Signet Jewelers (SIG) closed another 2.74% up today after reporting better-than-expected Q2 results on the “expansion of [its] on-trend fashion assortment, effective promotion and pricing strategy.”

On Tuesday, its management raised full-year guidance as well, further indicating confidence in the company’s business model and its overall market position.

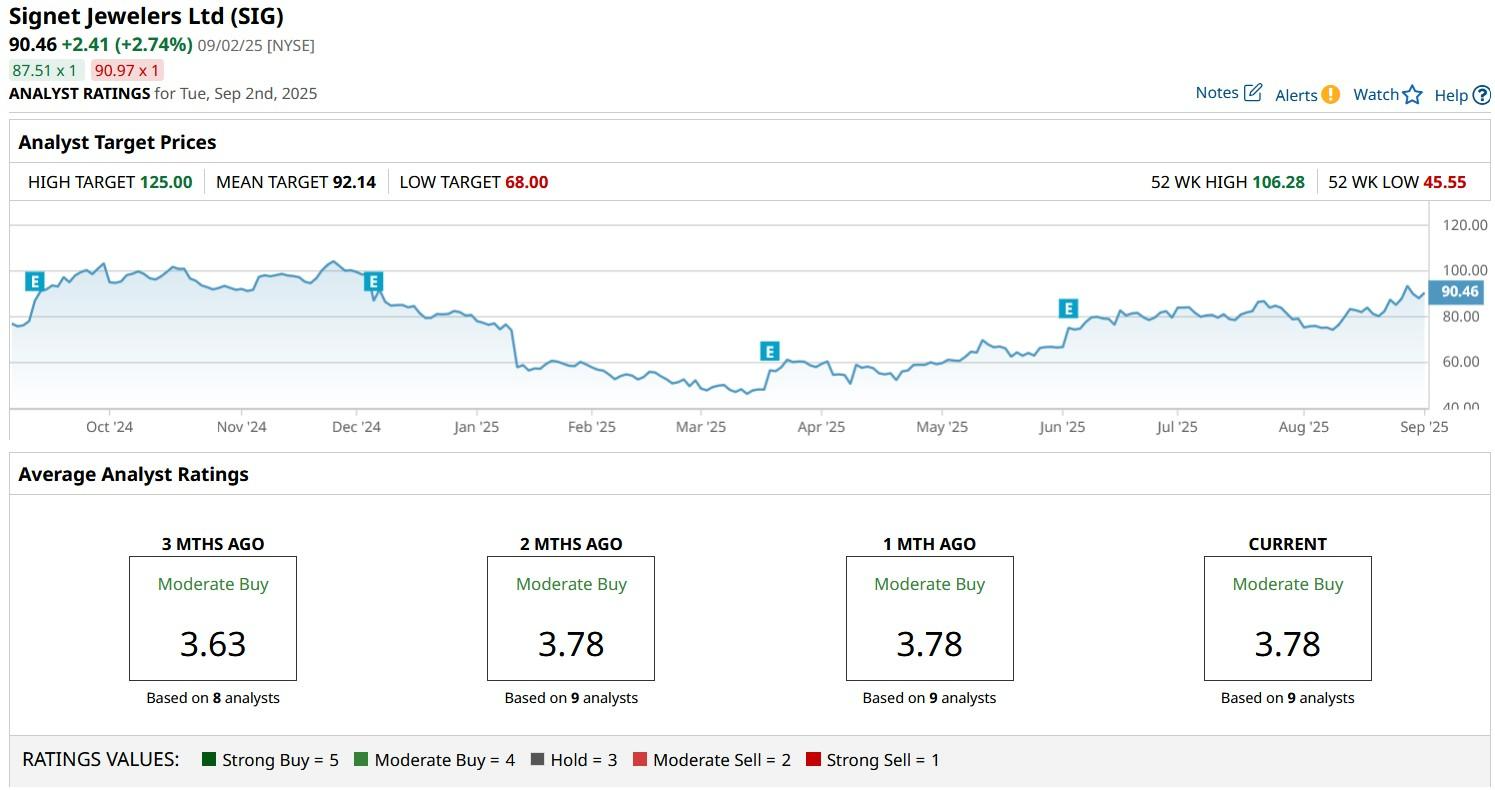

Signet stock has been a lucrative investment this year. At the time of writing, it’s up nearly 100% versus its year-to-date low in March.

What to Expect From Signet Stock Moving Forward

According to data from Barchart, options pricing suggests a wide trading range for the SIG shares heading into 2026, with an expected high of $108 and a low of $73.

This projected move reflects heightened investor interest and volatility around Signet Jeweler’s performance outlook.

While the bullish sentiment has been reignited after the world’s largest retailer of diamond jewelry posted market-beating financials for its Q2 today, the spread also signals caution as markets weigh macro headwinds and seasonal retail dynamics heading into the holiday quarter.

That said, Signet stock currently pays a dividend yield of 1.4% as well, which makes it even more exciting to own for the long term.

Taylor Swift Could Drive SIG Shares Up Further

While options data suggests a wide trading band for Signet shares, a bunch of near-term catalysts could tilt momentum toward the upper end.

The upcoming holiday season, which typically is a peak period of jewelry sales, offers a natural tailwind.

Additionally, the buzz around pop icon Taylor Swift’s engagement with NFL legend Travis Kelce could spark a cultural wave of diamond demand. As the world’s largest diamond jewelry retailer, SIG stock stands to benefit disproportionately from any surge in bridal interest.

Combined with strong Q2 results and raised guidance, these factors position the Signet Jewelers to potentially test the $108 ceiling heading into 2026.

Wall Street Is Bullish on Signet Jewelers in 2025

Investors should also note that Wall Street analysts remain largely bullish on Signet stock after its Q2 earnings.

The consensus rating on SIG shares currently sits at “Moderate Buy” with price objectives going as high as $125, indicating potential upside of nearly 40% from here.

/Broadcom%20Inc%20HQ%20photo-by%20Sundry%20Photogrpahy%20via%20iStock.jpg)

/Super%20Micro%20Computer%20Inc%20logo%20on%20building-by%20Poetra_RH%20via%20Shutterstock.jpg)

/Intel%20Corp_%20Santa%20Clara%20campus-by%20jejim%20via%20Shutterstock.jpg)

/Apple%20Inc%20Tim%20Cook-by%20John%20Gress%20Media%20Inc%20via%20Shutterstock.jpg)