Fourth-quarter earnings season is upon us, and data center stock Corning (GLW) is set to report before the market opens on Wednesday, Jan. 29. Wall Street is looking for the electrical components giant - whose optical fibers are key to supporting Nvidia's (NVDA) Blackwell infrastructure in AI data centers - to report a profit of $0.56 per share, on average, with revenue arriving at $3.76 billion.

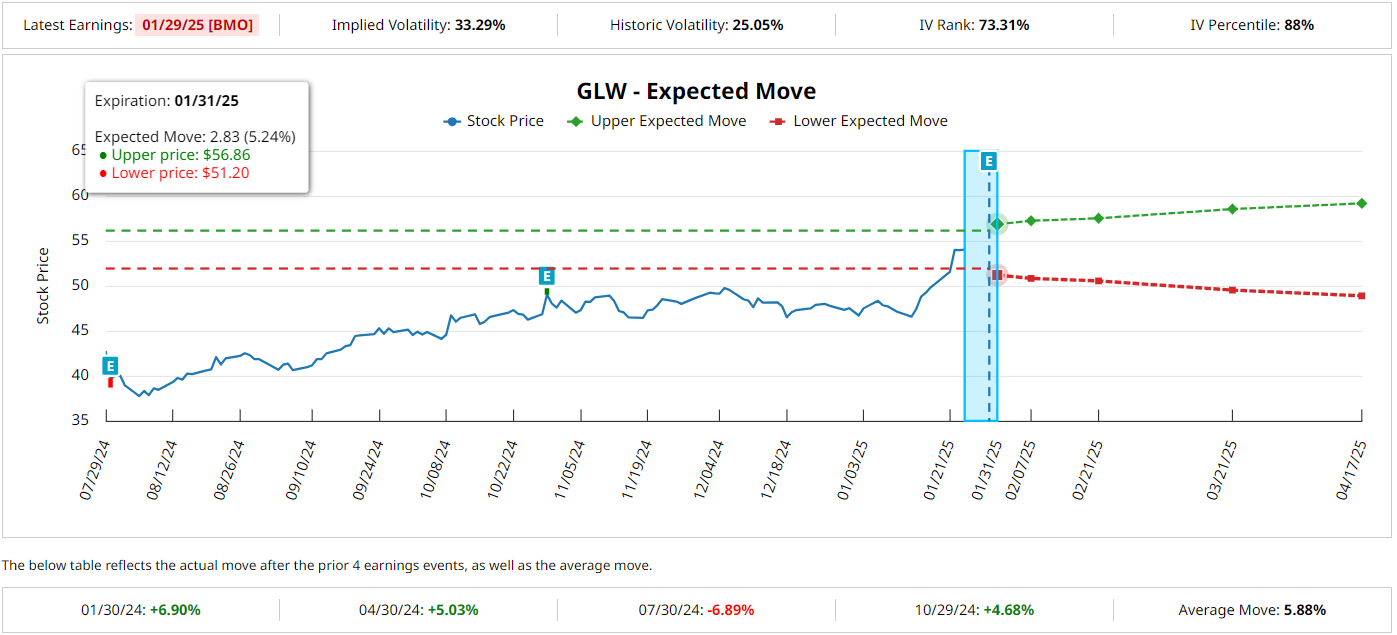

Over the last four quarters, GLW stock has moved an average of 5.88% after earnings. This time around, options traders are pricing in more of the same, with speculators looking for a 5.24% swing in the shares after next Wednesday’s results.

Corning stock is currently trading at $54.13, with a market capitalization of approximately $46.2 billion. The stock has delivered a one-year return of 78%, significantly outperforming the broader equities market.

Beyond pure capital appreciation, it’s worth noting that GLW is also a dividend stock. The forward yield of 2.07% is backed by 16 years of consistent dividend payments, making GLW an attractive pick for investors seeking passive income.

That said, outperforming GLW’s forward adjusted price-to-earnings (P/E) ratio stands at 27.64, indicating a premium valuation compared to the industry average, and suggesting it may be overvalued. Likewise, the price/sales (P/S) ratio is 3.22, which is relatively high, indicating that investors are paying a premium for each dollar of the company's sales.

Plus, technical traders have reason to be wary of a pullback around current levels. GLW just broke out above its upper Bollinger Band, suggesting the stock could be due for a mean reversion. Additionally, the 14-day Relative Strength Index (RSI) of 77.01 confirms a short-term overbought condition. On balance, this indicates that Corning stock is more vulnerable than usual to a short-term pullback or correction.

Analyst ratings for GLW average a “Moderate Buy,” but the stock’s mean price target of $54.77 is nearly flat with current levels - again, confirming that the shares could be fairly valued here, and suggesting that investors should proceed with caution ahead of next week’s quarterly report.

This article was generated with the support of AI and reviewed by an editor. On the date of publication, the editor did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Broadcom%20Inc%20HQ%20photo-by%20Sundry%20Photogrpahy%20via%20iStock.jpg)

/Intel%20Corp_%20Santa%20Clara%20campus-by%20jejim%20via%20Shutterstock.jpg)

/Super%20Micro%20Computer%20Inc%20logo%20on%20building-by%20Poetra_RH%20via%20Shutterstock.jpg)