In an article on Barchart on June 29, I wrote, “I expect natural gas prices to trade at over $10 per MMBtu over the coming months, but that does not mean the price cannot drop to $5 or lower before an explosive rally.” On July 5, the natural gas price came close to $5 when the nearby NYMEX futures contract reached a bottom at $5.325 per MMBtu, a $4.339 drop from early the June high.

Over the past weeks, the natural gas market has come storming back as an almost perfect bullish storm has gripped the energy commodity.

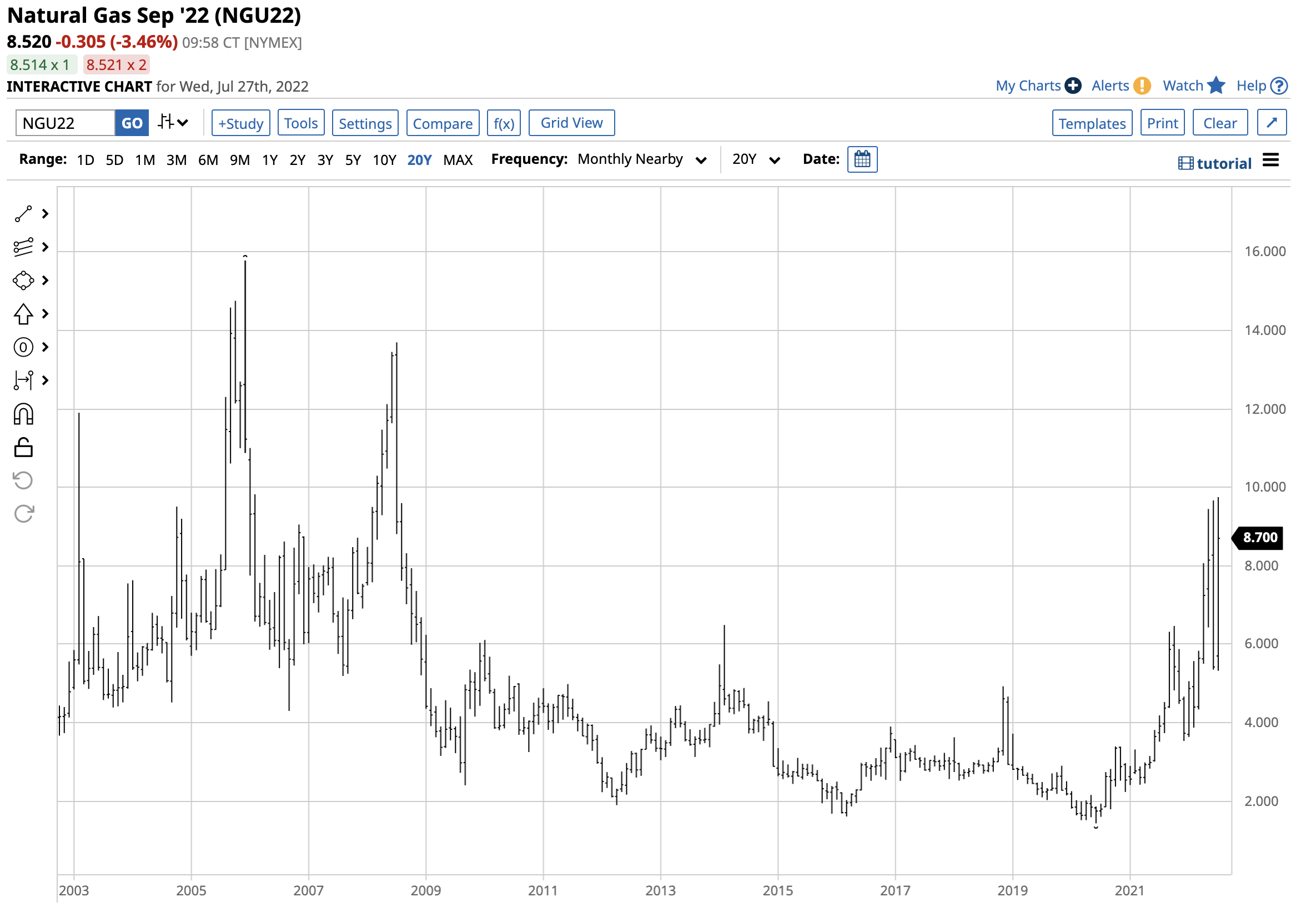

Wide price swings in the US natural gas futures market

In 2022, the price action in the NYMEX natural gas futures market has been like riding a psychotic horse through a burning barn. After trading to a high of $9.664 on the continuous futures contract in early June 2022 after rising from a low of $3.536 per MMBtu in December 2021. After correcting to $5.325 in early July, the price took off on the upside, reaching a higher $9.752 peak on July 26.

The chart shows that since nearby NYMEX natural gas futures broke out of the bearish trend of lower highs and lower lows above the November 2018 $4.929 high in September 2021, the price swings have been substantial, with the energy commodity exploding higher and imploding lower on a regular basis.

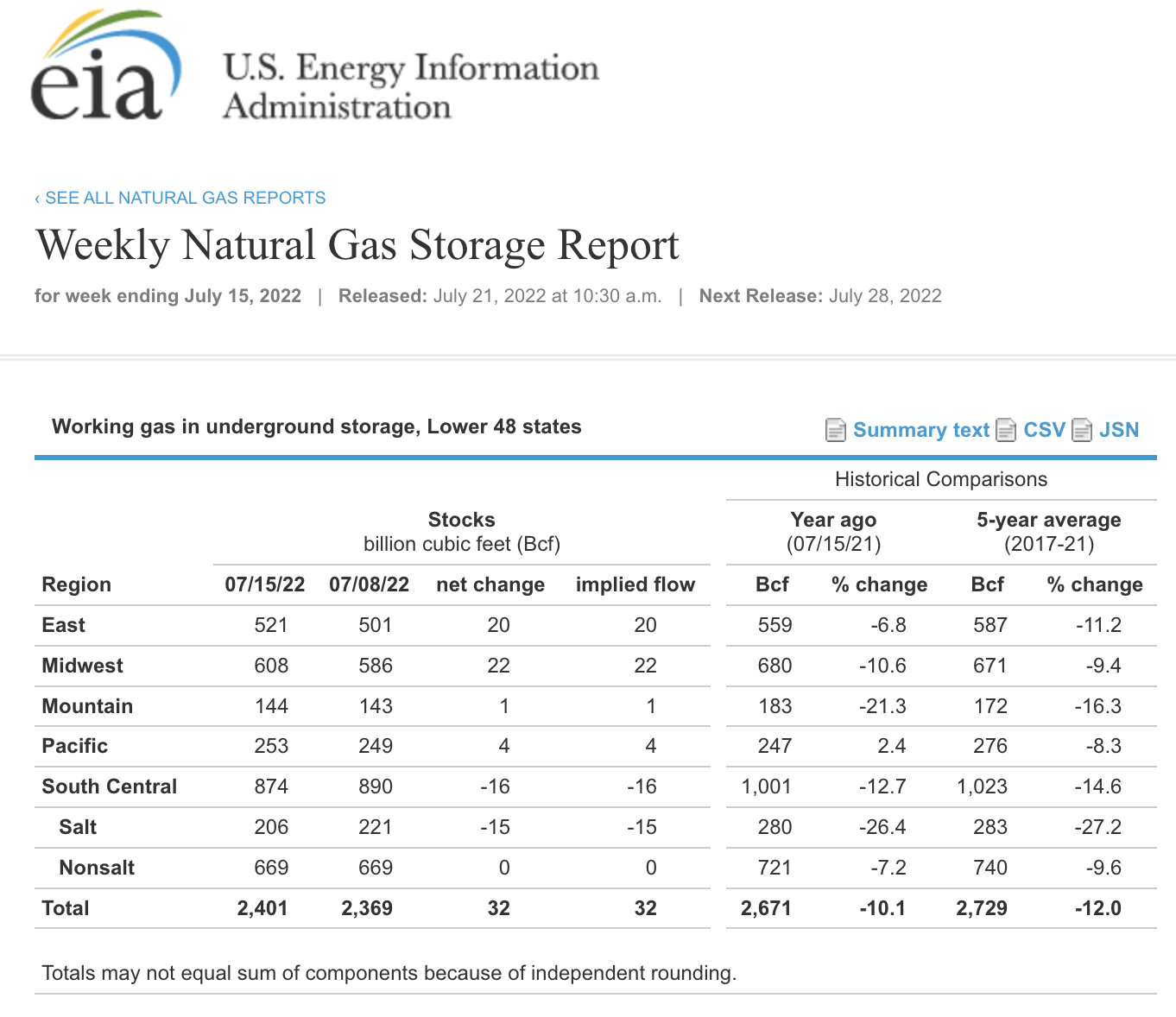

Inventories remain below last year’s level, and the five-year average

Natural gas in storage across the United States remains at a low level in mid-July 2022.

Source: EIA

As the chart shows, natural gas inventories were 10.1% below the level at the same time in 2021 and 12% under the five-year average as of July 15.

High temperatures across the US are increasing the cooling demand while US energy policy continues to inhibit production. Moreover, the demand for US LNG from abroad has increased dramatically since Russia invaded Ukraine in late February 2022. Liquefied natural gas has expanded the addressable market for US natural gas far beyond the North American pipeline network.

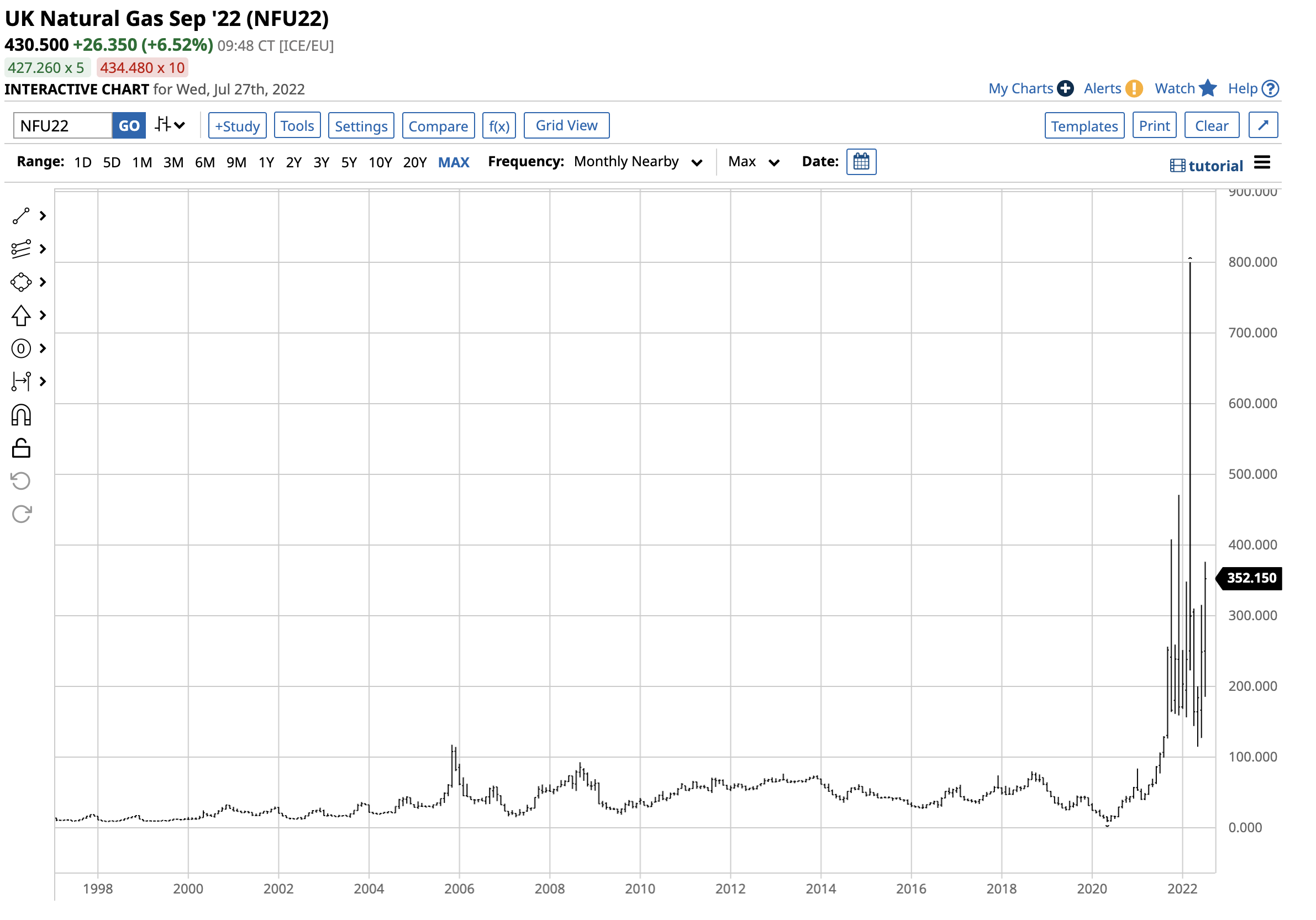

European natural gas prices remain at very high levels

Asian and European natural gas prices have soared to multiples of US prices. Europe depends on Russia for natural gas, and the war has caused Russia to ship less of the energy commodity west to “unfriendly” countries aiding Ukraine. Moreover, European sanctions have forced Europe to look elsewhere for energy supplies.

The chart shows that before August 2021, UK natural gas never traded over 117 in the futures market. In March 2022, the price exploded to the 800 level and was sitting at over 430 for September delivery on July 27.

In the Netherlands, the record high before June 2021 is just over 31. In March, it rose to 345 and was just over 210 for September delivery on July 27. Sky-high European prices are putting upward pressure on US natural gas prices. Meanwhile, a heat wave in Europe has increased the cooling demand on the continent.

Supply issues could push prices even higher as the 2022/2023 peak winter season approaches.

The war in Ukraine and Russian relations with the US and Europe are bullish

The war in Ukraine that began on February 24 continues to rage with no end in sight. The US and Europe have been providing arms and financial support for Ukraine, so relations with Moscow deteriorated in 2022.

Russia has partnered with China in opposing NATO expansion. Geopolitical tensions are not limited to Eastern Europe since President Xi, and President Putin shook hands on a “no limits” agreement on February 4, 2022, in Beijing. Russia considers Ukraine western Europe, while the US and Europe believe it is a sovereign country in Eastern Europe. Meanwhile, China considers Taiwan part of its territory, while the US, Europe, Japan, and other allies believe Taiwan is an independent republic. The bottom line is that geopolitical tensions are impacting trade. Russia is a leading oil and gas producer. While the US and Europe have embraced climate change initiatives, limiting fossil fuel production, oil and gas continue to power the world. Energy supplies have become a weapon in the international conflict that creates a bifurcation between the world’s nuclear powers.

The winter could push prices to levels not seen since 2008 and 2005 or higher

Natural gas futures prices tend to peak as the winter approaches, reaching annual seasonal highs from October through February. The UK and Dutch natural gas prices are trading at record levels after peaking in March 2022. US prices fell only 24.8 cents shy of $10 per MMBtu on July 26. The US futures price is trading at the highest level since 2008, when it reached $13.694. The all-time high since futures began trading in 1990 was $15.78 in 2005. Over the coming months, we could see natural gas eclipse the 2008 and 2005 highs as the almost perfect bullish storm in the natural gas futures arena continues to cause wide price variance and the upward trajectory of prices.

Natural gas is a dangerous futures market that has caused more than a few market participants to lose their shirts over the years. While extreme volatility creates a paradise of opportunities, the risk is always a function of potential rewards. Any risk position in the natural gas arena requires a plan and the discipline to stick to the program. I remain bullish on natural gas over the coming months, but that does not mean another price implosion will not take the price to lower levels. Be careful in the natural gas market and expect the unexpected. Watch out for a continuation of extreme price volatility as the winter approaches.

More Energy News from Barchart