Johnson & Johnson JNJ is one of the few large drug and medical device companies with a presence in both the pharmaceuticals as well as medical devices segments. J&J’s medical devices segment, called MedTech, offers products in the orthopedics, surgery, cardiovascular and vision markets. The MedTech segment accounts for around 36% of J&J’s total revenues.

Sales in the MedTech segment rose 4.1% on an operational basis in the first quarter of 2025, driven by new product uptake and commercial execution, and contributions from the recent acquisitions of Shockwave and Abiomed.

However, sales in J&J’s MedTech business continue to face headwinds in the Asia Pacific, particularly in China. Sales in China are being hurt by the impact of the volume-based procurement (VBP) program and the anticorruption campaign. VBP is a government-driven cost-containment effort in China.

In the MedTech segment, recent acquisitions of Shockwave and Abiomed, as well as continued uptake of its new products, are likely to drive growth in 2025. However, J&J does not expect any improvement in its business in the Asia Pacific region, specifically in China, in 2025. Competitive pressure is also hurting sales growth in some MedTech businesses, such as PFA ablation catheters in U.S. electrophysiology. JNJ expects continued impacts from VBP issues in China in 2025 as VBP expands across provinces and products.

Nonetheless, sales are expected to be higher in the second half of 2025 than in the first half as the business moves past tougher first-quarter comps and new products gain momentum throughout 2025. However, tariff-related costs are expected to hurt profits in the MedTech segment

J&J’s Key Competitors in the Medical Devices Market

J&J’s MedTech unit faces strong competition from several major players in the medical device industry like Medtronic MDT, Abbott, Stryker SYK and Boston Scientific BSX.

While Medtronic has a strong presence in cardiovascular, neuroscience and surgical technologies, Stryker Corporation is a global leader in medical technology, specializing in innovative solutions across surgical, neurotechnology, orthopedics and spine care. Boston Scientific markets products for cardiovascular, endoscopy, urology and neuromodulation. Abbott is known for its medical device products across cardiovascular, diagnostics, and diabetes care.

JNJ’s Price Performance, Valuation and Estimates

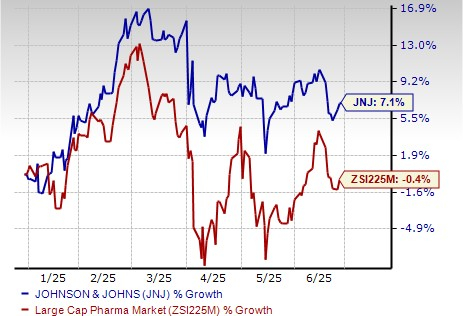

J&J’s shares have outperformed the industry year to date. The stock has risen 7.1% in the year-to-date period against a 0.4% decline of the industry.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

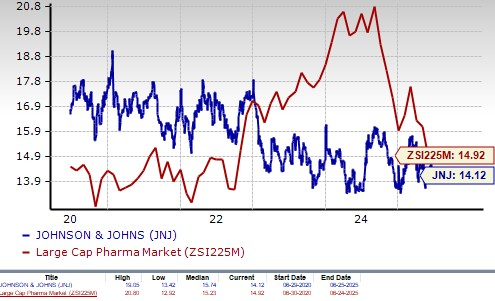

From a valuation standpoint, J&J is reasonably priced. Going by the price/earnings ratio, the company’s shares currently trade at 14.12 forward earnings, lower than 14.92 for the industry. The stock is also trading below its five-year mean of 15.74.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

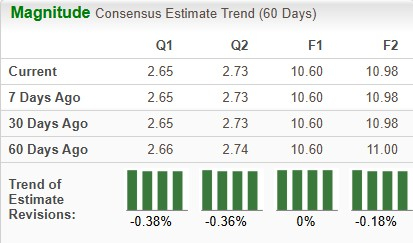

The Zacks Consensus Estimate for 2025 earnings has remained unchanged at $10.60 per share over the past 60 days, while that for 2026 has declined from $11.00 to $10.98 over the same timeframe.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

J&J has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Research Chief Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners UpWant the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Boston Scientific Corporation (BSX): Free Stock Analysis Report

Johnson & Johnson (JNJ): Free Stock Analysis Report

Medtronic PLC (MDT): Free Stock Analysis Report

Stryker Corporation (SYK): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

/EV%20charging%20spot%20by%20Patpitchaya%20via%20iStock.jpg)

/A%20Palantir%20office%20building%20in%20Tokyo_%20Image%20by%20Hiroshi-Mori-Stock%20via%20Shutterstock_.jpg)

/A%20Lucid%20Motors%20vehicle%20parked%20in%20front%20of%20a%20showroom_%20Image%20by%20Michael%20Berlfein%20via%20Shutterstock_.jpg)