How to Hedge Your Stocks With Options (Protect Yourself Now)

At one point or another, we’ve often thought: What if the market crashed tomorrow — would my retirement be wiped out?

Most of us shrug it off, thinking “The S&P 500 grows 10% a year on average. I’ll be fine.”

But here’s the problem: that 10% isn’t steady. It’s not a smooth ride up. It’s up 10%… then down 20%. If the crash happens right when you need your money for retirement, medical bills, sending your kid to college, that “average” doesn’t matter. You’re stuck selling at the bottom.

And that’s the issue right now. The market’s not only at its all time highs, but it’s at it’s highest valuations – EVER. More than 1929, 1965, and 1999… and it only takes one bad year to destroy decades of savings.

Look, I don’t want to scare you - because the sooner you’re aware of the strategies that can actually protect your portfolio, the better you’ll sleep at night.

Today, I’m going to break down exactly how investors can use these tools to protect themselves from a market crash, what risks they need to watch out for, and the specific framework I use to make sure my money is working for me — not against me.

So let’s get into it.

Options Introduction

The very best way to hedge against losses is by using the options market.

An option is a contract that gives the buyer the right but not the obligation to buy or sell a specified underlying asset at a specific price, known as the strike price, on or before a specified expiration date, in exchange for a fee, known as the premium. Each contract represents 100 shares of the underlying asset. Calls give you the right to buy, while puts give you the right to sell. Easy enough, right?

So, the buyer pays a premium for the contract, which is usually expressed on a per-share basis. So if you buy an option with a $2 premium, that means you’re paying $200 for the contract.

Buying options is a popular way to speculate on an asset’s price movement. They’re basically directional bets that allow you exposure through a leveraged position without holding the 100 shares of the underlying outright.

Hedging

Next, let’s define hedging.

Hedging doesn’t mean you’re going to start your own hedge fund. No, hedging means protecting yourself from something that could happen - it’s risk management - like buying insurance for your portfolio. And, like insurance, you spend a little money up front for that protection. You hope you don’t actually need it, but it’s good that you know it’s there.

However, the use of options for hedging extends beyond traditional insurance. And to show you exactly how, I’ll talk about put options.

Protective Puts

As I mentioned earlier, put options give the buyer the right but not the obligation to sell a specified asset at any time before the expiration date. Investors usually buy long puts to protect their underlying assets from a loss. But it’s not as simple as just getting to sell your options at your strike price.

There’s more nuance to the strategy, which, under the right conditions, can significantly mitigate or even eliminate your losses. Let me show you how it works.

Example

Let’s say you own 100 shares of Microsoft, which you bought recently for $500. With Microsoft trading at $502 today, you’re up $2 per share.

Now, as is common with disciplined trading, you might set a stop-loss to protect yourself from big drops. Let’s say you decide that if Microsoft ever hits $490 by December, you’re selling your shares.

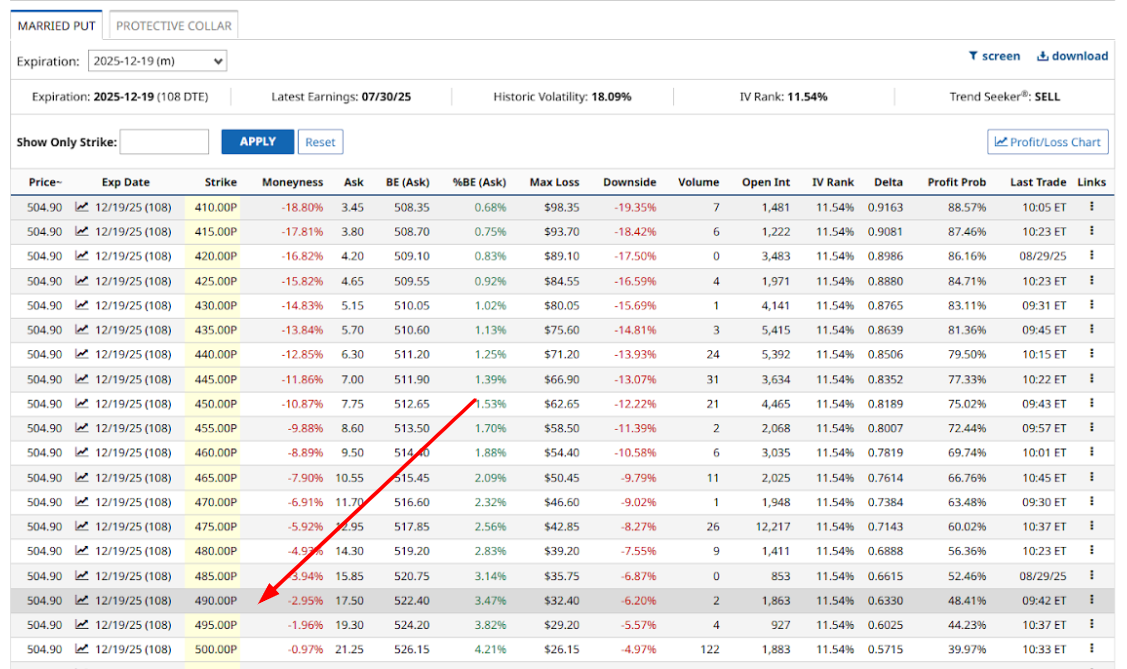

But instead of setting a stop-loss at $490, you buy a 490-strike put. But what will it cost? Well, with Barchart, you can check the prices before you buy.

From Microsoft’s profile page, click Long Call/Long Put here on the left, then Long Put. Then, change the expiration date to, say, December 19, 2025. From here, you’ll see the various strike prices for Microsoft puts expiring on that day.

With this long put, you’ll now have the right to sell your 100 MSFT shares at any time, for any reason, on or before December 19 for $490 per share — that’s 108 days of protection. And the cost? It is $17.50 per share, or $1,750 per contract.

Yes, that may seem like a lot of money upfront, but consider this: if Microsoft’s price falls to $450 on October 15, and you sold the shares without a protective put in place, your loss would be $50 a share — that’s $5,000 gone, just like that.

On the stocks, you’d lose $10 a share, plus the $17.50 a share of course that you paid for the option - or $2750 per contract.

But - you’d have saved yourself from additional $2,250 in losses - that’s the beauty of long puts when used for hedging!

But here’s the thing — exercising the option isn’t always the best way to utilize protective puts. Remember, option contracts are bought and sold during market hours, and their price is influenced by factors such as volatility, time to expiration, and demand, not just the stock’s movement.

Continuing with the example, Microsoft is now trading at $450 per share as of October 15, and you are holding a 490-strike put.

That means, one, your long put has an intrinsic value of $40 per share, and two, the contract still has 65 days till expiration, which means it has time or extrinsic value.

Because that’s the thing with options: they can have both intrinsic and extrinsic value, which increases their overall value — in the right circumstances.

So, let’s say your 490-strike put is now actually worth $60 per share on October 15. That means you can sell your Microsoft shares for $450 and take the $50 per share loss. At the same time, you also sell your long put for a $60 per share, or $6,000 per contract.

So with that long put, your stock loses $5,000, but the put makes you $6,000 — that’s a net gain of $1,000. After subtracting the $1,750 premium you paid upfront, your effective result is now only a $750 loss.

In other words, instead of losing $5,000, you’re only down $750 — that’s $4,250 of downside you’ve saved yourself.

Now, if nothing happens — if Microsoft doesn’t trade below $490 and December 19 rolls around, then the contract expires, and that $1,750 premium you paid for the long put is gone. That’s the maximum loss for long puts, and that’s just the price for protection.

Pros & Cons of Long Puts

So, yes, think of a long put like an insurance policy. They’re suitable if you have a bearish outlook and like an insurance policy, the risks are limited to the premium you paid at the start of the trade.

However, long puts lose value as expiration approaches. This phenomenon is called theta or time decay, and it is an immutable law in options. For that reason, it’s not uncommon to buy puts with very long expirations, all the better to protect yourself. In some cases, people buy puts that are more than a year out. These options are called LEAPS or Long-term equity anticipation securities and have expirations as far as 39 months into the future. That’s a lot of time!

But remember, the longer the expiration date, the more expensive the premium.

Protective Collar

So, it goes without saying that nothing on Wall Street is free. If you buy a put option, it protects you on the downside, but that insurance comes at a cost, and if you do it enough times, those premiums will add up quickly.

But what if you could protect your downside while offsetting most of the insurance cost by letting someone else pay for it?

That’s where a protective collar comes in. A collar is simple: buy or own 100 shares of the underlying, then buy an out-of-the-money put for downside protection, then sell an out-of-the-money call, all with the same expiration date.

The short call generates a premium, which offsets the cost of the long put. But again, nothing is ever free: the trade-off here is that while you’re protected on the downside, you give up some upside potential if the stock rises past your call strike.

Your maximum profit is basically the difference between what you paid for the stock and the call strike, plus or minus whatever net premium you collected or spent.

But your maximum loss is capped too: it’s your stock purchase price minus the put strike, adjusted for the net premium. You will not lose any more money should the stock fall below the put option strike.

So instead of watching your retirement account swing thousands of dollars in a market crash, a collar gives you a floor under your portfolio, while the premium from the short call helps cover your insurance.

Example

So, taking the previous example, let’s say you want to turn your 490-strike protective put into a protective collar. So let’s jump back over to the Microsoft profile page and click Protection Strategies, then click the Protective Collar tab. By the way, protective puts are also called married puts, and you can also find trades on this page.

But let’s go back to the protective collar section. Again, let’s change the expiration date to December 19. There are a lot of trades here, so to narrow it down, let’s switch the Show Only dropdown to Leg 2, or the long put, set the strike to 490, then click Apply.

And there we have it, a list of protective collar trades with 490-strike puts. If you look at the Net Credit/Debit column, you can see if the trade results in a credit or debit based on the positive or negative value.

So, let’s say you want to set the short call strike to $525. According to this screen, you can sell a 525-strike call and get $17.65 per share, then you can buy a 490-strike long put for $17.50. The trade results in a 15-cent credit or $15 total. Both options will expire in 108 days.

If Microsoft trades below $490 by expiration, your long put kicks in and protects you from any additional downside beyond that level. No matter how far the stock falls, you’ll be able to sell your shares at $490. Since you collected a small net credit of 15 cents a share upfront, your effective protection level is actually $490.15.

On the other hand, if Microsoft rallies above $525, your shares will be called away at that strike. Since you bought at $500, that locks in a maximum gain of $25 per share, plus the small net credit from the options. In other words, you’ve capped your upside, but in return, you’ve secured downside protection at little to no cost.

And if Microsoft closes between $490 and $525 at expiration, both options expire worthless, and you continue holding your shares at the $500 purchase price — while still keeping that $15 credit.

That’s the essence of a protective collar: sacrificing unlimited upside in exchange for affordable or even zero-cost protection against major losses.

Portfolio Hedging

So far, I’ve talked about protecting yourself from the fall in price of a stock, as well as a “cheaper” way to buy protection. What if you want to protect your entire portfolio? Well, you could buy puts against each of your stocks, but, chances are you probably don’t have a portfolio of “round lot” stocks. You probably don’t have 100 of Microsoft, 100 of Alphabet, 100 of Coca-Cola Cola and so on. If you’re like most, you might have 156 of Microsoft, 28 of Alphabet, and 94 Coca Cola - as an example.

So to protect your entire portfolio, now you’ll need to consider - is your portfolio comprised mostly of S&P 500 companies? Or Nasdaq? Or a mix?

If you’re like most of us, your portfolio will roughly track either the S&P 500 or the Nasdaq. So, instead of buying a put on individual stocks you can buy a put on the index ETF. For example, SPY is a common S&P 500 ETF and QQQ is a common ETF that tracks the Nasdaq.

The SPY currently trades at $643 - so since each put is for 100 shares, one long put will protect about $64,300 of your portfolio.

If you have a $300,000 portfolio you’d like to protect, then you’d buy 4 or 5 puts on the SPY.

Same goes for the Nasdaq. If your portfolio is mostly technology companies, you’d buy a QQQ put. Again, each put is for 100 shares, so based on its trading price, one QQQ put would protect about $57,000 of your tech stocks.

And you can mix and match. And not only that, you don’t have to protect the entire portfolio - you could protect, 40, 50% or more, or less. The choice is up to you.

Disadvantages of Hedging Strategies

I think I’ve laid out the biggest disadvantage of both hedging strategies: the cost.

Sure, protective collars can result in initial credits, but the thing is, doing so also brings the short call’s strike price down and closer to the current trading price, which increases the risk of assignment AND lowers your potential profit.

Protective puts also come with a dilemma - the lower you set the strike price away from the current trading price, the cheaper it is, but the less protection you actually get. Set your strike closer to the current trading price, and the more expensive it is. This issue is especially visible when the stock has risen sharply in a short period of time. Option premiums tend to inflate right alongside the stock price, so buying a protective put at that point can feel like paying top dollar for insurance you may not even need.

In other words, the protection becomes most expensive exactly when you’re most likely to want it.

Another drawback is the psychological trap. Hedging can give investors a false sense of security: the idea that they’re “safe no matter what.” In reality, these strategies still involve trade-offs - capped profits, limited protection windows, and the possibility of losing money if the hedge expires worthless while the stock drifts sideways.

Recap

Still, with the right planning and risk management, hedging can serve as a powerful tool to protect your portfolio. The key here is not to protect your portfolio forever, but to be strategic about it. Monitor volatility, earnings expectations, market news, and other factors that can significantly affect your holdings, and then use hedging when and where necessary.