Natural uranium contains approximately 0.7% uranium-235, the isotope necessary for nuclear weapons, and 99.3% uranium-238. Converting natural uranium into the form required for the weapons involves enriching the element in centrifuges to increase the concentration of uranium-235.

Uranium yellowcake is first turned into a gas called uranium hexafluoride, pumped into centrifuges that spin so rapidly that the ever-so-slightly heavier gas containing uranium-238 is forced to the outside. The lighter gas containing uranium-235 remains in the middle.

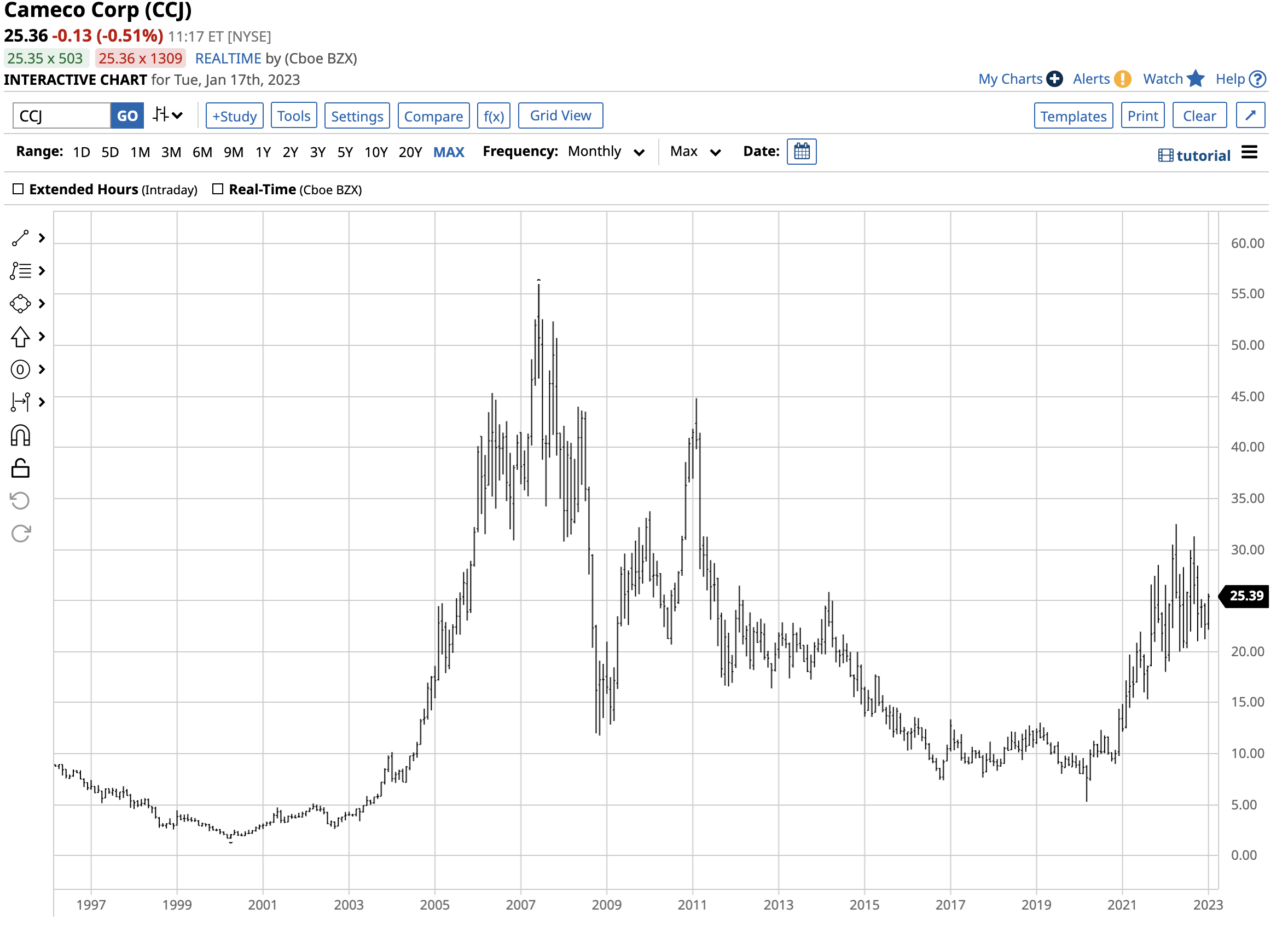

In a September 13, 2022, article on Barchart, I highlighted Cameco Corporation (CCJ), a leading and established Canadian uranium producer. The article spelled out the supply and demand fundamentals of the global uranium market. CCJ was at the $29.85 per share level on September 13. While the stock has corrected to around $25 per share, the potential for a rally remains high in early 2023.

Geopolitics continue to support uranium demand and prices

The CME lists UXC Uranium U308 contracts, representing 250 pounds of uranium. The contracts reflect the floating price for each contract month, the month-end spot U308 price published in Ux Weekly for the contract month. There is no open interest or volume in the CME Uranium contracts, making it purely a benchmark and barometer for prices.

The chart highlights the contract reached a record high of $148 per pound in May 2007. After falling to a low of $17.50 in November 2016, uranium prices have made higher lows and higher highs and were just over the $50 per pound level on January 17.

While most commodity prices have moved higher since the 2020 pandemic-inspired lows, geopolitics and energy policies have supported uranium. On the energy front, the demand for nuclear power has increased as countries worldwide address climate change. Nuclear power requiring uranium is an alternative to traditional fossil fuels, including oil, gas, and coal, used to generate electricity.

Meanwhile, Russia’s invasion of Ukraine, the “no-limits” alliance between China and Russia, and nuclear weapons programs in North Korea, Iran, and other countries have increased uranium demand.

More countries will seek nuclear weaponry in 2023 to counteract Russia, Iran, and North Korea

The arms race created by the Chinese-Russian alliance and the weapons development programs in Iran and North Korea encourages other countries worldwide to pursue nuclear weapon technology as a deterrent.

In 2023, countries in Europe, Asia, and the Middle East will likely increase their nuclear programs, increasing uranium demand.

Nuclear power demand will likely increase as the world addresses climate change

Addressing climate change also puts upward pressure on the demand side of the uranium market. As the world shifts from traditional hydrocarbons to alternative and renewable fuels, nuclear power will likely play an increasing role.

While some environmentalists object to nuclear power projects because of disasters at Three-Mile Island and Chernobyl, nuclear energy is an inexpensive alternative with a long history of power-generating efficiency. There is no nuclear power without uranium.

A bullish trend in CCJ since the 2020 low

Kazakhstan, Namibia, Canada, Australia, Uzbekistan, Russia, Niger, China, India, and Ukraine are the top-ten uranium-producing countries. While Kazakhstan is, by far, the leading producing country, the world’s leading publicly traded uranium company is Canada’s Cameco (CCJ). At $25.34 per share on January 17, CCJ had an over $11 billion market cap. CCJ trades an average of over eleven million shares daily. CCJ pays shareholders a 9.0 cents dividend, translating to a 0.36% yield. CCJ’s company profile states:

While CCJ is a Canadian company, it explores for uranium in the Americas, Australia, and Asia.

On September 30, 2022, Cameco’s uranium spot price was $48.38 per pound, and the long-term price was at the $51 level.

Source: Cameco

The chart shows Cameco’s sport price at the end of 2022 was slightly lower at $47.38, with the long-term price marginally higher at $52 per pound. Since September 13, 2022, CCJ shares have slipped.

The chart shows a 15.1% decline from $29.85 on September 13 to $25.34 on January 17.

CCJ still has significant upside potential

Meanwhile, the long-term trend in CCJ shares remains bullish in early 2023.

The long-term chart shows that CCJ shares have made higher lows and higher highs since the March 2020 spike low of $5.30 per share. The first technical resistance target is at the April 2022 $32.49 high. Above there, the February 2011 $44.81 high and the June 2007 $56 per share all-time peak are resistance levels.

The demand for uranium will increase as the world weaponizes and energy policies embrace a nuclear alternative to fossil fuels. The sell-off in CCJ shares could be buying opportunity as the bullish trend since March 2020 remains firmly intact at above the $25 per share level in early 2023.

More Energy News from Barchart

- Crude Rallies on a Weak Dollar and Chinese Energy Demand Optimism

- Nat-Gas Prices Sink on Above-Normal Winter Temps

- Crude Prices Underpinned on the Outlook for Stronger Chinese Oil Demand

- Crude Settles Higher on Dollar Weakness and Outlook for Less Fed Tightening

On the date of publication, Andrew Hecht did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/NVIDIA%20Corp%20logo%20on%20phone%20and%20AI%20chip-by%20Below%20the%20Sky%20via%20Shutterstock.jpg)

/Oracle%20Corp_%20logo%20on%20phone%20and%20stock%20data-by%20Rokas%20Tenys%20via%20Shutterstock.jpg)

/Broadcom%20Inc%20logo%20on%20building-by%20Poetra_%20RH%20via%20Shutterstock.jpg)