Dual Edge Research publishes two powerful newsletters that work great individually — and even better together. The Bull Strangle Newsletter focuses on stocks and options, combining stock ownership with premium-selling strategies to generate consistent income and market-beating returns. The Smart Spreads Newsletter specializes in seasonal commodity futures spreads, offering a diversified approach with low correlation to equities. Together, they deliver a complete investment perspective — one focused on income, the other on diversification — all under one simple subscription.

Introduction

Each January, the Bloomberg Commodity Index (BCOM) and S&P GSCI rebalance their portfolios, forcing large amounts of passive capital to buy or sell futures contracts to match new index weights. Most years, the impact is mild. But for smaller, less liquid markets, these flows can create powerful price moves. This year, cocoa is shaping up to be the standout beneficiary.

A Major Addition With Outsized Impact

This rebalance includes a significant structural change: cocoa is being added to the major commodity indices, and the required buying is substantial. Estimates suggest that index-linked funds may need to purchase around 40,000 cocoa futures contracts to reach their new target weights. That figure represents roughly 37% of current open interest—an unusually large requirement for any futures market, let alone one that already trades with limited depth and high volatility. For perspective, one ICE cocoa contract represents 10 metric tons of cocoa, and with prices in the $5,000+ per ton range, each contract carries a notional value in the $50,000–$55,000 range. Passive index funds don’t have discretion in how or when to buy—they must adjust to the new index rules during the January roll. That means a large block of mechanical buying is coming, regardless of price.

A Playbook From Recent History: Lead in 2023

There is a useful template for what can happen when a commodity with modest liquidity suddenly gets pulled into the index spotlight. Going into the 2023 rebalance, lead was added to BCOM with a non-trivial weight. Traders quickly recognized the magnitude of the flows and began buying ahead of the rebalance window. Lead prices rose sharply in late 2022 as funds positioned for the expected buying from index trackers. Once the January roll began, additional mandatory flows pushed the market even higher before prices eventually stabilized. Cocoa now sits in a very similar position—a relatively small market facing a very large, date-specific wall of index demand.

Why the Cocoa Market Is Especially Vulnerable to Flow-Driven Moves

Cocoa is already known for sharp, liquidity-driven swings, and recent trading has highlighted how quickly prices can overshoot in either direction. Factors contributing to that sensitivity include:

Concentrated production in West Africa, where weather, disease, or political disruptions can quickly tighten supply.

Thin speculative participation, which can exacerbate trending moves when new flows enter the market.

A history of wide, sudden price swings, often unrelated to changes in long-term supply-and-demand fundamentals.

Add in tens of thousands of contracts of index-driven buying, and the market becomes even more prone to outsized moves. If discretionary traders start positioning early—as many did in lead—the rally could begin well before the official January roll period.

Current Indicators Also Support Buying Over the Near Term

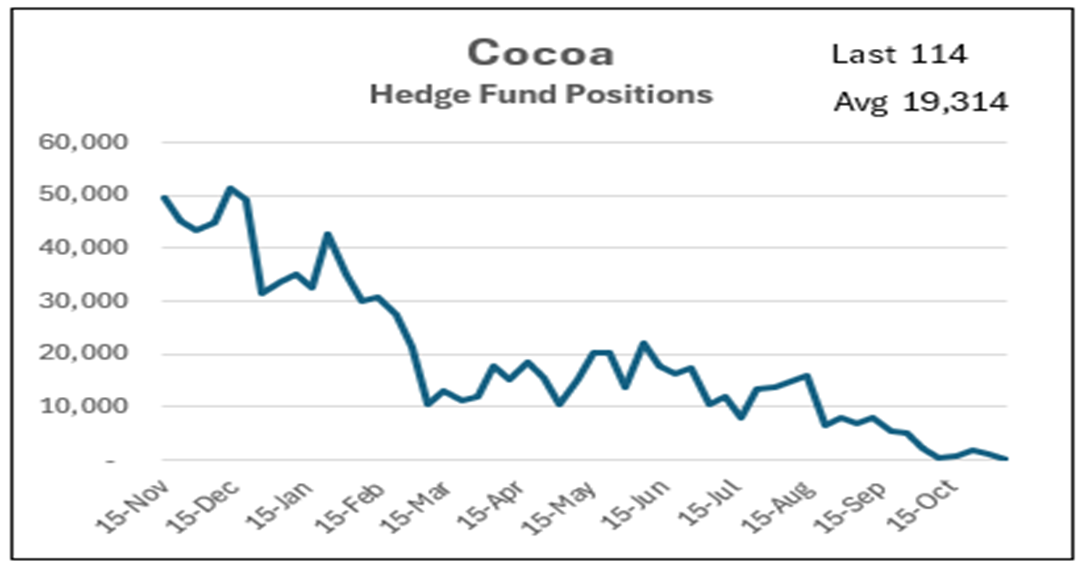

- Hedge Fund Position Estimates - The Commitment of Traders (COT) report, issued by the Commodity Futures Trading Commission (CFTC), offers a weekly snapshot of the positions taken by different market participants in the U.S. futures markets.

Cocoa is currently at its lowest Hedge Fund Positions for the past year and is currently ~19,000 net contracts below its 52 week average.

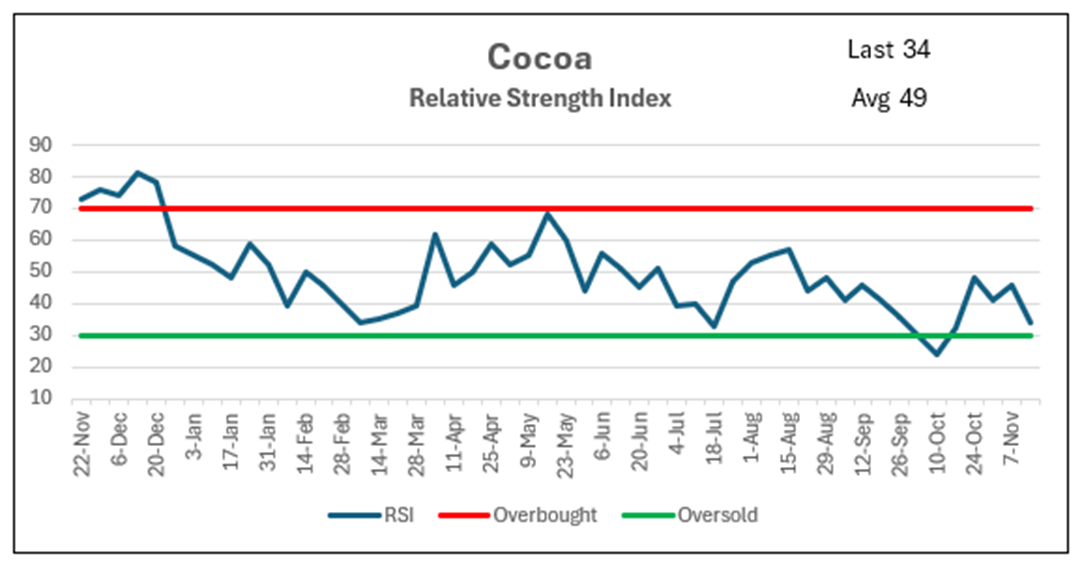

- Relative Strength Index (RSI) - (RSI) is a momentum indicator used in technical analysis that measures the magnitude of recent price changes to evaluate overbought or oversold conditions in the price of a stock or other asset. The RSI is displayed as an oscillator (a line graph that moves between two extremes) and can have a reading from 0 to 100.

Cocoa currently has a 34 RSI and very near the 30 level widely considered oversold.

What Traders Should Watch

As we move into the final weeks before the rebalance, several elements will determine how powerful the move becomes:

Front-Running by Funds - Traders anticipating the flows may build long positions ahead of January, lifting prices into year-end.

Liquidity During Execution - If commercial sellers limit their participation during the roll window, the forced buying could push prices sharply higher.

Fundamentals Layered On Top - Any additional supply concerns—weather, political risk, or disease—could amplify the impact of index flows.

Bottom Line

Cocoa is entering a rare alignment of conditions: tight liquidity, volatile fundamentals, the lowest hedge fund positions for the past 52 week, and a major surge of mandatory index buying concentrated into a narrow calendar window. The estimated 40,000 contracts of required buying represent one of the largest flow shocks cocoa has ever faced, and history shows that similar setups—like lead in early 2023—can drive dramatic price appreciation. For traders, the weeks leading into the January rebalance may offer a highly compelling opportunity. When a small market meets a large wave of price-insensitive capital, big moves can happen fast.

More Information

Now you can get two powerful newsletters — for one simple price!

- For stocks and options, the Bull Strangle Newsletter shows you how to combine stock ownership with dual option selling — a disciplined strategy that has consistently outperformed the S&P 500.

- For commodity futures, the Smart Spreads Newsletter focuses on seasonal commodity spreads — a proven, low-correlation approach that thrives in all types of markets.

Each newsletter is designed to deliver consistent income on its own — but when used together, they create a complete, diversified trading approach that works in any market environment.

Visit BullStrangle.com to subscribe for just $1 for the first month.

For a video overview of the Bull Strangle Newsletter

For a video overview of the Smart Spreads Newsletter

Darren Carlat

Dual Edge Research

(214) 636-3133

DualEdgeResearch@gamil.com

Disclaimer

This information is for informational purposes only and should not be considered as investment advice. Past performance is not indicative of future results, and all investments carry inherent risk. Consult with a financial advisor before making any investment decisions.

/A%20concept%20image%20of%20space_%20Image%20by%20Canities%20via%20Shutterstock_.jpg)

/A%20concept%20image%20of%20a%20flying%20car_%20Image%20by%20Phonlamai%20Photo%20via%20Shutterstock_.jpg)

/Oracle%20Corp_%20office%20logo-by%20Mesut%20Dogan%20via%20iStock.jpg)