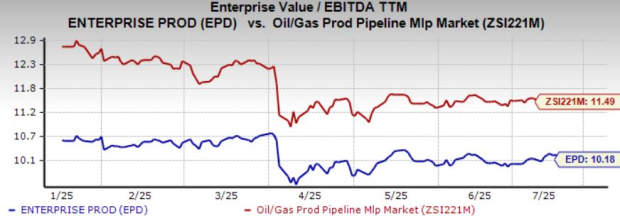

Enterprise Products Partners LP EPD is currently trading at a trailing 12-month enterprise value-to-EBITDA (EV/EBITDA) of 10.18x. This represents a discount compared with the broader industry average of 11.49x and midstream giants like Kinder Morgan KMI and Enbridge ENB, which trade at 14.34x and 15.10x, respectively.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Should investors bet on the undervalued stock right away? To answer this billion-dollar question, let's examine the partnership’s fundamentals and business outlook before coming to the investment conclusion.

EPD’s Downside if Project Economics Shift Unfavorably

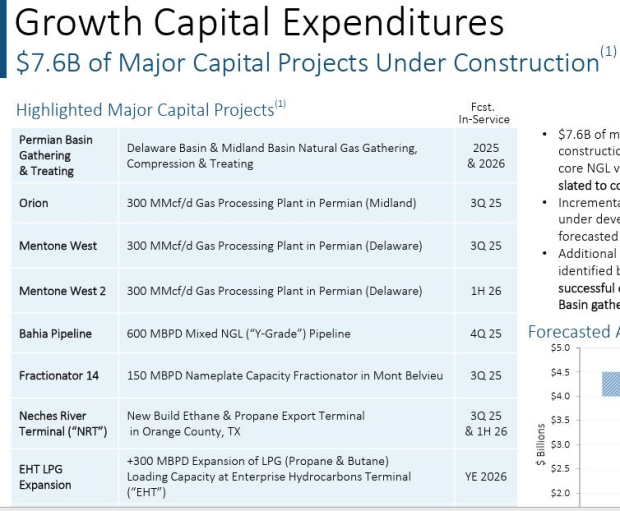

Enterprise Products is spending $7.6 billion on growth midstream projects, comprising building new pipelines, gas processing plants and export facilities that are currently under construction. However, on its first-quarter earnings call, the partnership disclosed that a large portion of its planned 2026 spending, between $1.8 billion and $1.9 billion, is already allocated to completing projects that have been formally approved. These projects have passed the Final Investment Decision (FID) stage, indicating that construction is in progress and the company is firmly committed to moving forward with them.

Image Source: Enterprise Products Partners

Image Source: Enterprise Products Partners

Because of this, even if Enterprise Products’ business market environment gets worse, it can’t easily reduce or delay this spending, which is a big risk to the midstream energy giant’s operations. This is because EPD may end up with lower-than-expected returns on these major investments if the economy weakens.

Oil Price Sensitivity May Hurt Enterprise Products' Business

Enterprise Products relies heavily on oil prices, given its strong presence in the Permian. Shippers utilize EPD’s pipeline networks to transport crude from the most prolific basin of the United States to the end market or refineries. This confirms that Enterprise Products’ midstream business is sensitive to oil prices. For the long term, EPD generally expects the price of West Texas Intermediate (WTI) to hover around $65 per barrel.

However, on the first-quarter earnings call, the partnership expressed a more cautious outlook that oil will trade at $55 or even $60 per barrel in the next three to five years. The partnership mentioned that at $55 to $60 per barrel, producers are generally capable of maintaining current production levels and mostly stop investing in new drilling.

Thus, it appears that EPD anticipates a slowdown in oil production due to declining oil prices. Once there is a slowdown in volumes, there will be lower demand for the partnership’s pipeline network, which could hurt its revenue generation in the coming years.

What Should Investors Do With the EPD Stock?

Although EPD generates stable fee-based revenues like Kinder Morgan and Enbridge, investors should stay away from the stock, given the business challenges.

Considering KMI’s business, it operates an extensive network of pipelines spanning 79,000 miles, transporting natural gas, gasoline, crude oil and carbon dioxide. In addition, the company owns 139 terminals that store a variety of products, including renewable fuels, petroleum products, chemicals and vegetable oils.

As a leading midstream service provider, Kinder Morgan’s pipeline and storage assets are secured under long-term take-or-pay contracts, generating almost two-thirds of its EBITDA. These contracts ensure the stability of Kinder Morgan’s business.

Similarly, Enbridge benefits from the long-term, fee-based nature of its midstream operations. Its pipelines transport 20% of the total natural gas consumed in the United States. The company generates stable, fee-based revenues from these midstream assets, as they are booked by shippers on a long-term basis, minimizing commodity price volatility and volume risks.

Adding to its stability, ENB will generate incremental cash flows from its C$28 billion backlog of secured capital projects, which include liquids pipelines, gas transmission, gas distribution and storage, and renewables. The maximum in-service date is 2029.

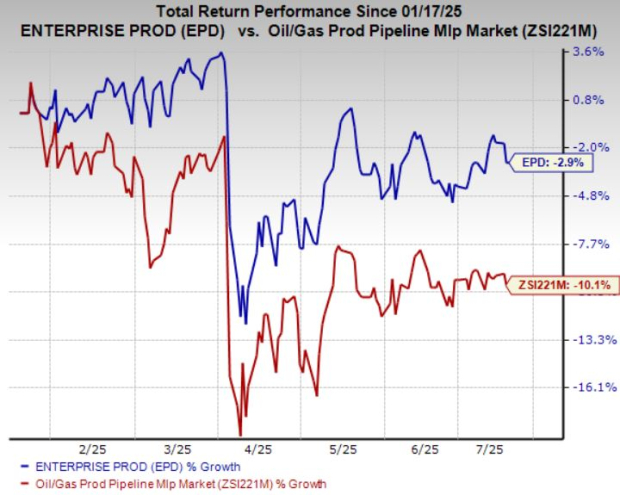

Coming back to EPD’s fundamentals and business outlook, although the partnership’s business model is supported by long-term contracts and the stock appears undervalued, ongoing business challenges suggest that investors should consider exiting the stock, which may see further declines in unit price. The partnership slipped 2.9% in the past six months, and currently carries a Zacks Rank #4 (Sell).

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Only $1 to See All Zacks' Buys and Sells

We're not kidding.

Several years ago, we shocked our members by offering them 30-day access to all our picks for the total sum of only $1. No obligation to spend another cent. Thousands have taken advantage of this opportunity.

Thousands did not - they thought there must be a catch. Yes, we do have a reason. We want you to get acquainted with our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators, and more, that closed 256 positions with double- and triple-digit gains in 2024 alone.

See Stocks Now >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Enterprise Products Partners L.P. (EPD): Free Stock Analysis Report

Enbridge Inc (ENB): Free Stock Analysis Report

Kinder Morgan, Inc. (KMI): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

/Super%20Micro%20Computer%20Inc%20logo%20on%20phone%20and%20stock%20data-by%20Poetra_RH%20via%20Shutterstock.jpg)

/Micron%20Technology%20Inc_%20logo%20on%20building-by%20vzphotos%20vis%20iStock.jpg)