With markets looking increasingly volatile, investors might be more interested in generating income rather than capital gains.

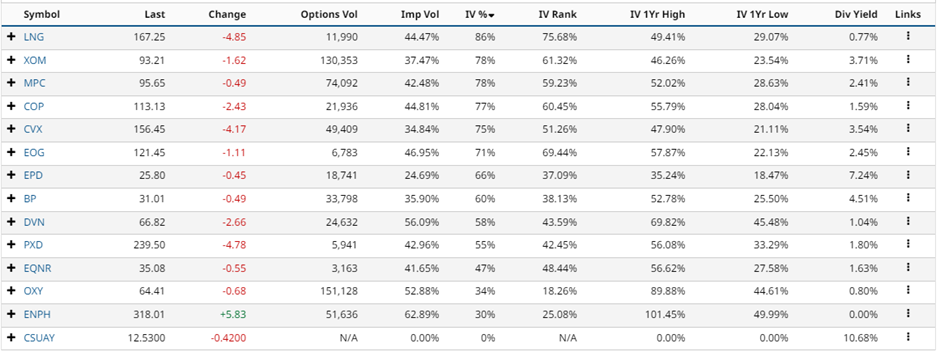

Oil related stocks have been some of the best performers this year and also tend to pay attractive dividends.

As sophisticated investors, we can generate an additional income from holding oil stocks by using options. The strategy is a known as a covered call which involves selling call options against a stock position.

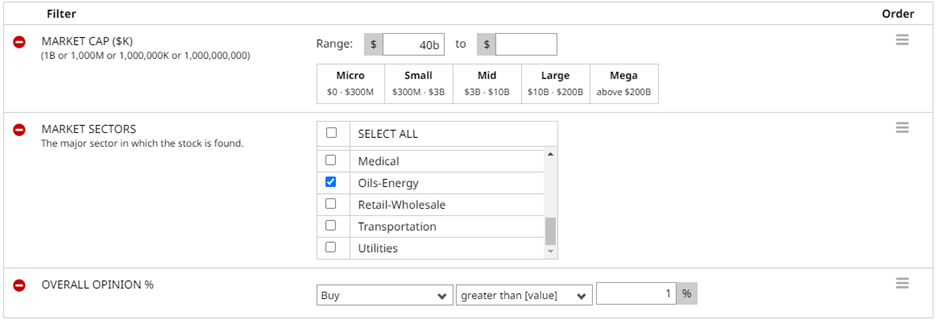

Let’s firstly check which bank stocks have a Buy Rating. To do this go to the Stock Screener and use these Parameters:

This gives us the following results and provides some names to consider for our Covered Call Screener.

XOM Covered Call Example

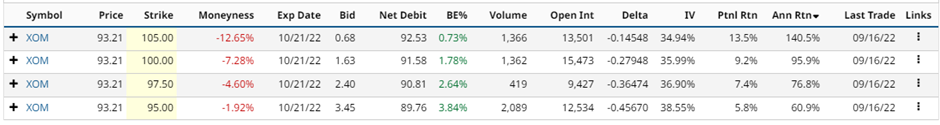

When running the Covered Call Screener for XOM, we find the following results:

Let’s evaluate the first XOM covered call example. Buying 100 shares of XOM would cost $9,321. The October 21, 105 strike call option was trading on Friday around $0.68, generating $68 in premium per contract for covered call sellers. Selling the call option generates an income of 0.73% in 32 days, equalling around 8.13% annualized. That assumes the stock stays exactly where it is. What if the stock rises above the strike price of 105?

If XOM closes above 105 on the expiration date, the shares will be called away at 105, leaving the trader with a total profit of $1,247 (gain on the shares plus the $68 option premium received). That equates to a 13.5% return, which is 140.5% on an annualized basis.

That particular covered call allows for a lot of capital appreciation. What if an investor was more income focused? They would need to sell a call much closer to the stock price (look for a low value in the Moneyness column).

Instead of the October 105 call, let’s look at the October 95 call (last row). Selling the 95 call option for $3.45 generates an income of 3.84% in 32 days, equalling around 42.51% annualized. If XOM closes above 95 on the expiration date, the shares will be called away at 95, leaving the trader with a total profit of $524 (gain on the shares plus the $345 option premium received).

That equates to a 5.8% return, which is 60.9% on an annualized basis.

Of course, the risk with the trade is that the XOM might drop, which could wipe out any gains made from selling the call.

Barchart Technical Opinion

The Barchart Technical Opinion rating is an 80% Buy with a weakening short term outlook on maintaining the current direction. Long term indicators fully support a continuation of the trend.

Implied volatility is at 37.47% compared to a 12-month low of 23.54% and a 12-month high of 46.26%.

Company Description

ExxonMobil's bellwether status in the energy space, optimal integrated capital structure that has historically produced industry-leading returns and management's track record of capex discipline across the commodity price cycle make it a relatively lower-risk energy sector play. The company owns some of the most prolific upstream assets globally. Other aspects of the company's story include the largest global refining operations, substantial chemicals assets and a dividend history and credit profile that are second to none in the space. ExxonMobil's capital spending discipline is quite aggressive. The company has a plan in place to allocate significant proportion of its budget to key oil and gas projects. The company's business perspective looks different from most peers since big oil rivals have pledged to lower carbon emissions to tackle climate change. ExxonMobil divides its operations into three main segments: Upstream, Downstream and Chemical.

Oil stocks are a common component of most investment portfolio and now you know how to generate an income from your XOM position now.

Please remember that options are risky, and investors can lose 100% of their investment. This article is for education purposes only and not a trade recommendation. Remember to always do your own due diligence and consult your financial advisor before making any investment decisions.

*Disclaimer: On the date of publication, Gavin McMaster did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. Data as of after-hours, September 18, 2022.

More Stock Market News from Barchart

/Microsoft%20sign%20at%20the%20headquarters%20by%20VDB%20Photos%20via%20Shutterstock.jpg)