Indian Rupee Feb '16 (H3G16)

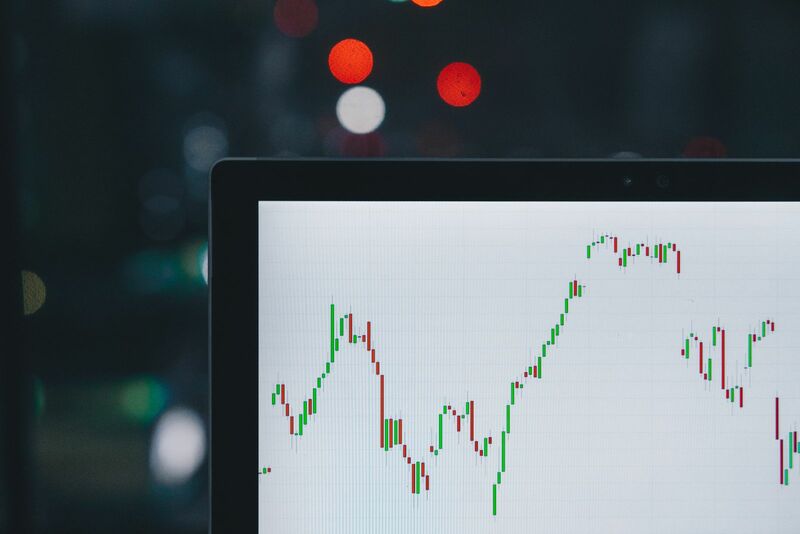

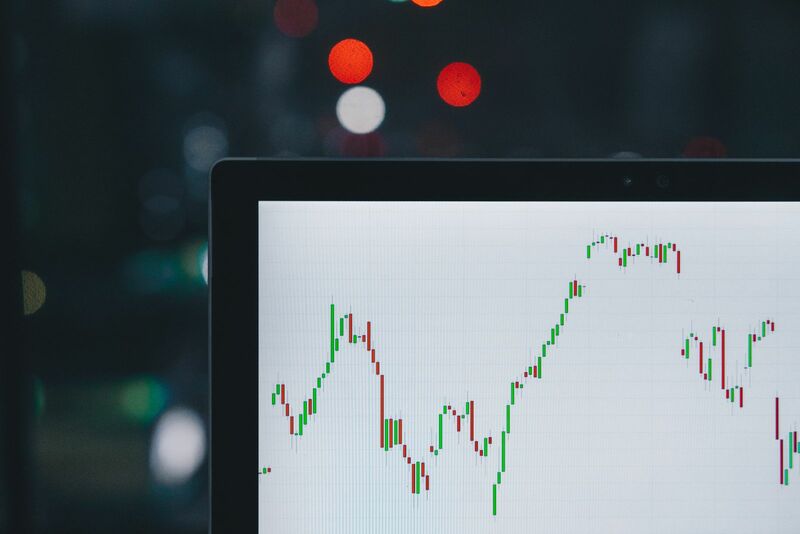

Seasonal Chart

Price Performance

See More| Period | Period Low | Period High | Performance | |

|---|---|---|---|---|

| 1-Month | 145.02 +0.52% on 02/19/16 | | 147.64 -1.27% on 02/04/16 | -1.26 (-0.86%) since 01/25/16 |

| 3-Month | 145.02 +0.52% on 02/19/16 | | 150.64 -3.23% on 12/24/15 | -2.60 (-1.75%) since 11/25/15 |

| 52-Week | 143.96 +1.26% on 08/24/15 | | 153.38 -4.96% on 02/27/15 | -6.86 (-4.49%) since 02/25/15 |

Most Recent Stories

More News

The dollar index (DXY00 ) today is down by -0.26% and dropped to a 5-week low. Today’s US economic reports were dovish for the Fed and weighed on the dollar. Today’s rally in the S&P 500 to a record...

Hello traders. In this blog post, we will look at how (GBPCAD) advances bullish sequence from late 2023 after it bounced from an equal leg area. As you know, we analyze and trade 78 instruments with members...

Hello fellow traders. In this technical article we’re going to take a quick look at the Elliott Wave charts of Dollar Index, published in members area of the website. As our members know, USDX has ended...

The dollar index (DXY00 ) on Tuesday fell by -0.20% and posted a 1-week low. The dollar retreated Tuesday due to strength in the euro. The dollar extended its losses Tuesday morning after Fed Chair Powell...

The dollar index (DXY00 ) this morning is down -0.14% at a 1-week low. The dollar today is mildly lower, weighed down by the strength of the euro. The dollar extended its losses after Fed Chair Powell...

The dollar index (DXY00 ) on Monday fell by -0.06%. The dollar was under pressure Monday from lower T-note yields, which weakened the dollar’s interest rate differentials. The dollar was also undercut...

The dollar index (DXY00 ) this morning is down by -0.17%. The dollar is under pressure today from lower T-note yields and strength in stocks, which reduces liquidity demand for the dollar. The dollar...

The dollar index (DXY00 ) Friday rose slightly by +0.07%. The dollar saw support from hawkish Fed comments and negative inflation news, which sparked a +4.9 bp rise in the 10-year T-note yield to 4.502%...

Greetings fellow traders. In this technical article we’re going to take a quick look at the Elliott Wave charts of (EURUSD) , published in members area of the website. As our members know, EURUSD has...

Short Term Elliott Wave in (AUDUSD) suggests the pullback to 0.636 ended wave (2). The pair has turned higher in wave (3) with internal subdivision in 5 waves in lesser degree. Up from wave (2), wave...