For much of the past two years, the U.S. housing market has been stuck in a familiar limbo – rates too high for comfort, prices too inflated for first-time buyers, and affordability stretched thin across income brackets. Last week, the tone shifted.

Mortgage rates dropped sharply after President Donald Trump said he is directing Fannie Mae and Freddie Mac to buy $200 billion in mortgage-backed securities, a signal aimed squarely at easing borrowing costs. The 30-year fixed mortgage slid to 5.99%, a level not seen since early 2023, reviving long-dormant conversations around demand, refinancing, and housing liquidity.

History shows that markets react quickly to such signals. Large-scale MBS purchases have the power to compress mortgage rates, stabilize lending, and unlock activity, even if the real-world impact proves incremental. Nevertheless, lower rates alone will not solve the affordability crisis. Home prices remain nearly 50% above pre-pandemic levels, consumers are stretched, and housing affordability remains the real choke point. Still, even a modest dip in rates can reopen refinancing pipelines and shift sentiment faster than fundamentals.

Companies like Rocket Companies (RKT) come into focus. As a leading digital mortgage platform, Rocket thrives on volume, refinancing cycles, and rate-driven momentum. It's no surprise RKT stock jumped nearly 10% on Friday, hitting a fresh three-year high as mortgage stocks rallied. The market is clearly betting on a rate-sensitive rebound, but after such a sharp move, does Rocket still have room to run, or is optimism getting ahead of reality?

About Rocket Companies Stock

Based in Detroit, Rocket has built a reputation for shaking up the traditionally clunky world of homebuying and personal finance. At the center of its ecosystem is Rocket Mortgage, one of the largest retail mortgage lenders in the U.S., backed by a lineup of complementary brands. Meanwhile, Rocket Homes helps buyers and sellers connect, Rocket Loans offers personal and small business financing, and Rocket Money brings budgeting and credit tracking into one place.

Powered by smart tech and deep data analytics, Rocket aims to make everything – from applying for a mortgage to managing money after closing – simpler, faster, and more transparent. Today, the company has a market capitalization of about $49 billion.

Shares of the mortgage and real estate-focused fintech platform have been on a serious run, and the momentum has been hard to miss. Over the past 52 weeks, RKT stock skyrocketed 125.49% over the past 52 weeks, while over the past six months, the stock rose by a solid 69.44%. That surge pushed RKT to a fresh 52-week high of $23.50 on Jan. 12. This may have been fueled in part by renewed optimism around the housing market after President Trump floated a proposal for government purchases of mortgage bonds to ease high home prices. The idea sparked fresh enthusiasm across mortgage-linked stocks, and Rocket was right in the sweet spot.

Technically, trading volume has been picking up, a sign that buyers remain engaged. The 14-day RSI has moved to 76.43 mark, placing the stock in overbought territory and signaling aggressive buying interest. While that confirms strength, it also raises the odds of a short-term pause or consolidation.

The MACD oscillator remains steady, with the MACD line holding above the signal line, signaling that upward momentum is still intact. Meanwhile, RKT is trading near or above the upper Bollinger Band, indicating upside price extension. This setup often points to strong trend continuation, but it also suggests the stock may cool off before its next meaningful move higher.

RKT stock is not exactly cheap at current levels. The stock is trading at about 100.8 times forward adjusted earnings, a valuation that stands well above both the broader industry average and its own sector median. The market is already paying a hefty premium for future growth, leaving little room for missteps and raising the bar for the company to keep delivering strong results.

Rocket Companies’ Solid Q3 Earnings Snapshot

On Oct. 30, Rocket Companies released its third-quarter numbers, generating a revenue of $1.61 billion, up 148% year-over-year (YOY), helped by a rebound in activity and some accounting tailwinds. Even after adjusting for changes in the fair value of mortgage servicing rights, Rocket’s top line still showed healthy momentum, climbing nearly 35% from the same period last year to $1.78 billion.

Earnings told a slightly more mixed story. Adjusted EPS came in at $0.07, a touch lower than last year’s $0.08, but still comfortably ahead of Wall Street’s $0.04 expectation. In that sense, Rocket did not fully beat its own past. But it did clear the bar analysts had set.

On the core business front, mortgage origination volumes continued to move higher. Rocket closed $32.4 billion in loans during the quarter, marking a 13.7% annual increase. Profitability on those loans also improved, with gain-on-sale margins rising to 2.80% from 2.78% a year ago.

The servicing side remains a steady engine. As of Sept. 30, Rocket’s servicing portfolio totaled $613 billion in unpaid principal balance, spread across 2.9 million loans. That book throws off roughly $1.7 billion in recurring servicing fee income each year. Just as important, Rocket ended the quarter with $5.84 billion in cash and cash equivalents, giving it plenty of financial flexibility.

Beyond the numbers, Rocket also leaned into technology. During the quarter, it rolled out several artificial intelligence (AI)-driven tools aimed at making life easier for loan officers and brokers, speeding up underwriting, and helping teams focus on the most promising leads.

Wall Street analysts’ outlook on Rocket Companies’ bottom Line trajectory is mixed. The current year looks rough on paper, with profits expected to shrink sharply. In fiscal 2025, its EPS is expected to shrink by 61.1% YOY to $0.07. However, for fiscal 2026, the company’s EPS is projected to grow by 928.6% annually to $0.72.

What Do Analysts Expect for Rocket Companies Stock?

JPMorgan is back, tracking Rocket Companies again, and this time it is coming in with a “Neutral” rating and a $24 price target after a pause on the stock’s coverage. The bank noted that Rocket’s ecosystem got broader. Bringing Redfin and Mr. Cooper into the fold opens new revenue streams and strengthens its mortgage origination engine.

Regardless, JPM is not getting carried away. While it likes the direction Rocket Companies is heading in and the logic behind the revamped strategy, the bank is also flagging a reality check. A lot of the good news – like hopes for falling interest rates and steady gains in market share – may already be baked into the stock. In other words, the recent rally could be pricing in a future that goes well beyond the near-term boost from these acquisitions.

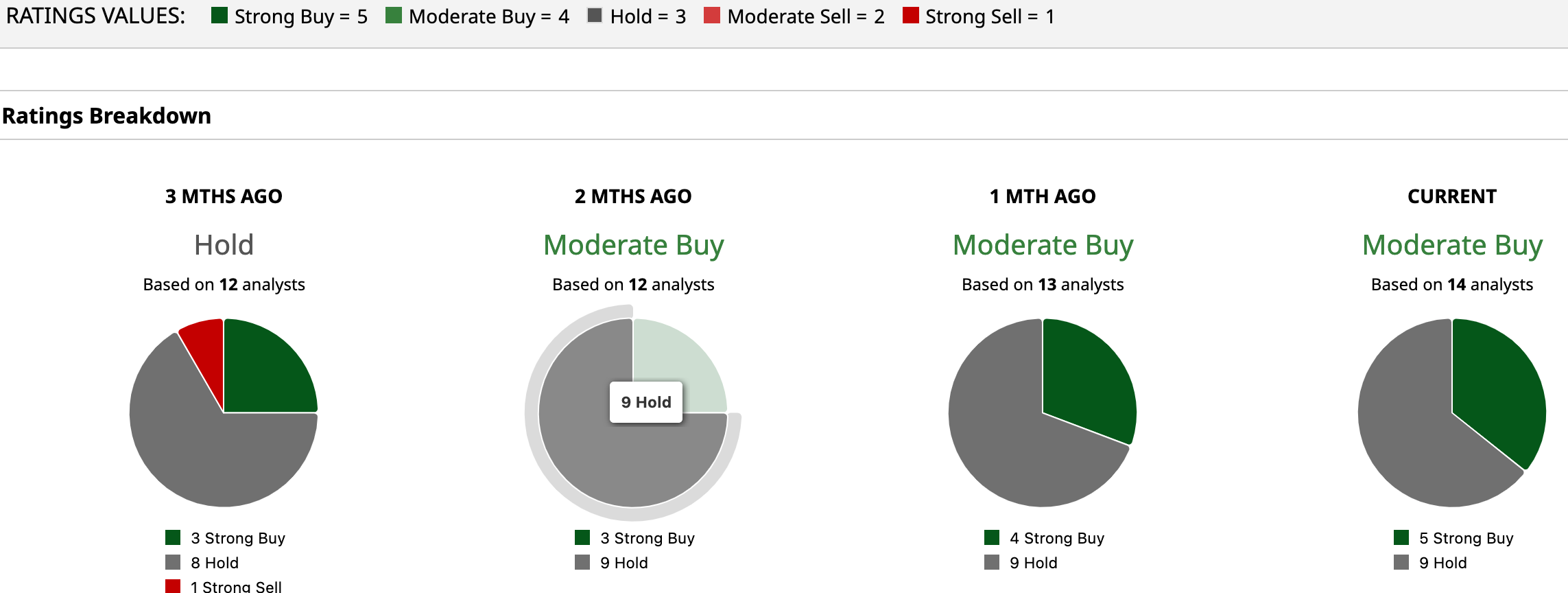

Wall Street analysts are bullish on RKT stock with a dash of caution, assigning it a consensus “Moderate Buy” rating. But that's an upgrade from the “Hold” rating three months back. Of the 14 analysts rating the stock now, five suggest a “Strong Buy,” and the remaining nine are playing it safe with a “Hold.”

After the recent run-up, RKT stock has already sprinted past the Street’s average price target of $21.50. Meanwhile, Jefferies’ Street-high price target of $25 indicates a possible 7.85% upside.

On the date of publication, Sristi Suman Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20Corporation%20logo%20on%20sign-by%20Jean-Luc%20Ichard%20via%20iStock.jpg)

/ServiceNow%20Inc%20logo%20on%20phone-by%20rafapress%20via%20Shutterstock.jpg)