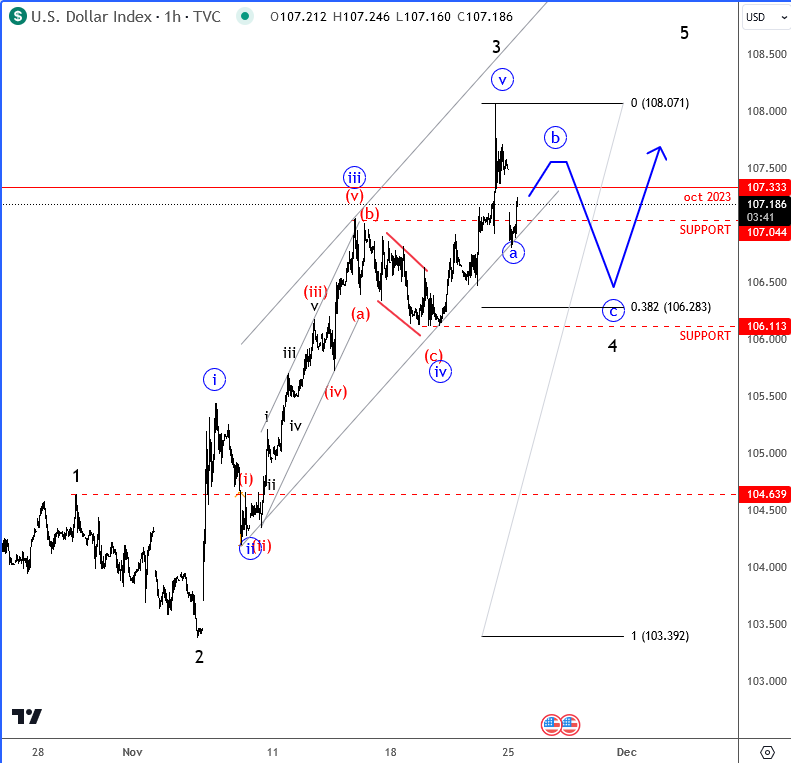

At the start of the week we can see some downside gap in the US dollar across the board, alongside lower US yields. This comes after Trump announced Scott Business as the new US Treasury Secretary, with potential policy actions that could lower yields and interest rates. While these gaps are already being filled, it seems to be a temporary reaction. So after some pause we still will expect more dollar strenght. In fact, a pullback was expected, especially as the Dollar Index moved above its October 2023 highs last week and completed five waves up within wave 3. Therefore, the current correction is likely wave four within an ongoing uptrend.

If this analysis is correct, the dollar should resume higher once this correction stabilizes, ideally near the 106.10–106.30 zone. This area is significant as it aligns with the former wave four, the 38.2% retracement, and matches the wave four-to-wave two distance. So I think that uptrend is incomplete, and that the final push up is yet to come, before market can put in a final top. For now, the trend remains up as long as the market holds above 104.65.

GH

On the date of publication, Gregor Horvat did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/A%20concept%20image%20of%20space_%20Image%20by%20Canities%20via%20Shutterstock_.jpg)

/A%20concept%20image%20of%20a%20flying%20car_%20Image%20by%20Phonlamai%20Photo%20via%20Shutterstock_.jpg)