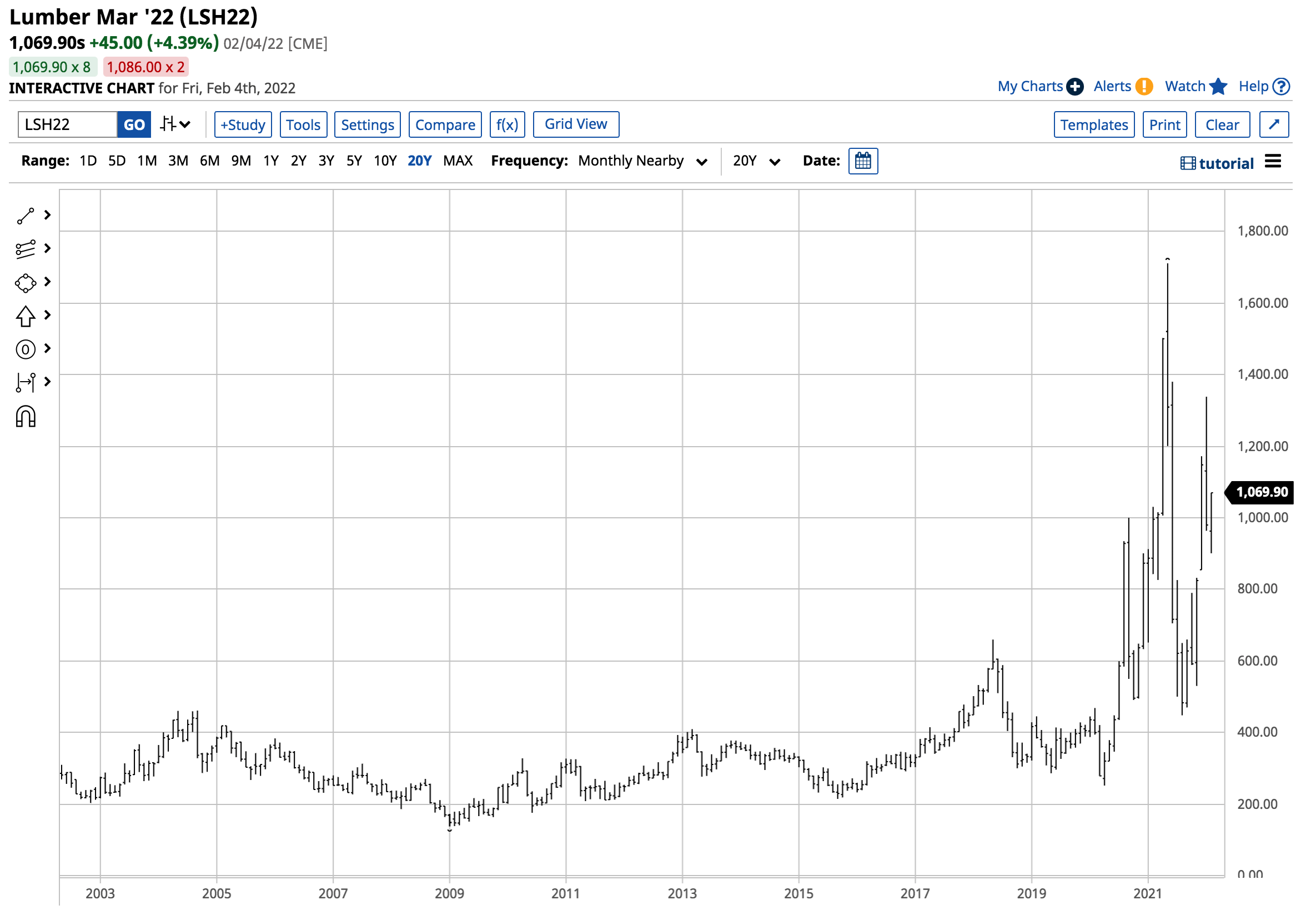

March lumber futures on the Chicago Mercantile Exchange reached the most recent high on January 14 at $1338.20 per 1,000 board feet. The move was impressive as a little less than four months earlier, on August 20, 2021, March lumber traded to a low of $515.50. On February 4, the nearby futures price settled at the $1069.90 level after probing below $1,000.

Before 2018, the all-time high in the wood futures market was the 1993 $493.50 high. While the continuous futures contract reached $448 in August 2021, the price did not stay below the 1993 high for long. In September 2021, it was back above $500, and in December, it eclipsed the $1000 level. Lumber futures are a wild bucking bronco.

The recent correction took the price down the extended $45 limit on three consecutive sessions, on January 24, 25, and 26. Any market participant caught long and wrong in the lumber market could not liquidate their risk position as there were no bids. Buyers were welcome in the market that became a falling knife, but there were few takers.

Lumber is a barometer for the US housing market as it is a critical construction component in new homes. Therefore, higher interest rates tend to weigh on wood’s price. While the US will require lots of lumber for its infrastructure rebuilding program, the futures market moves higher and lower with sentiment. Since January 14, the sentiment did an about-face, making a sharp turn from bullish to bearish.

Lumber had been a psychotic market

The lumber futures market continues to be a yo-yo of extreme price moves. However, the price remains substantially above the pre-2018 high.

As I highlighted in past articles on lumber, the low volume and open interest in the futures market leads to an environment where “bids disappear when prices fall and offers evaporate as they rise. Illiquid markets tend to experience illogical, unreasonable, and irrational price action that exacerbates price movements during trends. Illiquidity can lead a market to rise to unthinkable levels on the upside and fall to the same on the downside. Lumber futures are the poster child for illiquidity in the futures arena.”

Anyone who trades lumber knows it can be like riding a psychotic horse through a burning barn. Those barn doors can close for market participants on the wrong side of the trend.

The chart highlights three trading sessions on January 24, 25, and 26, where the barn doors were closed with those holding long positions inside. Lumber experienced three consecutive limit-down sessions, where the price fell by $45 per 1,000 board feet each day. Longs had no opportunity to liquidate risk positions as the bids evaporated. On February 3 and 4, the same occurred on the upside as the price rose the $45 daily limit.

Wild volatility from 2021 continues in 2022

From a longer-term perspective, the lumber price remains high even though it slipped below the $1,000 per 1,000 board feet as of February 4.

The monthly chart shows the following trading ranges over the past years:

- 2017- $303.30-$477.70- a $174.40 range

- 2018- $299.90- $659.00- a $359.10 range

- 2019- $286.10- $444.90- a $145 range

- 2020- $251.50- $1,000.00- a $748.50 range

- 2021- $448.00- $1,711.20- a $1,263.20 range

- 2022- $900.90- $1,338.20- a $347.30 range

In 2022, in a little over one month, lumber’s wide trading range continues, with the wood market already trading in a broader band than in 2017 and 2019.

Lumber is a critical construction input

The Fed may be increasing interest rates over the coming months, but the central bank will not snap its fingers and push rates to much higher levels overnight. The process will take months, where the central bank increases will come in increments of twenty-five basis points, and a fifty basis point increase would be the exception.

As the demand for new homes rises, we could see buyers scramble to purchase properties and lock in mortgage rates as they rise over the coming months. Real estate prices continue to increase, signifying the demand for wood is growing in the current market.

As the US rebuilds and refreshes the crumbling infrastructure, it puts upward pressure on lumber prices. Lumber is a component in all construction, from new homes to government infrastructure.

Canada supplies lots of wood to the US

Canada’s timberlands supply lumber to US consumers. Canadian pine is a highly sought-after wood for homebuilding because of its strength.

Supply chain issues because of the pandemic, including fewer truckers, rail employees, and less mill workers, have caused shortages of Canadian wood supplies. Moreover, in November 2021, the US Commerce Department doubled its tariff on Canadian softwood lumber imports to almost 18%, putting upward pressure on lumber prices. At the center of the dispute between the US and Canada is whether or not Canada subsidizes their lumber industry.

Simultaneously, increased wildfires in 2017-2018 created a shortage of Canadian trees for export to the US, weighing in supplies. The bottom line is that lumber has experienced an almost perfect bullish storm. Nature manufacturers lumber; humans can only cut down trees and process them into construction-grade lumber. Nature has curtained supplies, and labor shortages have added to the problems.

The liquid lumber futures market will continue to go from famine to feast to famine in a volatile and head-spinning pattern

Expect the wild price swings in lumber to continue throughout 2022. The futures market has already traded in a $347.30 per 1,000 board feet range, and we are only a little over one month into this year. The range is higher than the price of lumber futures at the April 2020 low.

Lumber is a market that is a bellwether and barometer for the housing and construction markets. Therefore, the price action provides insight into the overall economy.

Never trade the lumber futures market unless you enjoy psychotic horse rides through burning wooden barns. However, watch the price action as it can provide clues about the path of least resistance of other commodities and assets as it is a leading economic indicator.

/Tesla%20car%20with%20symbol%20by%20Michael%20Fortsch%20via%20Unsplash.jpg)

/Unitedhealth%20Group%20Inc%20HQ%20photo-by%20jetcityimage%20via%20iStock.jpg)

/Advanced%20Micro%20Devices%20Inc_%20office%20sign-by%20Poetra_RH%20via%20Shutterstock.jpg)

/AI%20(artificial%20intelligence)/AI%20technology%20-%20by%20Wanan%20Yossingkum%20via%20iStock.jpg)

/Amazon%20-%20Image%20by%20Tada%20Images%20via%20Shutterstock.jpg)