Options Greeks for Profit: Don't Trade Blind!

If you’re trading options without understanding the Greeks, it’s like driving a car with no dashboard — you have no idea how fast you're going, how much gas you’ve got left, or whether the engine’s about to overheat.

I’m going to break down the 5 essential options Greeks — Delta, Theta, Gamma, Vega, and Rho — and show you how each one helps you monitor risk, time decay, volatility, and more… so you can trade with confidence and precision.

And I won’t just explain them — I’ll also show you how to use a free tool on Barchart that acts like your options dashboard, letting you visualize all the Greeks in one place, and find high-probability trades faster.

I’ll walk you through the entire process using real examples with popular stocks — so you can follow along and start applying this today.

Options Quick Introduction

Now, if you’re new to options trading, let me give you a quick rundown of what options are.

Options are contracts that give the buyer the right, but not the obligation, to buy or sell an underlying asset at a specified strike price on or before a specified expiration date. They can be used for income generation, leveraged speculation, and hedging or asset protection.

What Are Options Greeks?

Now, onto options Greeks. Options Greeks are pieces of information that help traders understand how different factors affect the options price. Imagine them as the indicators on your car’s dashboard. Sure, you can turn the car on and drive without ever looking at the dashboard - but, who would do such a thing?

Unfortunately, when it comes to options trading, many of us ignore our figurative dashboard - or don’t even know one exists, and doing so costs us profit. I’ll explain how all the options greeks work, and how you can use them to your advantage. And then, I’ll even show you a dashboard on Barchart that you can use today.

Options Greeks provide investors with a better understanding of the trade, whether it's the trade's potential or otherwise, and gives you a more informed, strategic approach, rather than flying blind and clicking buy, or sell to open, and hoping for the best. When it comes to options greeks, they make your trade experience smoother and safer, giving you the best chance to arrive at your intended destination - profitably.

There are five option Greeks. Delta, theta, gamma, vega, and rho. Each one reveals a layer of risk and opportunity that you can utilize for your trading. Let’s start with the first one, delta.

Delta

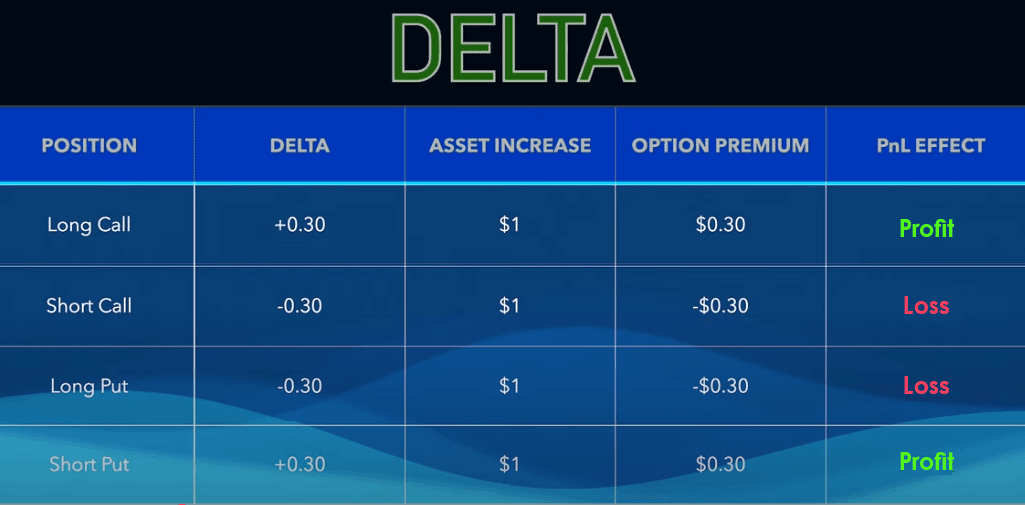

Delta tells how much the option's price will change based on every $1 change in the underlying security. Delta is displayed as a decimal from -1.0 to +1.0, although it’s sometimes shown and always mentioned as a whole number. But they mean the same thing.

The easiest way to think of Delta is to imagine it as your profit or loss on the trade as the underlying security moves up by $1. Let me explain.

Let’s say you’re trading a long call option. In this case, you profit when the underlying stock moves up. If the option has a delta of 0.30, often called 30 delta, it means the option premium is expected to increase by $0.30 for every $1 increase in the underlying stock’s price (all else being equal).

Long Call - Positive Delta - Make Money if Stock Moves Up

Since each standard option contract controls 100 shares of the underlying stock, a $0.30 increase in premium translates to an unrealized profit of $30.00 for every $1 move up in the stock.

With Short calls, however, the delta is negative. This is because you lose money when the underlying moves up. So, let’s say you sold a covered call with a -30 delta, then you’ll lose $0.30 for each $1 the underlying moves up.

Short Call - Negative Delta - Make Money if Stock Moves Down

With put options, it’s similar, but in reverse.

Long puts have negative delta because the trade loses money as the underlying moves up.

Long Put - Negative Delta - Make Money if Stock Moves Down

And short puts have positive delta because you profit as the underlying security increases in value.

Short Put - Positive Delta - Make Money if the Stock Moves Up

Theta

Next, we have Theta or time decay, which indicates how much the option will lose in value each day, assuming everything else stays the same - including the underlying security’s price.

IMG theta.png

Since options lose value every day as they get closer to expiration, theta in single-legged long trades is expressed as a negative number, because it’s the amount the option will lose in value each day. So, theta is expressed in cents, so, if you have a theta of -0.10, that means the option will decrease in price by 10 cents a day, assuming the underlying security doesn’t change.

IMG time-decay

For short option trades, theta is expressed as a positive number. It’s still interpreted the same; basically, the amount of the contract value or premium will decrease every day. However, in this case, time decay is seen as beneficial, as the trader profits as the option loses value over time.

Essentially, Theta indicates how much time is working for or against you, hurting long option buyers with daily decay, while rewarding short option sellers as the clock ticks down.

Gamma

Next, we have Gamma. Gamma tells us the rate of change between an option's Delta and the underlying security’s price. Higher Gamma means that Delta could change significantly, even with minimal price changes in the underlying security.

IMG gamma

So, if you're buying a call, higher Gamma means Delta will increase more rapidly as the stock price rises, which in turn can cause the option price to rise faster than it would with lower Gamma. With higher Gamma, Delta is less stable, which makes it less reliable as a standalone guide.

Now, if your options trading strategy is to buy deep in the money options, gamma isn’t all that important, because the option’s delta would already be near 1. Gamma is more critical for at-the-money options because small moves in the stock can quickly swing the position into or out of the money, causing rapid changes in Delta and extrinsic value.

Vega

The fourth Greek is vega. Vega tells us how much an option’s price is expected to change for a one-point change in implied volatility. In short, it indicates how sensitive the option’s value is to changes in implied volatility. Remember, options are more expensive when volatility is high, and cheaper when it’s low.

IMG vega

Let’s say you’re buying a call option on SMCI for $4.55 per share. At the time, implied volatility is 80.64%, and the option’s Vega is 0.6934 — meaning for every 1 percentage point change in implied volatility, the option’s premium is expected to move by about $0.6934.

Now, if implied volatility rises from 80.64% to 85%, that’s a 4.36-point increase. Multiply that by the Vega and we get $3.02.

0.6934 × 4.36 = 3.0222

So, the option’s price would be expected to increase by $3.02, making the new estimated premium to be $7.57, assuming no other factors (like price movement or time decay) change.

$4.55 + $3.02 = $7.57

In short, Vega captures the sensitivity of option pricing to changes in implied volatility which is a key measure of market expectations.

Rho

The last options Greek is Rho, which, I admit, isn’t used by a lot of traders, at least not in the last few decades, however, since 2022 that all changed.

Rho tells us the option’s sensitivity to changes in the risk-free interest rate, that’s the interest rate paid on Treasury bills. Rho is expressed as the amount of money an option will lose or gain with a 1% change in interest rates. So, it could be a positive or negative number.

IMG rho

For example, let's say you’re considering an option that has a Rho value of 0.1. In this case, a 1% increase in the risk-free rate would increase the option premium by $0.10.

So, if you expect interest rates to move before your options' expiration, Rho is something you’ll want to consider.

How To Find Greeks In Barchart’s P&L Feature

Now, remember that dashboard I was speaking about earlier? Now I’ll show you how to find it on Barchart so you can use it to your advantage. Let’s start by going to Barchart.com and then search for any stock that you’d want. For this example, let’s use Microsoft, which just recently reached an all-time high of just over $500.

From its profile page, click Long Call/Put at the left-hand panel under Option Strategies, then stay on the Long Call tab. Once there, you’ll immediately see the results page for potential long call trades.

Let’s say you want to sell a long call two to three months out. Here, you can change the expiration date on the drop-down to, let’s say, September 19, 2025, and you’ll see the potential trades. Then, let’s assume that you are confident that MSFT will trade well above $500 by then, so type in 500 on the strike field here and click Apply.

And there you have it, your 500-strike long call trade. Now, to review the Greeks, click the chart icon between the price and expiration date here. This will pull up Barchart’s P&L charts, which include everything you might want to know about your potential trades, including profit and loss zones, contract details, expected move, volatility, trends, and of course, the Greeks.

Now I’ll click the Greeks tab, and it will display all five Greeks, including Greek ratios relevant to long call trades.

Based on these values here, this option has a relatively balanced directional exposure and sensitivity to volatility.

A Delta of 52.98 means the option will increase by about $0.53 for every $1 increase in Microsoft stock.

Theta is –14.77, meaning the option loses approximately 15 cents per day solely due to time decay, which is a manageable drag, especially if the underlying asset moves favorably.

Gamma at 0.78 reflects modest delta acceleration, which is typical for options with some time until expiration.

Vega at 93.06 indicates that the option is fairly responsive to changes in implied volatility, gaining approximately $0.93 for every 1-point increase in implied volatility.

Lastly, Rho at 53.85 suggests around a $0.54 premium increase for every 1% rise in interest rates.

Overall, these Greeks suggest a well-rounded contract for traders expecting upward movement and/or rising volatility, while still being conscious of time decay.

Adding Greeks To Barchart’s Option Screener

Let’s say you don’t have an underlying asset in mind and want to explore your “options” in the market with a particular strategy.

In that case, you can access the strategy-specific option screener by clicking "Options" on the top menu and then selecting the strategy you’d like to use. For this example, let’s use the Covered or Short Call screener. I’m brought to a results page. From there, I’ll click on the Set Filters tab, where I’ll see the default filters for covered calls.

To add Greeks to your screen, simply type them in on the “find filter” field, select which one, then click add. You can also navigate to the Option Analysis > Greeks menu on the dropdown. By the way, delta is usually included in the default screen filters for most trades - it’s that important!

Again, add whatever you need, adjust the values, and you’re all set.

Final Thoughts

Understanding and using the Greeks gives you complete 360 degree view of your options trades and how they work. Forget randomly picking a strike and hoping for the best. Delta and Theta help you assess directional risk and time decay, while Vega, Gamma, and Rho help you forecast option price movement on potential changes over the horizon. And with Barchart’s new P&L tool and Options Screener, you have access to options Greeks without having to break out the calculator or fiddle with highly technical formulas with ever-changing variables.

So, the next time you set up an options trade, don’t just glance at the premium - look under the hood. In fact, I challenge you to select specific trades based on their Greeks and monitor their performance throughout the contract’s duration. This will give you a better idea of how real-world, real-time changes affect the Greeks and, eventually, your trade outcome.