/A%20sign%20and%20office%20building%20for%20QuantumScape%20by%20JHVEPhoto%20via%20Shutterstock.jpg)

QuantumScape (QS) shares are inching up this morning after the solid-state lithium metal batteries specialist announced a new strategic partnership with Murata Manufacturing (MRAAY).

The partnership aims at mass production of ceramic separators, a crucial component in the NYSE-listed firm’s innovative battery design. Last month, QS inked a similar agreement with Corning (GLW) as well.

Including today’s gain, QuantumScape stock is up more than 350% versus its year-to-date low in April, reflecting growing confidence in the company’s commercialization strategy.

Why QuantumScape Stock Popped on Murata Partnership

QS stock is extending gains on the Murata partnership mostly because it address one of the company’s primary operational challenges: scaling up manufacturing capabilities for essential battery parts.

In the press release, Dr. Siva Sivaram, the CEO of QuantumScape, described Murata as a world-class ceramics manufacturer essential to commercializing his firm’s technology.

Recent demonstrations, including in a Ducati motorcycle at IAA Mobility with PowerCo, have already validated QS technology’s real-world potential.

These strategic partnerships, combined with Volkswagen’s (VWAGY) expanded commitment and additional funding, have significantly strengthened QuantumScape's path to commercialization and could push its stock up further through the end of 2025.

Where Options Data Suggests QS Shares Are Headed Next

According to Barchart data, options traders are bracing for turbulence in QuantumScape shares.

The expected move through the end of Oct. 24 is 18.1%, within a trading range of $12.80 and $18.44.

Longer-term positioning into the Jan. 16 expiration reinforces this caution, with broader range stretching from $9.40 to $21.84.

The bearish tilt aligns with fundamental headwinds. QS posted a $127 million adjusted EBITDA loss in the first half of 2025 and remains years away from commercialization, with field testing slated for 2026.

While its liquidity runway extends to 2029 – thanks in part to Volkswagen’s backing – investors may remain hesitant until clearer revenue visibility emerges.

Wall Street Sees Massive Downside in QuantumScape

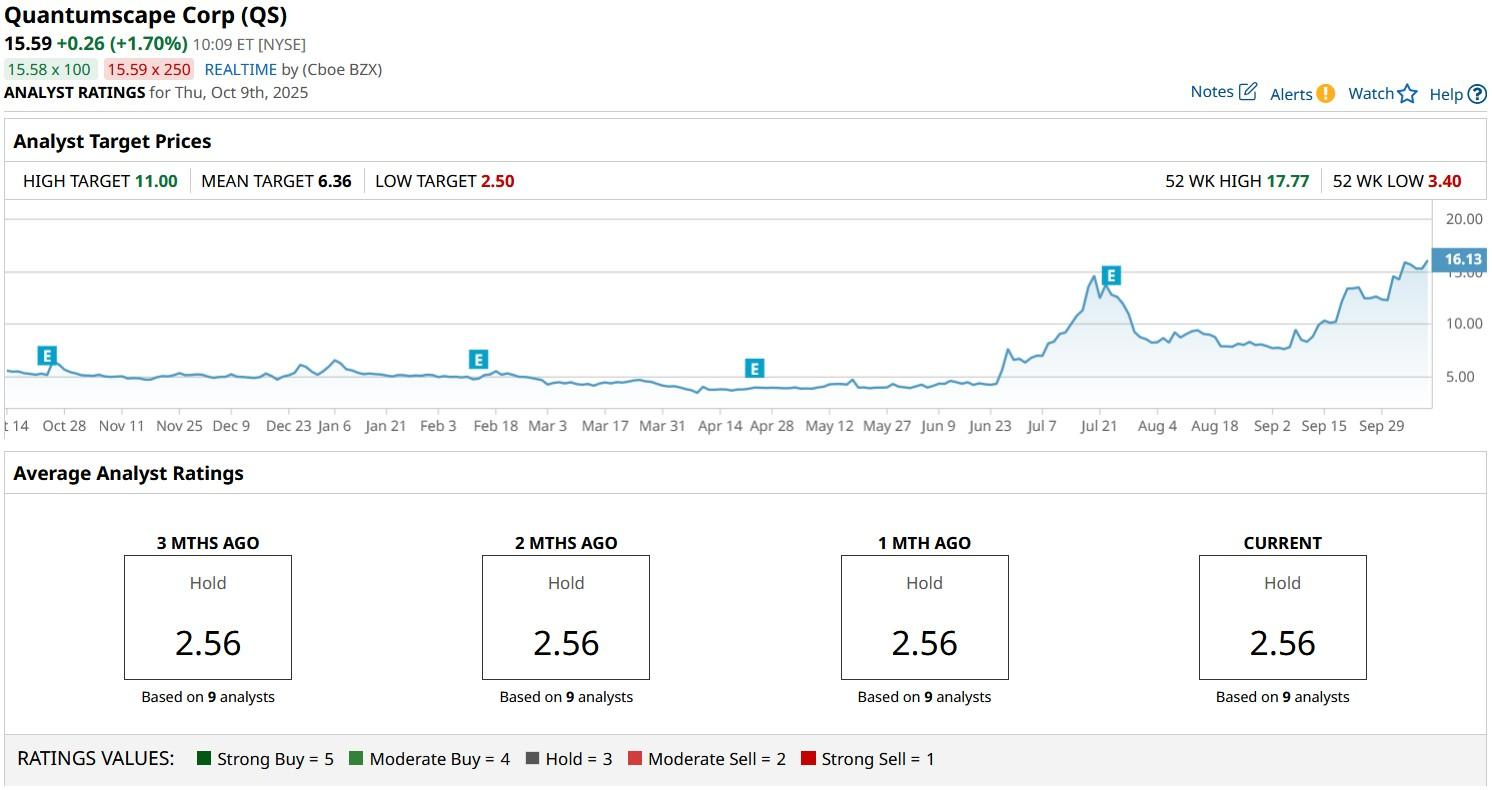

Wall Street analysts also forecast massive downside in QuantumScape stock from current levels.

At the time of writing, the consensus rating on QS shares stand at “Hold” only with the mean target of $6.36 indicating potential downside of nearly 60% from here.

/Microsoft%20Corporation%20logo%20on%20phone-by%20rafapress%20via%20Shuterstock.jpg)

/Advanced%20Micro%20Devices%20Inc_%20office%20sign-by%20Poetra_RH%20via%20Shutterstock.jpg)

/Quantum%20Computing/Image%20by%20Funtap%20via%20Shutterstock.jpg)