Unusual options activity represents a tricky subject, in large part because of the vagaries of its implications. Because options can be bought and sold — and therefore carry debit- or credit-based structures — it’s difficult to say with absolute certainty what the underlying dynamics mean. There has to be an objective mechanism to better determine which ideas could be intriguing and which ones to avoid.

Those who want to place a bold wager should put Array Technologies (ARRY) on their radar.

As a provider of solar tracking solutions for the construction, development and operation of solar PV sites, Array stands on interesting ground. On one hand, the world is eagerly embracing clean and renewable energy and solar clearly fits into this narrative. But on the other hand, the Trump administration’s policies don’t exactly favor ARRY stock.

Circumstances have not been particularly conducive for Array, with its equity losing nearly 4% on Monday. Over the past five sessions, ARRY stock is down roughly 10%. Conspicuously, since around mid-May, ARRY appears to have entered a consolidation phase.

Still, one could make the argument that, counterintuitively, slowing momentum may eventually be a net positive for ARRY stock. Yesterday, total options volume for the security reached 6,810 contracts, representing a 74.48% lift over the trailing one-month average. However, 5,378 of these contracts were puts, yielding a put/call ratio of almost 3.76.

Digging into options flow — which focuses exclusively on big block transactions likely placed by institutional investors — the screener revealed that net trade sentiment slipped to $287,500 below parity. Therefore, most of the puts were debit-based transactions, meaning that they technically represent “direct” bets against ARRY stock.

So, should this worry investors? Most of the puts appear to be for contracts expiring in January 2027. I’m not sure how that would pressure the market downward in the immediate future. In my view, these puts are insurance against volatility, which is very reasonable considering the high beta of 1.74.

Plus, the more important point may be that the bad news could be baked in.

Using Science to Justify a Long Position in ARRY Stock

To say that investors have reflected the pessimism of Array’s business (along with optimistic talking points) into the share price of ARRY stock is a reasonable assumption. However, the assertion is that ARRY is now favorably mispriced, that the bears have overextended themselves.

This is an extraordinary claim and therefore requires extraordinary evidence. I will let you decide if I have met this criterion.

Naturally, those who wish to extract the greatest possible rewards from ARRY stock should consider the options market. But because options have defined profitability thresholds that must be activated within a given time frame, they present a multi-dimensional risk profile. A trader must have a thesis which forecasts magnitude (y-axis) and time (x-axis).

To achieve such a predictive model for ARRY stock, we must understand its pattern of intentionality. It’s here that most analysts make the mistake of attempting to find patterns in the share price itself. This practice, I would argue, is too chaotic. Instead, it is far more helpful to compress this noise into market breadth or sequences of accumulative and distributive sessions.

In effect, we are going to convert the messiness of price discovery into a financial Morse code. Through this code, we can identify recurring patterns and more importantly, how they transition from one behavioral state to another. Conducting this exercise for ARRY stock across rolling 10-week intervals gives us the following demand profile:

L10 Category | Sample Size | Up Probability | Baseline Probability | Median Return if Up |

2-8-D | 11 | 63.64% | 43.78% | 8.02% |

3-7-D | 45 | 64.44% | 43.78% | 6.08% |

3-7-U | 6 | 66.67% | 43.78% | 8.52% |

4-6-D | 62 | 37.10% | 43.78% | 13.41% |

4-6-U | 22 | 9.09% | 43.78% | 6.59% |

5-5-D | 12 | 33.33% | 43.78% | 7.77% |

5-5-U | 17 | 35.29% | 43.78% | 5.48% |

6-4-D | 5 | 60.00% | 43.78% | 2.43% |

6-4-U | 20 | 45.00% | 43.78% | 7.88% |

7-3-U | 16 | 43.75% | 43.78% | 5.11% |

8-2-U | 2 | 50.00% | 43.78% | 1.02% |

In the trailing two months, ARRY stock is printing a 3-7-D sequence: three up weeks, seven down weeks, with a negative trajectory across the 10-week period. Ordinarily, this sequence should trigger bearish sentiments as the balance of distributive sessions far outweighs accumulative. However, in 64.44% of cases, the following week’s price action results in upside, with a median return of 6.08%.

Effectively, this is our alternative hypothesis, that a mispricing exists and that our odds of upside stands at a generous 64.44%. This contrasts with the null hypothesis, which is the assumption of no mispricing. Under this latter paradigm, the null hypothesis is 43.78% — this is the chance that a long position in ARRY stock will be profitable on any given week.

Since the 3-7-D sequence tilts the odds favorably for the bullish speculator, an incentive exists to consider a debit-based options strategy.

Taking a Shot on Array Technologies

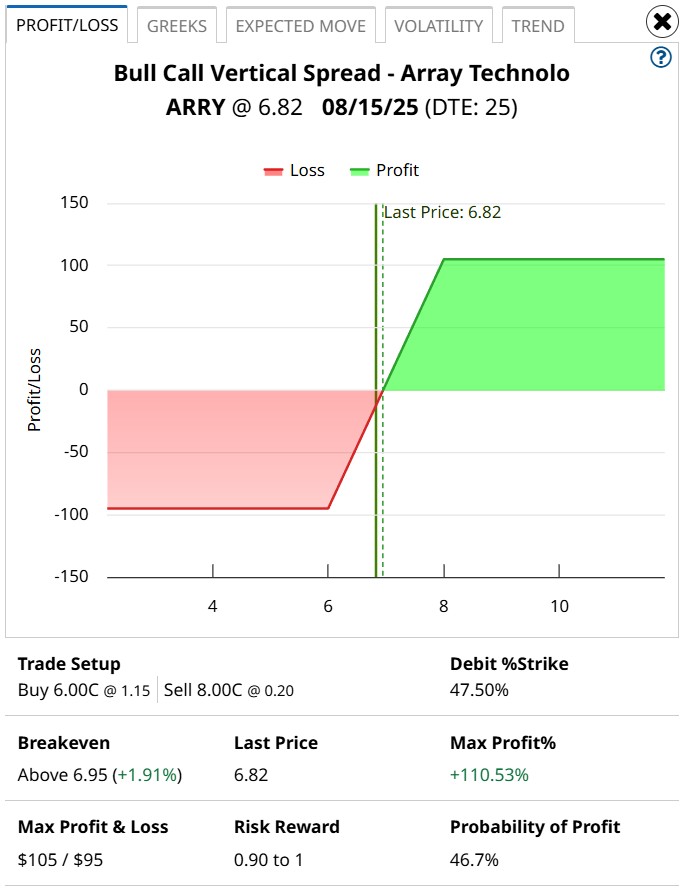

For ultra-aggressive speculators, the 6/8 bull call spread expiring Aug. 15 may be tempting. This transaction involves buying the $6 call and simultaneously selling the $8 call, for a net debit paid of $95 (the most that can be lost in the trade). Should ARRY stock rise through the short strike price ($8) at expiration, the maximum reward is $105, a payout of 110.53%.

The breakeven price for the above trade is $6.95, which is an important detail. Based on past analogs, the expected price target is around $7.28. Therefore, ARRY stock will require an above-average performance to hit the $8 strike price. Those interested in a much more probabilistic transaction may consider the 6/7 bull spread. However, this trade features a maximum payout of only around 54%.

One of the key questions regarding the above strategy is the statistical viability of the 3-7-D sequence. Running a one-tailed binomial test reveals a p-value of 0.0039, translating to a 99.61% confidence level that this signal is “intentional” rather than random. This also more than meets the scientific threshold of statistical significance, which stands at 95%.

To be clear, a high confidence of non-randomness does not mean a higher probability of success. It just states that there is something about this balance of market demand that traders can potentially exploit.

On the date of publication, Josh Enomoto did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Micron%20Technology%20Inc_billboard-by%20Poetra_RH%20via%20Shutterstock.jpg)

/Microsoft%20France%20headquarters%20by%20JeanLuclchard%20via%20Shutterstock.jpg)

/Palantir%20(PLTR)%20by%20Piotr%20Swat%20via%20Shutterstock.jpg)

/Nvidia%20logo%20on%20phone%20screen%20with%20stock%20chart%20by%20xalien%20via%20Shutterstock.jpg)

/International%20Business%20Machines%20Corp_%20logo%20on%20storage%20rack-by%20Nick%20N%20A%20via%20Shutterstock.jpg)