PayPal’s (PYPL) announcement that it plans to expand its PYUSD stablecoin to the Stellar network positions the company at the center of a retail revolution that’s reshaping commerce through artificial intelligence, blockchain technology, and novel payment solutions. Pending New York regulatory approval, this strategic move leverages Stellar’s infrastructure to enable fast, low-cost cross-border payments across more than 170 countries.

The timing aligns with broader industry shifts as retail giants Amazon (AMZN) and Walmart (WMT) explore proprietary stablecoins to bypass traditional payment processors, reduce transaction fees, and accelerate settlement times.

Visa’s (V) chief product officer recently highlighted the potential of stablecoins for emerging markets, cross-border remittances, and B2B payments, where users lack access to stable fiat currencies.

PayPal’s multi-blockchain approach, spanning Ethereum (ETHUSD), Solana (SOLUSD), and potentially Stellar (XLMUSD), demonstrates strategic positioning as the payment landscape evolves beyond traditional “physical” and “digital” definitions toward predictive, personalized commerce.

Is PayPal Stock a Good Buy Right Now?

PayPal is executing a comprehensive transformation under the leadership of CEO Alex Chriss. The payments giant has demonstrated strong momentum across key business segments after 18 months of strategic repositioning.

For instance, the digital payments heavyweight has stabilized transaction margin dollar growth while successfully turning around previously struggling areas, including the unbranded Braintree business and Venmo monetization. Moreover, the company’s branded checkout modernization has shown significant progress, with 45% of U.S. volume now on new experiences, delivering 100 basis points of conversion uplift.

PayPal is expanding this enhanced checkout experience to Europe, where over half of the volume already runs on newer integrations, positioning for accelerated adoption. Management targets a growth acceleration in branded experience from mid-single digits to 8%-10% in the medium term.

PayPal is also pioneering agentic commerce through strategic partnerships with Microsoft (MSFT), Google (GOOGL), Amazon, and OpenAI, leveraging its 400 m-plusillion consumer base and merchant ecosystem. It recently launched the first commerce Model Context Protocol server and developer toolkit, positioning for the next wave of AI-driven transactions.

With diversified revenue streams spanning processing, credit products, and emerging technologies like stablecoins, PayPal’s portfolio approach reduces execution risk while capitalizing on multiple growth vectors across its global two-sided network.

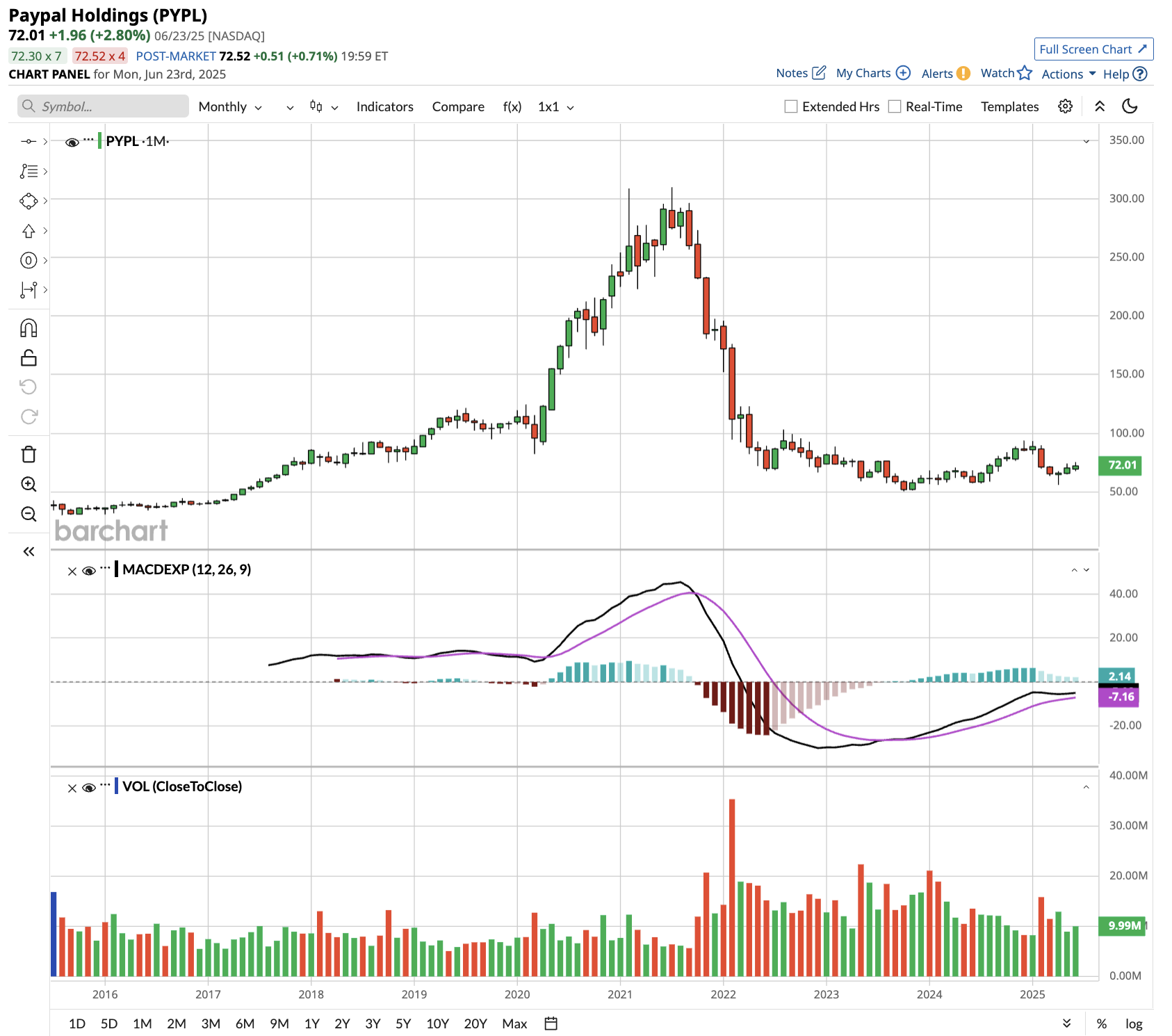

Is PYPL Stock Undervalued?

Analysts tracking PYPL stock expect revenue to increase from $31.8 billion in 2024 to $41.56 billion in 2029. In this period, adjusted earnings are forecast to expand from $4.65 per share to $8.26 per share. If PYPL stock is priced at a reasonable price-earnings multiple of 15x, it will trade around $125 in early 2029, indicating upside potential of 73% from current levels.

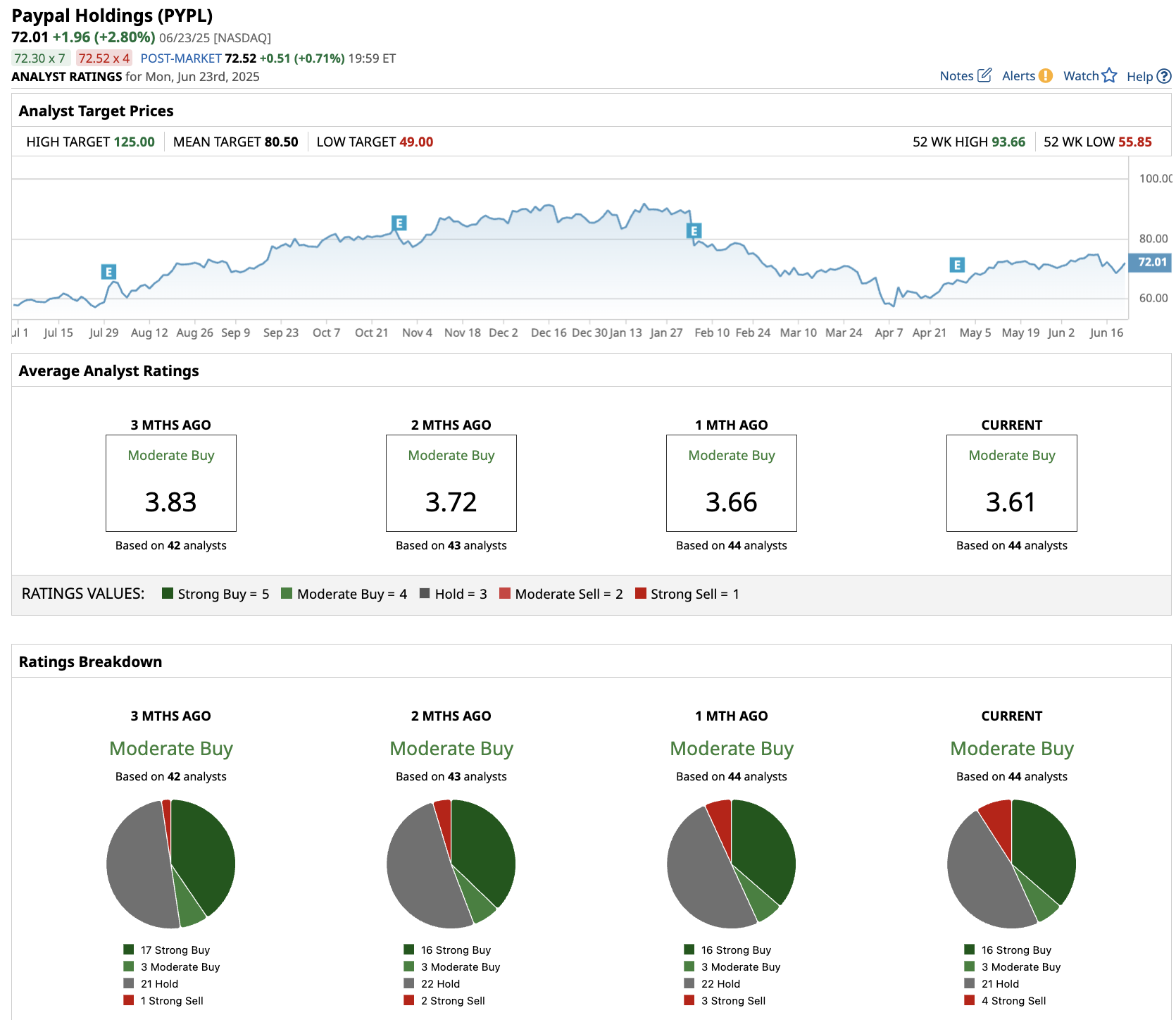

Out of the 44 analysts covering PYPL stock, 16 recommend “Strong Buy,” three recommend “Moderate Buy,” 21 recommend “Hold,” and four recommend “Strong Sell.” The average target price for PayPal stock is $80.50, 10% above the current trading price.

As AI-driven retail becomes more sophisticated and stablecoins gain regulatory clarity through legislation like the GENIUS Act, PayPal’s early positioning in blockchain payments infrastructure could drive growth in transaction volume and revenue diversification. This makes PayPal stock attractive for investors seeking exposure to digital payment transformation.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/AI%20(artificial%20intelligence)/Data%20Center%20by%20Caureem%20via%20Shutterstock%20(2).jpg)

/Netflix%20open%20on%20tablet%20by%20rswebsols%20via%20Pixabay.jpg)