The post-earnings behavior of Alphabet (NASDAQ:GOOGL) (NASDAQ:GOOG) stock may understandably befuddle some investors. If you missed the news, the tech giant just posted massive profit growth in the latest quarter and sees an apparent recovery in ad spending. However, that did not negate the robust but lower growth in its Google Cloud segment.

The stock has sunk nearly 10% since the report. Yet, such sharp, short-term swings in the share price could provide a key advantage to long-term investors. Let's see why.

Alphabet post-earnings

Alphabet filed what most would consider a solid earnings report for the third quarter. It was not so much good and bad news as it was good news and great news. Revenue in Q3 climbed 11% yearly to almost $77 billion.

One notable part of the revenue picture was the 9% increase in ad revenue, meaning the segment that makes up 77% of the Google parent's revenue may finally be recovering.

Unfortunately, investors did not react well to cloud revenue even though it grew 22% over the same time frame to $8.4 billion. Although this was a significant growth rate, Google Cloud revenue had increased by 38% annually in the year-ago quarter.

Also, many perceive Google Cloud as a key part of the company's future in driving company revenue, reducing the company's dependence on the ad market for revenue.

Still, Q3 2023 net income rose by 42% yearly to almost $20 billion. Additionally, despite the post-earnings slump, Alphabet stock has risen by more than 40% this year. Also, with the stock's P/E ratio at 24, it trades at a valuation near historical averages. Such metrics appear to make a better case for buying than selling.

How investors can benefit

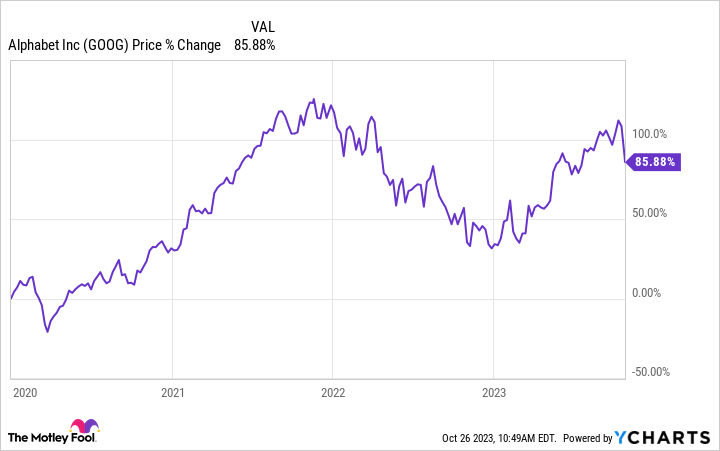

Instead, investors recoiled, which in itself can inspire investors to avoid the stock. Moreover, investors may have good reason to stay away from stocks so strongly guided by emotion. In just the last four years, investors saw how the post-pandemic market recovery took the valuation of many stocks to extreme highs.

Then they saw how some of those one-time highfliers lost more than 90% of their value in the 2022 bear market. And even Alphabet fell as much as 45% from its peak in early 2022.

Nonetheless, comparing a company's performance to its financials can reveal areas where the market may have overreacted to news about the stock. Fortunately, the fundamentals indicate that investors can buy Alphabet at a reasonable valuation.

Additionally, investors should not forget that Alphabet offered investors signs of recovery in its largest segment and double-digit revenue growth. These factors led to a massive surge in profits, and such fundamentals should ultimately bode well for this media stock.

Consider Alphabet amid the turmoil

Extreme emotions have provided an advantage to those who want to buy Alphabet stock. Admittedly, a relative slowdown in the growth of Google Cloud may unnerve investors since many had pinned high hopes on the cloud segment as a revenue source.

Nonetheless, it is the recovery in ad spending that is most important to the Google parent under current conditions. Additionally, when one couples the massive profit growth with a now-discounted stock price, it is a sign that investors should see such moves as a buying opportunity rather than a moment to sell out of fear.

10 stocks we like better than Alphabet

When our analyst team has a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

They just revealed what they believe are the ten best stocks for investors to buy right now... and Alphabet wasn't one of them! That's right -- they think these 10 stocks are even better buys.

*Stock Advisor returns as of October 23, 2023

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool's board of directors. Will Healy has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet. The Motley Fool has a disclosure policy.

/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)

/A%20Palantir%20office%20building%20in%20Tokyo_%20Image%20by%20Hiroshi-Mori-Stock%20via%20Shutterstock_.jpg)