7 Ways to Make Money From Your Investments (Beyond Dividends)

Here’s a question for you — how many ways can you actually make money from your investments?

Most of us think you only make money from stocks and other financial instruments in two ways: when the price goes up, or when you get a dividend.

Some of you might be expecting me to say, “There’s a third way.” But no, it goes beyond that. There are several ways you can generate income using an existing portfolio. They come with different risks and returns, but they offer the same thing - steady, reliable, and predictable cash flow, which makes it perfect for longer-term or retirement portfolios.

By the end of this article you’ll know exactly which strategies might fit your style best. I’ll cover the most effective ways to generate income and see how each one compares to the others in terms of risk and return.

Let’s get to it.

Income Generating Strategy Definition

Before we dive into specific strategies, let’s get on the same page.

An income-generating strategy is an approach that focuses on instruments that offer passive, recurring, and safe cash flow over capital appreciation. The goal is to establish a consistent and reliable stream of income that can be used to build wealth, provide financial stability or freedom, or cover your living expenses without withdrawing too much of your capital, as is required by retirees.

Investments that provide income include dividend stocks, government and corporate bonds, interest-generating instruments, and even some option strategies - all of which I’ll cover over the course of this video. In other words, we’re not just chasing the next hot stock… we’re building a money machine that pays you whether the market is up or down.

Dividends

Let’s kick things off with the simplest and most popular strategy: dividend investing.

For example, if a company pays $2 per share annually, that means shareholders get $2 per year per share that they own, as long as they don’t sell the stock.

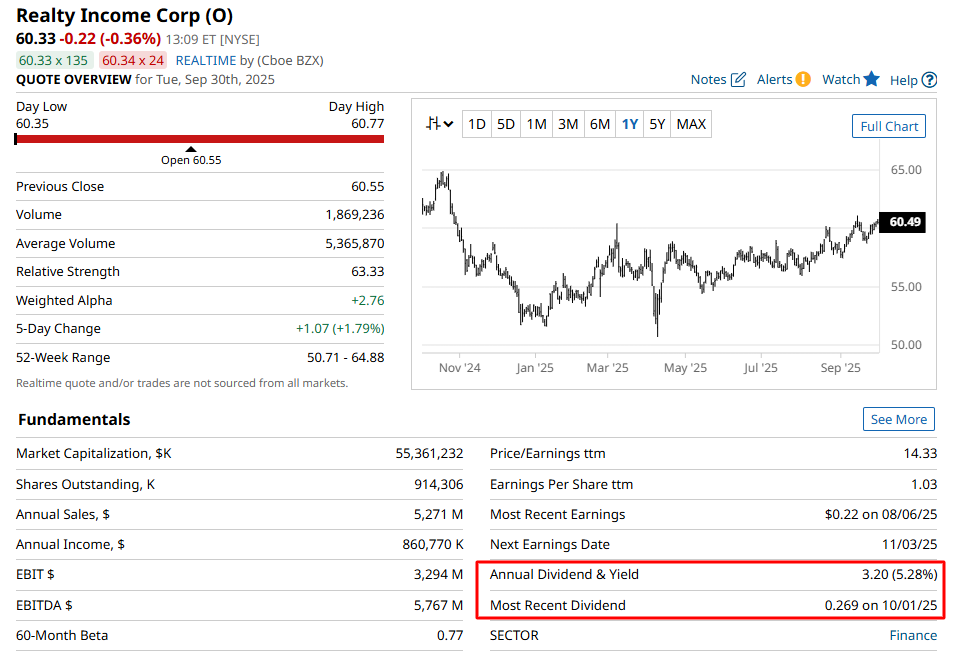

Dividend payout schedules and amounts depend on the company. Some pay quarterly, which is the most common, while some twice a year. Others even pay monthly like Realty Income or AGNC Investment Corp.

Now, when talking dividends, there’s something called yield, which compares the annual dividend you receive against the stock’s current trading price. This is expressed as a percentage. So, for example, that same stock that pays $2 a year, let’s say trades at $100 per share. So, that means, if you buy the company at $100 per share and receive the dividend, you are getting a 2% yield on your investment.

But you might be thinking, the higher the yield, the better, right? Not so fast. Yields are based on a stock’s trading price. So if a stock falls, its yield might look higher on paper — but that’s not always a good sign. In some cases, the company may be paying out more than it can realistically afford, which could lead to a dividend cut or even a complete stop.

That’s why yield alone isn’t enough. A company needs to have stable cash flow and consistent earnings to make those payments sustainable.

Think of it as giving a child an allowance. If the parent has a stable job with a reliable and consistent income, and if household expenses are kept under control, they can give the child a regular allowance. The more money the parent brings in, the higher the allowance can be.

However, if the parent loses their job or unexpected expenses arise, the allowance might be reduced or stopped altogether. That’s exactly how dividends work.

So, always consider the company’s earnings stability, payout ratio, cash flow, and dividend history - including it’s growth to judge whether the income is truly reliable.

Bottom line: dividends can be a steady income stream — but you want quality over quantity. Chasing yield alone can get you into trouble.

Types of Dividend Companies

But, here’s where it gets interesting — not all dividend stocks are created equal.

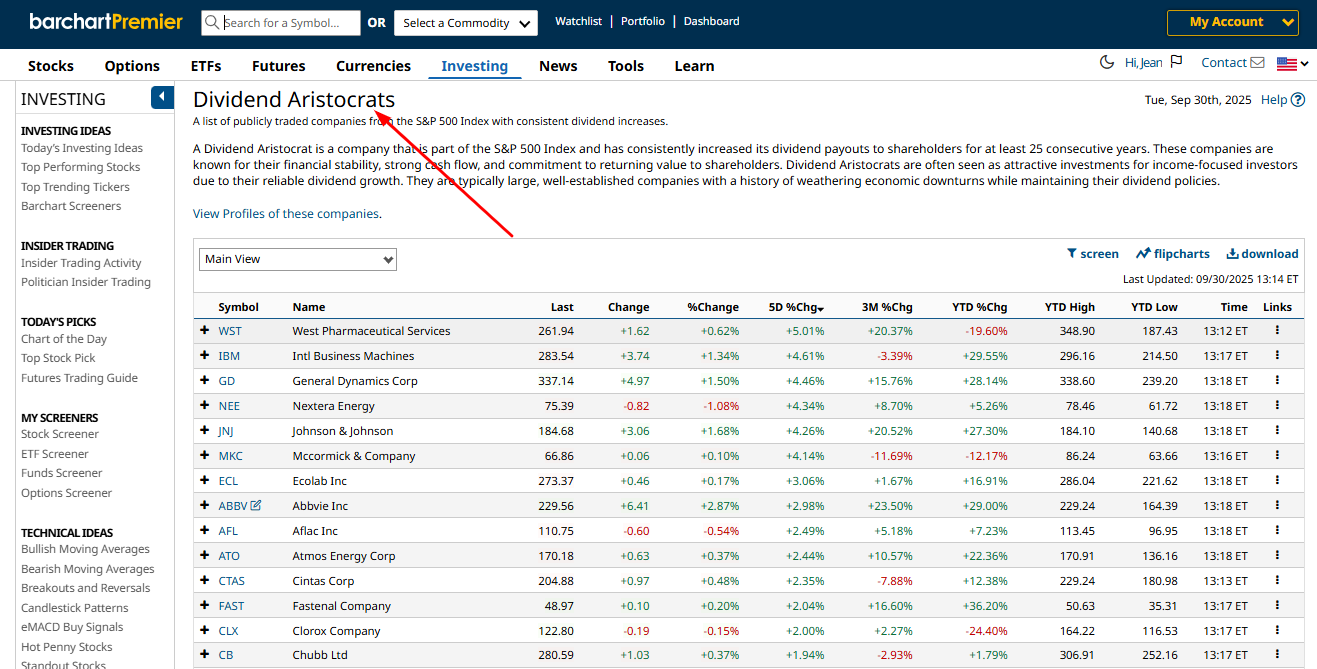

For example, did you know that some companies have paid increasing dividends for 25-plus years straight? The list is known as the S&P 500 Dividend Aristocrats Index. And yes, if a company has been growing their dividends for more than two decades, it means a higher degree of reliability.

Companies included in these lists are Abbvie, Abbot Labs, Archer Daniels Midland and over 60 more. Now, there’s other, better-known companies in the Dividend Aristocrats list, but the reason why I separated them is, well, they intersect with the next group of stocks: Dividend Kings.

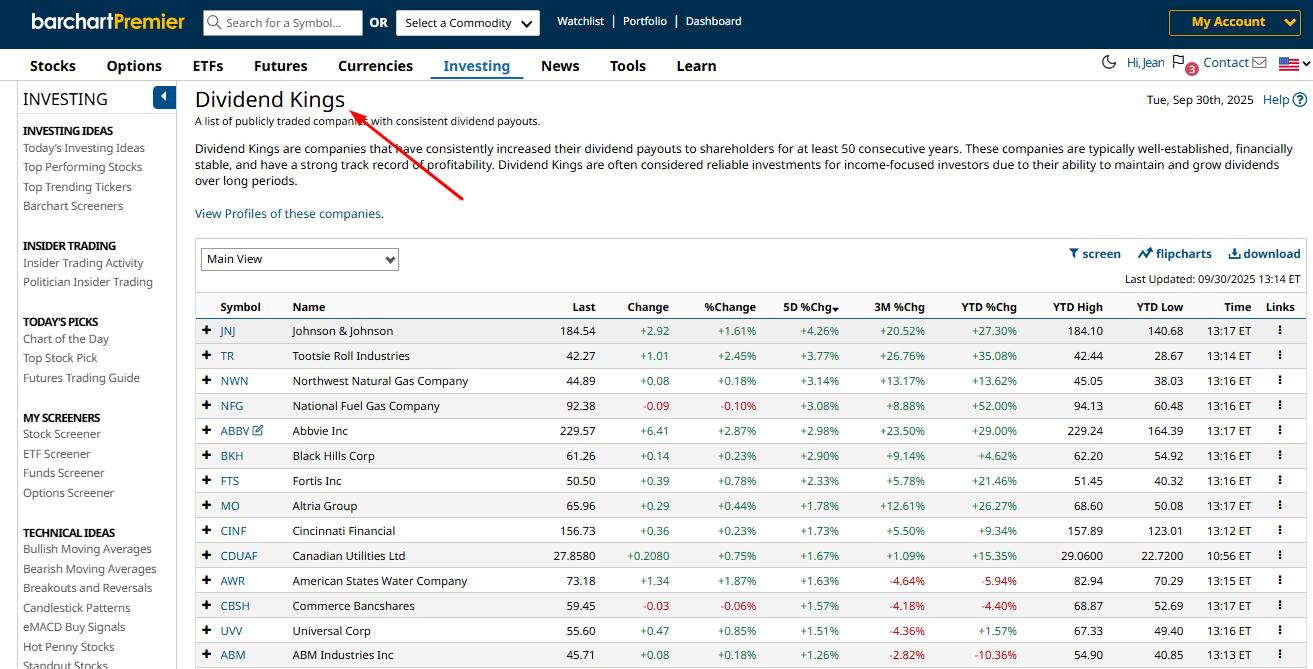

These companies have increased their dividends for 50 or more years straight. Imagine: 50 years of weathering the many economic downturns, market crashes, inflationary cycles, and shifting business landscapes.

Over the last 50 years, we’ve seen the rotary phone, the DVD, cassette tapes, VHS, and other once ubiquitous things come and go. These Dividend Kings, they’ve outlived them all. That’s the kind of consistency long-term investors want.

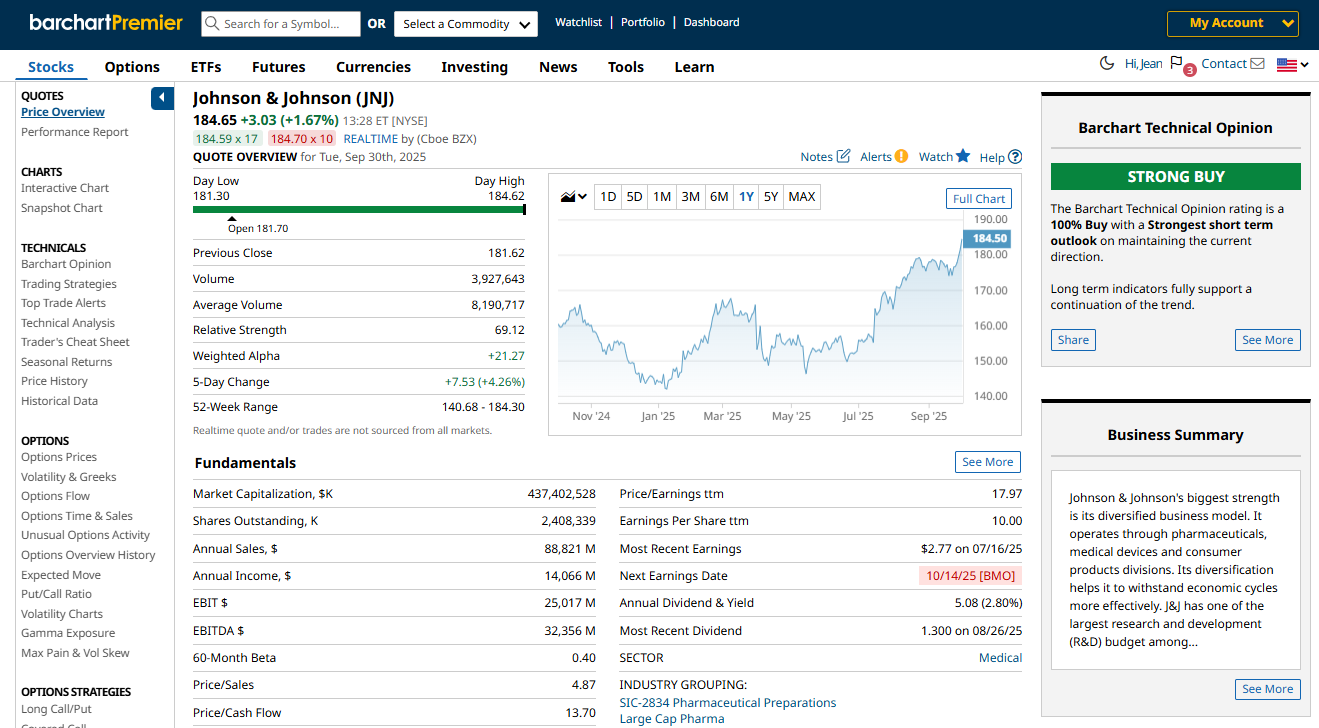

Companies in the Dividend Kings list include Coca-Cola, Johnson & Johnson, and Procter & Gamble.

There’s also the Dividend Zombies - and no, they’re not dead companies that pay dividends, if that even makes sense. They’re companies that have paid dividends for 100 years straight - no pauses. That said, they don’t necessarily have to increase their payouts for the full 100 years. That’s why not all Zombies are Kings, or even Aristocrats.

Other Types of Dividend Companies

And speaking of yield — let’s talk about some of the highest payers out there.

Aside from those long-term dividend growers, we also have REITs, and business development companies, or BDCs. Because of how they’re structured, these companies are required to pay out at least 90% of their earnings to shareholders, which, you guessed it, often leads to higher yields.

The drawback with REITs and BDCs is that they don’t get to keep much of their profit, so they don’t have as much left to reinvest in their businesses. Many of these companies raise capital through debt or issuing more shares, which can dilute existing shareholders.

That usually means slower growth, or in some cases, no growth at all in their stock price.

In short: REITs and BDCs can be fantastic for income, but these company’s don’t tend to increase their dividend like say, the Aristocrats.

So, if you’re after long-term reliability, look to Dividend Aristocrats and Kings. If you’re chasing yield, REITs and BDCs might give you more income, but they often trade growth for payouts.

Warning About Dividend Stocks

Now before you go looking for stocks with the highest dividends, here’s an important reality check.

So, there’s one thing about dividend stocks – even those in the Dividend Kings and Aristocrats lists – are not risk-free. The stock’s value can and will fluctuate over time, and the company may cut its dividend payments due to business hardship.

Investing in dividend stocks with reasonable yields offers medium returns for moderate risks. The higher the yield, the higher the risk.

So the lesson here is: stability beats excitement. The most sustainable income streams come from companies that can actually afford to keep paying you

The other type of income that’s available is interest income.

Treasury Bills & Bonds

And that leads me to a question — what if you could lend money to the safest borrower on the planet and get paid interest for decades?

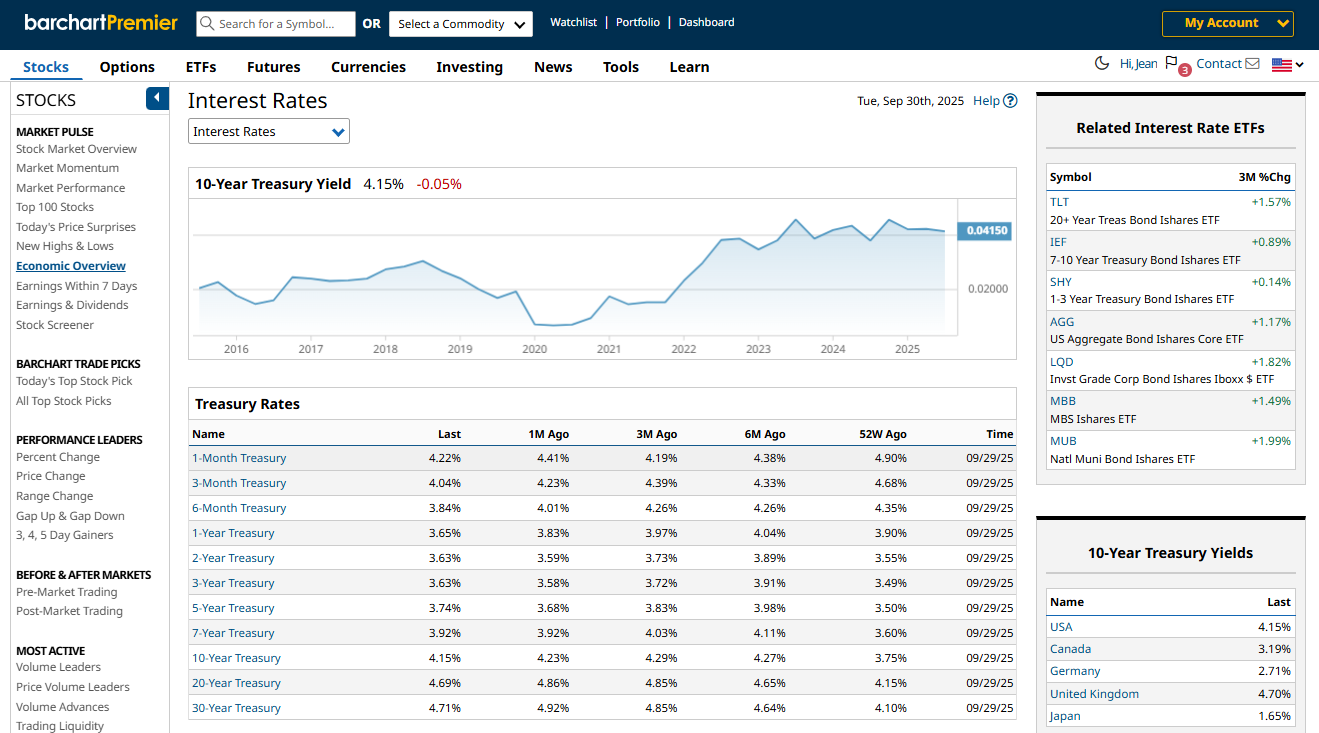

The easy answer: invest in treasuries. These are short- or long-term debt securities issued by the US Treasury, that last anywhere between a few months for T-bills to as long as 30 years for Treasury bonds. They essentially serve as a way for you to lend money to the US government. And with that debt comes interest.

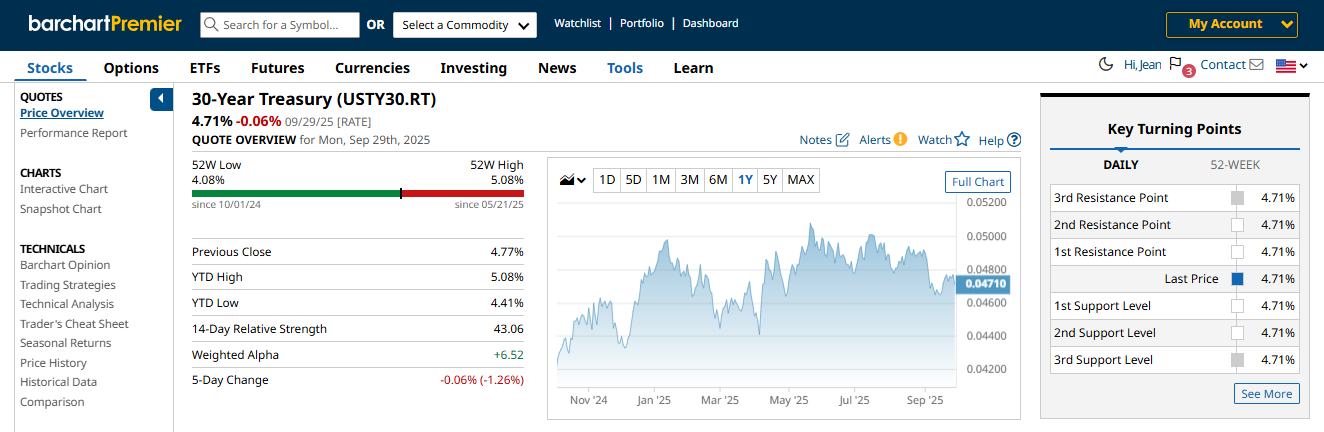

Let’s take the long-term ones- treasury bonds - as an example. The US government pays bondholders a fixed interest rate, and today, it’s around 4.8-4.9% annually for the 30 year bond. The bond value itself will go up and down over time, but at maturity, you’d paid the par value - which was the initial value of the bond when it was issued.

The payments are called coupons, and they represent the income you get when buying treasuries, and they’re paid twice a year.

And here’s the kicker: they’re one of, if not the, safest investments around. Unless the US defaults on its debts or ceases to exist in the next 20 or 30 years - both of which are extremely unlikely to happen - you can expect your coupon payments in full and on time. Treasuries won’t make you rich overnight, but they give you safety, stability, and predictable income.

Bond Laddering

But here’s the problem — locking up your cash for 30 years feels like forever. So what’s the workaround? That’s where bond laddering comes in.

Bond laddering means buying bonds with different maturity dates. As each bond matures, you take the proceeds and roll them into something else - maybe a stock, or maybe a new long-term bond at the far end of your timeline.

So, for example, you invest $10,000 in three bonds — one that matures in one year, another in two years, and the third in three years.

When the one-year bond matures, you can use the proceeds to buy a new three-year bond. That way, you always have bonds coming due in one, two, and three years.

This creates a rolling cycle where a bond matures every year, giving you consistent interest payments and some protection against sudden changes in rates.

Think of it like setting up financial dominoes — one falls every year, freeing up cash, while you keep the rest of the ladder working for you.

Options

Now, with all that out of the way, what if you’re already sitting on stocks in your portfolio? Is there a way to squeeze out extra income without selling them outright?

Covered calls is the answer to your question.

First, let’s go over the definitions.

An option is a contract that gives the buyer the right but not the obligation to buy or sell a specified underlying asset at a specific price, known as the strike price, on or before a specified expiration date, in exchange for a fee, known as the premium. A call option gives you the right to buy the asset, while a put option gives you the right to sell.

On the other side of the trade, the seller or writer receives the premium in exchange for taking on the obligation to fulfill the contract should the buyer exercise their right. A seller fulfilling their obligation is called an assignment.

Covered Calls

Covered calls are my personal favorite — because it’s one of the most straightforward ways to turn the stocks you already own into a cash-flow machine.

A covered call is a strategy where you sell a call option against 100 shares of stock that you already own. When you sell a covered call, you’ll pick an expiration date and a strike price. The expiration date is when the option expires, and the strike price is the level you want the stock to stay below by expiration. That’s the goal.

If the stock crosses above that strike, you’ll sell your 100 shares at that strike price. So in general, with covered calls, you want to set the strike at a high enough price you’d be happy to sell your shares at.

But there’s the balancing act: the higher the premium, the lower the strike price — and the higher the chance you’ll get assigned. As an investor who prefers to hold onto my shares, I’d personally take a smaller premium in exchange for a better chance of keeping my stock. That’s the trade-off: less upfront cash, but more control over your long-term position.

Example

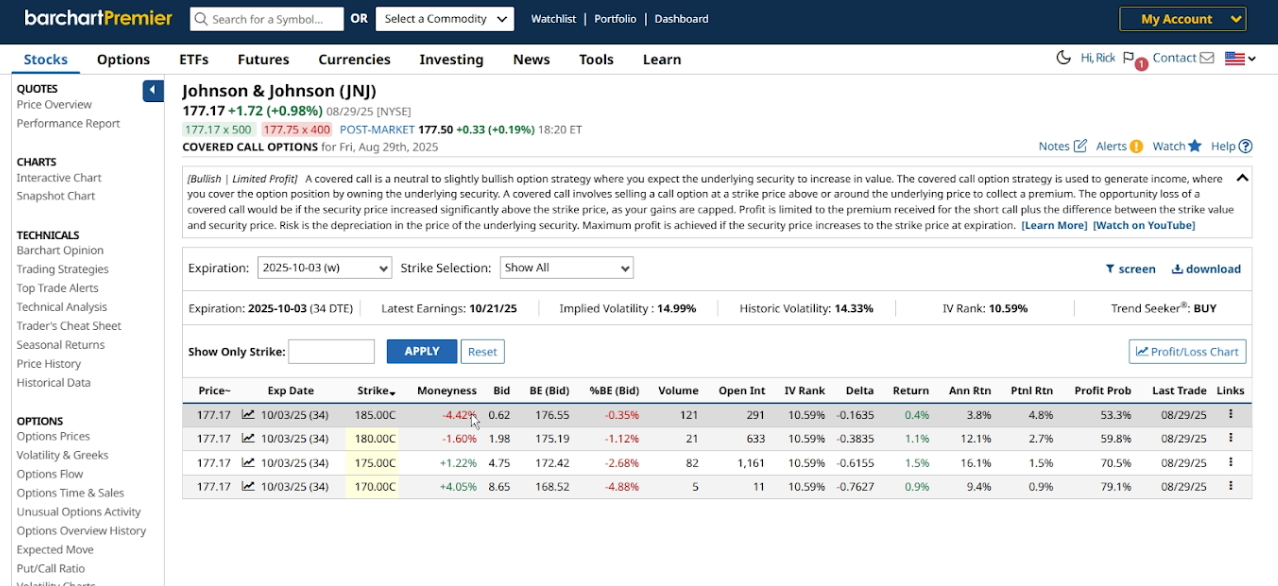

For example, let’s say you already own 100 shares of Johnson & Johnson. The stock today trades at $177.17 each, and maybe you want to sell a covered call on your shares.

The next thing you would do is choose the expiration date for your trade and identify a strike price that JNJ has a low chance of exceeding by that date.

So, let’s say you think that JNJ won’t trade at or above $185 in the next month. To check the trade details for a 185-strike call, navigate to the company’s profile page on Barchart, then click on "Covered Call" on the left side of the screen. Here, you’ll see suggested covered call trades, including all the details plus option analytics and probabilities.

I’ll switch the expiration date to October 3, which is 34 days away from the time of recording, then change the strike selection to Show All.

Once there, you’ll see the suggested trades with different strike prices. For the 185-strike trade, the screener suggests selling a call for 62 cents per share or $62 total. It also has a relatively low delta of -0.16, which means it’s less likely to get assigned. That’s a key detail — a lower delta often means a higher probability you keep your shares.

In terms of returns, for this trade, you’re looking at a 0.4% return over the next 34 days, or 3.8% over the year. And with JNJ having a forward yield of 2.9%, you can potentially be looking at a total return of 6.7% a year.

That’s like getting paid twice — once from the dividend – and once from the option premium. And the risk? It’s relatively low. Worst case, if JNJ trades above the $185 strike at expiration, you’ll sell the 100 shares at that price. That’s cash deposited right into your account — and remember, you already keep the premium.

Now, you’re not limited to selling covered calls on dividend stocks. Maybe you have growth stocks in your portfolio like Microsoft or Nvidia - companies that pay little to no dividends. You can sell covered calls on them too, and let me tell you, the premiums are very juicy!

Cash-Secured Puts

But let’s flip the script — what if you have a little cash on the sidelines and you’re waiting for the right price to buy a specific stock?

Well, with a cash-secured put, you get paid to buy stocks at a discount.

Cash-secured puts involve selling a put option on a stock and collecting a premium. Like the covered call, you’ll pick a strike and expiration date. But there’s a twist. Remember, with a covered call, the only risk is having to sell your shares. With a cash-secured put, your risk is being obligated to buy 100 shares of the stock if it trades below the strike at expiration. So, you’ll only want to sell a put on a stock you’d actually want to own - because between now and expiration, you can get paid while waiting for the stock to drop to a price you’re comfortable owning it at. Think of it as getting paid to place a limit order.

Example

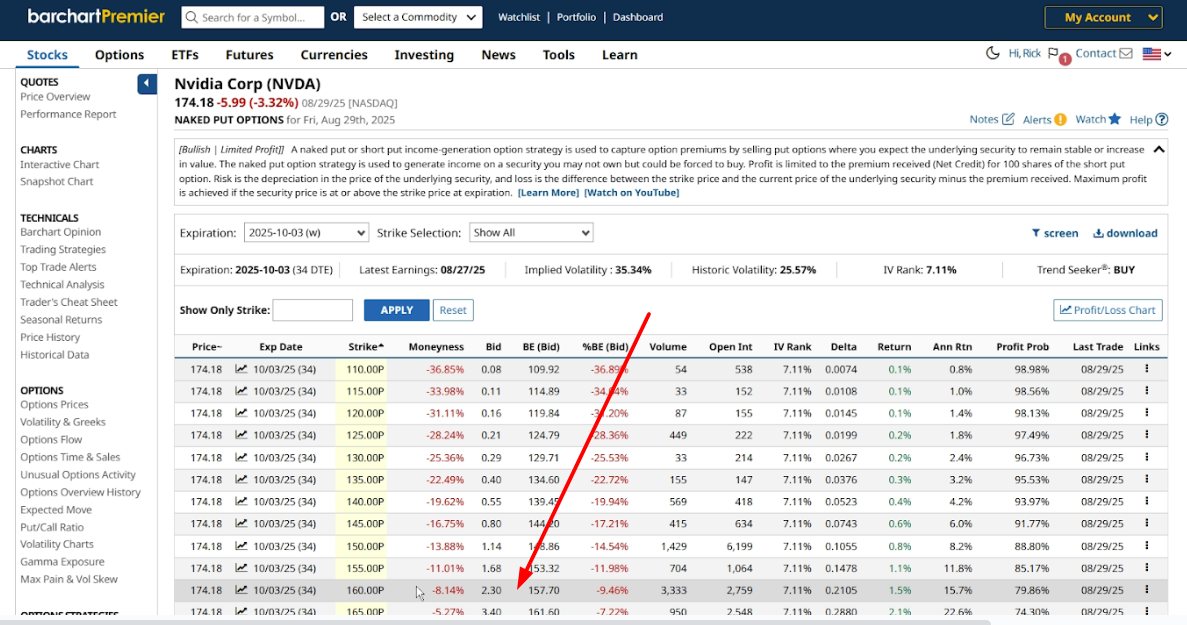

So, let’s say you’re thinking about buying Nvidia, but it’s always too expensive. Today it trades around $174. Let’s say you’d be happy to buy it at $160. Well, this is where you could generate a little income from the cash you already have, and potentially get the opportunity to buy 100 shares of Nvidia at $160 a pop.

So what do you do?

Let's start by visiting Nvidia’s profile page, select Naked Put from the Option Strategies selection, and let’s change the expiration date to October 3rd, for example, so we can see all the potential trades.

With this trade, you can sell a put on Nvidia and receive $2.30 per share, or $230 total, per contract. If Nvidia trades above $160 by October 3, then the put expires worthless and you get to keep the $230 premium in full. And by the way, you just got a 15.7% annualized return on your money. Not bad eh?

Then, you can sell another to get a steady income while waiting for Nvidia to dip below your strike price.

The important thing about cash-secured puts is that you have enough money to buy 100 shares of the stock if you get assigned.

You might also be tempted to use margin to sell puts - most brokerages offer margin, but I’d avoid that, especially if you’re selling options in retirement.

So, this strategy works best if you’re patient, disciplined, and only sell puts on companies you truly want to own anyway.

Other Income-Generating Option Strategies

By now you’re probably wondering — are those the only strategies, or are there more ways to get paid from your investments?

Income generation using options is not limited to covered calls or cash-secured puts.

There are also credit spreads like bull put and bear calls, which generate income and work best if you have smaller amounts of cash available to invest.

There are also more advanced strategies that include iron condors, which combine the two credit spreads and create a zone of profitability between the short put and short call strike prices.

That said, only the covered call allows you to generate income directly from the stocks you already own. And that’s why it remains one of the most popular choices for long-term investors like me.

You could think of this: dividends are your baseline paycheck, covered calls are your side hustle, and strategies like spreads or iron condors are advanced plays for those looking to maximize every opportunity.

Recap

There are a lot of income-generating strategies that you can apply to your long-term portfolio. And the exciting part? You don’t have to pick just one — the best investors often combine them.

In a typical retirement portfolio, you’d want a balanced mix of bonds, dividend stocks, and maybe even some options strategies to boost your income.

As long as you understand the risks and weigh them against the potential rewards, you can build a portfolio that pays you a steady, reliable, and predictable income for years to come.