SOYBEANS

Pre-report estimates for tomorrow's WASDE have an average yield estimate of 53.1 bpa, compared to 53.5 bpa in September. The average production estimate is 4,271 bb. In September, the USDA estimated domestic soybean production at 4,301 bb. Ending stocks are estimated at an average of 306 mb, compared to the 300 mb figure in September. The low estimate is 187 mb. while the high estimate is 450 mb. The target for soybean exports to China is 12 mmt this year, and 25 mmt per year for the following 3 years. There is fear in the market that China purchases won’t materialize as anticipated following the APEC Summit. Reportedly China has plenty of soybeans for feed after booking so many cargoes from South America. Soybeans may need to pullback for exports to stay competitive. However, support levels have been holding and profit-taking has been pretty light.

If you like this article and would like to receive more information on the commodity markets, please use the link to join our email list

CORN

I’ve been bullish corn for a long time now, and I’m still bullish going forward. The average estimate for corn yield is 184.0 bpa, compared to the USDA’s September figure at 186.7 bpa. The lowest yield estimate is 181.7 bpa, while the highest yield estimate is 186.3 bpa. Even the highest yield estimate is below the USDA’s September estimate. Analysts are expecting this report to come out friendly, with a yield cut, however that may not materialize until January. The average production estimate is 16,566 bb versus 16,814 bb in September. The average ending stock estimate is 2,168 bb versus 2,110 bb in September. If the upcoming crop report turns out unfriendly, it should help boost exports even more.

If you like this article and would like to receive more information on the commodity markets, please use the link to join our email list

WHEAT

Wheat has been strong, even with bearish fundamentals. The grains are trading as if the funds are very long in these markets. EU wheat production is estimated at +14% YoY, with exports +17%. US wheat is still more expensive than French and Black Sea wheat. Estimates for domestic wheat ending stocks are mixed. The high estimate for wheat ending stocks is 905 mb, while the low estimate is 828 mb. The average ending stock estimate for wheat is 869 mb, compared to 844 mb in September.

If you like this article and would like to receive more information on the commodity markets, please use the link to join our email list

Please consider the following trade ideas:

March ’26 Soybean

Buy March Soybean 1120 Put 24 1/4

Sell March Soybean 1070 Put 10 1/4

Price: 14.00 Cost: $700.00 Debit/Trade Package, Plus Fees and Commissions.

March’26 Soybean Options Expire 2/20/26 (99 Days)

MAXIMUM LOSS: LIMITED

If you’re a producer looking for protection, this trade covers the end of the year if Chinese exports don’t meet the target. I still think soybeans can go higher, but I’d rather use futures after rallying this much since early October.

March ’26 Soybean

Sell March Soybean 1260 Call 12 3/8

Price: 12 3/8 Cost: $618.75 Credit/Trade Package, Plus Fees and Commissions.

March ’26 Soybean Options Expire 2/20/26 (99 Days)

You can collect over $600/Trade Package on this trade. Soybeans may keep rallying but a move above 1250 is ambitious, unless something changes. If you wanted to be more aggressive you could sell the 1200 calls.

MAXIMUM LOSS: UNLIMITED

March ’26 Corn

Buy March 460 Call 11 1/8

Sell March 480 Call 5 3/4

Price: 5 3/8 Cost: $268.75 Debit/Trade Package, Plus Fees and Commissions.

December’25 Corn Options Expire 2/20/26 (99 Days)

MAXIMUM LOSS: LIMITED

.

.

If you like this article and would like to receive more information on the commodity markets, please use the link to join our email list

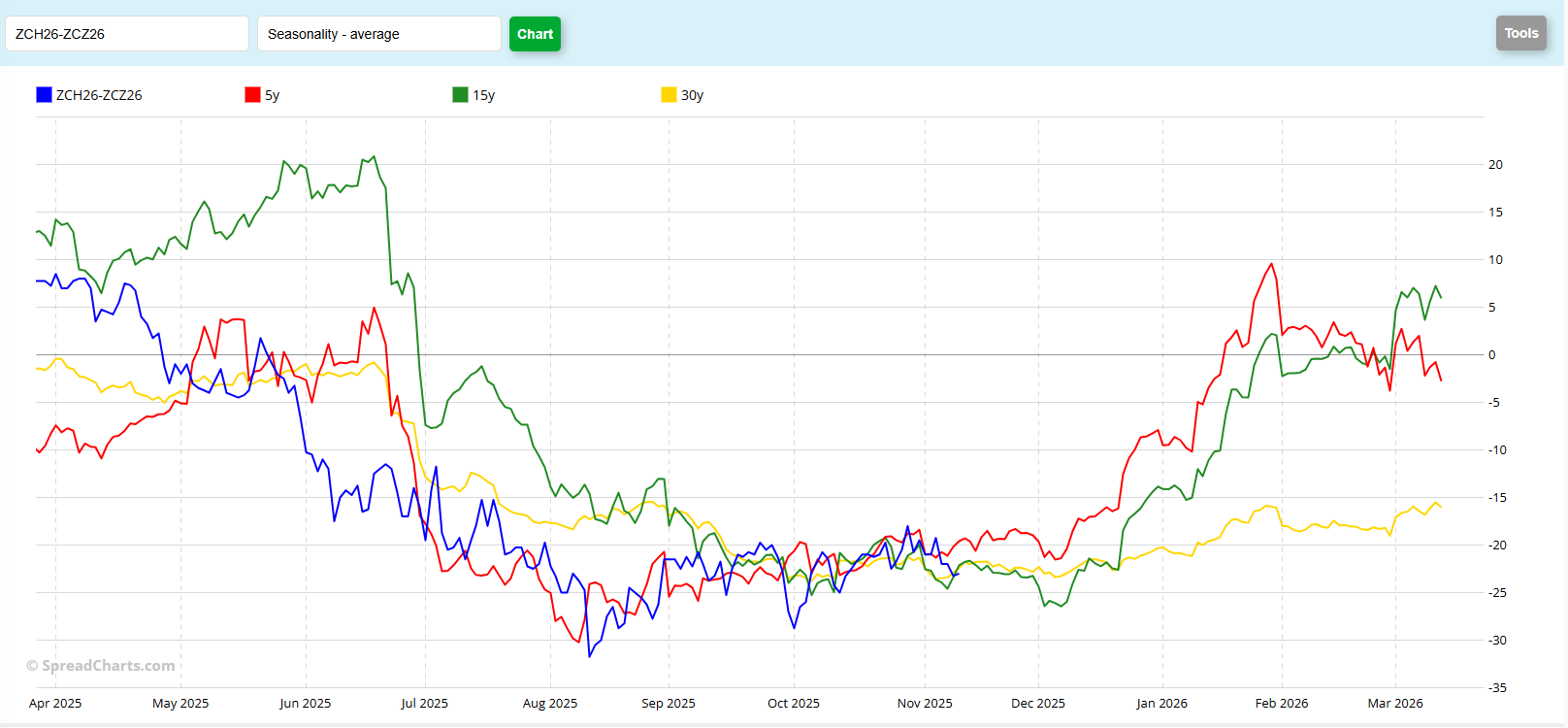

I like buying the March/ December ’26 Corn spread. It looks this spread can continue higher the next couple months if the pattern holds.

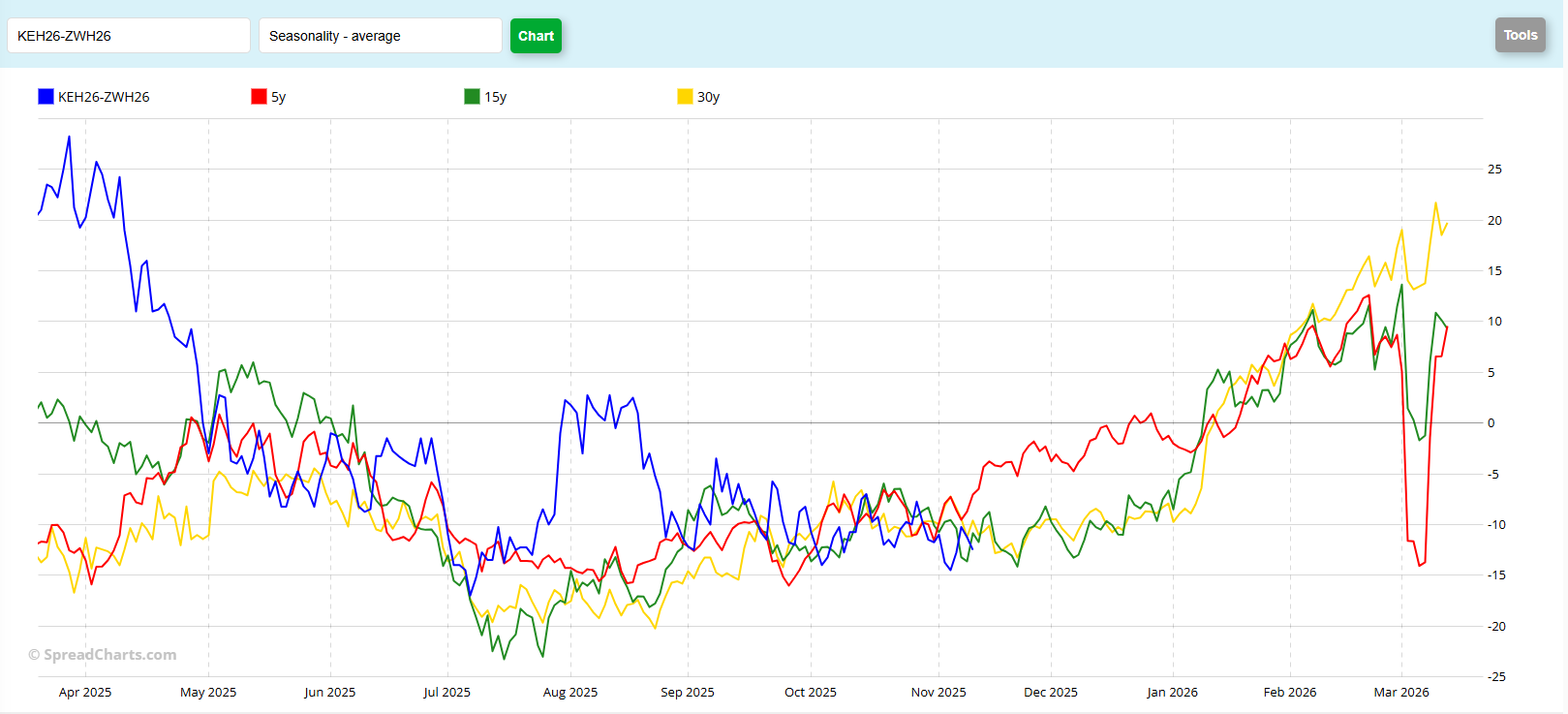

I also like buying the March KC Wheat/March '26 Chicago Wheat spread.

If you like this article and would like to receive more information on the commodity markets, please use the link to join our email list

Hans Schmit, Walsh Trading

Direct 312-765-7311 Toll Free 800-993-5449

hschmit@walshtrading.com www.walshtrading.com

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.

/A%20concept%20image%20of%20space_%20Image%20by%20Canities%20via%20Shutterstock_.jpg)

/A%20concept%20image%20of%20a%20flying%20car_%20Image%20by%20Phonlamai%20Photo%20via%20Shutterstock_.jpg)

/Oracle%20Corp_%20office%20logo-by%20Mesut%20Dogan%20via%20iStock.jpg)