Axon Enterprise (AXON) shares crashed as much as 20% on Nov. 5 after the taser maker reported weaker-than-expected profit for its fiscal third quarter (Q3) due to tariffs-related headwinds.

The Nasdaq-listed firm earned $1.17 on a per-share basis in its recently concluded quarter, notably below the $1.52 per share that analysts had forecast.

Following the post-earnings plummet, Axon stock was seen trading nearly 35% below its year-to-date in the first week of August.

Axon Stock’s Technicals Suggest Bears Are Now in Control

The aforementioned decline in AXON shares on disappointing Q3 earnings resulted in a dramatic technical breakdown.

It pushed the company’s stock decisively below all major moving averages (50-day, 100-day, and 200-day) – representing a fundamental shift in market sentiment.

The comprehensive breach signals bearish momentum has taken hold and sellers will likely remain in control across multiple timeframes moving forward.

Note that Axon stock has historically experienced a more than 3% decline on average in December, which doesn’t help the case for owning it heading into 2026 either.

Carbyne Acquisition Could Drive AXON Shares Higher Again

On Wednesday, Axon Enterprise also confirmed plans of spending about $625 million to acquire Carbyne, an emergency communications and response platform based out of New York.

Bringing Carbyne under its umbrella is an adequately strong reason for long-term investors to stick with AXON stock or even dollar-cost-average their positions on the pullback.

Why? Because it’s a strategic leap into cloud-native 911 infrastructure that positions Axon as a full stack public safety tech leader.

This transaction will unlock recurring software revenue, deepen agency relationships, and expand its total addressable market.

It’s not about vertical integration only, it’s about dominance, mission-critical stickiness, and long-term margin expansion.

What’s the Consensus Rating on Axon Enterprise?

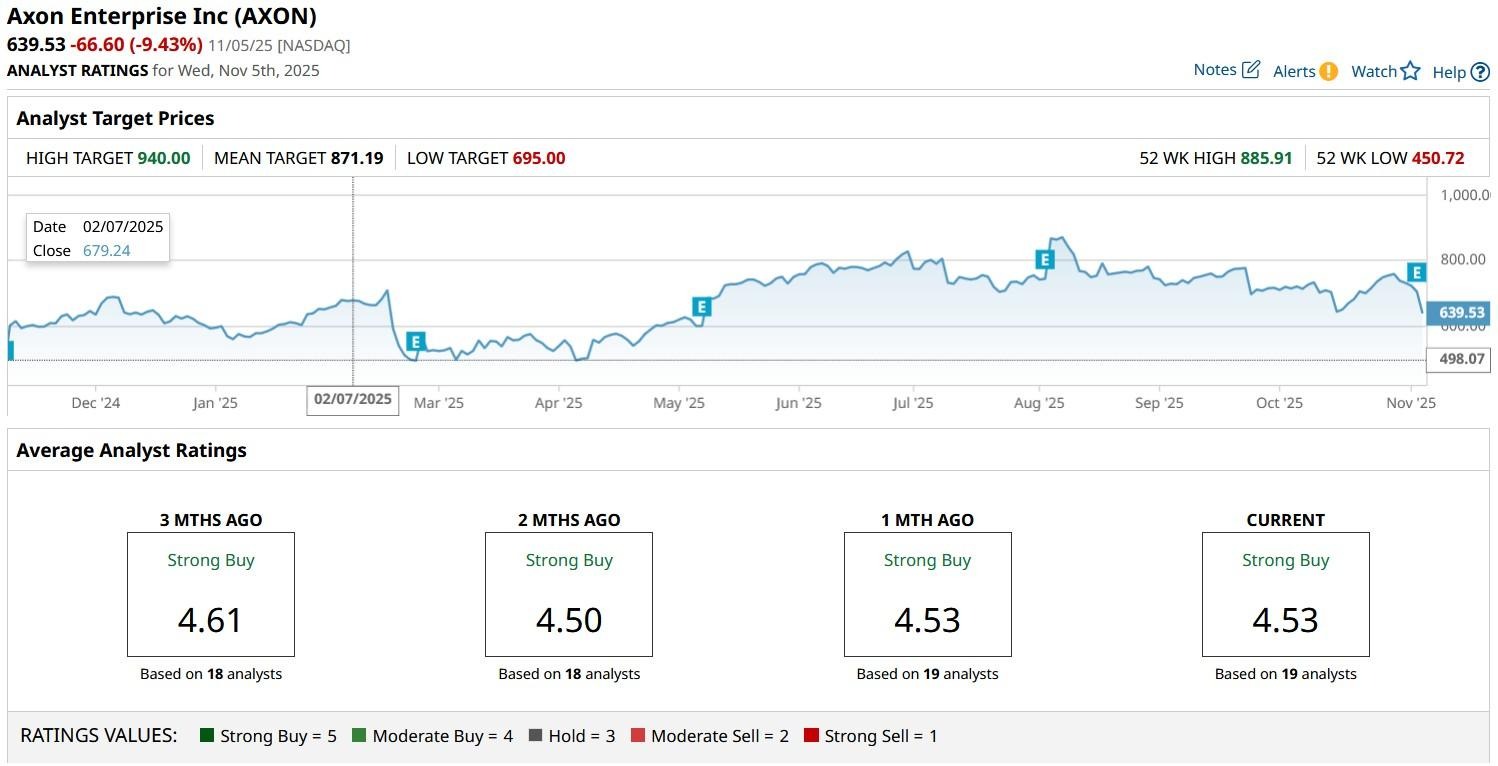

Investors should also note that Wall Street firms remain bullish on AXON shares despite its weak Q3 earnings amid tariffs-related headwinds.

According to Barchart, the consensus rating on Axon stock remains at “Strong Buy” with the mean target of $871 indicating potential upside of more than 55% versus its intraday low on Nov. 5.

/Broadcom%20Inc%20HQ%20photo-by%20Sundry%20Photogrpahy%20via%20iStock.jpg)

/Intel%20Corp_%20Santa%20Clara%20campus-by%20jejim%20via%20Shutterstock.jpg)

/Super%20Micro%20Computer%20Inc%20logo%20on%20building-by%20Poetra_RH%20via%20Shutterstock.jpg)