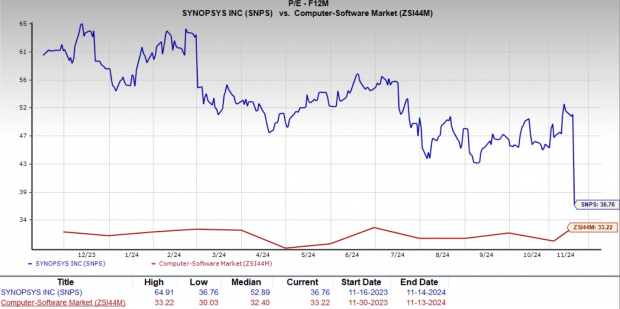

Synopsys Inc. SNPS has long been a respected name in the electronic design automation (EDA) sector, providing essential tools and services to semiconductor design and manufacturing companies. However, with a forward 12-month price-to-earnings (P/E) ratio of 36.76 — significantly above the Zacks Computer - Software industry average of 33.22 — concerns are rising about whether Synopsys' premium valuation is justified in the current market.

Image Source: Zacks Investment Research

Synopsys’ Underwhelming Year-to-Date Performance

One of the main red flags for investors is Synopsys' underperformance in 2024. Year to date, SNPS shares have risen only 6.5%, lagging the Technology Select Sector SPDR Fund XLK ETF, which is up 21.8%, and the S&P 500, which has gained 25.9%.

The contrast is even more striking compared to top competitors like Cadence Design Systems CDNS and Arm Holdings ARM, which have surged 81.2% and 11.1%, respectively. This relative weakness suggests that Synopsys may not be keeping pace with broader market trends or its peers in the EDA space.

YTD Price Return Performance

Image Source: Zacks Investment Research

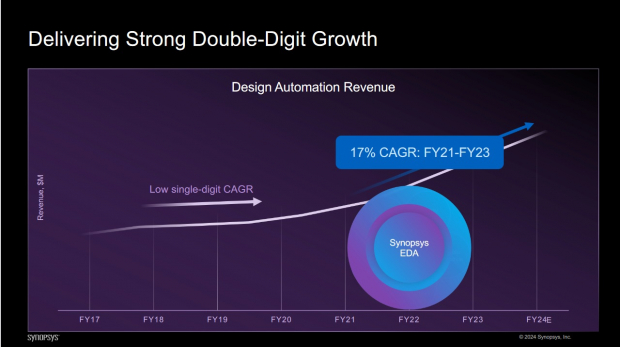

Slowing Growth in Synopsys’ Core Design Automation Segment

The most concerning issue for Synopsys is the evident slowdown in its core Design Automation segment. In the third quarter of fiscal 2024, the segment's revenues increased by just 6% year over year to $1.06 billion. While positive, this growth rate falls short of the double-digit expansion seen in previous years. This deceleration is troubling because Synopsys' EDA tools are crucial to semiconductor design, and any slowdown in this segment could indicate deeper issues with the company’s ability to maintain its competitive edge.

The slowdown in this critical segment raises concerns because Synopsys' Electronic Design Automation tools are fundamental to the semiconductor design process. Any deceleration in this area could signal challenges in maintaining the company's competitive edge. The decline can be attributed, in part, to economic uncertainties, as semiconductor companies cut on research and development spending due to fears of a potential recession.

Image Source: Synopsys

Rising Competitive Pressure for Synopsys

Intensifying competition is another significant challenge for Synopsys. Cadence Design Systems, a key rival in the EDA market, has been making aggressive moves to expand its product portfolio. Cadence’s focus on AI-driven and high-performance computing applications positions it well to capture market share, putting pressure on Synopsys to step up its innovation and potentially reduce its pricing to remain competitive.

Arm Holdings also poses a serious threat with its dominant position in chip architecture licensing. As the adoption of Arm-based designs accelerates across sectors such as mobile, IoT and data centers, Synopsys may face difficulties penetrating certain markets. Arm’s efforts to develop proprietary tools and optimize chip development for its customers could marginalize Synopsys’ offerings, limiting future revenue opportunities.

The combined effect of increased competition from Cadence and Arm puts pressure on Synopsys to boost research and development spending and pursue strategic partnerships. While these efforts are necessary to maintain relevance, they come at the cost of higher operational expenses and narrower profit margins.

Conclusion: Sell SNPS Stock for Now

Given the slowing growth in its core Design Automation segment, rising competitive pressures and an above-average P/E ratio, Synopsys’ outlook appears uncertain. While the company has a solid position in the EDA market, its current valuation and mounting challenges make it difficult to justify holding the stock at this time. Investors may find better opportunities by reallocating capital to other tech stocks with stronger growth momentum and more attractive valuations. For now, selling Synopsys stock seems to be the prudent choice. The stock currently carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Must-See: Solar Stocks Poised to Skyrocket

The solar industry stands to bounce back as tech companies and the economy transition away from fossil fuels to power the AI boom.

Trillions of dollars will be invested in clean energy over the coming years – and analysts predict solar will account for 80% of the renewable energy expansion. This creates an outsized opportunity to profit in the near-term and for years to come. But you have to pick the right stocks to get into.

Discover Zacks’ hottest solar stock recommendation FREE.Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ARM Holdings PLC Sponsored ADR (ARM): Free Stock Analysis Report

Synopsys, Inc. (SNPS): Free Stock Analysis Report

Cadence Design Systems, Inc. (CDNS): Free Stock Analysis Report

Technology Select Sector SPDR ETF (XLK): ETF Research Reports

/The%20CoreWeave%20logo%20displayed%20on%20a%20smartphone%20screen_%20Image%20by%20Robert%20Way%20via%20Shutterstock_.jpg)

/AI%20(artificial%20intelligence)/Artificial%20intelligence%20and%20machine%20learning%20concept%20-%20by%20amgun%20via%20iStock.jpg)

/Nvidia%20logo%20by%20Konstantin%20Savusia%20via%20Shutterstock.jpg)