As we head into February, expectations for a recession are fading fast - and predictions for a relatively rare economic “soft landing” are ramping up. With the Fed holding off on rate cuts for now - but still on pace to ease monetary policy later this year - Deutsche Bank wrote today, “When we first adopted a mild recession as our baseline forecast, a key element was that, with an economy far from the Fed’s objectives, the history of central bank-induced disinflations showed the path to a soft landing was narrow if not unprecedented. We now think the economy will land on this narrow path and that a recession will be averted with limited cost in the labor market."

Fortunately, analysts at Wolfe have already named a top stock pick for a soft-landing scenario, and it just so happens to be a favorite of legendary value investor Warren Buffett, as well. Here's a closer look.

About Capital One Financial Stock

Valued at $51.5 billion by market cap, Capital One Financial (COF) is a credit card issuer, as well as a commercial and consumer lender.

The stock has been a part of the Berkshire Hathaway (BRK.B) equity portfolio since the first quarter of 2023, around the time of the regional bank crisis. The Buffett-run conglomerate holds a stake of 3.3% in Capital One, representing about 0.4% of Berkshire's equity holdings.

Capital One stock is up more than 13% over the past year, powered largely by a 26% rally over the past three months.

However, the shares have pulled back since the release of Capital One's fourth-quarter earnings, which they reported on Jan. 25. Adjusted EPS of $2.24 fell short of what Wall Street analysts were expecting, even as revenue of $9.51 billion edged past estimates. Investors also eyed the company's rising net charge-off rate, which climbed to 3.21% from 1.86% a year ago.

Plus, the stock pays a quarterly dividend of $0.60, which translates to a forward yield of 1.77%. With a modest payout ratio of less than 20%, and further backed by a substantial cash position, Capital One has plenty of ceiling to keep raising its dividend payments to shareholders going forward.

What Do Analysts Expect for COF?

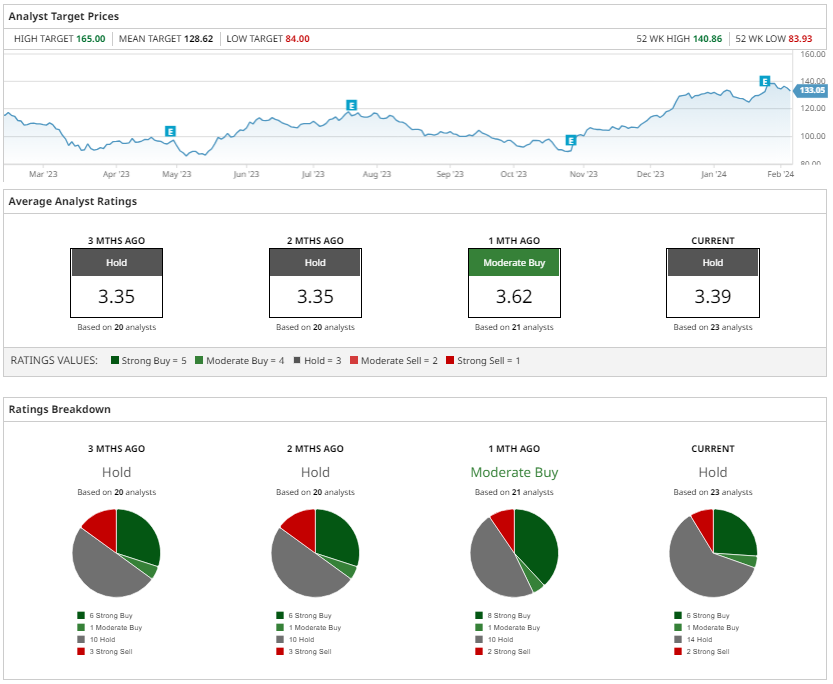

When it comes to Capital One, analysts aren't exactly overwhelmingly bullish. The consensus opinion is a “Hold,” with 14 of these tepid recommendations out of 23 total analyst ratings. The remaining analysts have given the stock 6 “Strong Buys,” 1 “Moderate Buy,” and 2 “Strong Sells.”

Plus, the average price target among these analysts is $128.62, which is a slight discount to COF's current price.

However, some experts are getting less gloomy as economic forecasts improve. Analyst Bill Carcache of Wolfe Research upgraded COF to “Market Weight" after earnings, and wrote, "We now see clear evidence that delinquency rate formations are rolling over. Against this backdrop, we no longer believe an Underweight rating is appropriate."

Notably, the Street-high price target for COF is $159.00, which is a forecast shared by both Goldman Sachs and KBW. This implies expected upside of about 19% from here - indicating that Capital One stock could be worth scooping up at current levels for investors seeking income and growth to complement an increasingly likely “soft landing” scenario.

On the date of publication, Ebube Jones did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Broadcom%20Inc%20HQ%20photo-by%20Sundry%20Photogrpahy%20via%20iStock.jpg)

/Intel%20Corp_%20Santa%20Clara%20campus-by%20jejim%20via%20Shutterstock.jpg)

/Super%20Micro%20Computer%20Inc%20logo%20on%20building-by%20Poetra_RH%20via%20Shutterstock.jpg)