Either the AI bets pay off, or they don’t; the stakes are high

“Beware the investment activity that produces applause; the great moves are usually greeted by yawns.” – Warren Buffett.

It is very lonely to be skeptical of the latest technology stock boom, but I have seen and felt this movie before. I entered the futures and options brokerage industry in early 2004, which allows me some relatively lengthy perspective. I was in college during the dotcom bust but was a young commodity “professional” (I use that term loosely) during the financial crisis. I suspect there are a plethora of industry insiders who are younger and maybe even smarter than their predecessors, but they lack real-life experience in pain. I, on the other hand, learned some very hard and expensive lessons. In recent years, this experience has been a handicap, but at some point, it will be a crutch as the younger population gets its opportunity to attend the school of hard knocks.

I’ve mentioned this at least once or twice in the past, so if this is repetitive for you, feel free to skip to the next paragraph. I had a front-row seat to the intense wealth creation and destruction that occurred in the late 1990s and early 2000s. Close relatives of humble means decided to put their entire net worth — roughly $250,000 — into 3 or 4 tech stocks in the 90s while the getting was good. This turned out to be a fantastic decision; at the height of their investment prowess, they were worth over $13,000,000. They built a custom home featured in Homes & Gardens Magazine, they visited my hometown of Las Vegas regularly to drop hundreds of thousands of dollars in a single weekend, they drove impressive cars, and they voiced the challenge of making money faster than they could spend it. This was obviously an enviable problem to have. When all was said and done, the market giveth and it taketh away. Their holdings (WorldCom, E Digital Corp, Level 3, and one I can’t recall) posted stunning rallies on undeniable euphoria over the future of communication and technology. Still, the rallies proved to be overzealous, unsustainable, and the worst thing that could have happened to investors who went along for the ride. Two of these three stocks, once considered the cream of the crop, are worthless, while the third has traded near $53.00 per share for over 20 years after peaking at just under $1,800 in 1999. Similarly, my college finance professor made a fortune as a significant shareholder in a local software company that served Las Vegas casinos. I can’t recall if it was a Lamborghini or a Ferrari he drove to campus, but he partook in a lot of hooting and hollering over his financial success. As you can imagine, it didn’t end as well as it began.

I am seeing and talking to people who are filled with the same feelings of ecstasy I witnessed as my relatives and finance professor became rich through risk-taking. Also reminiscent of the time, buying dips with a never-sell mindset has taken over, leaving risk consideration on the back burner. I don’t know if this cycle ends in the same kind of despair, but I know history has a tendency to repeat itself, and if it walks like a duck and talks like a duck, it's probably a duck.

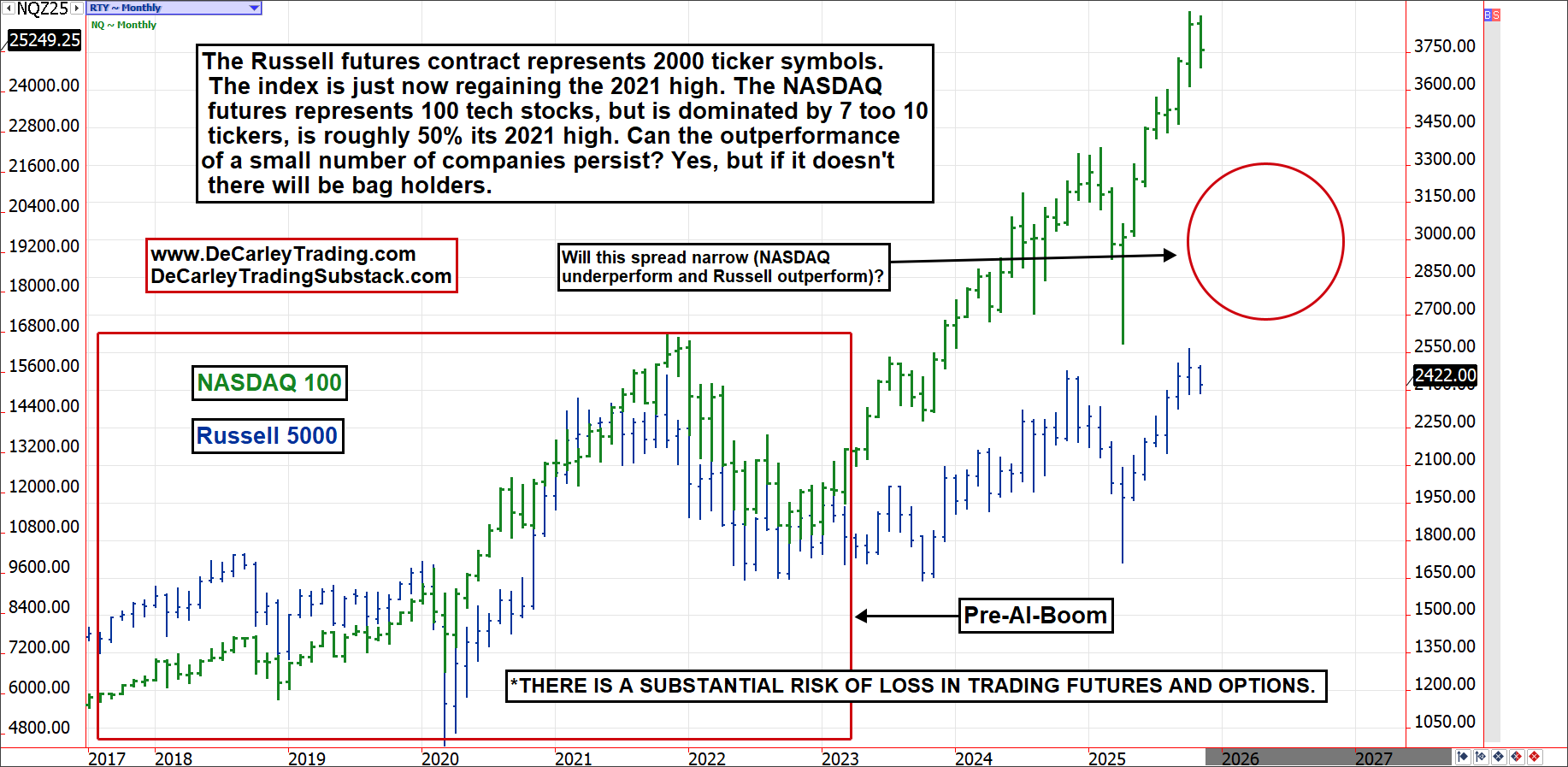

To further the conversation from our previous newsletter, I’d like to point out the outperformance of tech stocks (NASDAQ 100) vs the broad small-cap market (Russell 2000). Like the late 90s, investors have been chasing performance higher, and also like the 90s, that strategy has worked like a charm. Does anybody remember the Janus funds of the 1990s?

What we have to ask ourselves is whether or not what has been working since the 2023 bottom will continue to work going forward. Perhaps this is the new normal, but historical perspective leads me to believe the next cycle will bring historical norms back into line. I’m old enough to remember from Finance 101 that small caps are supposed to outperform large caps during economic growth due to higher beta (greater sensitivity to growth). If the Russell is just now reaching 2021 pricing, perhaps we aren’t in an economic expansion cycle at all. Maybe the growth we are seeing is frivolous spending caused by the wealth effect, as those fortunate to be in the right stocks take lavish trips to Las Vegas. In other words, maybe the Russell is a better representation of where we are economically than the NASDAQ. While it has always been true that the stock market and the economy operate separately and often disconnect, the current environment is at an extreme that feels unsustainable.

Prior to the AI boom that mostly began in 2023, any spread between the NASDAQ 100 and the Russell 2000 was corrected. After all, both indices rely on leverage; so low interest rates grease the wheel, but high interest rates thwart growth, so they tend to be tied to one another. In the late 2010s, it was the Russell that outperformed the NASDAQ, but the spread between the two narrowed and remained constant until 2023. Will the spread narrow again? We believe it will.

During this particular cycle from the 2023 lows, credit appears to have been tighter for smaller companies than for larger. Treasury Secretary Scott Bessent noticed this and has pledged to support small regional banks through deregulation policy to correct this imbalance. If he succeeds, we should see the Russell outperform the NASDAQ.

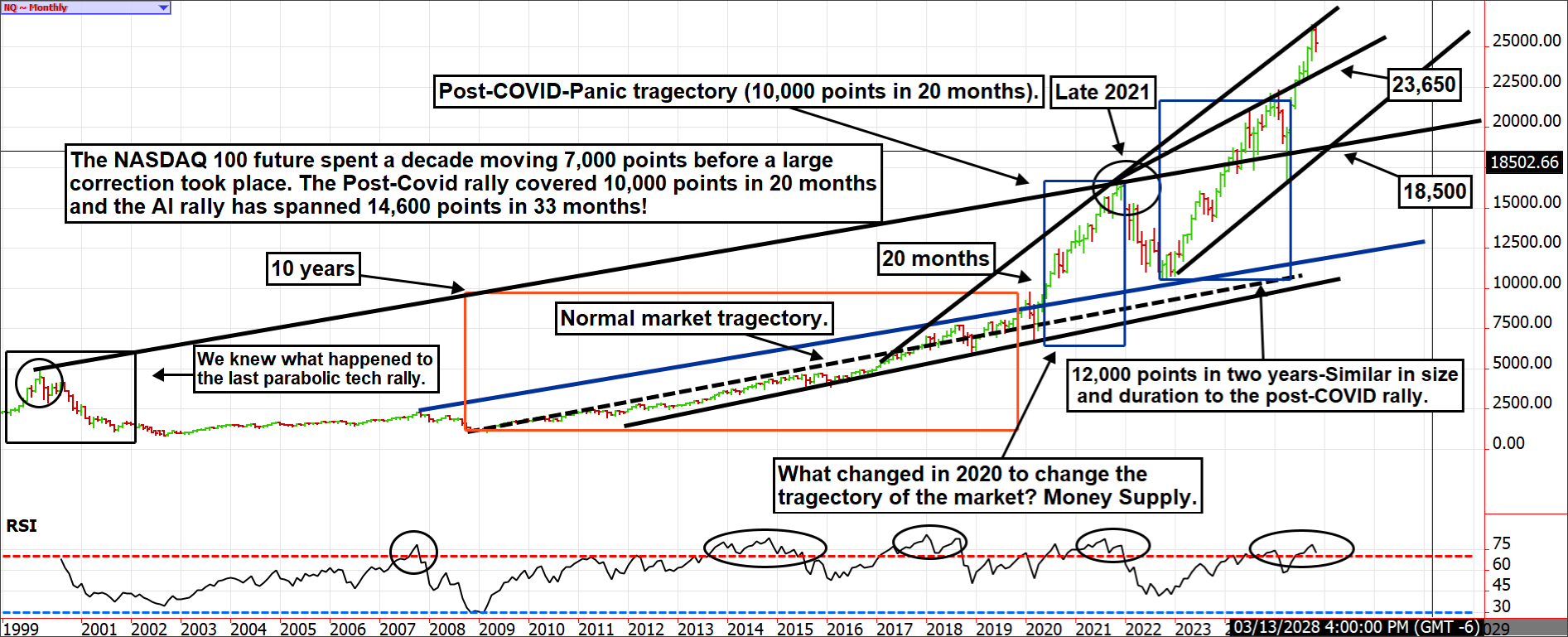

There is a reason investors are lured into tech stocks; when they are hot, it can feel like printing money for those with emotional acuity or risk tolerance to be boldly long. But there is another side that few talk about until it is too late; risk comes fast, and it can ruin the lives of the overleveraged or complacent. For perspective, we are re-sharing a monthly NASDAQ-100 futures chart. This is a clear picture of how abnormal the last few years have been, specifically following the 2020 money supply explosion. We are nearing the same steep uptrend line that rejected the 2021 tech rally; a similar correction would put us in the mid-18,000s. If there is as much leverage in the system as we believe (leveraged ETFs, long futures, investors buying stocks but running up personal debt), such a move is very doable. This isn’t to scare anyone out of the market, but we all must keep our wits about us and be mindful of the risks.

Honing in on the weekly chart, we can see the big picture outlook remains the same. The NASDAQ is in a compelling uptrend, and that might continue. But extended RSI readings and reliable trendlines are working against that narrative. However, the most important takeaway is that the upside profit potential is relatively low compared to the downside risk. For instance, there is significant resistance near 26,700, just 300 points higher than the all-time high set a few weeks ago. But support is over 3,000 points away from that level. Even worse, if 23,650ish fails, we are looking at a full retest of the long-term trendlines, with 18,500 being more probable than market participants are accounting for. Even more stunning, the potential for mid-15,500s exists should we see economic weakness or an unforeseen fundamental event.

While it is true that stocks have historically increased in value over time, buying the shallowest dips in individual stocks or indices heavily weighted to a handful of stocks has been a far more effective strategy in the last five years than it likely will be going forward. Likewise, aggressive dip buying in appreciating assets has returned decades of misery more reliably than the riches we have seen with this strategy since 2020. Despite the massive wealth creation that has occurred throughout this phenomenon, I am not sure this will persist as the clock ticks. If you need help hedging your portfolio, give us a call.

*There is a substantial risk of loss in trading futures and options. There are no guarantees in speculation; most people lose money trading commodities. Past performance is not indicative of future results. Seasonality is already factored into current prices, any references to such does not infer certainty in future price action.

These recommendations are a solicitation for entering into derivatives transactions. All known news and events have already been factored into the price of the underlying derivatives discussed. From time to time persons affiliated with Zaner, or its associated companies, may have positions in recommended and other derivatives.

/A%20concept%20image%20of%20space_%20Image%20by%20Canities%20via%20Shutterstock_.jpg)

/A%20concept%20image%20of%20a%20flying%20car_%20Image%20by%20Phonlamai%20Photo%20via%20Shutterstock_.jpg)