Deep ITM Calls

What if you could get almost stock-like gains for a fraction of the cost – and with less risk? I’ll show you how deep in-the-money call options can do exactly that.

Deep in-the-money calls cost more upfront and have lower returns on a percentage basis compared to out-of-the-money calls, and many traders overlook them.

But with a higher delta and more stock-like behavior, buying deep in-the-money calls can be a powerful way to capture upside while reducing the effects of time decay – making them a smart choice if you’re confident in a stock’s future direction.

I’ll share one simple tool that helps me find the best trades.

Deep ITM Calls - Definition

What are deep in-the-money, or deep ITM calls, anyway?

Well, call options are contracts that give the buyer the right but not the obligation to buy an underlying asset at a pre-determined strike price, on or before the expiration date. If the underlying asset’s price moves above your breakeven price – which will be above your strike price – the trade becomes profitable.

Now, options premiums are made up of two parts: intrinsic and extrinsic value. Intrinsic value is, as the name suggests, how much the option is actually worth. For example, a $90 strike call on a stock trading at $100 has a $10 intrinsic value.

CALL INTRINSIC VALUE = MARKET PRICE - STRIKE PRICE

But if you look at a live options chain, $90 strike calls for underlying assets trading at $100 are often more expensive than $10. That’s because of extrinsic value – the part of the premium that accounts for time until expiration, implied volatility, and demand.

CALL EXTRINSIC VALUE = OPTION PREMIUM - INTRINSIC VALUE

An out-of-the-money or OTM call has a strike price that’s higher than the current trading price. That means it has no intrinsic value and 100% extrinsic value.

In-the-money or ITM calls are ones with strike prices below the underlying asset’s current market trading price, so their premium consists of both intrinsic and extrinsic value.

Deep ITM calls are those with a significantly lower strike price -- typically about 20% or more below.

So now you know – intrinsic is the real value – and extrinsic is basically the “time and hype” baked in. This will be important in a minute.

Barchart.com SMCI Example

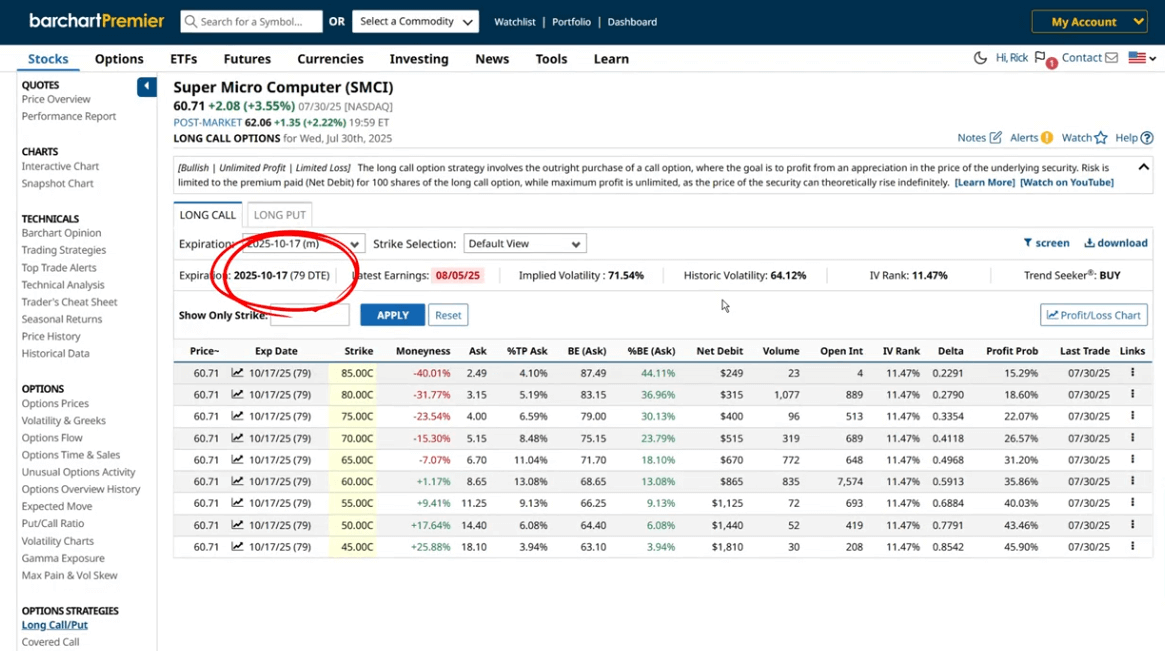

Visit Barchart.com and look up any underlying asset. I’ve had my eye on Super Micro for a couple of weeks, as I think it might finally break through its resistance level around $63 to $65 – of course these numbers are at the time of writing. It doesn’t matter what they are today, as it’s just an example.

Today, SMCI is trading at $60.71.

Now, let’s explore the call options on Super Micro – go to the left navigation pane, under Options, and click Long Call/Put.

Here’s why I’m showing you this: you’ll see exactly how to compare a deep ITM call to a deep OTM call, and why the price tag isn’t the whole story.

Now, just for this example, let’s look at trades with 60 days to expiration, or DTE. So, I’ll change the expiration date on the dropdown here to October 17, 79 days away from the time of writing. Of course, you can set your days to expiration to anything you like. Generally speaking with deep in-the-money calls, the longer the better – because over time, stocks tend to rise in value.

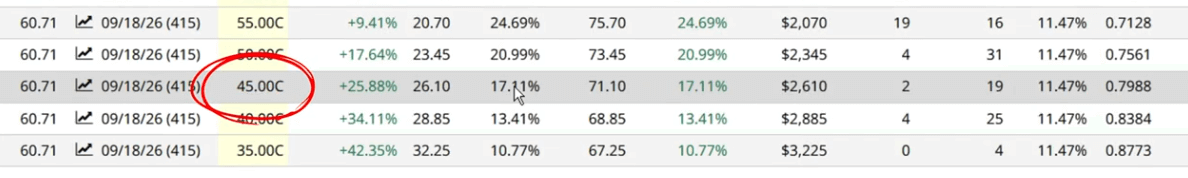

And there we have it – a list of suggested long call trades for SMCI. On the third column from the left is the moneyness value, or how much in or out of the money the trade is.

Let’s compare a deep ITM and deep OTM call here – the 45-strike and 75-strike trades, both roughly $15 and over 20% away from the current trading price.

IMG smci-strikes.png

The deep ITM call is 26% in the money and costs $18.10 per share.

The deep OTM call is 24% out of the money and costs $4.00 per share.

Which one would you pick right now? Many traders would pick the cheaper one – but let’s look closer.

Why Choose OTM Over ITM?

You may have read about some traders’ incredible gains with long calls – often preferring OTM calls over ITM calls. That’s because, on average, OTM calls have higher percentage returns because you’re paying less at the start.

But OTM calls are like a “lottery ticket” – exciting, but often a gamble.

On the other hand, the returns on ITM calls are far more realistic. Sure, they’re more expensive and feel “boring” due to the built-in intrinsic value, but that “boring” part is what gives you stability.

Think of it like this – OTM calls are like buying a lottery ticket, and ITM calls are like buying a home. One has real value, the other does not.

The smart money often uses ITM LEAPS calls to simulate a long position, benefitting from the underlying’s upside – for far less money than owning the underlying outright!

Why Should You Trade Deep ITM Calls?

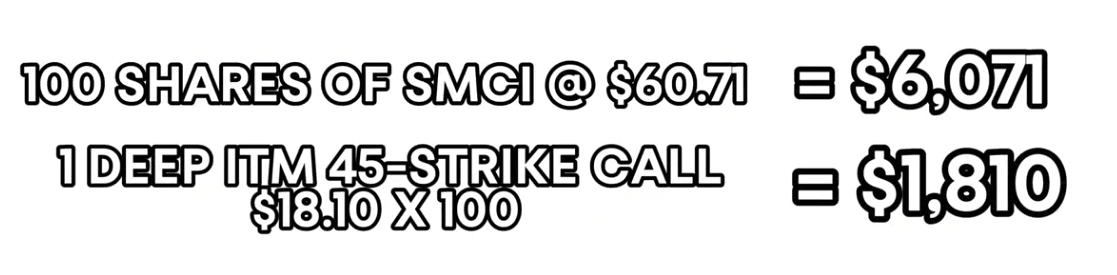

Let me give you an example. Say I’m looking to buy 100 shares of Super Micro. Instead of buying the shares, I could buy one deep ITM call – for much less than the cost of owning the shares.

Which would you rather do – tie up $60,000 or $18,000 for nearly the same exposure?

Deep ITM calls work best for high-conviction trades on high-quality, highly liquid stocks where you want reduced risk without sacrificing directional potential.

High Delta = Stock-Like Behavior

First, deep ITM calls have a high delta. Delta is the options Greek that measures how much an option’s price changes per $1 change in the underlying asset price. Long calls have positive delta because as the stock moves up, so does the premium.

So, if your ITM call has a 50 delta, the premium is expected to go up by $0.50 per $1 increase in the underlying stock, all things being equal.

Deep ITM calls have a higher delta. In my Super Micro example, the 45-strike call has an 85 delta.

That means, all things being equal, your premium will increase by $0.85 per $1 increase in SMCI. Essentially, you have an almost stock-like exposure to SMCI’s price movement, with the leverage offered by call options. That’s why deep ITM calls can feel like “owning the stock – but with more bang for your buck.”

Capital Efficiency & Limited Losses

Options are also more capital-efficient than buying stocks outright. You see, each option contract represents 100 shares of an underlying stock, and they cost significantly less as well!

If you were to buy 100 shares of SMCI today, you’d need to fork over $6,071. But with the 45-strike call, you’d pay $1,810 – well, the premium is $18.10 and since an option is for 100 shares, it’s $18.10 times a hundred.

And if you picked a higher delta, your option’s value increases nearly as much as the stock – that’s a win-win situation!

If that’s not enough, you also get downside protection as well! With long calls, your maximum loss is the premium paid to enter the position in the first place. Even if SMCI goes down to 0 at expiration, you’ll only lose $1,810. Compare that to owning the shares outright – your loss could be much, much bigger.

Lower Theta Decay

The next advantage of owning deep ITM calls is that they have less theta decay. Theta is the options Greek that tracks how much extrinsic value an option loses as it gets closer to expiration.

Since deep ITM calls have less extrinsic value than OTM calls, you are less exposed to theta or time decay.

The reduced exposure to theta means that deep ITM calls hold their value more consistently over time, especially if the stock price remains stable or trends upward. This makes them ideal for longer-term bullish strategies, such as LEAPS, where you want meaningful exposure to a stock's movement – for let’s say a year or more -- without constantly battling time decay.

Bottom line? You’re paying for reliability rather than speculation.

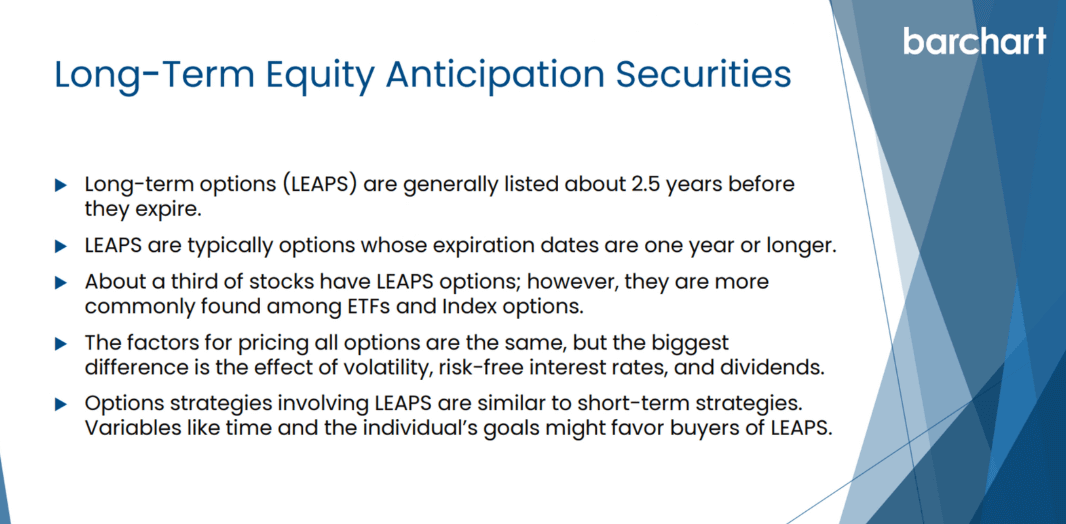

LEAPS Example & Breakdown

All right, so using Super Micro again, let’s look for LEAPS trades by just changing the expiration date in the dropdown. As you can see, available expiration dates go as far as the last trading day of 2027.

For now, we can pick a date about a year out – say September 18, 2026, which is 415 days away.

Then, I’ll look at the same $45 strike price.

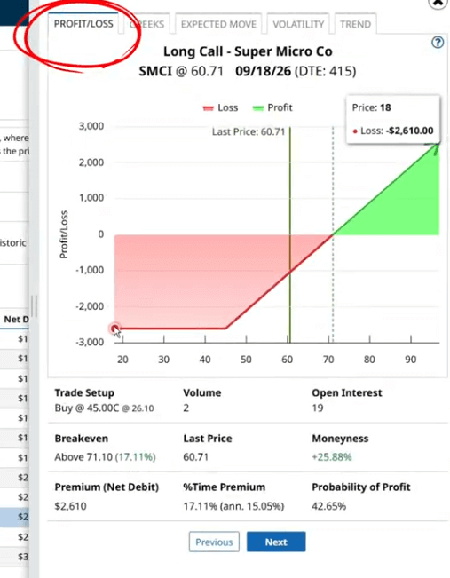

According to the screener, you can buy a 45-strike call on SMCI for $26.10 per share or $2,610 total. The trade is 25.88% or $15.71 in the money, has a delta of 80, and your breakeven price is set to $71.10.

To calculate the breakeven price on the long call, simply add the premium to the strike price. If SMCI trades above your breakeven price at or before your expiration date, your trade is profitable, though I’d say sooner is better in this case.

Now, to get more information about this trade, you can click the chart icon between the strike price and expiration date. This will pull up Barchart’s new profit and loss charting tool.

The first tab here is profit and loss, which outlines the details of your trade, as well as charts the potential results. You can hover your mouse over here to see the exact profit or loss for every price point at expiration. You can also see the open interest for the trade, which is the total number of outstanding contracts currently held in the market and tells you if the option trade has high liquidity. More on that later.

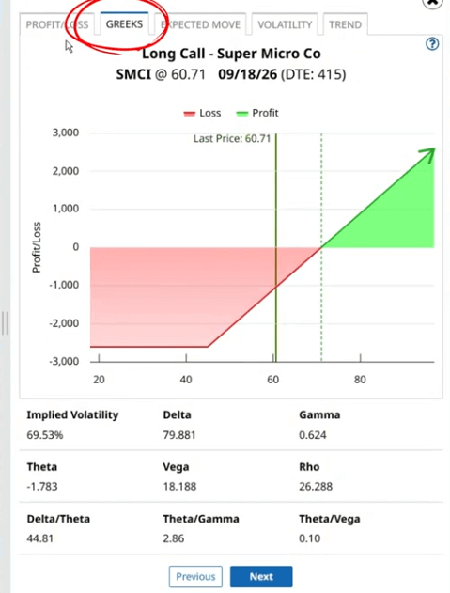

The next tab is the Greeks, where you can see delta, theta, as well as gamma, vega, and rho. Theta is -1.78, so your long call will lose around 1.8 cents per day in extrinsic value, all things being equal. As the stock rises, theta will also decline.

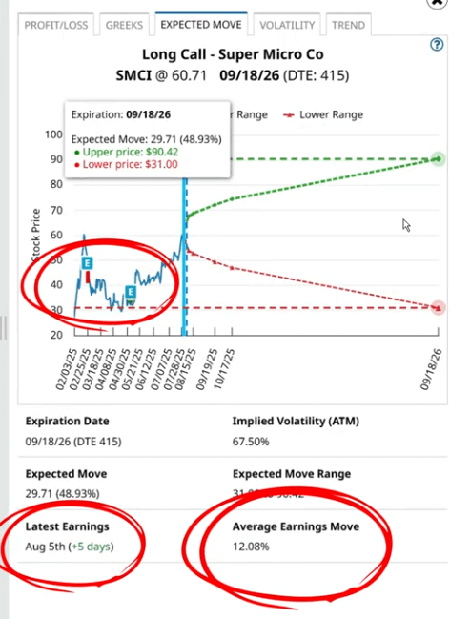

Next is the expected move tab, where it graphs the expected trading range of the stock based on 85% of at-the-money straddle premiums. The range indicates $31.00 to $90.42, so it’s all to play for. You can also see earnings details, as well as how much the stock has moved on average after its last four earnings.

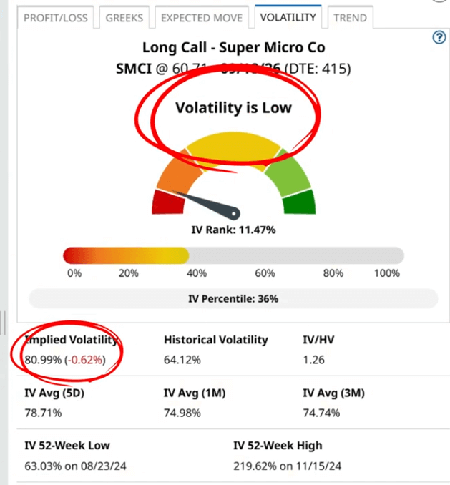

Next is the volatility tab, and this is where it gets a little interesting. As you can see, implied volatility is at 80.99%, which might look high at first glance, but according to IV rank -- which compares implied and historical volatility -- it’s actually low.

That’s because SMCI has had heightened volatility in the last 52 weeks, with the highest value clocking in at 219%. This shows why it’s critical to check IV rank, not just the raw volatility number -- it can change the whole picture.

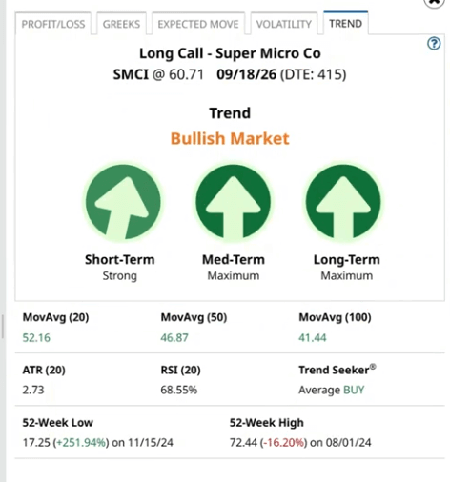

The last tab is trend, a favorite of technical traders. The arrows show the expected direction of the stock based on its 20, 50, and 100-day moving averages. As you can see, SMCI is expected to trade bullishly, which is great news for you.

You can also see ATR or average true range value, which tracks how much the stock has moved on average for the last 20 days. According to the ATR, SMCI has moved by $2.73 on average.

There’s also RSI, or the relative strength index, which takes a stock’s price movement from the previous 20 days and plots it on a 1-100 scale to see if it is overbought or oversold. Currently, RSI is at 68.55%, which means it’s nearing overbought territory at the 70% level.

Managing Your Trades

Deep ITM calls aren’t “set it and forget it” trades – no. Even with long-dated contracts, you don’t want to get caught underwater when the market moves against you. Think of this section as your playbook for staying in control.

So, here’s some tips on how to potentially manage the trade:

When trading LEAPS calls, you don’t actually need to hold the position until expiration. If the stock moves in your favor and the premium rises, and you’re happy with it, no one will fault you for selling to close the option. Locking in profits early can be a great way to remove risk from the table.

Now, if the stock moves against you and you want to adjust your trade, you can do so by selling your current position and then buying to open a new one with a longer expiration date, a different strike price, or both. This is what rolling your position is, and just to be clear, it should only be done if you still believe that the stock will go up. Rolling isn’t a magic fix – it’s a way to give your trade more time to work if your conviction hasn’t changed.

So, manage your trades like you’d manage a business – keep what’s working, adjust what’s not, and always know why you’re making the move.

Risks of Buying Deep ITM Calls

Now, buying deep ITM calls isn’t perfect. So let’s discuss the risks that you face when trading them.

First, of course, is the upfront cost. Deep ITM calls may be cheaper than OTM calls in terms of extrinsic value, but at the end of the day, it’s still more expensive to get into the trade. If you have a smaller account and can’t afford the premium, you wouldn’t be able to buy the 100 shares anyway – well, maybe you could on margin, but not 100% with cash.

The next risk is time decay. Like death and taxes, time decay is inevitable, and it will accelerate as expiration draws near. And if the stock doesn’t move in your favor, that time decay can chip away at your premium.

The next problem you might face is illiquidity. The options market works similarly to the stock market; there must be someone on the other side willing to buy your contract from you at the desired price. With deep ITM calls, especially on less popular stocks or far-dated expirations, there may be fewer traders interested in those strikes. Wider bid-ask spreads make it unlikely that you sell the option at your desired price, which can lead to slippage, or a difference between the price you expect to get and the actual price that you sell it for.

To avoid slippage, use a limit order, or aim to trade popular, highly liquid assets, like SMCI. You can see the open interest on any options trade in the option screener section and the profit and loss chart.

And here’s a Pro tip for you: Treat liquidity like insurance – you hope you never need it urgently, but you’ll be glad it’s there when it matters.

Final Thoughts

Deep ITM calls are ideal for traders seeking stock-like exposure, with less downside risk and reduced time decay, particularly at longer DTEs. Sure, they’re not flashy, and they won’t give you lottery-like returns, but they offer excellent advantages that more speculative positions just cannot. If you’re looking to trade with more control and consistency, deep ITM calls deserve a spot in your playbook.

Just remember: always look out for liquidity, make sure the trade fits your overall plan, and monitor your positions when they’re open.

So, before trying to buy an ITM call, make use of your broker’s paper trading account. See if deep ITM setups work for you, monitor the underlying’s movement and how it affects the Greeks and other option metrics, and when you’re good and ready, that’s when you try it in the open market.