Want to convert your Legacy Portfolios to the new Investor Portfolio? Features of the Investor Portfolio include multi-transaction consolidation, dividend reinvestment and Market Value charts. Best of all, we have an easy conversion process to help get you started. Convert Your Portfolios Here.

Investor Portfolio Overview

Tutorials:

Barchart's New Investor Portfolio (3:03)

Convert Your Old Portfolio To An Investor Portfolio (5:46)

Create an Investor Portfolio (2:41)

How to Add Transactions (5:16)

Adding Cash and Other Investments (4:14)

Managing Transactions (3:15)

Multiple Currency Tracking (2:28)

Finding Your Way Around The Investor Portfolio (10:31)

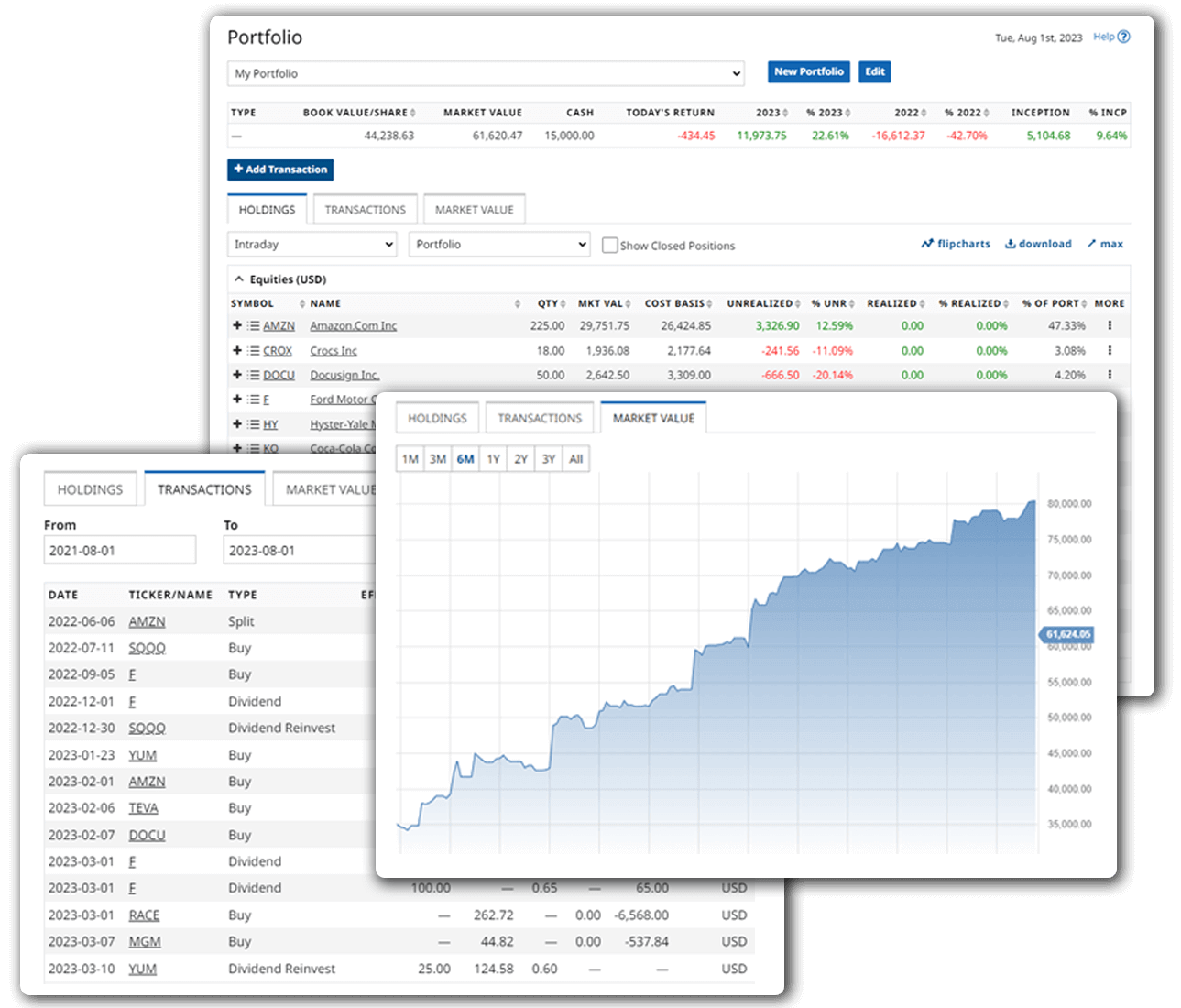

The Investor Portfolio page is used to analyze and track your investments. Barchart Premier Members may create unlimited Portfolios for stocks, funds, ETFs, commodities, or futures or equity options. A Plus Membership allows for 10 Investor Portfolios, and a free site membership allows you to track 1 Portfolio.

The first time you access the Portfolio page, you are asked to create a new Portfolio.

- Allows for multiple transactions for a single position. For example, BUY 100 TSLA, SELL 50, SPLIT, DIVIDEND, BUY 20 gives us a single position with a balance of 70 shares, five transactions, and realized and unrealized gains/losses. (This is significant as it differs from Barchart's current Portfolio program.)

- Track cash positions, with support for multiple currencies.

- When a Portfolio is created, you identify the currency in which it will be valued. Currencies supported include U.S. Dollar (USD), Australian Dollar (AUD), Canadian Dollar (CAD), CHF, Eurodollars (EUR), British Pound (GBP), Japanese Yen (JPY), Norwegian Krone (NOK), and Swedish Krona (SEK).

- For cross-currency portfolios, totals are translated to the Portfolio default currency, using the current spot rates.

- Corporate actions can be automatically applied to positions (e.g. dividends and splits). This is set when you create a Portfolio.

- Enter, edit, and delete individual transactions. You can even edit transaction history (e.g. insert a BUY transaction, change the date of a SELL transaction, etc).

- Ad hoc assets can be tracked by the portfolio (e.g. baseball cards, real estate, etc). You have complete control over the valuation.

- The Portfolio tracks your positions and calculates the portfolio value-over-time for charting (e.g. your portfolio was worth $1,000 yesterday and is worth $1,050 today).

- Your portfolio positions are aggregated by type (e.g. equity, fund) and position prices (along with gains/losses) are continuously updated.

- Monitor position and portfolio performance with streaming market data quotes. Track your performance in real-time. Totals are calculated using the latest prices available. For U.S. equities where we have Cboe BZX real-time data, real-time prices are used during market hours. For all other equities, prices are delayed 15 minutes, ET.

- Portfolios are aggregated and revalued continuously. You are provided (a) the summary of all your portfolios and (b) the summary of every single portfolio.

- At this time, the portfolio does not support entry for option spreads. You must enter the spread synthetically, one leg at-a-time (where each leg has a price).