USD/JPY Forex pair remains in an uptrend since April lows and we are now possibly looking for a push towards slightly higher prices because each lag in an ending diagonal should be made by three waves. We are watching this trend line here around 154 to 155.

Keep in mind that political situation is the one that drive this dollar yen to the upside lately. But you have, on the other hand Bank of Japan this week that could potentially be hawkish and turn this trend around back to the downside.

|

Let's not forget that we still have Some very big unfilled gap down here on the spot markets, meaning a lot of unfilled orders are sitting in this region. So that's why at some point this could act as a magnet. And then once these levels, this gap zone is filled, those unfilled orders will be executed and could once again turn this trend around.

So, for now we stick with the view that potentially we are moving closer to the resistance.

|

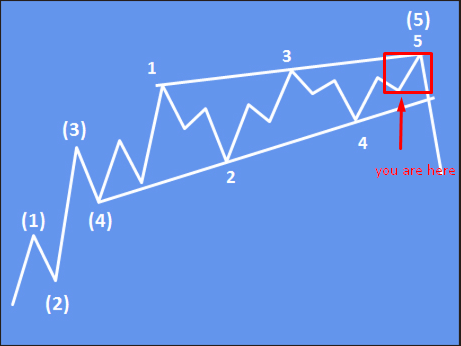

Below, we’ve prepared small educational content about ending diagonals, enjoy!

Ending Diagonal

- An Ending Diagonal (ED) is a special type of Elliott Wave pattern that appears in wave 5 of an impulse or wave C of a correction.

- It signals trend exhaustion — momentum fades as price keeps grinding higher or lower within a contracting wedge structure.

- All subwaves (1–2–3–4–5) subdivide into zigzags (3-3-3-3-3), and wave 4 typically overlaps wave 1, which distinguishes it from standard impulses.

- The pattern often ends with a sharp reversal once the diagonal completes.

Fibonacci Relationships in Ending Diagonals

- Wave 2 typically retraces 61.8% to 78.6% of wave 1

- Wave 3 often reaches 61.8% to 100% of wave 1

- Wave 4 usually retraces 50% to 78.6% of wave 3 (and overlaps wave 1)

- Wave 5 is commonly 61.8% to 100% of wave 3, sometimes extends to 1.236× in strong cases

|

/AI%20(artificial%20intelligence)/AI%20engineer%20working%20on%20laptop%20by%20ART%20STOCK%20CREATIVE%20via%20Shutterstock.jpg)