The cryptocurrency class has redefined market volatility over the past years. Few assets in history have achieved the returns seen in Bitcoin, which rose from five cents in 2010 to the $69,000 per token level on November 10, 2021. Ethereum’s results have not been as dramatic as Bitcoin’s, but they have been impressive. In May 2016, an Ether token was at the $11.13 level, and it rose to a high of $4,865 in mid-November 2021.

At the end of last week, Bitcoin and Ethereum were significantly below their all-time highs but had recovered from the late January lows. The cryptos have been uncharacteristically quiet in 2022 after substantial rallies in 2019, 2020, and 2021. In Q1 2020, Ethereum and Bitcoin prices declined as rising inflation did not cause buying in the sector.

Bitcoin has rallied over the past three years- A correction leads to sideways price action

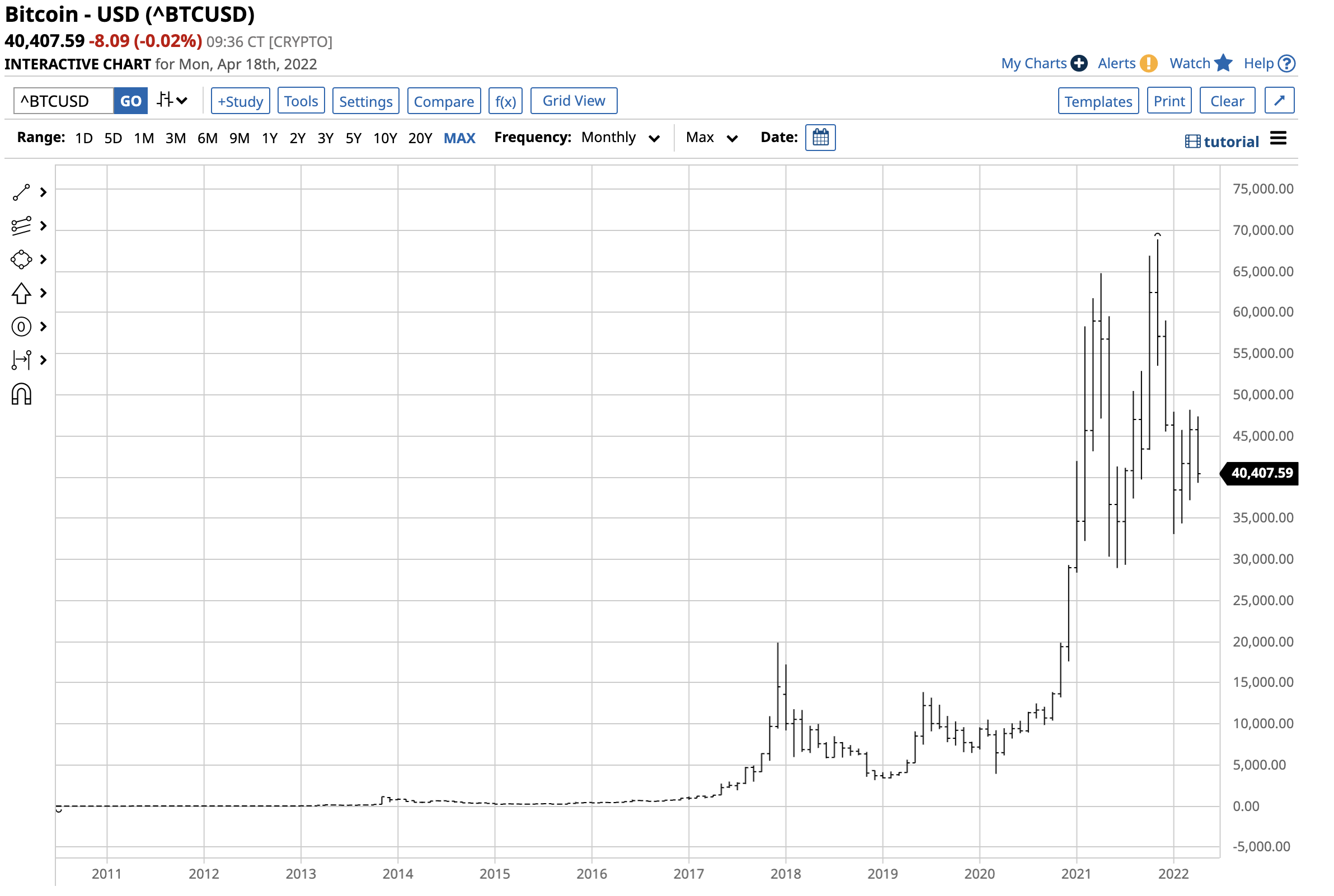

The explosive appreciation of Bitcoin over the past twelve years has been anything but a smooth ride. Price explosions and implosions have been the norm, not the exception.

The long-term chart highlights the wild ride in Bitcoin. The latest decline took the crypto from $68,906.48 on November 10 to a low of $33,076.69 on January 24, a 52% decline.

At around the $40,400 level on April 17, the price was a lot closer to the late January low than the mid-November high. In 2019, Bitcoin rallied 93.65%, and in 2020 it moved 303.19% higher. Last year, Bitcoin added another 57.81%. In Q1 2022, the leading crypto edged only 0.73% to the downside from the December 31, 2021, closing level.

Ethereum has followed the same path

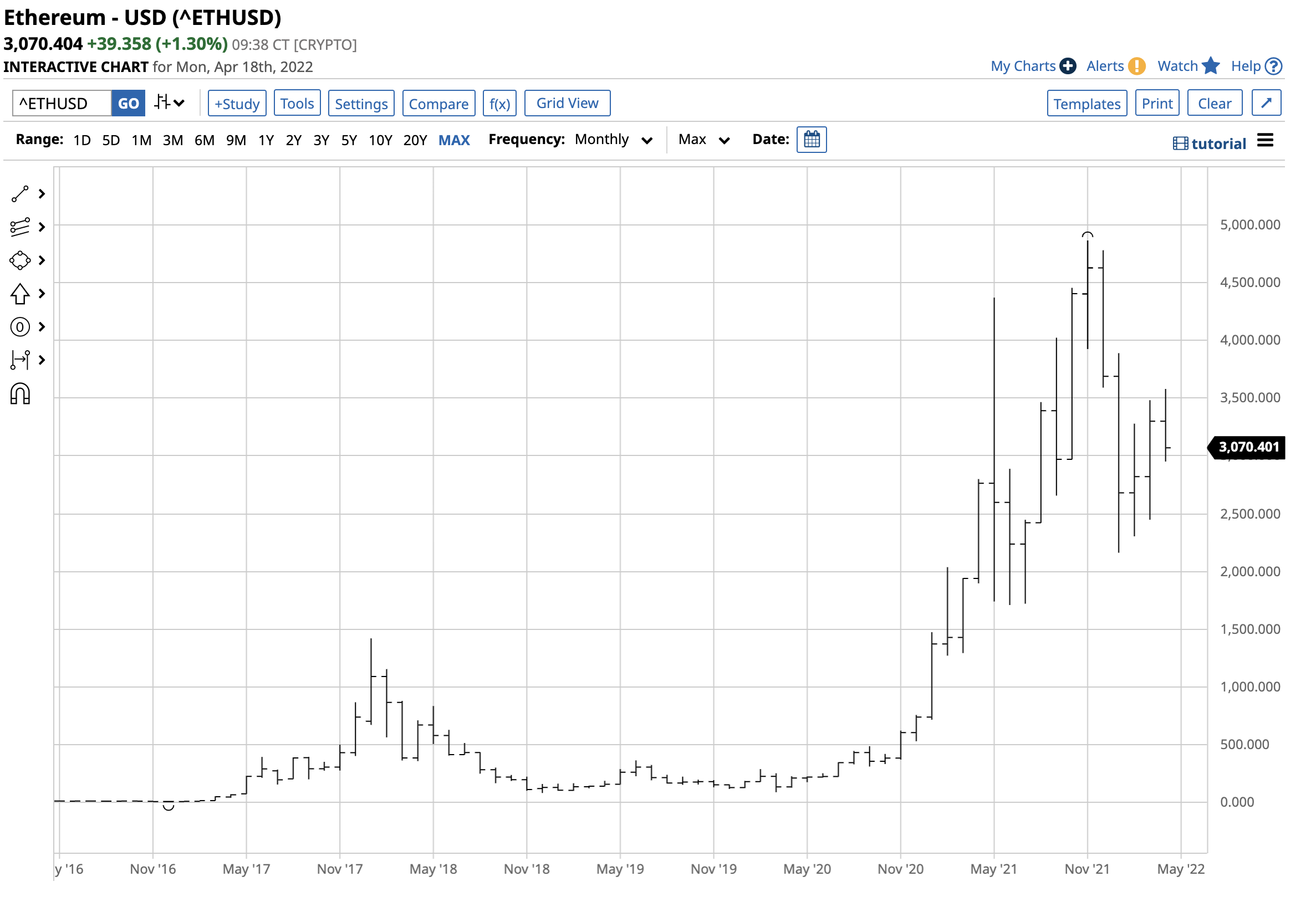

Ethereum also peaked on November 10, 2021, when the two cryptos made bearish key reversal patterns on the daily charts.

The chart shows Ethereum dropped from $4,865.426 to $2,163.316, a 55.5% decline. Like Bitcoin, at just over the $3,070 level on April 17, the price was closer to the low. Ethereum moved 1.93% lower in 2019. In 2020, it was up 108.19%, and in 2021 the price rallied 291.75%. In Q1 2022, Ethereum corrected 9.94% lower.

April 18 is Tax Day- Could tax selling have held the prices down?

Monday, April 18, is Tax Day in the US, and some US filers were sitting with substantial profits in cryptocurrencies. While the prices were sitting closer to the late January lows than the November 2021 high, market participants that bought cryptos over the past years were sitting with substantial gains. The potential for increasing capital gains taxes on wealthy filers could have led to tax selling in the asset class over the past weeks and months.

Selling for tax purposes could have weighed on Bitcoin, Ethereum, and other cryptocurrencies through last week. The selling pressure could decline with the filing date for the 2021 tax year in the rearview mirror.

Inflation has not lit a bullish fuse, yet

The latest March consumer and producer price index data have come in hot, with inflation running at the highest level since the early 1980s. While the Fed could raise the Fed Funds rate by 50 basis points at the April FOMC meeting, the central bank will remain far behind the inflationary curve.

The inflationary seeds were the unprecedented levels of central bank liquidity and government stimulus in response to the 2020 global pandemic. Supply chain bottlenecks caused by the COVID-19 virus exacerbated inflationary pressures, pushing prices of goods and services higher. Meanwhile, Russia’s invasion of Ukraine and Western sanctions on Russia poured fuel on the already burning inflationary fire as Russia is a leading energy and raw material producer and exporter.

The CFTC defines cryptocurrencies as commodities, and most raw material prices have risen to multi-year and all-time highs over the past months. Meanwhile, Bitcoin, Ethereum, and other asset class members rose to record peaks in November 2021 but corrected and are sitting near the lows. Some market participants are frustrated that they are not reflecting inflation. However, we could see a delayed reaction as fiat currency values have eroded because of the economic condition. Moreover, the geopolitical bifurcation with China and Russia on one side and the US and Europe on the other could open the door for more acceptance of cryptocurrencies as they are global and transcend borders.

Buying dips has been the optimal approach- Risk-reward favors the upside

Over the past decade, buying cryptocurrencies on price corrections has been the best approach to investing in the asset class. There have been many selloffs before the November 2021 high that led to higher highs, and I expect that trend to continue.

I view the $40,000 level in Bitcoin and the $3000 level in Ethereum as attractive levels for investors. However, the uncertainty of custody, security, and regulatory issues creates risk for investors. I only invest capital I am willing to lose in cryptocurrencies as the worst-case downside is zero. Meanwhile, risk-reward at the current price continues to favor the upside. Bitcoin is around $10,000 above the late January low and over $28,000 per token below the November 2021 high. Ethereum is nearly $1,800 below the high and close to $900 above January’s bottom. The cryptos offer at least 2:1 reward versus risk odds based on the most recent highs and lows on a risk-reward basis.

Only invest what you are willing to lose. The potential for rewards is always a function of risk. In a market that moves from feast to famine and experiences price explosions and implosions, the odds favor another explosion after the most recent implosion. The cryptos are digesting their recent price volatility and consolidating at attractive levels.

/AI%20(artificial%20intelligence)/Data%20Center%20by%20Caureem%20via%20Shutterstock%20(2).jpg)

/Netflix%20open%20on%20tablet%20by%20rswebsols%20via%20Pixabay.jpg)