Platinum Jul '20 (PLN20)

Seasonal Chart

Price Performance

See More| Period | Period Low | Period High | Performance | |

|---|---|---|---|---|

| 1-Month | 815.2 +16.61% on 07/06/20 | | 979.4 -2.94% on 07/28/20 | +133.8 (+16.38%) since 06/29/20 |

| 3-Month | 757.7 +25.46% on 05/06/20 | | 979.4 -2.94% on 07/28/20 | +151.0 (+18.88%) since 04/29/20 |

| 52-Week | 556.0 +70.97% on 03/16/20 | | 1,052.3 -9.66% on 01/16/20 | +54.0 (+6.02%) since 07/29/19 |

Most Recent Stories

More News

I discussed the recent action in the wheat, soybean, and corn markets on AgWeb's Market's Now with Michelle Rook today. We also talked about the cattle markets and gold.

The dollar index (DXY00 ) on Wednesday rose +0.16%. The dollar on Wednesday recovered from a 1-1/2 week low and moved moderately higher. Strength in T-note yields Wednesday boosted the dollar. Also,...

The dollar index (DXY00 ) today recovered from an early 1-1/2 week low and is up +0.12%. The dollar is seeing support from higher T-note yields but is being undercut by reduced liquidity demand due to...

The dollar index (DXY00 ) Tuesday fell to a 1-week low and finished down by -0.37%. The dollar was under pressure from strength in the euro after Tuesday’s news showed the Eurozone Apr S&P composite...

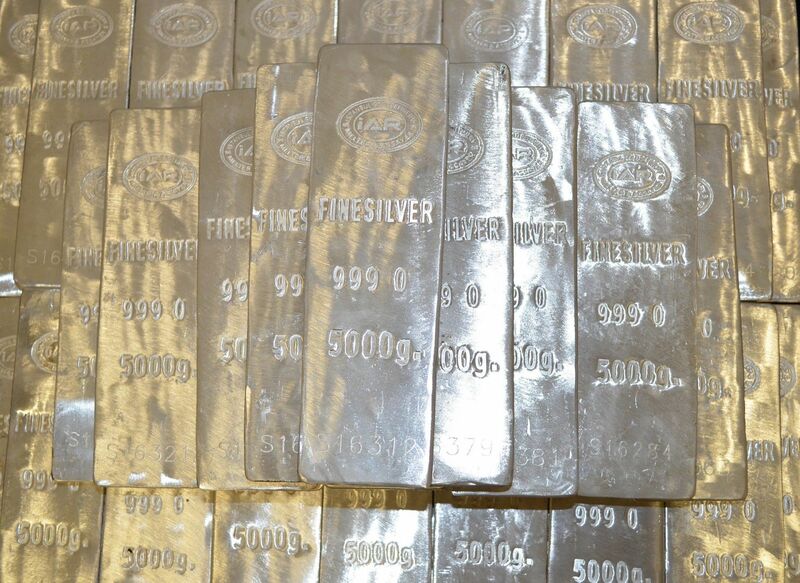

Silver approached a test of the $30 per ounce level, the highest price since February 2021. If silver can eventually power through $30, it could be on a path to challenge the 2011 and 1980 highs.

Platinum (PL) looks to have formed a bottom and the metal has started to rally higher in the next bullish cycle. The metal still needs to break above 1348.2 to confirm that the next leg higher has started....

Hello everyone. In today’s article, we will look at the past performance of the 1H Hour Elliott Wave chart of SPDR Metals & Mining ETF (XME) . The rally from 3.14.2024 low at $55.37 unfolded as 5 waves...

Gold slides once again today, proving that yesterday’s $67 slide was not accidental.

The dollar index (DXY00 ) this morning is down by -0.35% and posted a 1-week low. The dollar is under pressure as the euro strengthened after today’s news that the Eurozone Apr S&P composite PMI expanded...

Bill Baruch joined the CNBC Halftime Report Monday to detail adding to two names.