/Ford%20Motor%20Co_%20logo%20by-%20Vera%20Tikhonova%20via%20iStock.jpg)

The article below is taken from our US Single Stocks service (Beta launch). If you’re interested, register at https://wavetraders.com and get free access today

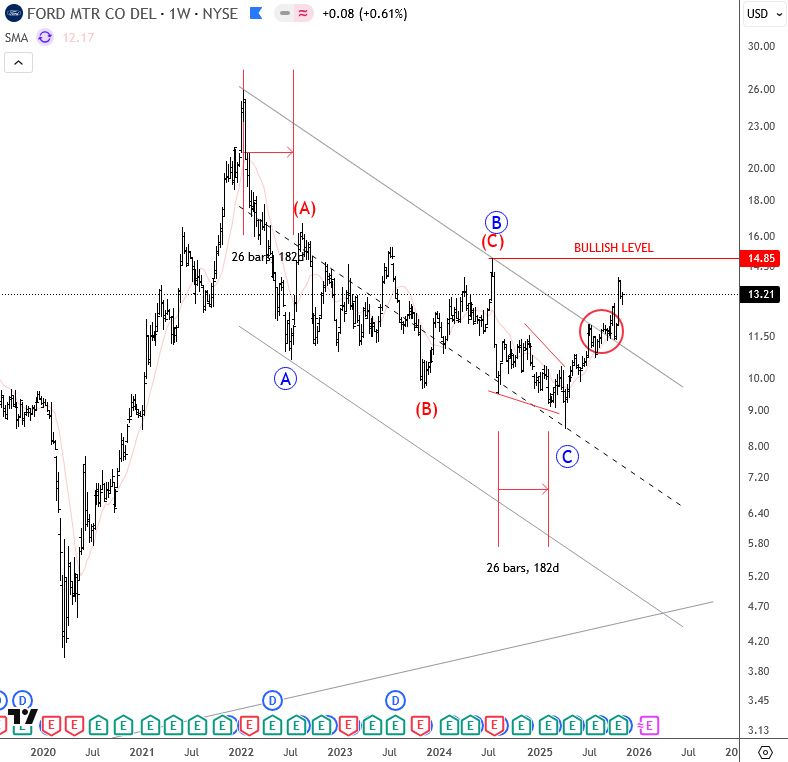

Ford has been turning higher since April, and we can now clearly count five waves up from the lows into the 14 area, where the market also filled gap from July 2024. That gap seems to be acting as resistance for now and could trigger deeper near-term retracement. Ideally, we’ll see only an A-B-C pullback, with initial support around 12.31 followed by 11.36 or even 10.67, which would be idea zone to complete the corrective cycle before new bullish opportunities emerge. Because when looking at the weekly chart, Ford shows a very nice and deep A-B-C correction that possibly completed around 8.44, followed by a breakout from a downward channel — a strong sign that the long-term trend may be turning higher.

For more visit us and read detailed monthly, weekly and daily updates on BCH and other cryptocurrencies, or if you are into FX, Commodities or Stocks, we got you covered there too! Thank you for reading, and we hope you enjoyed it - see you inside our community!

/A%20concept%20image%20of%20space_%20Image%20by%20Canities%20via%20Shutterstock_.jpg)

/A%20concept%20image%20of%20a%20flying%20car_%20Image%20by%20Phonlamai%20Photo%20via%20Shutterstock_.jpg)