Base metals traded on the London Metals Exchange and copper on the CME’s COMEX division are infrastructure building blocks. They are also increasingly crucial ingredients for alternative and renewable energy. The base or nonferrous metals include copper, aluminum, nickel, lead, zinc, and tin. Iron ore, another industrial commodity, is the primary ingredient in steel, a ferrous metal. Meanwhile, the Baltic Dry Index measures freight rates for dry bulk commodities and is a barometer of the supply and demand for industrial commodities. China is the world’s leading industrial commodity consumer and a top producer. However, Chinese requirements make the world’s most populous country a significant importer.

Rising interest rates, a strong dollar, and Chinese COVID-19 lockdowns weighed on the industrial commodities in Q3 and throughout the first three quarters of 2022.

Copper posted a significant decline in Q3 and over the first nine months of 2022- Iron ore and the BDI posted substantial losses

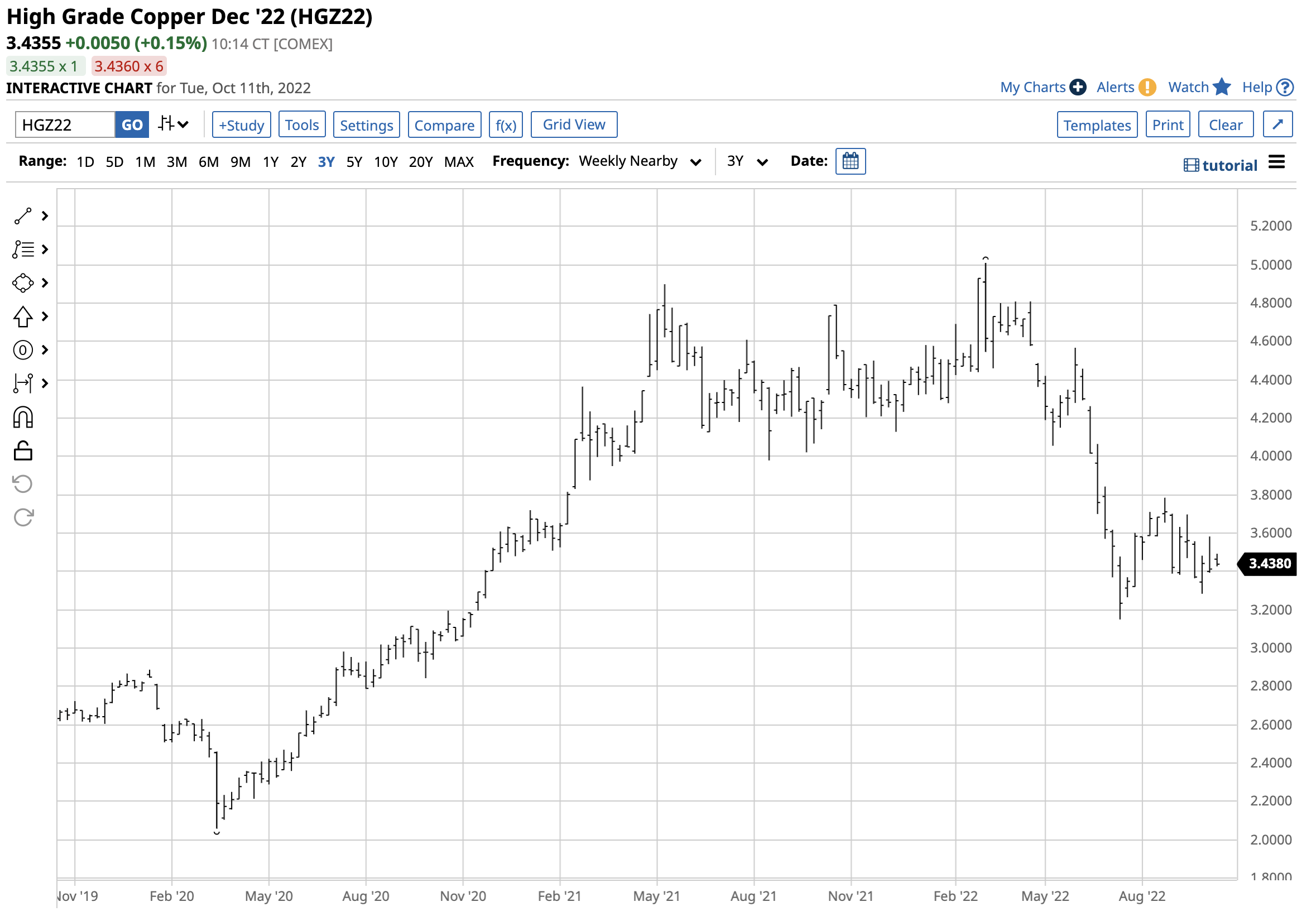

COMEX copper futures fell 8.13% in Q3 and were 23.55% lower over the first nine months of 2022.

After reaching a record high of $5.01 in March, the futures corrected as interest rates and a strong US dollar caused copper to run out of upside steam. The nearby futures closed at $3.4125 on September 30 and were slightly higher at $3.4355 on October 11. In 2021, the COMEX futures rose 26.84%.

LME three-month copper forwards had moved 25.31% higher in 2021 and were 8.45% lower in Q3. Over the first three quarters of 2022, the LME forwards posted a 22.23% decline, settling at the $7,560 per ton level on September 30. The LME copper forwards was lower at the $7,578.50 level on October 11.

Iron ore prices declined 21.81% in Q3 and were 20.72% lower over the first nine months of 2022, settling at the $95.30 per ton level on September 30. The November contract was just above at $95.41 on October 11. Iron ore prices had moved 24% lower in 2021 after rising 27.56% in 2020.

The Baltic Dry Index fell 19.49% in Q3 and was 20.61% below the December 31, 2021, closing level on September 30 at 1760. The BDI rose 62.3% in 2021. At 1,944 on October 11, the BDI was appreciably above the Q3 closing level.

Aluminum and Zinc moved to the downside in Q3

In 2021, three-month LME aluminum forwards gained 41.76%. In Q3, the most liquid of the base metals fell 11.59% and was 22.99% lower over the first nine months of 2022, settling at $2,162 per ton on September 30. At 2,260 per ton on October 10, aluminum forwards had moved higher since the end of Q3.

LME zinc three-month forwards fell 5.99% in Q3 and were 16.02% lower over the first three quarters of 2022, settling at the $2,968 level on September 30. LME Zinc was marginally lower at the $2,964 level on October 10. In 2021, zinc prices gained 28.74%.

Tin was the worst-performing base metal

While aluminum is the most liquid nonferrous LME metal by volume, tin is on the other end of the spectrum. Lower liquidity often leads to greater volatility as bids and offers tend to evaporate when the price moves. In Q3, LME three-month LME tin forwards led the sector on the downside with a 21.99% decline and were 46.9% lower over the first nine months of this year. In 2021, LME tin prices soared 91.52%. On September 30, the three-month price was at the $20,634 per ton level and was lower at $20,085 on October 10.

After leading the LME metals on the upside in 2021, tin has been the worst-performing base metal in 2022.

Nickel declined in Q3 but was higher since the end of 2021- Lead posted a marginal Q3 gain but was lower since the end of 2021

The global nickel market suffered controversy in early 2022 when a Chinese company’s short position caused the price to soar to a record high. In Q3, three-month LME nickel prices fell 7.01% but were still 1.69% higher over this year’s first three quarters. In 2021, nickel forwards rallied 24.99%. On September 30, the forwards were at the $21,107 per ton level and were higher at around $22,412 on October 10. Nickel was the only LME base metal that moved to the upside since the end of 2021.

Three-month lead forwards bucked the bearish trend, posting a 0.03% gain in Q3, settling at $1,908 per ton. However, lead forwards moved 17.19% lower since the end of 2021, as of September 30. Lead moved 16.22% higher in 2021. At $1,989.50 on October 10, lead prices were higher than the Q3 2022 closing price.

Lead and nickel are crucial ingredients in EV batteries, supporting the metal’s respective prices as hydrocarbon prices remain highly volatile at multi-year highs.

A look at LME inventory changes and the outlook for Q4 and beyond

Inventory data can provide clues about the base metal’s underlying supply and demand equations and the path of least resistance of prices:

- LME copper stockpiles were at the 135,250 metric ton level on September 30, up 10,975 tons from the Q2 closing level.

- LME aluminum stocks fell 41,000 tons in Q3 and were sitting at 332,175 MTs on September 30.

- LME nickel inventories dropped 14,022 MTs in Q3 to the 52,758-ton level.

- LME lead stocks moved 6,775 lower in Q3 to the 32,750 MT level.

- LME Zinc inventories experienced the most significant change, plunging 27,450 tons in Q3 to 53,625 metric tons.

- LME tin stocks moved 1,575 tons higher, to 5,075 in Q3.

Source: LME

As we move forward into the final three months of 2022 and beyond, base metals and industrial commodities face opposing price pressures. Rising interest rates and the strongest US dollar in two decades are bearish. Combating climate change via alternative and renewable energy sources supports increasing demand for many nonferrous metals.

Meanwhile, Chinese COVID-19 lockdowns had been bearish for global metals demand in Q3. As China emerges from the lockdowns, a sudden demand surge could lift prices over the coming months. The bottom line is that bullish and bearish factors will likely fuel volatility in the base metals and industrial commodities over the coming months and into 2023. I am primarily positive for the future path of least resistance of industrial commodity prices as Chinese demand and a greener energy path will underpin prices. I believe a scale-down buying approach, leaving plenty of room to add on further declines, is the optimal strategy for base metals over the coming months and years.

More Metals News from Barchart

- Growth Fears Weigh on Stocks

- Dollar Rises on Hawkish Fed Comments and Weak Stocks

- Stocks Slide on Losses in Chipmakers

- Dollar Gains on Strong U.S. Labor Market

/Oracle%20Corp_%20office%20logo-by%20Mesut%20Dogan%20via%20iStock.jpg)

/Tesla%20Inc%20tesla%20by-%20Iv-olga%20via%20Shutterstock.jpg)

/Microsoft%20sign%20at%20the%20headquarters%20by%20VDB%20Photos%20via%20Shutterstock.jpg)