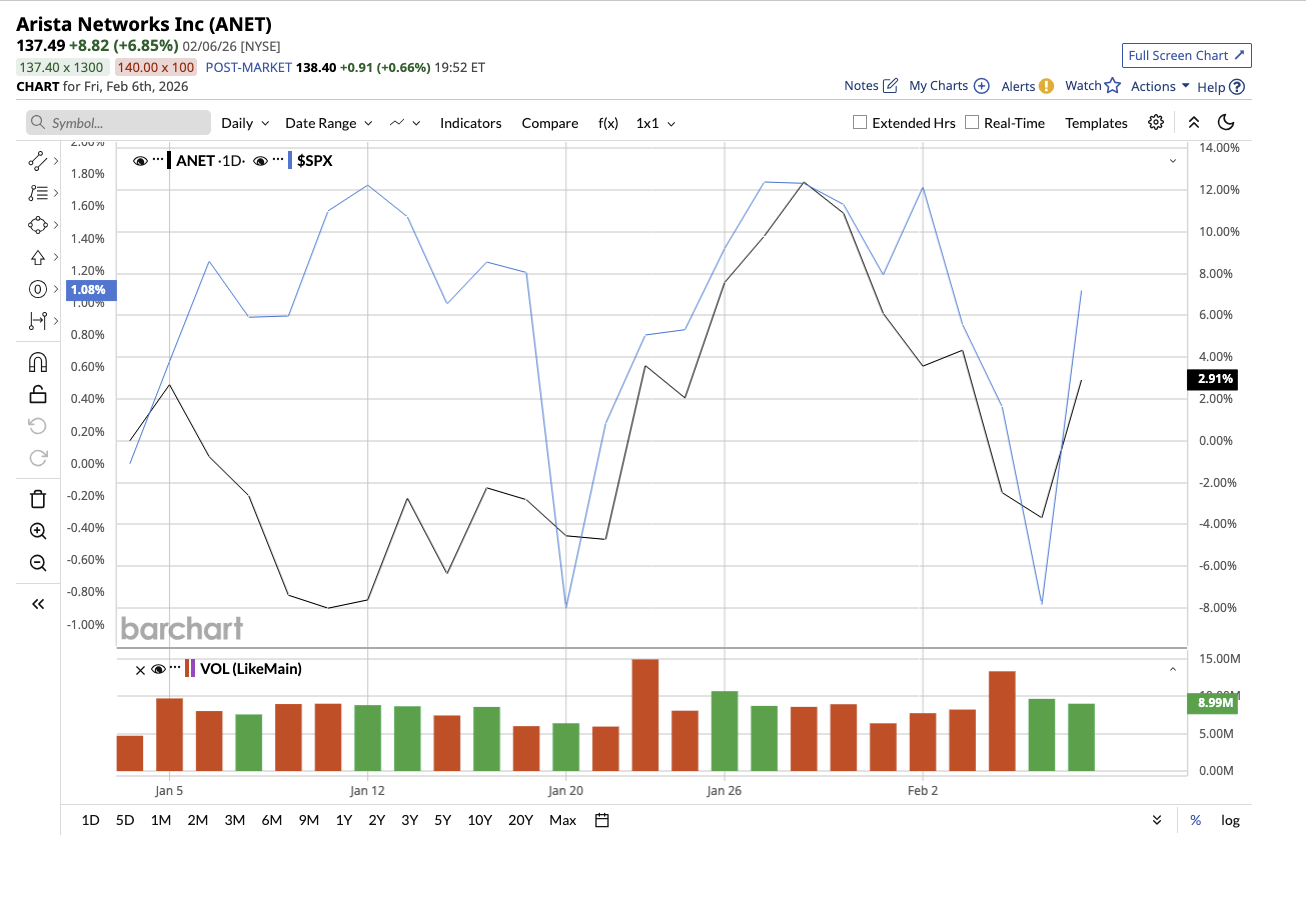

One such company is Arista Networks (ANET), which is quietly powering the networking infrastructure that allows AI workloads to scale efficiently. As the firm prepares to report its fourth-quarter results on Feb. 12, investors will be watching closely to see whether strong AI-driven demand can continue supporting its rapid growth and justify its premium valuation.

Arista is Building the Backbone of AI Networks

AI workloads require enormous volumes of data to move quickly and reliably across servers, accelerators, and storage systems. As a result, networking has emerged as an essential component of AI infrastructure, and Arista specializes in designing systems that can handle these high-speed data transfers effectively and securely.

In the third quarter, Arista reported revenue of $2.31 billion, representing a 27.5% year-over-year (YOY) increase, driven by strong demand from cloud providers, AI deployments, commercial clients, and campus environments. Software and services accounted for 18.7% of total revenue, highlighting the increasing relevance of higher-margin items in Arista's portfolio. Rather than relying on a single partner, Arista has focused on building an open ecosystem spanning multiple technology providers. Its collaborations include chipmakers, AI developers, and storage businesses, emphasizing the idea that AI performance is dependent on the seamless integration of computing, memory, storage, and networking. Profitability also increased throughout the quarter, with adjusted gross margins rising to 65.2%. Earnings per share increased 25% YOY to $0.75. Meanwhile, deferred revenue increased to $4.7 billion, indicating ongoing client demand and product adoption, particularly in AI-related applications.

Geographically, the Americas generated more than 80% of total revenue, while international markets contributed roughly 20%. Management noted that AI-driven network demand is expanding at an unprecedented pace as clients migrate to more complex and data-intensive infrastructures. Arista's growth plan is centered on its EtherLink portfolio, which offers unified network control across automation, security, telemetry, and traffic management. EtherLink fabrics are already used in some of the world's largest AI systems, providing complete performance even at massive data scales.

Arista's balance sheet remains a key strength. The company ended the quarter with about $10.1 billion in cash, cash equivalents, and investments. It also retained roughly $1.4 billion from its approved share repurchase program.

The Road Ahead

For the fourth quarter, Arista expects revenue in the range of $2.3 billion to $2.4 billion, a growth of around 21% to 26% YOY, in line with consensus estimates, which also predict earnings of $0.76 per share. Management expects adjusted gross margin to be around 62% to 63%. For the full year, while the company didn’t provide any guidance, it expects at least $1.5 billion in AI-related revenue by 2025, covering both front-end and back-end deployments. For fiscal 2026, the company is targeting around $2.75 billion in AI data center revenue within a broader total revenue goal of $10.65 billion, implying approximately 20% overall growth. The long-term opportunity remains substantial, with management estimating that the networking market could exceed $100 billion in the coming years, allowing ample room for growth.

Meanwhile, analysts predict a 27% increase in revenue to $8.9 billion, followed by 26.8% increase in earnings to $2.88 per share. Furthermore, analysts expect this trend to continue in 2026 with double-digit growth for both the top line and bottom line. However, the stock trades at around 43.56 times forward 2026 earnings, indicating that much of this optimism is already reflected in its valuation.

For Arista to justify its premium valuation, it must continue delivering strong earnings, maintaining margins, and sustaining growth even as competition intensifies across AI infrastructure markets. For investors with a high risk appetite, Arista represents a quieter but potentially powerful way to gain exposure to the AI boom.

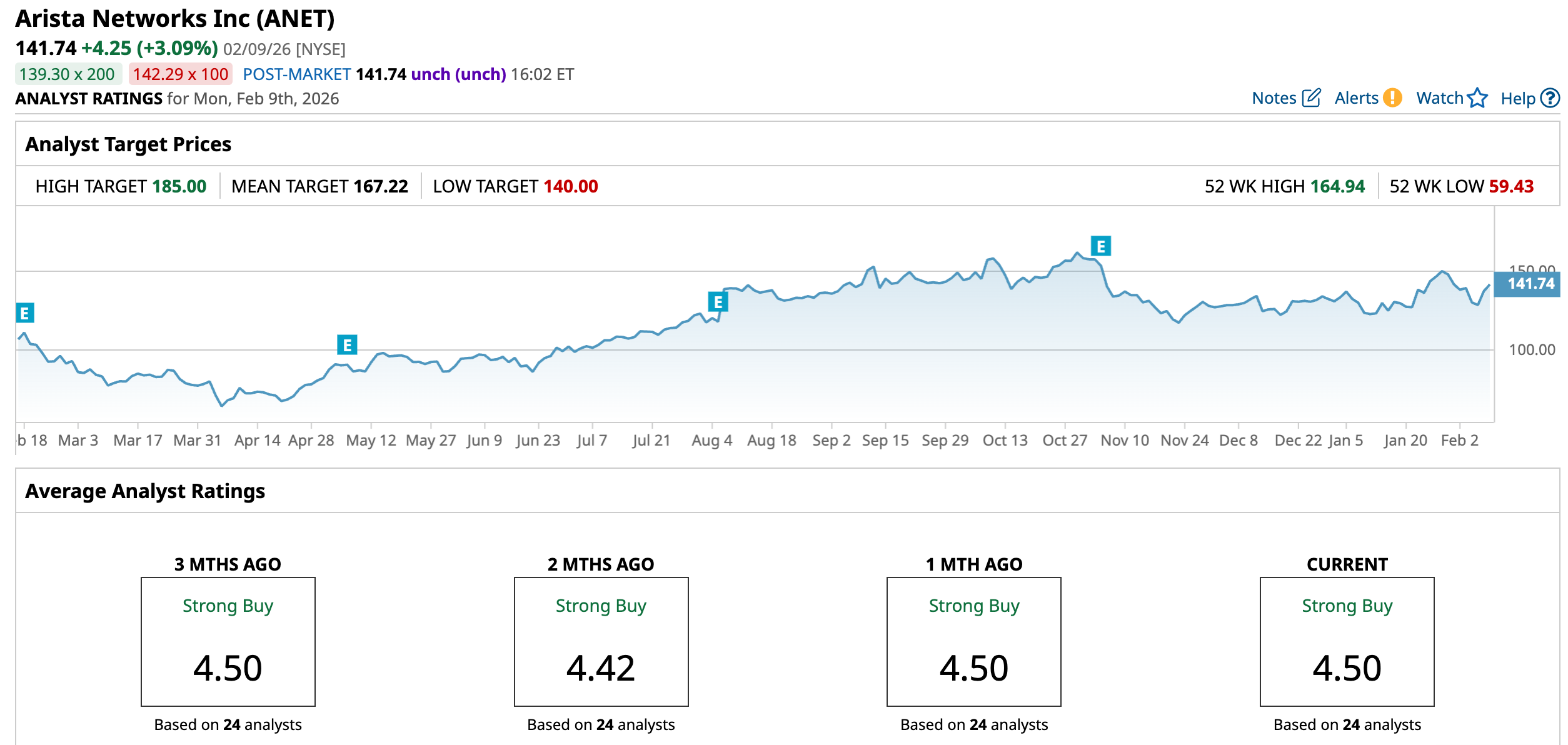

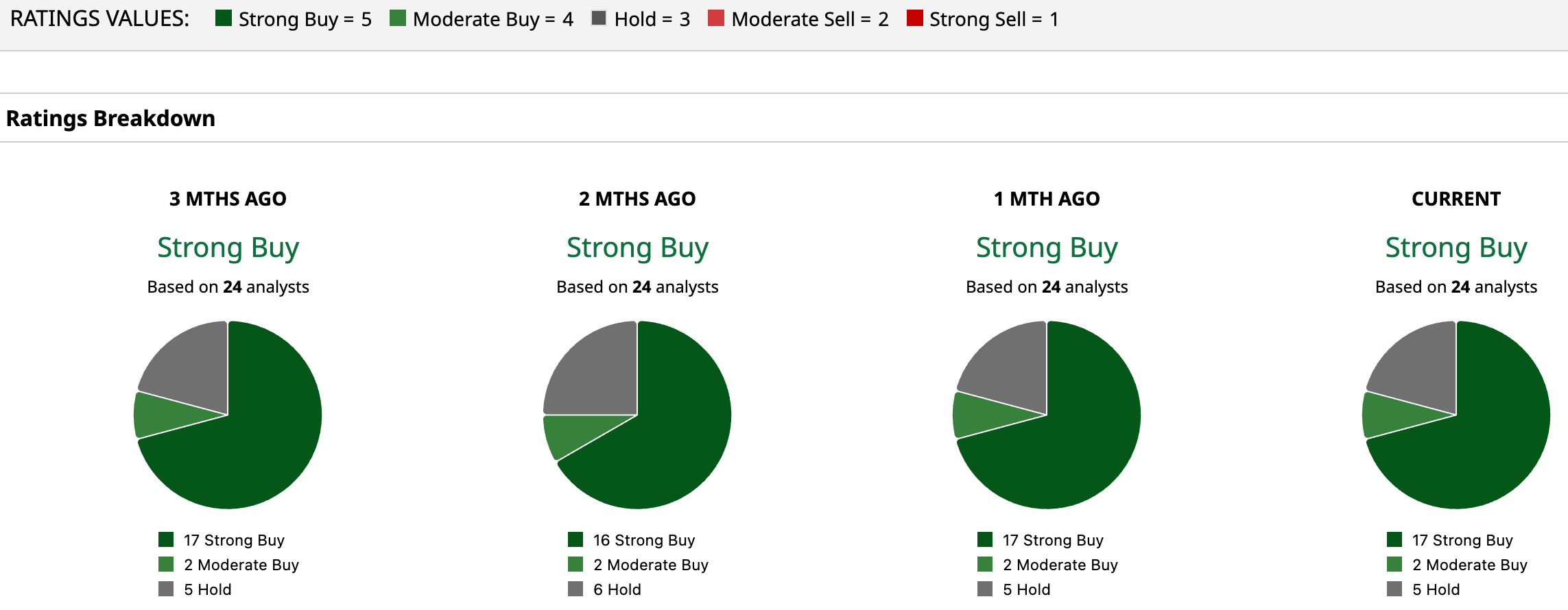

Is Arista Stock a Buy, Hold, or Sell on Wall Street?

Arista stock is up 2.9% so far this year. Nonetheless, Wall Street believes the stock can climb 18% from its current levels to reach its average target price of $167.22. Plus, its Street-high estimate of $185 implies a potential upside of about 30.5% in the next 12 months. Overall, Wall Street rates Arista stock a “Strong Buy.” Out of the 24 analysts covering Arista stock, 17 have a “Strong Buy” recommendation, two rate it a “Moderate Buy,” and five suggest it’s a “Hold.”

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Alphabet%20(Google)%20Image%20by%20Piotr%20Swat%20via%20Shutterstock.jpg)