Over the last six months, Clover Health’s shares have sunk to $2.60, producing a disappointing 13.5% loss - a stark contrast to the S&P 500’s 8.2% gain. This may have investors wondering how to approach the situation.

Following the pullback, is now the time to buy CLOV? Find out in our full research report, it’s free.

Why Does CLOV Stock Spark Debate?

Founded in 2014 to improve healthcare for America's seniors through technology, Clover Health (NASDAQ:CLOV) provides Medicare Advantage plans for seniors with a focus on affordable care and uses its proprietary Clover Assistant software to help physicians manage patient care.

Two Things to Like:

1. New Clients Drives Additional Growth Opportunities

Revenue growth can be broken down into the number of customers and the average spend per customer. Both are important because an increasing customer base leads to more upselling opportunities while the revenue per customer shows how successful a company was in executing its upselling strategy.

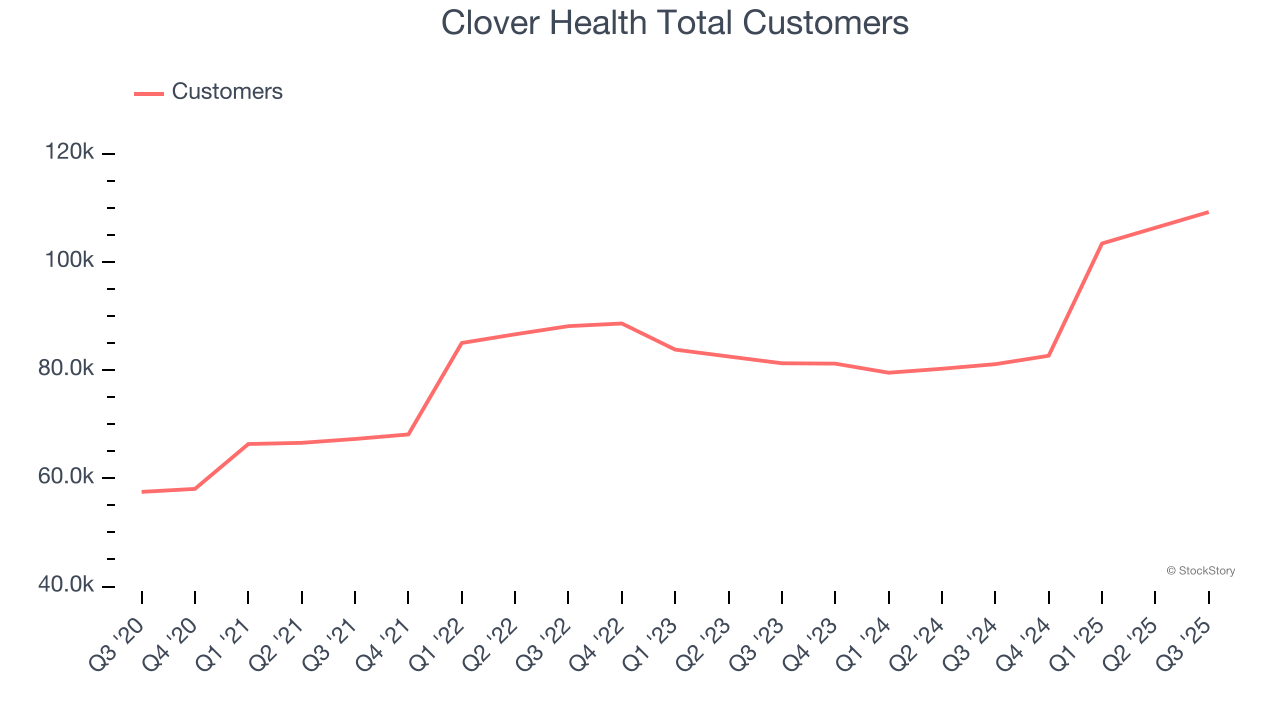

Clover Health’s total customers punched in at 109,226 in the latest quarter, and over the last two years, their count averaged 10.3% year-on-year growth. This performance was solid, reflecting its ability to "land" new contracts and potentially "expand" them later - a powerful one-two punch for sales.

2. Increasing Free Cash Flow Margin Juices Financials

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

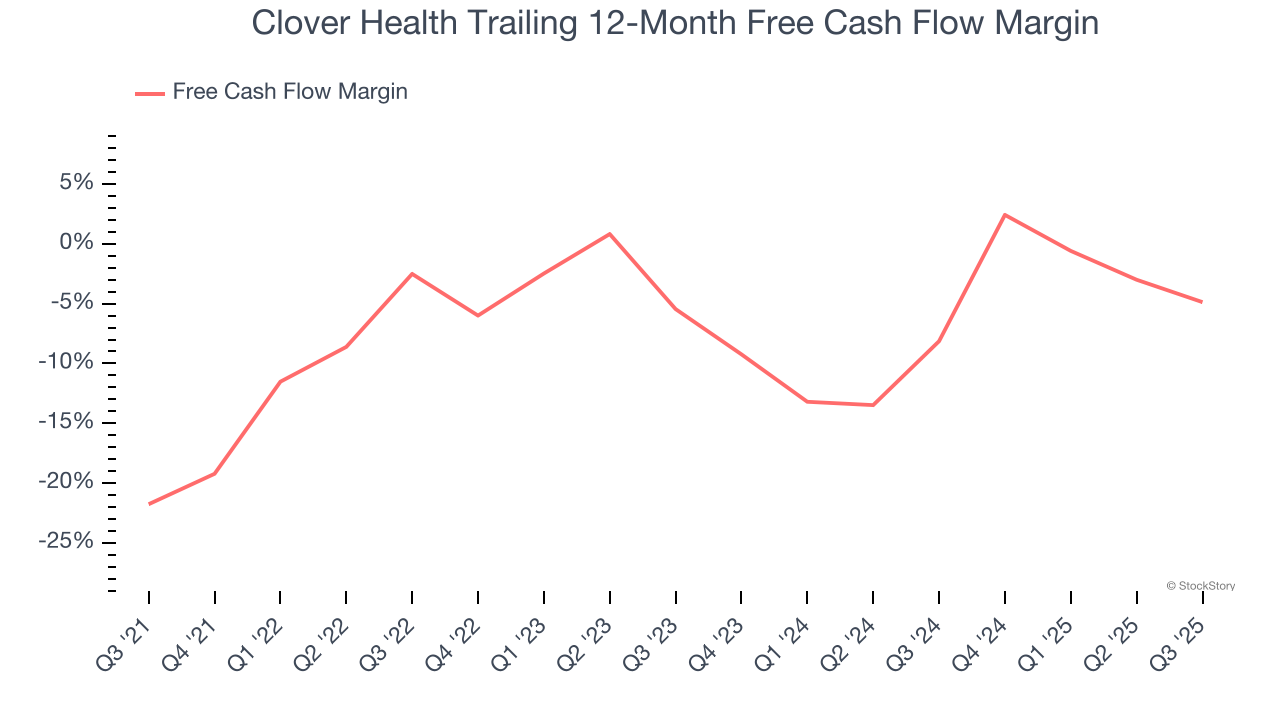

As you can see below, Clover Health’s margin expanded by 16.9 percentage points over the last five years. Clover Health’s free cash flow margin for the trailing 12 months was negative 4.9%, and continued increases could help it achieve long-term cash profitability.

One Reason to be Careful:

Revenue Tumbling Downwards

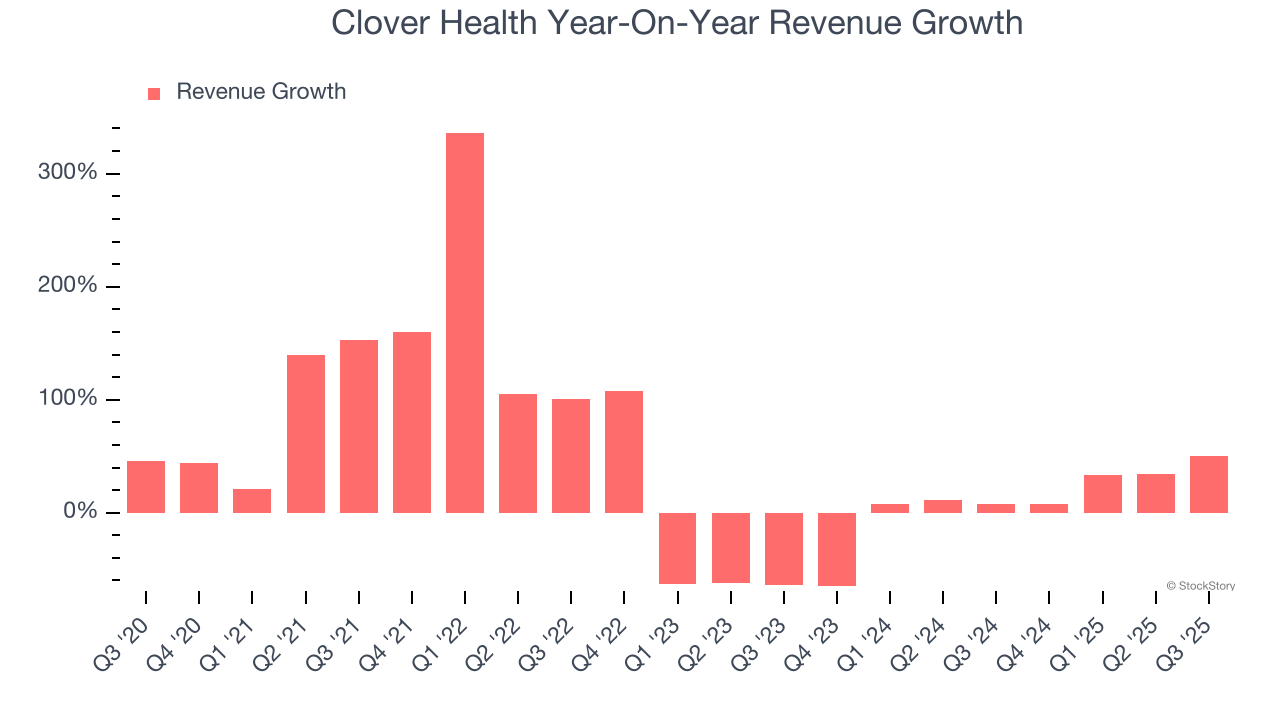

We at StockStory place the most emphasis on long-term growth, but within healthcare, a stretched historical view may miss recent innovations or disruptive industry trends. Clover Health’s recent performance marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 2% over the last two years.

Final Judgment

Clover Health has huge potential even though it has some open questions. After the recent drawdown, the stock trades at 38.3× forward P/E (or $2.60 per share). Is now the time to initiate a position? See for yourself in our full research report, it’s free.

High-Quality Stocks for All Market Conditions

Check out the high-quality names we’ve flagged in our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.

/Intel%20Corp_%20Santa%20Clara%20campus-by%20jejim%20via%20Shutterstock.jpg)