On April 19, in an article on Barchart, I wrote, “inflation, supply issues, and robust demand favor the lumber arena’s upside around the $880 per 1,000 board feet level.” July futures were trading at the $885 level on April 19 and were close to that price on April 27 on the active month July futures contract. Lumber futures are nothing but a benchmark as the daily volume and the total number of open long and short positions do not support an active trading market. When lumber prices move, they tend to gap higher or lower in a series of limit-up or limit-down moves as liquidity evaporates. I was bullish on the prospects for the lumber price on April 19, and the recent price action continues to support that view.

Lumber futures recovered and are consolidating

Lumber futures corrected after making a lower high of $1,477.40 per 1,000 board feet during the first quarter of 2022.

The continuous contract chart highlights the lower high compared to the 2021 $1,711.20 record high. Lumber futures fell from the Q1 2022 high to $829.30 in April. The July contract fell further because of the forward curve’s backwardation with higher nearby prices compared to prices for deferred delivery.

The forward curve shows that expiring May futures were over $135 higher than the active month July contract.

Moreover, prices are progressively lower for delivery out to November 2022, when they move into contango, where deferred prices are higher out to March 2023. There is another backwardation between March 2023 and May 2023. The backwardation reflects ongoing supply concerns in the lumber futures arena.

The chart illustrates that July futures fell to $758.80 on April 12 before recovering to $986.60 on April 21. The price was around the $920 level on April 27 as lumber futures are consolidating.

Prices remain above the pre-2018 high

Before 2018, the all-time high in the lumber futures market came in 1993.

The long-term chart shows that lumber futures reached $493.50 per 1,000 board feet in March 1993 and remained below that price through December 2017. Aside from a dip below the 1993 high in October 2020 and August 2021, the wood price has remained north of the 1993 peak. The lowest price over the past years has been $448, the August 2021 low.

Russia impacts the worldwide lumber market

Sanctions on Russia, the war in Ukraine, and Belarus’s support for the Russian aggression have impacted lumber supplies in Europe. Russia exports substantial wood products. In 2018, the Russian Federation accounted for:

- 6% of wood pellet exports

- 20% of sawn wood exports

- 17% of veneer sheet exports

- 6% of wood-based panel exports

- 4% of paper pulp exports

- 3% of paper and paperboard exports

Canadian sawn wood production declined from 2016 through 2018 because of trade disputes and USA import duties. Meanwhile, sawn wood and panel production grew in Russia, which surpassed Canada the become the world’s leading sawn wood exporter.

The war in Ukraine and sanctions are causing Estonian companies to buy expensive wood from the Nordic countries. The first major war in Europe since WW II has an ongoing impact on the lumber market’s global supply and demand fundamentals.

In the US, the Fed is ready to push interest rates much higher over the coming months after the inflationary March consumer and producer price indices showed 8.5% and 11.2% respective increases. While some FOMC members favor a 75-basis point increase in the Fed Funds Rate at the next meeting, the central bank will likely push the short-term rate 50 basis points higher, which could become the new monthly increase until inflation subsides. Meanwhile, longer-term rates have moved higher, with the 30-Year US Treasury Bond futures falling to the lowest level since November 2018 last week at 138-14. The long bond was just above the 142 level on April 27. Rising rates further out along the yield curve have pushed conventional mortgage rates higher. In late 2021, a 30-Year fixed-rate mortgage was below the 3% level and has risen to over 5% in April 2022. However, a severe housing shortage in the US continues to push new home prices higher. The US is more than three million homes short of the demand from would-be homebuyers, making for robust lumber demand.

An inside year in 2022

In 2021, lumber futures traded in a range from $448 to $1,711.20 per 1,000 board feet. Supply chain bottlenecks, wildfires in Canada and the US, labor issues, inflation, trade issues, and rising demand caused the widest range in history, leading to a new record peak. I do not expect lumber to trade outside the 2021 range in 2022. However, I expect the price to remain above the pre-2018 all-time high and find a pivot point, likely around the $1,000 per 1,000 board feet level. Rising US interest rates may temper the demand for new home construction, but government infrastructure building and the ongoing home shortage could keep a bid under wood’s price.

A bullish trend in the WOOD ETF product

Speculators and investors tend to flock to the most liquid assets, making lumber low on the list for market participants. Meanwhile, the iShares Global Timber & Forestry ETF product (WOOD) reflects the price action in the lumber market. Lumber has been in a bullish market since the April 2020 $251.50 low, and the WOOD ETF has followed.

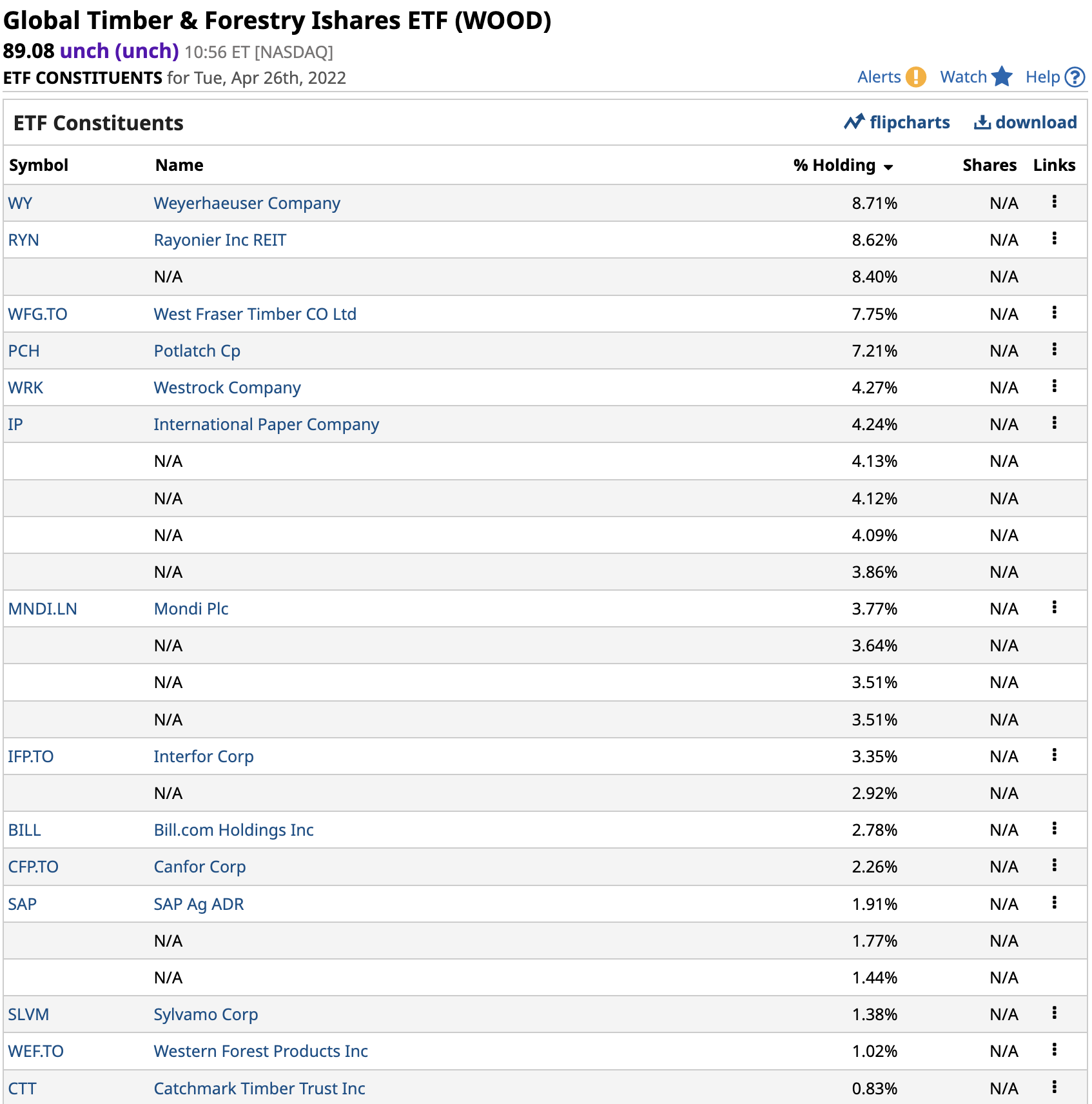

WOOD’s top holdings include:

The holdings include publicly traded equities related to the timber and forestry industry.

At the $89.08 per share level, WOOD had over $310 million in assets under management and trades an average of 20,355 shares each day. The ETF charges a 0.43% management fee, but the most recent annual dividend of $1.14 per share or 1.28% pays for the expense ratio in the months.

The chart shows the bullish pattern of higher lows and higher highs since 2008. WOOD peaked at $98.98 in May 2021 when lumber futures traded at the record peak. The stock has consolidated between $81.73 and $95.27 over the past year.

Lumber futures feel like they made a bottom at a higher low in April. An inside year with the price above the pre-2018 all-time high supports the WOOD ETF’s bullish trend.

/Tesla%20charging%20station%20black%20background%20by%20Blomst%20via%20Pixabay.jpg)

/Netflix%20on%20laptop%20by%20Jade87%20via%20Pixabay.jpg)