WALSH PURE SPREADER

Pure Hedge Division

RICH MORAN 11/12/2025

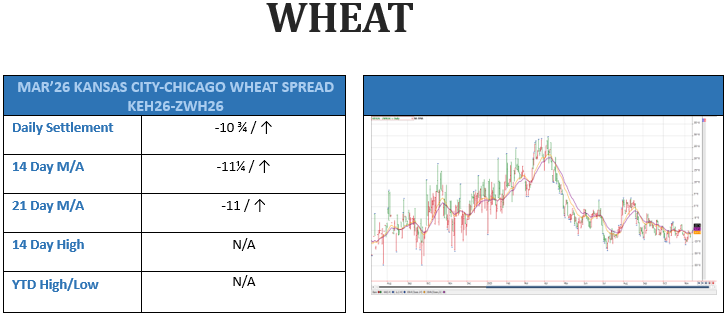

MAR’26 Kansas City-Chicago Wheat Spread (KEH26-ZWH26)

Hard Red Winter Wheat minus (-) Soft Red Winter Wheat is more commonly known as the Kansas City-Chicago Wheat Spread.

We are already long (on paper) the DEC ’25 version of this spread (KEZ25-ZWZ25 at -14½ from 9/25/2025.

Kansas City Wheat and Chicago Wheat are similar however they are used for different end products. Kansas City (Hard Red Winter) Wheat is used for all-purpose flour and is found in pan breads, artesian breads and noodles. If forms a stronger and more elastic dough. Chicago (Soft Red Winter) Wheat is found in cakes, cookies and pastries.

The school of thought is that is that Chicago Wheat should trade at a slight discount to Kansas City Wheat because of its lower protein content. There are obviously many more factors such as the weather and size of the crop production that affect the supply and demand of these wheats.

Recent data shows that the difference/spread between these wheats hovers near 0 (zero) cents. For the March’26 Kansas City-Chicago Wheat Spread (KEH’26-ZWH’26), the 52-week high is +29 on 4/7/25 and the 52-week low is -18¼ on 11/12/25. If you go back a year to KEH’25-ZWH’25, you see much the same. The high was +28¾ and the low was -14¾.

We are already long KEZ25-ZWZ25 at -14½. Today KEH26-ZWH26 settled -10¾.

If we can sell our KEZ25-ZWZ25 Wheat Spread and buy the KEH26-ZWH26 Wheat Spread at the same price, we would be selling the (KEZ25-ZWZ25)-(KEH26-ZWH26) condor at zero (0) or par. This would leave us flat in the KEZ25-ZWZ25 (that we were previously long) and long KEH26-ZWH26 (where we previous flat) at -14½.

If we are able to roll these DEC ’25 spreads into March ‘26 spreads at par, I suggest using the same exit points as we were already using.

Risk 8 cents (price of -22½) or $400 to make 24 cents (price of +9½ or $1,200, plus fees and commissions.

*** If this seems a little confusing, or if you have any questions at all about it, please reach out to me via Sign Up Now or feel free to call me at (312)985-0298.

Following up on the still active past trade ideas:

- 11/7/2025: ZSF26-ZSH26 (JAN-MAR’26 Soybean-Spread)

Today’s Settlement: -10¼, Long at -9½

I believe the Soybean Oil market may continue to move higher. As I wrote last Wednesday (10/27/25), if the JAN-MAR’26 Soybean-Oil Spread gets above the 14-day and 21-day moving averages, which is very close, it may strengthen more because it is above full carry. This spread could help strengthen the JAN-MAR’26 Soybean-Spread. Also, the potential soybean purchases that might be coming in from places like Korea, Vietnam, Indonesia, Malaysia, Taiwan etc. could help soybeans to uptick and we may see JAN-Soybeans (ZSF26) make a new 52-week high above 1137. This could strengthen the JAN-MAR’26 Soybean-Spread as well.

Today (11/7/25), the JAN-MAR’26 Soybean-Spread settled -8¾. I suggest to bid -9.5 for this spread. That is just above the 14-day moving average (-9¾) and the 21-day moving average (-10¾). The spread has been hovering above these moving averages since 10/21/25.

*** Yesterday (Tuesday 11/11/25), the spread opened at -9½ and traded lower, so we are long at - 9½.

I suggest putting in a short stop at -13, risking 3.5 cents or $175 Per Spread to make 9 cents (price of -0.5) or $450 Per Spread, plus fees and commissions.

- 11/5/2025: ZWH26-ZWK26 (MAR-MAY’26 Wheat-Spread)

Today’s Settlement: -10½, Long at -11½

Today (11/7/25) ZWH26-ZWK26 settled at -9¼, about 1 cent above the 14-day moving average (-10) and the 21-day moving average (-10¼). Because we are already long Wheat Spreads, we can be more patient trying to buy the ZWH26-ZWK26 Spread. If the spread gets close to these moving averages while staying above them, I think it might be a good place to get long this Wheat Spread. At this point, that would be around -11. The 52-week low is -13½.

Friday (11/7/25) I said, “If we are fortunate to get long ZWH26-ZWK26 at -10½ …. I suggest risking 3½ cents (price of -14) or $175 Per Spread to make 9 cents (price of -1½) or $450 Per Spread, plus fees and commissions.

*** Today (11/12/25), we open at -10½ and traded lower, so we are long at -10½.

Risk 3½ cents (price of -14) or $175 Per Spread to make 9 cents (price of -1½) or $450 Per Spread, plus fees and commissions.

- 10/27/2025: ZLF26-ZLH26 (JAN-MAR’26 Soybean Oil Spread)

Today (11/7/25) the JAN-MAR’26 Soybean Oil Spread (ZLF26-ZLH26) settled at -0.57 below both the 14-day moving average that ended the day at -0.52 and the 21-day moving average that ended the day -0.50.

We are basing this trade on the current Fully-Carry levels. Full Carry for the JAN ’26 Soybean Oil – (minus) MAR ’26 Soybean Oil Spread is 0.44 cents (or 44 – 100ths of a cent). Every tic represents 1/100th of a cent and is worth $6.00.

On Wednesday (10/29/25), the spread settled at -0.51 cents. That was 115.9% of full carry. So, we settled 15.9% above full carry. This spread does go above full carry-on occasion and how far it will go we never know, but I believe the risk/reward for getting long ZLF226-ZLH26 at these levels might be something to try, using a fairly short stop below the 52-week low with the hope of a nice move up (less negative).

I am suggesting that if we can trade above and settle above these moving averages, we try to get long this spread. We can pick our exact exit points when and if we are able to put this trade on.

- 10/24/2025: LEZ25-HEZ25 (DEC Live Cattle – DEC Live Hogs Spread)

Today this spread settled at 148.400, still below both the 14-day that ended the day at 152.650 and the 21-day that ended the day at 152.925.

Last month (9/5/25-9/10/25) we tracked selling OCT Live Cattle and buying OCT Lean Hogs against them. I call this the STORK trade …. STeak – (minus) pORK. I think this trade could possibly be a safer way to slip some sales in the Live Cattle market into or position by hedging them with some buys in Lean Hog market.

On Friday (10/24//25), I said, “If the DEC-STORK opens on Monday below 155.700, which is below the 14-day and the 21-day moving averages, I suggest we try to sell it at 155.000 or better. That is sell DEC Live Cattle and buy DEC Lean Hogs (LEZ25-HEZ25) at 155.00 or better. If we are not able to sell it on the opening, continue to offer it at 155.000.”

10/29/2025 – I am adjusting these levels …. Tomorrow, lower our offer to 153.600 or better on the opening. If we are not able to sell it on the opening, continue to offer it at 153.600.

10/31/2025 – We are now offering the spread at 153.600.

Risk 6.000 (price of 159.600) or $2,400 Per Spread To Make 18.000 (price of 135.600) or $7,200 Per Spread, plus fees and commissions.

*** Today (11/5/25) the December STORK settled 139.925, more than 13.000 away from our offer of 153.600. We were absolutely correct about the direction of this spread, but we missed it and it has gotten away from us. I suggest pulling your offer for now and we will keep an eye on it.

- 10/1/2025: SBH26-SBK26 (MAR-MAY’26 Sugar #11 Spread)

Today’s settlement: 0.45, Long at 0.42

On 10/1/25 I said, “I think it might be a good play to bid today’s settlement (42 cents) or better when the Sugar market opens.”

“If we get filled, risk 24 cents or $268.80 Per Spread to make 50 cents or $560 Per Spread plus fees and commissions.

On 10/2/25 the market opened at .41, so we are long at .42.

Risk 24 cents (price of .18) or $268.80 Per Spread to make 50 cents (price of .92) or $560.00 Per Spread plus fees and commissions.

- 9/24/25: KEZ25-ZWZ25 (DEC’25 Kansas City-Chicago Wheat Spread)

Today’s Settlement: -10½, Long at -14½

On 9/24/25, KEZ25-ZWZ25 settled -12¾.

I suggested placing an offer to buy KEZ25-ZWZ25 at -14½ on 9/25/25. The spread traded -15, so we are long at -14½.

Risking 8 cents (price of -22½) or $400 to make 24 cents (price of +9½) or $1,200 plus fees and commissions.

*** Todays article is about rolling this spread into MAR’26 (KEZ25-ZWZ25). Please see above.

- 8/6/25: ZSX25-ZSF26 (NOV-JAN Soybean Spread)

Today’s Settlement: -14½, Long at -17½

The spread settled above the 14-day and the 21-day at -17¾ on 8/21/25. You would be long at -17½ from the open on 8/22/25.

Risking 3½ cents (price of -21) or $175 to make 9½ cents (price of -8) or $475 Per Spread, plus fees and commissions.

*** On Wednesday (11/5/2025) I said, November Soybeans go off the board on Friday (11/14/2025), so I suggest selling out this spread (ZSX25-ZSF26) tomorrow (11/6/25) when the market opens.

The market opened on 11/6/2025 at -15 and traded higher, so we made 2½ cents or $125 Per Spread, plus fees and commissions.

- 7/23/25: ZWZ25-ZWH26 (DEC’25-MAR’26 Wheat Spread)

Today’s Settlement: -16½, Long at -18½

We were risking 3½ cents (price of -22) or $175 Per Spread to make 10 cents (price of -8½) or $500 Per Spread, plus fees and commissions.

Today (10/31/25) I am lowering our stop to -18½ for a scratch. I never like to turn a winner into a loser.

So now we are risking a scratch (price of -18½) To Make 10 cents (price of -8½) or $500 Per Spread, plus fees and commissions.

If you have any thoughts/questions on this article or any questions at all in regard to the commodities futures markets, please use this link Sign Up Now

Rich Moran

Senior Commodities Broker

Direct: (312)985-0298

Cell: (773)502-5321

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.

/A%20concept%20image%20of%20space_%20Image%20by%20Canities%20via%20Shutterstock_.jpg)

/A%20concept%20image%20of%20a%20flying%20car_%20Image%20by%20Phonlamai%20Photo%20via%20Shutterstock_.jpg)