Sofi Technologies (SOFI) surprised the market today with huge revenue and EBITDA gains in Q4. SOFI stock is up over 20%. As a result, SOFI stock put option premiums are at high levels. They look attractive to short sellers as an income play.

Sofi released its earnings on Monday, Jan. 29, showing that adjusted revenue was up 34% YoY to $594 million. Moreover, adjusted earnings before interest, depreciation, taxes, and amortization (EBITDA) were up 159% YoY to $181 million.

The company also guided for continued strong Q1 2024 results. This included higher top-line (revenue) growth and flat expense forecasts. The market is very pleased with these results and SOFI stock is now up 22% in morning trading to $9.34 per share.

Hitting Its Target

SOFI also said it reached its adjusted EBITDA margin target of 30%. That is because its adj. EBITDA was 30.47% of revenue (i.e., $181m/$594m).

Adj. EBITDA is a form of cash flow, although not completely a free cash flow (FCF) figure. Many tech companies use adj. EBITDA as it eliminates most non-cash expenses, although it also cuts out accrued taxes, which eventually have to be paid.

It also does not include changes in working capital and capex payments, which are included in free cash flow (FCF) measures. Nevertheless, it serves a useful purpose of showing that the company has plenty of cash flow to make debt payments.

The bottom line is the return of student loan payments (including accrued interest) and growth in the company's tech and financial services platforms.

As a result, put option premiums have risen significantly. That makes them attractive to short sellers.

Selling OTM Puts in SOFI Stock

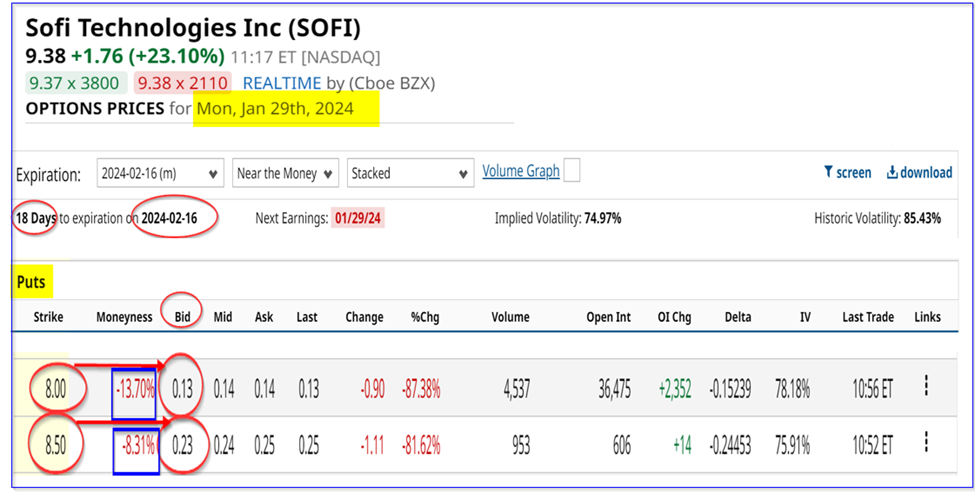

For example, the Feb. 16, 2024, expiry period shows that out-of-the-money (OTM) puts are at high premium levels. The $8.50 strike price premium, which is over 8% below today's price, trades for 23 cents on the bid side. Moreover, the $8.00 strike price, a 13.7% OTM level, is at 13 cents.

That means that the short seller of 10 put contracts at $8.50 can immediately make $230 for an investment of $8,500. That works out to an immediate yield of 2.705%.

Moreover, for more conservative investors, the yield using the $8.00 strike price put, is 1.625% (i.e., $130/$8,000) for 10 puts shorted.

These are excellent returns for both existing investors in SOFI stock and investors who are willing to buy the stock at these strike prices should the stock fall in the next 3 weeks on or before Feb. 16.

In other words, this is a good way to buy into the stock for investors who think today's rise might make a retracement. Either way, the stock looks very attractive, especially if these outstanding results continue.

More Stock Market News from Barchart

- Should You Buy These 2 Top-Rated Energy Stocks Now?

- Stocks Mixed Awaiting Megacap Tech Earnings and FOMC Results

- Amazon Q4 Earnings Preview: Will AMZN Stock Scale New Highs?

- Markets Today: Stocks Mixed after Corporate News and Lower Bond Yields

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Cybersecurity%20by%20AIBooth%20via%20Shutterstock.jpg)