/Uber%20Technologies%20Inc%20logo%20on%20phone-by%20DenPhotos%20via%20Shutterstock.jpg)

Last month, I demonstrated in a June 20 Barchart article that investors could short out-of-the-money (OTM) UBER Technologies (UBER) puts and achieve a 2.0% one-month yield.

That was proved successful as the short put options expired worthless on Friday. Today, it's possible to make a similar one-month 3.0% yield shorting OTM puts.

UBER closed at $90.59 on Friday, and I had recommended shorting the $80.00 strike price puts expiring July 18 ("How to Make a 2.0% Yield with UBER Over the Next Month"). I showed that UBER was worth at least $95.59. This article will update that price target.

The short put play strike was 4.7% below the trading price at the time. The premium received was $1.66; hence, the 2.0% yield (i.e., $ 1.66/$80.00 = 0.02075).

Today, it's possible to make almost a 3% yield at a strike price with a similar distance below the trading price. More on that below. First, let's look at why UBER looks cheap here.

UBER Stock Price Targets

FCF-Based Target. My previous price target was based on UBER Technologies' free cash flow (FCF) margins. For example, in Q1, it made $2.25 billion FCF on $11.533 billion in revenue, or a 19.5% FCF margin. That was higher than the Q4 FCF margin of 14.27%, 18.85% in Q3 2024, and 16.08% in Q2.

Stock Analysis shows that over the trailing 12 months (TTM), it generated $7.786 billion FCF on $45.38 billion in revenue, or an FCF margin was 17.16%. That was higher than the prior quarter's TTM FCF margin of 15.68%.

So, on balance, it seems reasonable to assume that going forward, UBER could make at least an 18.5% FCF margin. Using analysts' next 12-month (NTM) revenue forecasts, UBER could make at least $10 billion in FCF:

0.185 x $54.36 billion NTM revenue = $10.06 billion NTM FCF

Using a 4.5% FCF yield metric (i.e., 22.2x FCF) (its TTM FCF yield is 4.1%), here is how that values UBER stock:

$10.06b / 0.045 = $223.6 billion market value

That is +18% over Friday's market cap of $189.439 billion. In other words, UBER stock is worth +18.0% more at about $107 per share:

1.18 x $90.59 = $106.90 per share

P/E Based Target. Historically, UBER stock has traded at 35.4x forward earnings, according to Morningstar's last 3 years' data (i.e., 55.5x 2023, 18.5x 2024, 32.3x current).

In addition, analysts now project 2025 earnings per share (EPS) of $2.86 this year and $3.29 in 2026, or $3.08 over the next 12 months (NTM). Therefore, we can estimate its value:

$3.08 NTM EPS x 35.4 avg forward multiple = $109.03 price target

That is +20.3% over today's price.

Analysts' Price Targets. Yahoo! Finance's analyst survey shows an average price target of $96.68 from 54 analysts, and Barchart's survey has a mean price of $100.35. Moreover, Stock Analysis says 34 analysts have an average $99.42 price target, and AnaChart.com says 37 analysts have an average of $105.86.

As a result, the average analyst price target from surveys is $100.58 per share, which is +11.0% over Friday's close.

Summary Price Targets. The bottom line is that using 3 different methods, UBER stock looks around 16.5% undervalued:

FCF-Based Target ……….. $106.90

P/E-Based Target ………… $109.03

Analyst-Based Target ….. $100.58

Average Price Target …… $105.50 per share +16.5% upside

As mentioned earlier, one way to play this, to set a lower buy-in price and get paid for this, is to sell short out-of-the-money (OTM) put options.

Shorting OTM Puts

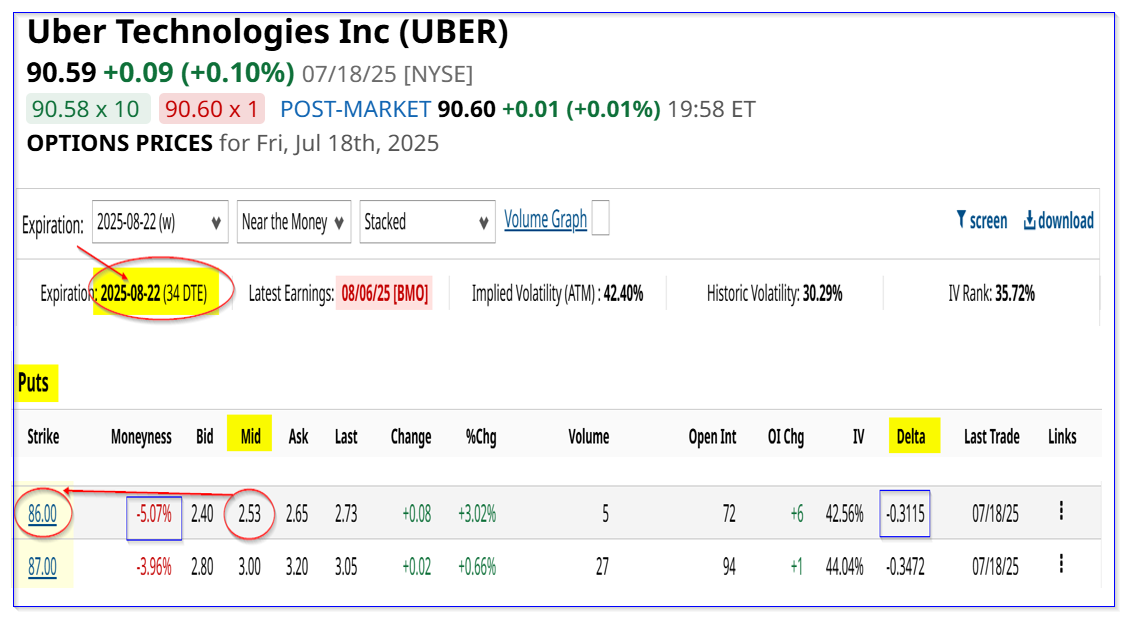

The August 22 expiry period, just over one month from now, shows that the $86.00 strike price put option, which is 5% below Friday's $90.59 close, has a midpoint premium of $2.53 per put contract.

That means a short-seller of these puts (i.e., enter an order to “Sell to Open” 1 put contract) can make an immediate yield of 2.94% (i.e., $2.53/$86.00 = 0.0294).

Moreover, for investors willing to take on more risk, the $87.00 strike price put has a midpoint premium of $3.00, or a 3.45% yield (i.e., $3.00/$87.00 = 0.0345).

So, in effect, the investor could use a mix of these two put options to make at least a 3.0% yield over the next month.

Moreover, the $86.00 strike price put has a low breakeven point: $86 - $2.53, or $83.47, or -7.9% below Friday's closing price of $90.59. That means that even if UBER stock fell to $86.00 over the next month, the investor's actual investment cost would be just $83.47.

Note that there is less than a one-third chance of this happening, as the delta ratio is -31%. That chance is based on historical trading volatility patterns in UBER stock.

This also provides a good upside to investors, should it eventually reach the average $105.50 price target:

$105.50 / $83.47 breakeven = 1.26 -1 = +26% upside

Even if the stock does not fall to $86.00, the investor has a good expected return (ER). If this 2.94% yield can be repeated every 34 days for four and a half months (i.e., 34 x 3 times = 136 days, or 4.5x months):

2.94% x 3 = 8.82% expected return (ER) over 4.5 months

The bottom line here is that UBER stock looks deeply undervalued. One way to profitably play this is to sell short out-of-the-money (OTM) puts in nearby expiry periods.

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/AI%20(artificial%20intelligence)/Ai%20chip%20by%20Quality%20Stock%20Arts%20via%20Shutterstock.jpg)

/Netflix%20on%20tv%20with%20remote%20by%20freestocks%20via%20Unsplash.jpg)

/A%20Palantir%20office%20building%20in%20Tokyo_%20Image%20by%20Hiroshi-Mori-Stock%20via%20Shutterstock_.jpg)