UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

For

the fiscal year ended

or

For the Transition Period from _____ to _____

Commission

File Number

(Exact name of registrant as specified in its charter)

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| (Address of principal executive offices) | (Zip Code) | |

| Registrant’s telephone number, including area code: |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading symbol | Name of exchange on which registered | ||

| The

|

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

☐

Yes ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Securities Act.

☐

Yes ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

☒

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted and posted pursuant

to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant

was required to submit such files). ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ | |

| Smaller

reporting company | ||

| Emerging

growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements.

☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b).

☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ Yes ☒

As

of June 30, 2022, the aggregate market value of the registrant’s Class A common stock held by non-affiliates of the registrant

was approximately $

As of March 27, 2023, there were outstanding shares of Class A common stock, $2.00 par value per share, and shares of Class C common stock, $2.00 par value per share.

Documents Incorporated by Reference

Security National Financial Corporation

Form 10-K

For the Fiscal Year Ended December 31, 2022

TABLE OF CONTENTS

| 2 |

PART I

Item 1. Business

Security National Financial Corporation (the “Company”) operates in three reportable business segments: life insurance, cemetery and mortuary, and mortgages. The life insurance segment is engaged in the business of selling and servicing selected lines of life insurance, annuity products, and accident and health insurance. These products are marketed in 40 states through a commissioned sales force of independent licensed insurance agents who may also sell insurance products of other companies. The cemetery and mortuary segment consists of eight mortuaries and five cemeteries in the state of Utah, one cemetery in the state of California, and one cemetery and four mortuaries in the state of New Mexico. The Company also engages in pre-need selling of funeral, cemetery, mortuary, and cremation services through its cemetery and mortuary locations. The mortgage segment originates and underwrites or otherwise purchases residential and commercial loans for new construction, existing homes, and other real estate projects. The mortgage segment operates through 118 retail offices in 26 states, and is an approved mortgage lender in several other states.

The Company’s design and structure are that each business segment is related to the other business segments and contributes to the profitability of the other segments. The Company’s cemetery and mortuary segment provides a level of public awareness that assists in the sales and marketing of insurance and pre-need cemetery and funeral products. The Company’s insurance segment invests its assets (including, in part, pre-need funeral products and services) in investments authorized by the respective insurance departments of their states of domicile. The Company also pursues growth through acquisitions. The Company’s mortgage segment provides mortgage loans and other real estate investment opportunities.

The Company was organized as a holding company in 1979 when Security National Life Insurance Company (“Security National Life”) became a wholly owned subsidiary of the Company and the former stockholders of Security National Life became stockholders of the Company. Security National Life was formed in 1965 and has acquired or purchased significant blocks of business which include Capital Investors Life Insurance Company (1994), Civil Service Employees Life Insurance Company (1995), Southern Security Life Insurance Company (1998), Menlo Life Insurance Company (1999), Acadian Life Insurance Company (2002), Paramount Security Life Insurance Company (2004), Memorial Insurance Company of America (2005), Capital Reserve Life Insurance Company (2007), Southern Security Life Insurance Company, Inc. (2008), North America Life Insurance Company (2011, 2015), Trans-Western Life Insurance Company (2012), Mothe Life Insurance Company (2012), DLE Life Insurance Company (2012), American Republic Insurance Company (2015), First Guaranty Insurance Company (2016), and Kilpatrick Life Insurance Company (2019). In August 2021, the Company sold Memorial Insurance Company of America.

The cemetery and mortuary operations have also grown through the acquisition of other cemetery and mortuary companies. The cemetery and mortuary companies that the Company has acquired are Holladay Memorial Park, Inc. (1991), Cottonwood Mortuary, Inc. (1991), Deseret Memorial, Inc. (1991), Probst Family Funerals and Cremations L.L.C. (2019), Heber Valley Funeral Home, Inc. (2019), Rivera Funerals, Cremations and Memorial Gardens (2021), and Holbrook Mortuary (2021).

In 1993, the Company formed SecurityNational Mortgage Company (“SecurityNational Mortgage”) to originate and refinance residential mortgage loans. In 2012, the Company formed Green Street Mortgage Services, Inc. (now known as EverLEND Mortgage Company) (“EverLEND Mortgage”) also to originate and refinance residential mortgage loans. In December 2021, the Company ceased operations in EverLEND Mortgage and merged its operations into SecurityNational Mortgage.

See Note 15 of the Notes to Consolidated Financial Statements for additional information regarding business segments of the Company.

| 3 |

Life Insurance

Products

The Company, through Security National Life, First Guaranty Insurance Company (“First Guaranty”), and Kilpatrick Life Insurance Company (“Kilpatrick”), issues and distributes selected lines of life insurance and annuities. The Company’s life insurance business includes funeral plans and interest-sensitive life insurance, as well as other traditional life, accident, and health insurance products. The Company places specific marketing emphasis on funeral plans through pre-need planning. The Company’s insurance subsidiaries, Southern Security Life Insurance Company, Inc. (“Southern Security”) and Trans-Western Life Insurance Company (“Trans-Western”), do not actively write policies, but service and maintain policies that were purchased prior to their acquisition by Security National Life.

A funeral plan is a small face value life insurance policy that generally has face coverage of up to $30,000. The Company believes that funeral plans represent a marketing niche that has lower competition because most insurance companies do not offer similar coverage. The purpose of the funeral plan policy is to pay the costs and expenses incurred at the time of a person’s death. On a per thousand-dollar cost of insurance basis, these policies can be more expensive to the policyholder than many types of non-burial insurance due to their low face amount, requiring the fixed cost of the policy administration to be distributed over a smaller policy size, and the simplified underwriting practices that result in higher mortality costs.

Markets and Distribution

The Company is licensed to sell insurance in 40 states. The Company, in marketing its life insurance products, seeks to locate, develop and service specific niche markets. The Company’s funeral plan policies are sold primarily to persons who range in age from 45 to 85 and have low to moderate income. A majority of the Company’s funeral plan premiums come from the states of Arkansas, California, Florida, Georgia, Louisiana, Mississippi, Texas, and Utah.

The Company sells its life insurance products through direct agents, brokers, and independent licensed agents who may also sell insurance products of other companies. The commissions on life insurance products range from approximately 50% to 120% of first year premiums. In those cases where the Company utilizes its direct agents in selling such policies, those agents customarily receive advances against future commissions.

In some instances, funeral plan insurance is marketed in conjunction with the Company’s cemetery and mortuary sales force. When it is marketed by that group, the beneficiary is usually the Company’s cemeteries and mortuaries. Thus, death benefits that become payable under the policy are paid to the Company’s cemetery and mortuary subsidiaries to the extent of services performed and products purchased.

In marketing funeral plan insurance, the Company also seeks and obtains third-party endorsements from other cemeteries and mortuaries within its marketing areas. Typically, these cemeteries and mortuaries will provide letters of endorsement and may share in mailing and other lead-generating costs since these businesses are usually made the beneficiary of the policy. The following table summarizes the life insurance business for the five years ended December 31, 2022:

| 2022 | 2021 | 2020 | 2019 (1) | 2018 | ||||||||||||||||

| Life Insurance | ||||||||||||||||||||

| Policy/Cert Count as of December 31 | 646,296 | 653,450 | 659,237 | 669,064 | 531,831 | |||||||||||||||

| Insurance in force as of December 31 (in thousands) | $ | 2,865,957 | $ | 2,863,759 | $ | 2,890,791 | $ | 2,877,402 | $ | 1,838,488 | ||||||||||

| Premiums Collected (in thousands) | $ | 103,304 | $ | 99,006 | $ | 92,058 | $ | 78,253 | $ | 74,965 | ||||||||||

| (1) | Acquisition of Kilpatrick |

| 4 |

Underwriting

The factors considered in evaluating an application for ordinary life insurance coverage can include the applicant’s age, occupation, general health, and medical history. Upon receipt of a satisfactory (non-funeral plan insurance) application, which contains pertinent medical questions, the Company issues insurance based upon its medical limits and requirements subject to the following general non-medical limits:

| Age Nearest Birthday | Non-Medical Limits |

| 0-50 | $100,000 |

| 51-up | Medical information |

| required (APS or exam) |

When underwriting life insurance, the Company will sometimes issue policies with higher premium rates for substandard risks.

The Company’s funeral plan insurance is written on a simplified medical application with underwriting requirements being a completed application, a phone interview of the applicant, and an intelliscript prescription history inquiry. There are several underwriting classes in which an applicant can be placed.

Annuities

Products

The Company’s annuity business includes single premium deferred annuities, flexible premium deferred annuities, and immediate annuities. A single premium deferred annuity is a contract where the individual remits a sum of money to the Company, which is retained on deposit until such time as the individual may wish to annuitize or surrender the contract for cash. A flexible premium deferred annuity gives the contract holder the right to make premium payments of varying amounts or to make no further premium payments after his initial payment. These single and flexible premium deferred annuities can have initial surrender charges. The surrender charges act as a deterrent to individuals who may wish to prematurely surrender their annuity contracts. An immediate annuity is a contract in which the individual remits a sum of money to the Company in return for the Company’s obligation to pay a series of payments on a periodic basis over a designated period of time, such as an individual’s life, or for such other period as may be designated.

Annuities have guaranteed interest rates that range from 1% to 6.5% per annum. Rates above the guaranteed interest rate credited are periodically modified by the Board of Directors at its discretion. In order for the Company to realize a profit on an annuity product, the Company must maintain an interest rate spread between its investment income and the interest rate credited to the annuities. Commissions, issuance expenses, and general and administrative expenses are deducted from this interest rate spread.

Markets and Distribution

The general market for the Company’s annuities is middle to older age individuals. A major source of annuity sales come from direct agents and are sold in conjunction with other insurance sales. If an individual does not qualify for a funeral plan, the agent will often sell that individual an annuity to fund final expenses.

The following table summarizes the annuity business for the five years ended December 31, 2022:

| 2022 | 2021 | 2020 | 2019 (1) | 2018 | ||||||||||||||||

| Annuities Policy/Cert Count as of December 31 | 24,225 | 24,901 | 25,476 | 26,565 | 22,313 | |||||||||||||||

| Deposits Collected (in thousands) | $ | 9,972 | $ | 9,719 | $ | 9,637 | $ | 10,400 | $ | 9,644 | ||||||||||

| (1) | Acquisition of Kilpatrick |

| 5 |

Accident and Health

Products

Through its various acquisitions, the Company occasionally acquires small blocks of accident and health policies, which it continues to service. The Company offers a low-cost comprehensive diver’s accident policy that provides worldwide coverage for medical expense reimbursement in the event of a diving accident.

Markets and Distribution

The Company currently markets its diver’s accident policies through the internet.

The following table summarizes the accident and health insurance business for the five years ended December 31, 2022:

| 2022 | 2021 | 2020 | 2019 (1) | 2018 | ||||||||||||||||

| Accident and Health Policy/Cert Count as of December 31 | 11,132 | 12,494 | 13,735 | 15,133 | 3,763 | |||||||||||||||

| Premiums Collected (in thousands) | $ | 543 | $ | 353 | $ | 296 | $ | 110 | $ | 98 | ||||||||||

| (1) | Acquisition of Kilpatrick |

Reinsurance

The primary purpose of reinsurance is to enable an insurance company to issue an insurance policy in an amount larger than the risk the insurance company is willing to assume for itself. The insurance company remains obligated for the amounts reinsured (ceded) in the event the reinsurers do not meet their obligations.

The Company currently cedes and assumes certain risks with various authorized unaffiliated reinsurers pursuant to reinsurance treaties, which are generally renewed annually. The premiums paid by the Company are based on a number of factors, primarily including the age of the insured and the risk ceded to the reinsurer.

It is the Company’s policy to retain no more than $100,000 of ordinary insurance per insured life, with the excess risk being reinsured. The total amount of life insurance reinsured by other companies as of December 31, 2022, was $346,749,000, which represented approximately 12.1% of the Company’s life insurance in force on that date.

See “Management’s Discussion and Analysis of Results of Operations and Financial Condition” and “Notes to Consolidated Financial Statements” for additional disclosure and discussion regarding reinsurance.

Investments

The investments that support the Company’s life insurance and annuity obligations are determined by the investment committees of the Company’s subsidiaries and ratified by the full boards of directors of the respective subsidiaries. A significant portion of the Company’s investments must meet statutory requirements governing the nature and quality of permitted investments by its insurance subsidiaries. The Company maintains a diversified investment portfolio consisting of common stocks, preferred stocks, municipal bonds, corporate bonds, mortgage loans, real estate, and other securities and investments.

See “Management’s Discussion and Analysis of Results of Operations and Financial Condition” and “Notes to Consolidated Financial Statements” for additional disclosure and discussion regarding investments.

| 6 |

Cemetery and Mortuary

Products

Through its cemetery and mortuary segment, the Company markets a variety of products and services both on a pre-need basis (prior to death) and an at-need basis (at the time of death). The products include: plots, interment vaults, mausoleum crypts, markers, caskets, urns and other death care related products. These services include: professional services of funeral directors, opening and closing of graves, use of chapels and viewing rooms, and use of automobiles and clothing. The Company has a mortuary at each of its cemeteries, other than Holladay Memorial Park and Singing Hills Memorial Park, and has six separate stand-alone mortuary facilities.

Markets and Distribution

The Company’s pre-need cemetery and mortuary sales are marketed to persons of all ages but are generally purchased by persons 45 years of age and older. The Company is limited in its geographic distribution of these products to areas lying within an approximate 20-mile radius of its mortuaries and cemeteries. The Company’s at-need sales are similarly limited in geographic area.

The Company actively seeks to sell its cemetery and funeral products to customers on a pre-need basis. The Company employs cemetery sales representatives on a commission basis to sell these products. Many of these pre-need cemetery and mortuary sales representatives are also licensed insurance salesmen and sell funeral plan insurance. In some instances, the Company’s cemetery and mortuary facilities are the named beneficiaries of the funeral plan policies.

Potential customers are located via telephone sales prospecting, responses to letters mailed by the pre-planning consultants, billboards and other outside advertising, referrals, and door-to-door canvassing. The Company trains its sales representatives and helps generate leads for them.

Mortgage Loans

Products

The Company, through SecurityNational Mortgage, is active in the residential real estate market. SecurityNational Mortgage is approved by the U.S. Department of Housing and Urban Development (HUD), the Federal National Mortgage Association (Fannie Mae), and other secondary market investors, to originate a variety of residential mortgage loan products, which are subsequently sold to investors. The Company uses internal and external funding sources to fund mortgage loans. In December 2021, the Company ceased operations through EverLEND Mortgage and merged its operations into SecurityNational Mortgage.

Security National Life originates and funds commercial real estate loans, residential construction loans, and land development loans for internal investment.

Markets and Distribution

The Company’s residential mortgage lending services are marketed primarily to real estate brokers, builders and directly with consumers. The Company has a strong retail origination presence in the Utah, Florida, Texas, Nevada and Arizona markets and many other states across the country. See “Management’s Discussion and Analysis of Results of Operations and Financial Condition” and “Notes to Consolidated Financial Statements” for additional disclosure and discussion regarding mortgage loans.

| 7 |

Recent Acquisitions and Other Business Activities

Acquisitions

Acquisition of Rivera Funerals, Cremations and Memorial Gardens

On December 21, 2021, the Company, through Memorial Estates Inc., completed a business combination transaction with Rivera Funerals, Cremations and Memorial Gardens. The mortuaries and cemetery are located in New Mexico.

Under the terms of the transaction, as set forth in the Asset Purchase Agreement, dated December 21, 2021, Memorial Estates Inc. paid a net purchase price of $10,693,395 for the business and assets of Rivera Funerals, Cremations and Memorial Gardens, subject to holdback amounts held by Memorial Estates, Inc. in the total amount of $1,120,000. Pursuant to the Asset Purchase Agreement, Memorial Estates, Inc. used $70,000 of the holdback amount to pay trade accounts payable of Rivera Funerals, Cremations and Memorial Gardens to third parties that remained unpaid at the time of purchase. The remaining $1,050,000 holdback amount is to be released and paid by Memorial Estates Inc. in annual payments of up to $105,000 each, beginning in January 2023.

Acquisition of Holbrook Mortuary

On December 28, 2021, the Company, through its wholly-owned subsidiary, Memorial Mortuary Inc., completed a business combination transaction with Holbrook Mortuary located in Salt Lake City, Utah.

Under the terms of the transaction, as set forth in the Asset Purchase Agreement, dated December 28, 2021, Memorial Mortuary Inc. paid a net purchase price of $3,051,747 for the business and assets of Holbrook Mortuary.

Real Estate Development

The Company is capitalizing on the opportunity to develop commercial and residential assets on its existing properties. The cost to acquire existing for-sale assets currently exceeds the replacement costs, thus creating the opportunity for development and redevelopment of the land that the Company currently owns. The Company has developed, or is in the process of developing, assets that have an initial development cost exceeding $100,000,000, primarily relating to the Center53 Development. The Company plans to continue its development endeavors as based upon its assessment of the market demand.

Center53 Development

Center53 Development is an office development project comprising nearly 20 acres of land that is currently owned by the Company in the central valley of Salt Lake City. At final completion, the multi-year, phased development is expected to create a campus atmosphere and include nearly one million square-feet of office space in five buildings, ranging from four to eleven stories, and will be serviced by three parking structures with about 4,000 stalls. In 2015, the Company broke ground and commenced development on the first phase which included a six-story building of nearly 200,000 square feet and a parking garage with 748 parking stalls. The first phase of the project was completed in July 2017 and is currently 100% leased. The second phase of the project began in March 2020 and includes a second six story building of nearly 221,000 square feet and a parking garage with approximately 870 stalls. The Company began its occupancy of a portion of the building in October 2021 and the remainder of the building is currently 100% leased. The Company plans to initiate future phases of the Center53 Development for additional Class A office space in the central valley of Salt Lake City.

| 8 |

Regulation

The Company’s insurance subsidiaries are subject to comprehensive regulation in the jurisdictions in which they do business under statutes and regulations administered by state insurance commissioners. Such regulation relates to, among other things, prior approval of the acquisition of a controlling interest in an insurance company; standards of solvency which must be met and maintained; licensing of insurers and their agents; nature of and limitations on investments; deposits of securities for the benefit of policyholders; approval of policy forms and premium rates; periodic examinations of the affairs of insurance companies; annual and other reports required to be filed on the financial condition of insurers or for other purposes; and requirements regarding aggregate reserves for life policies and annuity contracts, policy claims, unearned premiums, and other matters. The Company’s insurance subsidiaries are subject to this type of regulation in any state in which they conduct relevant business. Such regulation may cause unforeseen costs and operational restrictions, and delay implementation of the Company’s business plans.

The Company’s life insurance subsidiaries are currently subject to regulation in Utah, Louisiana, Mississippi and Texas under insurance holding company legislation, and other states where applicable. Generally, intercompany transfers of assets and dividend payments from insurance subsidiaries are subject to prior notice of approval from the relevant state insurance department where, they are deemed “extraordinary” under relevant state law. The insurance subsidiaries are required, under state insurance laws, to file detailed annual reports with the supervisory agencies in each of the states in which they do business. Their business and accounts are also subject to examination by these agencies. The Company was last examined in 2021 (First Guaranty Insurance), 2022 (Security National Life, Southern Security and Trans-Western) and 2021 (Kilpatrick Life). Its most recent final examination reports have been approved by the insurance departments and are public record.

The Texas Department of Banking also audits pre-need insurance policies that are issued in the state of Texas. Pre-need policies include the life and annuity products sold as the funding mechanism for funeral plans through funeral homes by Security National agents. The Company is required to send the Texas Department of Banking an annual report that summarizes the number of policies in force and the face amount or death benefit for each policy. This annual report is also required to indicate the number of new policies issued for that year, all death claims paid that year, and all premiums received.

The Company’s cemetery and mortuary subsidiaries are subject to the Federal Trade Commission’s comprehensive funeral industry rules and to state regulations in the various states where such operations are domiciled. The morticians must be licensed by the respective state in which they provide their services. Similarly, the mortuaries and cemeteries are governed and licensed by state statutes and city ordinances in Utah, California and New Mexico. The subsidiaries are required to keep annual reports on file including financial information concerning the number of spaces sold and, where applicable, funds provided to the Endowment Care Trust Fund. Licenses are issued annually on the basis of such reports. The cemeteries maintain city or county licenses where they conduct business.

The Company’s mortgage subsidiaries are subject to the rules and regulations of the U.S. Department of Housing and Urban Development (HUD), and to various state licensing acts and regulations and the Consumer Financial Protection Bureau (CFPB). These regulations, among other things, specify minimum capital requirements and; procedures for loan origination and underwriting, licensing of brokers and loan officers and, quality review audits and specify the fees that can be charged to borrowers. Each year, the Company is required to have an audit completed for each mortgage subsidiary by an independent registered public accounting firm to verify compliance with the relevant regulations. In addition to the government regulations, the Company must meet loan requirements, and underwriting guidelines of various investors who purchase the loans. EverLEND Mortgage is not required to have an audit for 2021 since it ceased operations in December 2021.

Income Taxes

The Company’s insurance subsidiaries, Security National Life, First Guaranty and Kilpatrick, are taxed under the Life Insurance Company Tax Act of 1984. Under the act, life insurance companies are taxed at standard corporate rates on life insurance company taxable income. Life insurance company taxable income is gross income less general business deductions and reserves for future policyholder benefits (with modifications). Under The Tax Cuts and Jobs Act, December 31, 2017 policyholder surplus account balances result in taxable income over a period of eight years.

Security National Life, First Guaranty and Kilpatrick calculate their life insurance taxable income after establishing a provision representing a portion of the costs of acquisition of such life insurance business. The effect of the provision is that a certain percentage of the Company’s premium income is characterized as deferred expenses and recognized over a five or ten-year period. The Tax Act changed this recognition period for amounts deferred after December 31, 2017 to a five or fifteen-year period.

The Company’s non-life insurance company subsidiaries are taxed in general under the regular corporate tax provisions. The Company’s subsidiaries Southern Security and Trans-Western are regulated as life insurance companies but do not meet the Internal Revenue Code definition of a life insurance company, so they are taxed as insurance companies other than life insurance companies.

| 9 |

Competition

The life insurance industry is highly competitive. There are approximately 800 legal reserve life insurance companies in business in the United States. These insurance companies differentiate themselves through marketing techniques, product features, pricing, and customer service. The Company’s insurance subsidiaries compete with a large number of insurance companies, many of which have greater financial resources, a longer business history, and more diversified line of insurance products than the Company. In addition, such companies generally have a larger sales force. Further, the Company competes with mutual insurance companies which may have a competitive advantage because all profits accrue to policyholders. Because the Company is smaller by industry standards and lacks broad diversification of risk, it may be more vulnerable to losses than larger, better-established companies. The Company believes that its policies and rates for the markets it serves are generally competitive.

The cemetery and mortuary industry is also highly competitive. In the Utah, California and New Mexico markets where the Company competes, there are a number of cemeteries and mortuaries which have longer business histories, more established positions in the community, and stronger financial positions than the Company. In addition, some of the cemeteries with which the Company must compete for sales are owned by municipalities and, as a result, can offer lower prices than can the Company. The Company bears the cost of a pre-need sales program that is not incurred by those competitors which do not have a pre-need sales force. The Company believes that its products and prices are generally competitive with those in the industry.

The mortgage industry is highly competitive with a large number of mortgage companies and banks in the same geographic area in which the Company is operating. The mortgage industry in general is sensitive to changes in interest rates and the refinancing market is particularly vulnerable to changes in interest rates.

Human Capital Management

As of December 31, 2022, the Company employed 1,422 full-time and 202 part-time employees. Of the full-time employees, 934 were employed by the mortgage segment, 368 by the life insurance segment, and 120 by the cemetery and mortuary segment. The Company requires monthly acknowledgement of its anti-discrimination and anti-harassment policies and communicates to its employees how to report concerns that relate to their employment experience.

Employee Benefits

All eligible employees may elect coverage under the Company’s group health (including health savings and flexible spending), retirement, supplemental life and voluntary benefit programs. As of December 31, 2022, 826 employees had elected to participate in the Company’s group health insurance plans.

The Company has an employee safe harbor retirement plan that qualifies under section 401(k) of the Internal Revenue Code and contributes a matching contribution based on the employee’s contribution and years of service.

The Company provides other time off benefits such as paid sick and paid vacation time. The Company provides discounts on pre-need and death benefits to tenured employees. Additionally, the Company offers an employee assistance program that provides 24/7 counseling services for employees who may be facing challenges outside of the workplace.

Available Information

The Company’s internet address is securitynational.com. The Company’s investor relations website is investor.securitynational.com and the Company promptly makes available on this website, free of charge, the reports that it files or furnishes with the Securities and Exchange Commission.

Item 1A. Risk Factors

As a smaller reporting company, the Company is not required to provide information typically disclosed under this item.

| 10 |

Item 1B. Unresolved Staff Comments

None. As a smaller reporting company, the Company is not required to provide information typically disclosed under this item.

Item 2. Properties

The following tables set forth the location of the Company’s office facilities and certain other information relating to these properties.

| Street | City | State | Function | Owned / Leased | Approximate Square Footage | Lease Amount | Expiration | ||||||||||||

| 433 Ascension Way, Floors 4, 5 and 6 | Salt Lake City | UT | Corporate Headquarters, Insurance Operations, Cemetery and Mortuary Operations, Mortgage Operations and Sales | Owned | 221,000 | N/A | N/A | ||||||||||||

| 1044 River Oaks Dr. | Flowood | MS | Insurance Operations | Owned | 5,522 | N/A | N/A | ||||||||||||

| 1818 Marshall St. | Shreveport | LA | Insurance Operations | Owned | 12,274 | N/A | N/A | ||||||||||||

| 812 Sheppard St. | Minden | LA | Insurance Sales | Owned | 1,560 | N/A | N/A | ||||||||||||

| 909 Foisy Ave. | Alexandria | LA | Insurance Sales | Owned | 8,059 | N/A | N/A | ||||||||||||

| 1550 N. Third St. | Jena | LA | Insurance Sales | Owned | 1,737 | N/A | N/A | ||||||||||||

| 1 Sanctuary Blvd. Suite 302A | Mandeville | LA | Insurance Sales | Leased | 1,335 | $ | 2,262 | / | mo | 6/30/2023 | |||||||||

| 79 E. Main Street | Midway | UT | Funeral Service Sales | Leased | 4,476 | $ | 6,051 | / | mo | 10/31/2025 | |||||||||

| 4387 S. 500 W. | Salt Lake City | UT | Funeral Service Sales | Leased | 2,168 | $ | 1,840 | / | mo | 7/31/2025 | |||||||||

| 1627A Central Ave. | Los Alamos | NM | Funeral Service Sales | Leased | 1,400 | $ | 1,600 | / | mo | 12/30/2024 | |||||||||

| 200 Market Way | Rainbow City | AL | Fast Funding Operations | Leased | 12,850 | $ | 10,490 | / | mo | 1/31/2025 | |||||||||

| 500 Blount Avenue, | Guntersville | AL | Mortgage Sales | Leased | 1,250 | $ | 1,000 | / | mo | 6/30/2023 | |||||||||

| 1101 McMurtrie Drive, Suite F1 | Huntsville | AL | Mortgage Sales | Leased | 4,500 | $ | 5,625 | / | mo | 2/28/2026 | |||||||||

| 5100 N. 99th Ave., Suite 101/103 | Phoenix | AZ | Mortgage Sales | Sub-Leased | 3,940 | $ | 3,369 | / | mo | month to month | |||||||||

| 10609 N. Hayden Rd., Suite 100 | Scottsdale | AZ | Mortgage Sales | Leased | 3,585 | $ | 8,650 | / | mo | month to month | |||||||||

| 1819 Dobson Rd., Suite 202 | Mesa | AZ | Mortgage Sales | Leased | 890 | $ | 2,114 | / | mo | 7/31/2023 | |||||||||

| 2828 N. Central Ave., Suite 1100A | Phoenix | AZ | Mortgage Sales | Sub-Leased | 1,691 | $ | 4,859 | / | mo | month to month | |||||||||

| 1490 S. Price Road, Suite 318 | Chandler | AZ | Mortgage Sales | Leased | UNK | $ | 3,050 | / | mo | 6/30/2023 | |||||||||

| 5100 N. 99th Ave., Suite 111 | Phoenix | AZ | Mortgage Sales | Sub-Leased | 720 | $ | 1,023 | / | mo | month to month | |||||||||

| 1951 West Camelback Rd, Ste 200 | Phoenix | AZ | Mortgage Sales | Leased | 2,446 | $ | 3,567 | / | mo | month to month | |||||||||

| AZ (01144) 2636 Hwy 95 Suite 2 Bullhead City, 86442 (az-2636) | Bullhead City | AZ | Mortgage Sales | Leased | 1,000 | $ | 1,250 | / | mo | month to month | |||||||||

| 6870 S Highway 95 Building C Suite 451B, | Mohave Valley | AZ | Mortgage Sales | Leased | 661 | $ | 3,000 | / | mo | month to month | |||||||||

| 2220 S. Country Club Drive Suite 101 | Mesa | AZ | Mortgage Sales | Leased | 3,274 | $ | 5,184 | / | mo | 2/14/2028 | |||||||||

| 108 E. El Caminito Dr. | Phoenix | AZ | Mortgage Sales | Leased | 100 | $ | - | / | mo | month to month | |||||||||

| 9971 E. Paseo De La Masada | Tucson | AZ | Mortgage Sales | Leased | 100 | $ | - | / | mo | month to month | |||||||||

| 350 West 16th Street #209 | Yum | AZ | Mortgage Sales | Leased | 1,731 | $ | 3,725 | / | mo | 6/30/2024 | |||||||||

| 102 North Cortez St. | Prescott | AZ | Mortgage Sales | Leased | 100 | $ | 600 | / | mo | month to month | |||||||||

| 40977 Oak Dr. | Forest Falls | CA | Mortgage Sales | Leased | 250 | $ | - | / | mo | month to month | |||||||||

| 2934 E. Garvey Ave. South, Suite 250 | West Covina | CA | Mortgage Sales | Leased | 500 | $ | 712 | / | mo | month to month | |||||||||

| 7398 Fox Trail Unit B | Yucca Valley | CA | Mortgage Sales | Leased | 900 | $ | 550 | / | mo | month to month | |||||||||

| 3247 West March Lane, Ste 125 | Stockton | CA | Mortgage Sales | Leased | 1,504 | $ | 3,610 | / | mo | 11/30/2024 | |||||||||

| 5001 E. Commercial Dr, Ste 285 | Bakersfeild | CA | Mortgage Sales | Leased | 985 | $ | 1,623 | / | mo | 6/30/2024 | |||||||||

| 155 S. Highway 101 Suite 7 | Solana Beach | CA | Mortgage Sales | Leased | 2,000 | $ | 7,210 | / | mo | 7/31/2026 | |||||||||

| 44441 West 16th Street #101 | Lancaster | CA | Mortgage Sales | Leased | 2,115 | $ | 2,015 | / | mo | 1/31/2023 | |||||||||

| 1420 Magnolia Ave | Oxnard | CA | Mortgage Sales | Leased | 100 | $ | 6,206 | / | mo | 3/30/2024 | |||||||||

| 81 Broadmoor Ct. | Novato | CA | Mortgage Sales | Leased | 100 | $ | 1,000 | / | mo | month to month | |||||||||

| 625 The City Drive, Suite 450 | Orange | CA | Mortgage Sales | Leased | 2,485 | $ | 6,461 | / | mo | 12/31/2024 | |||||||||

| 5475 Tech Center Dr., Suite 100 | Colorado Springs | CO | Mortgage Sales | Leased | 3,424 | $ | 4,851 | / | mo | 9/30/2023 | |||||||||

| 27 Main St., Suite C-104B | Edwards | CO | Mortgage Sales | Leased | 680 | $ | 1,950 | / | mo | month to month | |||||||||

| 4501 Mohawk Dr. | Larkspur | CO | Mortgage Sales | Leased | 250 | $ | 50 | / | mo | month to month | |||||||||

| 7800 E. Union Ave., Suite 550 | Denver | CO | Mortgage Sales | Sub-Leased | 4,656 | $ | 11,446 | / | mo | 2/28/2023 | |||||||||

| 5982 s Zeno Ct | Aurora | CO | Mortgage Sales | Leased | 50 | $ | - | / | mo | month to month | |||||||||

| 1145 Town Park Ave., Suite 2215 | Lake Mary | FL | Mortgage Sales | Leased | 5,901 | $ | 13,484 | / | mo | 2/28/2023 | |||||||||

| 8191 College Parkway, Suite 201 | Ft Myers | FL | Mortgage Sales | Leased | 4,676 | $ | 4,333 | / | mo | 8/21/2024 | |||||||||

| 113th St. N. and 82nd Ave. N. | Seminole | FL | Mortgage Sales | Leased | 1,400 | $ | 1,692 | / | mo | 8/31/2023 | |||||||||

| 2350 Fruitville Rd Ste, Ste 101 | Sarasota | FL | Mortgage Sales | Leased | 2,455 | $ | 5,113 | / | mo | 3/14/2026 | |||||||||

| 921 Club House Blvd, New Smyrna Beach, | FL | Mortgage Sales | Leased | 50 | $ | - | / | mo | month to month | ||||||||||

| 5237 Summerlin Commons Blvd. | Fort Myers | FL | Mortgage Sales | Leased | 120 | $ | 1,095 | / | mo | month to month | |||||||||

| 10752 Deerwood Park Blvd South Waterview II, Suite 135, Office # 170 | Jacksonville | FL | Mortgage Sales | Leased | 100 | $ | 1,055 | / | mo | 1/31/2023 | |||||||||

| 3331 Pasadena Court | Fort Myers | FL | Mortgage Sales | Leased | 100 | $ | - | / | mo | month to month | |||||||||

| 106 A Adamson Square | Carrolton | GA | Mortgage Sales | Leased | 1,000 | $ | 1,750 | / | mo | 10/31/2023 | |||||||||

| 11 |

Item 2. Properties (Continued)

| Street | City | State | Function | Owned / Leased | Approximate Square Footage | Lease Amount |

Expiration | ||||||||||||

| 900 Cricle 75 Parkway, Ste 175 | Atlanta | GA | Mortgage Sales | Leased | 3,020 | $ | 6,156 | / | mo | 6/30/2026 | |||||||||

| 6600 Peachtree Dunwoody Rd, Ste 135 | Atlanta | GA | Mortgage Sales | Leased | 2,129 | $ | 4,843 | / | mo | 3/31/2026 | |||||||||

| 102 Mary Alice Park Road Suite 506 | Cummings | GA | Mortgage Sales | Leased | 1,190 | $ | 1,813 | / | mo | 12/31/2023 | |||||||||

| 4370 Kukui Grove St., Suite 201 | Lihue | HI | Mortgage Sales | Leased | 864 | $ | 1,498 | / | mo | 2/28/2025 | |||||||||

| 1001 Kamokila Blvd. | Kapolei | HI | Mortgage Sales | Leased | 737 | $ | 1,759 | / | mo | 12/31/2025 | |||||||||

| 32 Kinoole St. Suite 101, Hilo HI | Hilo | HI | Mortgage Sales | Leased | 730 | $ | 1,795 | / | mo | 5/31/2023 | |||||||||

| 1885 Main Street #108 | Wailuku | HI | Mortgage Sales | Leased | 1,092 | $ | 1,602 | / | mo | 5/14/2023 | |||||||||

| 677 Ala Moana Blvd. Suite 609 | Honolulu | HI | Mortgage Sales | Leased | 716 | $ | 2,076 | / | mo | 1/31/2024 | |||||||||

| 970 No Kalaheo Ave, Kailua, Suite A307, HI 96734 | Kailua | HI | Mortgage Sales | Leased | 510 | $ | 1,173 | / | mo | 5/31/2023 | |||||||||

| 70 Kanoa Street Suite #140 | Wailuku | HI | Mortgage Sales | Leased | UNK | $ | 300 | / | mo | month to month | |||||||||

| 315 Cece Way | Mccall | ID | Mortgage Sales | Leased | 100 | $ | - | / | mo | month to month | |||||||||

| 4622 Gap Creek Avenue | Caldwell | ID | Mortgage Sales | Leased | 100 | $ | - | / | mo | month to month | |||||||||

| 802 West Bartlett Road | Bartlett | IL | Mortgage Sales | Leased | 2300 | $ | 6,000 | / | mo | 12/31/2023 | |||||||||

| 568 Greenluster Dr. | Covington | LA | Mortgage Sales | Leased | 150 | $ | 750 | / | mo | month to month | |||||||||

| 81 Boulder Drive, | Elizabethtown | KY | Mortgage Sales | Leased | 100 | $ | - | / | mo | month to month | |||||||||

| 8684 Veterans Hwy, Ste 101 | Millersville | MD | Mortgage Sales | Leased | 4,018 | $ | 6,725 | / | mo | 7/31/2026 | |||||||||

| 4987 Fall Creek Rd. Suite 1 | Branson | MO | Mortgage Sales | Leased | 700 | $ | 1,000 | / | mo | month to month | |||||||||

| 4700 Homewood Ct #260 | Raleigh | NC | Mortgage Sales | Leased | 2,339 | $ | 5,353 | / | mo | 2/28/2025 | |||||||||

| 2015 Ayrsley Town Blvd, Suite 202-#256 & 258, | Charlotte | NC | Mortgage Sales | Leased | UNK | $ | 2,003 | / | mo | month to month | |||||||||

| 3115 Boone Trail | Fayetteville | NC | Mortgage Sales | Leased | 1,000 | $ | 3,000 | / | mo | month to month | |||||||||

| 2602 Camino Plata Loop NE | Rio Rancho | NM | Mortgage Sales | Leased | 100 | $ | - | / | mo | month to month | |||||||||

| 1980 Festival Plaza Dr., Suite 850 | Las Vegas | NV | Mortgage Sales | Leased | 12,866 | $ | 45,031 | / | mo | 3/31/2027 | |||||||||

| 840 Pinnacle Ct., Suite 3 | Mesquite | NV | Mortgage Sales | Leased | 900 | $ | 720 | / | mo | 3/12/2022 | |||||||||

| 2635 St. Rose Pkwy, Suites D 100, 110, 120 | Hendeson | NV | Mortgage Sales | Leased | 5,788 | $ | 12,281 | / | mo | 9/30/2025 | |||||||||

| 8720 Orion Place, Suite 160 | Colombus | OH | Mortgage Sales | Leased | 1,973 | $ | 1,809 | / | mo | 6/30/2023 | |||||||||

| 3311 NE MLK Jr Blvd., Suite 203 | Portland | OR | Mortgage Sales | Leased | 1,400 | $ | 875 | / | mo | month to month | |||||||||

| 10365 SE Sunnyside Rd., Suite 310 | Clackamus | OR | Mortgage Sales | Leased | 1,288 | $ | 2,815 | / | mo | 11/30/2024 | |||||||||

| 11104 SE Stark St., Suite S | Portland | OR | Mortgage Sales | Sub-Leased | 506 | $ | 600 | / | mo | month to month | |||||||||

| 11592 SW Roundup Place | Terrebonne | OR | Mortgage Sales | Leased | 100 | $ | - | / | mo | month to month | |||||||||

| 110 Awendaw Way, | Greenville | SC | Mortgage Sales | Leased | 50 | $ | - | / | mo | month to month | |||||||||

| 6263 Poplar Ave., Suite 900 | Memphis | TN | Mortgage Sales | Leased | 1,680 | $ | 2,028 | / | mo | 3/31/2023 | |||||||||

| 144 Alf Taylor Rd. | Johnson City | TN | Mortgage Sales | Sub-Leased | 1,521 | $ | 800 | / | mo | month to month | |||||||||

| 347 Main St., Suite 200 | Franklin | TN | Mortgage Sales | Leased | 2,444 | $ | 6,050 | / | mo | 8/31/2025 | |||||||||

| 820 N Church Street, | Livingston | TN | Mortgage Sales | Leased | 1,050 | $ | 700 | / | mo | month to month | |||||||||

| 3027 Marina Bay Dr., Suite 200 | League City | TX | Mortgage Sales | Leased | 1,225 | $ | 2,450 | / | mo | 4/30/2023 | |||||||||

| 11550 Fuqua, Suite 200 | Houston | TX | Mortgage Sales | Leased | 1,865 | $ | 3,264 | / | mo | 4/30/2024 | |||||||||

| 1848 Norwood Plaza, Suite 213 | Hurst | TX | Mortgage Sales | Sub-Leased | 1,596 | $ | 1,031 | / | mo | month to month | |||||||||

| 17347 Village Green Dr., Suite 102 | Houston | TX | Mortgage Sales | Sub-Leased | 3,300 | $ | 8,970 | / | mo | 12/1/2024 | |||||||||

| 9737 Great Hills Trail, Suites 150, 200, 220 | Austin | TX | Mortgage Sales | Leased | 19,891 | $ | 40,696 | / | mo | month to month | |||||||||

| 1213 East Alton Gloor Blvd., Suite H | Brownsville | TX | Mortgage Sales | Leased | 2,000 | $ | 2,310 | / | mo | 2/28/2024 | |||||||||

| 5020 Collinwood Ave., Suite 100 | Fort Worth | TX | Mortgage Sales | Leased | 2,687 | $ | 5,400 | / | mo | 1/31/2025 | |||||||||

| 2408 Jacaman Road, Suite F | Laredo | TX | Mortgage Sales | Leased | UNK | $ | 945 | / | mo | 6/1/2023 | |||||||||

| 1900 Country Club Dr., Suite 150 | Mansfield | TX | Mortgage Sales | Leased | 175 | $ | 325 | / | mo | month to month | |||||||||

| 3220 Gus Thomasson Rd. | Mesquite | TX | Mortgage Sales | Sub-Leased | 130 | $ | 1,000 | / | mo | month to month | |||||||||

| 722 Kiowa Dr. West | Lake Kiowa | TX | Mortgage Sales | Leased | 150 | $ | 495 | / | mo | month to month | |||||||||

| 124 N. Main St. | Mansfield | TX | Mortgage Sales | Sub-Leased | 100 | $ | 3,000 | / | mo | month to month | |||||||||

| 4411 W. Illinois, Suite B-4 | Midland | TX | Mortgage Sales | Sub-Leased | 100 | $ | 1,700 | / | mo | month to month | |||||||||

| 23227 Red River Drive | Katy | TX | Mortgage Sales | Leased | 144 | $ | 750 | / | mo | month to month | |||||||||

| 6401 Eldorado Pkwy, Ste 313 | Mckinnney | TX | Mortgage Sales | Sub-Leased | 345 | $ | 827 | / | mo | month to month | |||||||||

| 10000 North Central Expressway, Ste 400 | Dallas | TX | Mortgage Sales | Leased | 200 | $ | 749 | / | mo | 7/31/2023 | |||||||||

| 5707 Cold Springs Drive | San Antonio | TX | Mortgage Sales | Leased | 100 | $ | - | / | mo | month to month | |||||||||

| 12258 Queenston Blvd, Suite A | Houston | TX | Mortgage Sales | Leased | 1,300 | $ | 4,000 | / | mo | month to month | |||||||||

| 825 Fairmont Parkway, Suite 100 | Pasadena | TX | Mortgage Sales | Leased | 3,052 | $ | 3,000 | / | mo | month to month | |||||||||

| 4500 1-40 West, Suite B | Amarillo | TX | Mortgage Sales | Leased | 1,238 | $ | 1,600 | / | mo | 11/30/2023 | |||||||||

| 11525 S. Fry Road #106 | Fulshear | TX | Mortgage Sales | Leased | UNK | $ | 800 | / | mo | month to month | |||||||||

| 30417 Fifth Street Suite B | Fulshear | TX | Mortgage Sales | Leased | 1,000 | $ | 1,000 | / | mo | month to month | |||||||||

| 1526 Katy Gap Road Units 503 & 504 | Katy | TX | Mortgage Sales | Leased | 2,400 | $ | 5,390 | / | mo | 2/29/2024 | |||||||||

| 105 Hunters Lane, Suite 106 | Friendswood | TX | Mortgage Sales | Leased | UNK | $ | 3,750 | / | mo | 12/31/2023 | |||||||||

| 590 W. State Street | Pleasant Grove | UT | Mortgage Sales | Leased | 250 | $ | 500 | / | mo | month to month | |||||||||

| 126 W. Sego Lily Dr., Suite 126 | Sandy | UT | Mortgage Sales | Leased | 2,794 | $ | 6,781 | / | mo | 1/31/2027 | |||||||||

| 75 Towne Ridge Parkway, Suite 100 | Sandy | UT | Mortgage Sales | Leased | 6,867 | $ | 17,712 | / | mo | 8/31/2023 | |||||||||

| 1133 North Main St., Suite 150 | Layton | UT | Mortgage Sales | Sub-Leased | 300 | $ | 1,000 | / | mo | month to month | |||||||||

| 12 |

Item 2. Properties (Continued)

| Street | City | State | Function | Owned / Leased | Approximate Square Footage | Lease Amount | Expiration | ||||||||||||

| 497 S. Main | Ephraim | UT | Mortgage Sales | Leased | 1,884 | $ | 1,600 | / | mo | 4/30/2025 | |||||||||

| 11240 S. River Heights Dr. | South Jordan | UT | Mortgage Sales | Leased | 3,403 | $ | 8,212 | / | mo | 11/30/2024 | |||||||||

| 500 East Village Blvd. | Stansbury Park | UT | Mortgage Sales | Leased | 1,950 | $ | 3,374 | / | mo | 10/31/2024 | |||||||||

| 833 N. 900 W. | Orem | UT | Mortgage Sales | Leased | 2,391 | $ | 3,198 | / | mo | 1/31/2023 | |||||||||

| 1350 E. 300 S. 3rd Floor | Lehi | UT | Mortgage Sales | Leased | 15,446 | $ | 37,276 | / | mo | 12/22/2026 | |||||||||

| 2455 E. Parleys Way, Suites 120 & 150 | Salt Lake City | UT | Mortgage Sales | Leased | 5,256 | $ | 8,743 | / | mo | 7/31/2030 | |||||||||

| 859 W South Jordan Pkwy, Suite 101, | South Jordan | UT | Mortgage Sales | Leased | 3,376 | $ | 5,995 | / | mo | 5/30/2025 | |||||||||

| 558 E. Riverside Dr., Suite 204 | St. George | UT | Mortgage Sales | Leased | 1,685 | $ | 2,235 | / | mo | 8/31/2023 | |||||||||

| 420 N. SR 198 | Salem | UT | Mortgage Sales | Leased | 1,000 | $ | 1,200 | / | mo | month to month | |||||||||

| 768 S. 1600 W., Suite B | Mapleton | UT | Mortgage Sales | Leased | 1,500 | $ | 4,000 | / | mo | month to month | |||||||||

| 21430 Cedar Dr., Suite 200-202 | Sterling | VA | Mortgage Sales | Leased | 6,850 | $ | 15,970 | / | mo | 3/9/2024 | |||||||||

| 15640 NE Fourth Plain Blvd., Suite 220/221 | Vancouver | WA | Mortgage Sales | Leased | 360 | $ | 850 | / | mo | month to month | |||||||||

| 2701 Currant St. | Lynden | WA | Mortgage Sales | Leased | 1,500 | $ | 50 | / | mo | month to month | |||||||||

| 1508 24th Ave., Suite 23 | Kenosha | WI | Mortgage Sales | Leased | 250 | $ | 150 | / | mo | month to month | |||||||||

| 27903 99th St. | Trevor | WI | Mortgage Sales | Leased | 300 | $ | 150 | / | mo | month to month | |||||||||

| 219 W. Washington St. | Charlestown | WV | Mortgage Sales | Leased | 2,430 | $ | 1,700 | / | mo | 4/14/2023 | |||||||||

The Company believes the office facilities it occupies are in good operating condition and adequate for current operations. The Company plans to enter into additional leases or modify existing leases based on its assessments of market demand. Those leases are expected to be month to month where possible. As leases expire, the Company plans to either renew or find comparable leases or acquire additional office space.

| 13 |

Item 2. Properties (Continued)

The following table summarizes the location and acreage of the seven Company owned cemeteries, each of which includes one or more mausoleums:

| Net Saleable Acreage | ||||||||||||||||||||||

| Name of Cemetery | Location | Date Acquired | Developed Acreage (1) | Total Acreage (1) | Acres Sold as Cemetery Spaces (2) | Total Available Acreage (1) | ||||||||||||||||

| Memorial

Estates, Inc. Lakeview Cemetery | 1640

East Lakeview Drive Bountiful, Utah | 1973 | 9 | 39 | 8 | 31 | ||||||||||||||||

| Memorial

Estates, Inc. Mountain View Cemetery | 3115

East 7800 South Salt Lake City, Utah | 1973 | 26 | 54 | 20 | 34 | ||||||||||||||||

| Memorial

Estates, Inc. Redwood Cemetery (3) | 6500

South Redwood Road West Jordan, Utah | 1973 | 28 | 71 | 35 | 36 | ||||||||||||||||

| Deseret

Memorial Inc. Lake Hills Cemetery | 10055

South State Street Sandy, Utah | 1991 | 9 | 28 | 6 | 22 | ||||||||||||||||

| Holladay

Memorial Park, Inc. Holladay Memorial Park (3) | 4900

South Memory Lane Holladay, Utah | 1991 | 12 | 14 | 7 | 7 | ||||||||||||||||

| California

Memorial Estates, Inc. Singing Hills Memorial Park (4) | 2800

Dehesa Road El Cajon, California | 1995 | 8 | 97 | 6 | 91 | ||||||||||||||||

| SNR-SF Cemetery LLC Santa Fe Memorial Gardens (5) | 417

Rodeo Rd Santa Fe, New Mexico | 2021 | 5 | 5 | 4 | 1 | ||||||||||||||||

| (1) | The acreage represents estimates of acres that are based upon survey reports, title reports, appraisal reports, or the Company’s inspection of the cemeteries. The Company estimates that there are approximately 1,200 spaces per developed acre. | |

| (2) | Includes both reserved and occupied spaces. | |

| (3) | Includes two granite mausoleums. | |

| (4) | Includes an open easement. | |

| (5) | Includes five main columbariums that can hold approximately 6,000 inurnments. |

| 14 |

Item 2. Properties (Continued)

The following table summarizes the location, square footage and the number of viewing rooms and chapels of the twelve Company owned mortuaries:

| Name of Mortuary | Location | Date

Acquired | Viewing

Room(s) | Chapel(s) | Square

Footage | |||||||||||||

| Memorial

Mortuary, Inc. Memorial Mortuary | 5850 South 900 East, Murray, Utah | 1973 | 3 | 1 | 20,000 | |||||||||||||

| Affordable

Funerals and Cremations, St. George | 157 East Riverside Dr., No. 3A, St. George, Utah | 2016 | 1 | 1 | 2,360 | |||||||||||||

| Memorial

Estates, Inc. Redwood Mortuary (1) | 6500 South Redwood Rd., West Jordan, Utah | 1973 | 2 | 1 | 10,000 | |||||||||||||

| Memorial

Estates, Inc. Mountain View Mortuary (1) | 3115 East 7800 South, Salt Lake City, Utah | 1973 | 2 | 1 | 16,000 | |||||||||||||

| Memorial

Estates, Inc. Lakeview Mortuary (1) | 1640 East Lakeview Dr., Bountiful, Utah | 1973 | 0 | 1 | 5,500 | |||||||||||||

| Deseret

Memorial Inc. Lakehills Mortuary (1) | 10055 South State St., Sandy, Utah | 1991 | 2 | 1 | 18,000 | |||||||||||||

| Cottonwood

Mortuary, Inc. Cottonwood Mortuary | 4670 South Highland Dr., Holladay, Utah | 1991 | 2 | 1 | 14,500 | |||||||||||||

| SN

Probst LLC Heber Valley Funeral Home | 288 North Main St., Heber City, Utah | 2019 | 1 | 1 | 5,900 | |||||||||||||

| SN

Holbrook LLC Milcreek Funeral Home | 3251 S 2300 E, Millcreek, Utah | 2021 | 2 | 1 | 6,300 | |||||||||||||

| SNR-SF

Mortuary LLC Rivera Family Funeral Home Santa Fe (1) | 417 Rodeo RD, Santa Fe, New Mexico | 2021 | 2 | 1 | 7,700 | |||||||||||||

| SNR-Espanola

LLC Rivera Family Funeral Home Española | 305 Calle Salazar, Española, New Mexico | 2021 | 1 | 2 | 10,400 | |||||||||||||

| SNR-Taos

LLC Rivera Family Funeral Home Taos | 818 Paseo Del Pueblo Sur, Taos, New Mexico | 2021 | 0 | 1 | 9,600 | |||||||||||||

| (1) | These funeral homes also provide burial niches at their respective locations. |

| 15 |

Item 3. Legal Proceedings

The Company is not a party to any material legal proceedings outside the ordinary course of business or to any other legal proceedings, which if adversely determined, would be expected to have a material adverse effect on its financial condition or results of operation.

Item 4. Mine Safety Disclosures

Not applicable.

PART II

Item 5. Market for the Registrant’s Common Stock, Related Stockholder Matters, and Issuer Purchases of Equity Securities

The Company’s Class A common stock trades on The Nasdaq Global Select Market under the symbol “SNFCA.” As of March 27, 2023, the closing stock price of the Class A common stock was $6.09 per share. As of March 27, 2023, there were 1,801 registered stockholders of record of the Company’s Class A common stock and 44 registered stockholders of record of the Company’s Class C common stock. Because many of the Company’s shares of Class A common stock are held by brokers and other institutions on behalf of the stockholders, the Company is unable to estimate the total number of stockholders represented by these record holders.

The following were the high and low market closing stock prices for the Class A common stock by quarter as reported by NASDAQ since January 1, 2021:

| Price Range (1) | ||||||||

| High | Low | |||||||

| Period (Calendar Year) | ||||||||

| 2021 | ||||||||

| First Quarter | $ | 9.56 | $ | 7.69 | ||||

| Second Quarter | $ | 8.69 | $ | 7.06 | ||||

| Third Quarter | $ | 8.86 | $ | 7.68 | ||||

| Fourth Quarter | $ | 9.17 | $ | 7.81 | ||||

| 2022 | ||||||||

| First Quarter | $ | 9.86 | $ | 8.53 | ||||

| Second Quarter | $ | 9.87 | $ | 7.84 | ||||

| Third Quarter | $ | 8.61 | $ | 6.23 | ||||

| Fourth Quarter | $ | 7.57 | $ | 6.10 | ||||

| 2023 | ||||||||

| First Quarter (through March 27, 2023) | $ | 7.55 | $ | 6.00 | ||||

(1) Stock prices have been adjusted retroactively for the effect of annual stock dividends.

The Class C common stock is not registered or traded on a national exchange. See Note 12 of the Notes to Consolidated Financial Statements.

The Company has never paid a cash dividend on its Class A or Class C common stock. The Company currently anticipates that all of its earnings will be retained for use in the operation and expansion of its business and does not intend to pay any cash dividends on its Class A or Class C common stock in the foreseeable future. Any future determination as to cash dividends will depend upon the earnings and financial position of the Company and such other factors as the Board of Directors may deem appropriate. The Company paid a 5% stock dividend on Class A and Class C common stock each year from 1990 through 2019, a 7.5% stock dividend for year 2020, and a 5.0% stock dividend for the years 2021 and 2022.

| 16 |

On December 27, 2022, the Company executed a 10b5-1 agreement with a broker to repurchase the Company’s Class A Common Stock. Under the terms of the agreement, the broker is permitted to repurchase up to $1,000,000 of the Company’s Class A Common Stock. The agreement is subject to the daily time, price and volume conditions of Rule 10b-18. The initial term of the agreement is for one year and may be amended with written consent. The purchases under the 10b5-1 agreement are subject to the 2020 amended stock repurchase plan.

The following table shows the Company’s repurchase activity of its common stock during the three months ended December 31, 2022 under its Stock Repurchase Plan.

| Period | (a) Total Number of Class A Shares Purchased | (b) Average Price Paid per Class A Share (1) | (c) Total Number of Class A Shares Purchased as Part of Publicly Announced Plan or Program | (d) Maximum Number of Class A Shares that May Yet Be Purchased Under the Plan or Program (2) | ||||||||||||

| 10/1/2022-10/31/2022 | 9,829 | $ | 6.32 | - | 433,349 | |||||||||||

| 11/1/2022-11/30/2022 | 10,920 | $ | 6.54 | - | 422,429 | |||||||||||

| 12/1/2022-12/31/2022 | 39,222 | $ | 6.47 | - | 383,207 | |||||||||||

| Total | 59,971 | $ | 6.45 | - | 383,207 | |||||||||||

| (1) | Includes fees and commissions paid on stock repurchases. | |

| (2) | In September 2018, the Board of Directors of the Company approved a Stock Repurchase Plan that authorized the repurchase of 300,000 shares of the Company’s Class A Common Stock in the open market. The Company amended the Stock Repurchase Plan on December 4, 2020. The amendment authorized the repurchase of a total of 1,000,000 shares of the Company’s Class A Common Stock in the open market. Any repurchased shares of Class A common stock are to be held as treasury shares to be used as the Company’s employer matching contribution to the Employee 401(k) Retirement Savings Plan and for shares held in the Deferred Compensation Plan. |

| 17 |

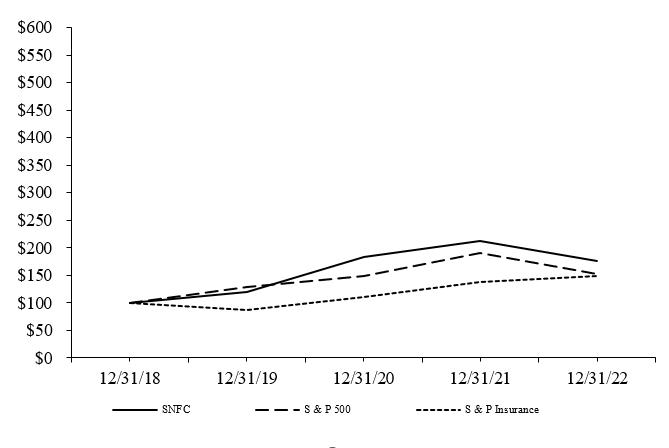

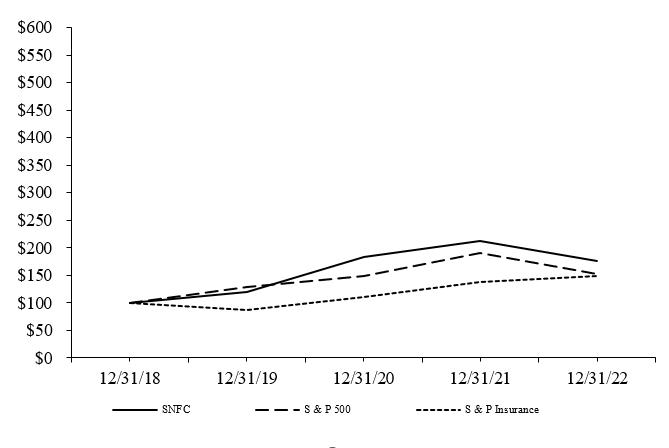

The graph below compares the cumulative total stockholder return of the Company’s Class A common stock with the cumulative total return on the Standard & Poor’s 500 Stock Index and the Standard & Poor’s Insurance Index for the period from December 31, 2018 through December 31, 2022. The graph assumes that the value of the investment in the Company’s Class A common stock and in each of the indexes was $100 at December 31, 2018 and that all dividends were reinvested.

The comparisons in the graph below are based on historical data and are not intended to forecast the possible future performance of the Company’s Class A common stock.

| 12/31/18 | 12/31/19 | 12/31/20 | 12/31/21 | 12/31/22 | ||||||||||||||||

| SNFC | 100 | 119 | 183 | 212 | 176 | |||||||||||||||

| S & P 500 | 100 | 129 | 149 | 190 | 153 | |||||||||||||||

| S & P Insurance | 100 | 87 | 110 | 137 | 148 | |||||||||||||||

The stock performance graph set forth above is required by the Securities and Exchange Commission and shall not be deemed to be incorporated by reference by any general statement incorporating by reference this Form 10-K into any filing under the Securities Act of 1933, as amended, or under the Securities Exchange Act of 1934, as amended, except to the extent that the Company specifically incorporates this information by reference, and shall not otherwise be deemed soliciting material or filed under such acts.

Item 6. [Reserved]

As a smaller reporting company, the Company is not required to provide information typically disclosed under this item.

| 18 |

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Overview

The Company’s operations over the last several years generally reflect three strategies which the Company expects to continue: (i) increased attention to “niche” insurance products, such as the Company’s funeral plan policies and traditional whole life products; (ii) increased emphasis on cemetery and mortuary business; and (iii) capitalizing on the housing market by originating mortgage loans. The Company has adjusted its strategies to respond to the changing economic circumstances resulting from COVID-19.

Insurance Operations

The following table shows the condensed financial results for the Company’s insurance operations for the years ended December 31, 2022 and 2021. See Note 15 of the Notes to Consolidated Financial Statements.

| Years

ended December 31 (in thousands of dollars) | ||||||||||||

| 2022 | 2021 | 2022 vs 2021 % Increase (Decrease) | ||||||||||

| Revenues from external customers: | ||||||||||||

| Insurance premiums | $ | 105,002 | $ | 100,255 | 5 | % | ||||||

| Net investment income | 62,565 | 56,092 | 12 | % | ||||||||

| Gains (losses) on investments and other assets | (459 | ) | 4,555 | (110 | %) | |||||||

| Other than temporary impairments | - | (40 | ) | 100 | % | |||||||

| Other | 2,075 | 2,152 | (4 | %) | ||||||||

| Total | $ | 169,183 | $ | 163,014 | 4 | % | ||||||

| Intersegment revenue | $ | 6,601 | $ | 7,570 | (13 | %) | ||||||

| Earnings before income taxes | $ | 14,196 | $ | 14,973 | (5 | %) | ||||||

Intersegment revenues for the Company’s insurance operations were comprised primarily of interest income from the warehouse lines provided to the Company’s mortgage lending affiliates to fund loans held for sale. Profitability for 2022 decreased due to (a) a $4,974,000 decrease in gains on investments and other assets primarily due to a decrease in the fair value of equity securities, (b) a $3,345,000 increase in selling, general and administrative expenses, (c) a $2,596,000 increase in future policy benefits, (d) a $1,741,000 increase in amortization of deferred policy acquisition costs primarily due to an increase in the average outstanding balance of deferred policy and pre-need acquisition costs, (e) a $1,641,000 increase in interest expense, (f) a $968,000 decrease in intersegment revenue, and (g) a $220,000 decrease in other revenues, which were partially offset by (i) a $6,473,000 increase in net investment income, (ii) a $4,890,000 increase in insurance premiums and other considerations, (iii) a $3,152,000 decrease in death, surrenders and other policy benefits, and (iv) a $193,000 decrease in intersegment interest expense and other expenses.

In response to the COVID-19 pandemic, the Company’s life insurance sales force began using virtual and tele sales processes to market products. During the third quarter 2021, the life insurance sales force returned to in person sales, however, it continues to use virtual and tele sales where needed. Currently, approximately 75% of insurance operations office staff work in the office with the flexibility for hybrid-remote or completely remote working arrangements as needed.

| 19 |

Cemetery and Mortuary Operations

The following table shows the condensed financial results for the Company’s cemetery and mortuary operations for the years ended December 31, 2022 and 2021. See Note 15 of the Notes to Consolidated Financial Statements.

| Years

ended December 31 (in thousands of dollars) | ||||||||||||

| 2022 | 2021 | 2022 vs 2021 % Increase (Decrease) | ||||||||||

| Revenues from external customers: | ||||||||||||

| Cemetery revenues | $ | 13,871 | $ | 15,626 | (11 | %) | ||||||

| Mortuary revenues | 13,123 | 8,371 | 57 | % | ||||||||

| Net investment income | 2,445 | 1,654 | 48 | % | ||||||||

| Gains (losses) on investments and other assets | (796 | ) | 1,512 | (153 | %) | |||||||

| Other | 305 | 100 | 205 | % | ||||||||

| Total | $ | 28,948 | $ | 27,263 | 6 | % | ||||||

| Earnings before income taxes | $ | 6,094 | $ | 7,925 | (23 | %) | ||||||

Profitability in 2022 decreased due to (a) a $2,398,000 increase in selling, general and administrative expenses, (b) a $2,308,000 decrease in gains on investments and other assets primarily attributable to a $579,000 decrease in gains on real estate sales and a $1,729,000 decrease in gains on equity securities classified as restricted assets and cemetery perpetual care trust investments primarily due to a decrease in the fair value of equity securities, (c) a $2,066,000 decrease in cemetery pre-need sales, (d) a $1,017,000 increase in costs of goods sold, (e) a $225,000 increase in intersegment interest expense and other expenses, and (f) a $66,000 increase in amortization of deferred policy acquisition costs, which were partially offset by (i) a $4,751,000 increase in mortuary at-need sales, (ii) a $791,000 increase in net investment income, (iii) a $311,000 increase in cemetery at-need sales, (iv) a $205,000 increase in other revenues (v) a $137,000 increase in intersegment revenues, and (vi) a $54,000 decrease in interest expense.

In response to the COVID-19 pandemic, the cemetery and mortuary’s pre-need sales force began using virtual selling processes to market its products and services including some in home sales as local regulations permitted. During the third quarter 2021, the sales force returned mostly to in home sales, however, it continues to use virtual selling where needed. Currently, the cemetery and mortuary operations office staff works in the office with the flexibility for hybrid-remote or completely remote working arrangements as needed.

Mortgage Operations

The Company’s wholly owned subsidiary, SecurityNational Mortgage, is a mortgage lender incorporated under the laws of the State of Utah and approved and regulated by the Federal Housing Administration (FHA), a department of the U.S. Department of Housing and Urban Development (HUD), which originate mortgage loans that qualify for government insurance in the event of default by the borrower, in addition to various conventional mortgage loan products. SecurityNational Mortgage originates and refinances mortgage loans on a retail basis. Mortgage loans originated or refinanced by the Company’s mortgage subsidiaries are funded through loan purchase agreements with Security National Life, Kilpatrick Life and unaffiliated financial institutions.

SecurityNational Mortgage receives fees from borrowers that are involved in mortgage loan originations and refinancings, and secondary fees earned from third party investors that purchase the mortgage loans. Mortgage loans are generally sold with mortgage servicing rights (“MSRs”) released to third-party investors or retained by SecurityNational Mortgage. SecurityNational Mortgage currently retains the MSRs on approximately 7% of its loan origination volume. These mortgage loans are serviced by either SecurityNational Mortgage or an approved third-party sub-servicer. In December 2021, the Company ceased operations in EverLEND Mortgage and merged its operations into SecurityNational Mortgage. On October 31, 2022, the Company sold certain of its MSRs. The MSRs related to mortgage loans previously originated by the Company in aggregate unpaid principal amount of approximately $7.02 billion. As a result of the sale, the book value of the Company’s MSRs decreased $51,185,906 and generated a gain of $34,051,938 included in mortgage fee income on the consolidated statements of earnings.

| 20 |

For the twelve months ended December 31, 2022 and 2021, SecurityNational Mortgage originated 10,663 loans ($3,373,554,000 total volume) and 19,342 loans ($5,502,894,000 total volume), respectively. For the twelve months ended December 31, 2021, EverLEND Mortgage originated 323 loans ($108,295,000 total volume).

Mortgage rates have followed the US Treasury yields up in response to the higher than expected inflation and the expectation that the Federal Reserve will continue to raise rates in the near term. As expected, the rapid increase in mortgage rates has resulted in a decrease in loan originations classified as ‘refinance’. Higher mortgage rates have also had a negative effect on loan originations classified as ‘purchase’, although not as significant as those in the refinance classification.

The following table shows the condensed financial results for the Company’s mortgage operations for the years ended December 31, 2022 and 2021. See Note 15 of the Notes to Consolidated Financial Statements.

| Years

ended December 31 (in thousands of dollars) | ||||||||||||

| 2022 | 2021 | 2022 vs 2021 % Increase (Decrease) | ||||||||||

| Revenues from external customers: | ||||||||||||

| Secondary gains from investors | $ | 153,728 | $ | 230,417 | (33 | %) | ||||||

| Income from loan originations | 32,772 | 44,897 | (27 | %) | ||||||||

| Change in fair value of loans held for sale | (8,835 | ) | (8,783 | ) | 1 | % | ||||||

| Change in fair value of loan commitments | (4,309 | ) | (3,113 | ) | 38 | % | ||||||

| Net investment income | 1,188 | 519 | 129 | % | ||||||||

| Gains on investments and other assets | 398 | 199 | 100 | % | ||||||||

| Other | 16,580 | 16,282 | 2 | % | ||||||||

| Total | $ | 191,522 | $ | 280,418 | (32 | %) | ||||||

| Earnings before income taxes | $ | 14,088 | $ | 28,903 | (51 | %) | ||||||

Included in other revenues is service fee income. Profitability in 2022 has decreased due to (a) a $76,689,000 decrease in secondary gains from investors, (b) a $12,125,000 decrease in income from loan originations, (c) $1,196,000 decrease in the fair value of loan commitments, (d) a $1,124,000 increase in intersegment expenses, (e) a $242,000 decrease in intersegment revenues, (e) a $51,000 increase in depreciation on property and equipment, and (f) a $51,000 decrease in the fair value of loans held for sale, which were partially offset by (i) a $55,003,000 decrease in commissions, (ii) an $8,481,000 decrease in other expenses, (iii) a $4,360,000 decrease in personnel expenses, (iv) a $3,002,000 decrease in costs related to funding mortgage loans, (v) a $2,230,000 decrease in intersegment interest expense, (vi) a $1,474,000 decrease in advertising expenses, (vii) a $884,000 decrease in interest expense, (viii) $669,000 increase in net investment income, (ix) a $297,000 increase in other revenues, (x) a $199,000 increase in gains on investments and other assets, (xi) and a $64,000 decrease in rent and rent related expenses.

In response to the COVID-19 pandemic, the mortgage operations has integrated employee work from home accommodations into its standard operating procedures. A large percentage of fulfillment employees are in office however the flexibility remains to accommodate in office or work from home functionality.

Critical Accounting Policies and Estimates

The following is a brief summary of the Company’s significant accounting policies and a review of the Company’s most critical accounting estimates. See Note 1 of the Notes to Consolidated Financial Statements.

Insurance Operations

In accordance with generally accepted accounting principles in the United States of America (“GAAP”), premiums and other considerations received for interest sensitive products are reflected as increases in liabilities for policyholder account balances and not as revenues. Revenues reported for these products consist of policy charges for the cost of insurance, administration charges, amortization of policy initiation fees and surrender charges assessed against policyholder account balances. Surrender benefits paid relating to these products are reflected as decreases in liabilities for policyholder account balances and not as expenses.

| 21 |

The Company receives investment income earned from the funds deposited into account balances, a portion of which is passed through to the policyholders in the form of interest credited. Interest credited to policyholder account balances and benefit claims in excess of policyholder account balances are reported as expenses in the consolidated financial statements.

Premiums and other considerations received for traditional life insurance products are recognized as revenues when due. Future policy benefits are recognized as expenses over the life of the policy by means of the provision for future policy benefits.

The costs related to acquiring new business, including certain costs of issuing policies and other variable selling expenses (principally commissions), defined as deferred policy acquisition costs, are capitalized and amortized into expense. For nonparticipating traditional life products, these costs are amortized over the premium paying period of the related policies, in proportion to the ratio of annual premium revenues to total anticipated premium revenues. Such anticipated premium revenues are estimated using the same assumptions used for computing liabilities for future policy benefits and are generally “locked in” at the date the policies are issued. For interest sensitive products, these costs are amortized generally in proportion to expected gross profits from surrender charges and investment, mortality and expense margins. This amortization is adjusted when the Company revises the estimate of current or future gross profits or margins. For example, deferred policy acquisition costs are amortized earlier than originally estimated when policy terminations are higher than originally estimated or when investments backing the related policyholder liabilities are sold at a gain prior to their anticipated maturity.

Death and other policyholder benefits reflect exposure to mortality risk and fluctuate from year to year on the level of claims incurred under insurance retention limits. The profitability of the Company is primarily affected by fluctuations in mortality, other policyholder benefits, expense levels, interest spreads (i.e., the difference between interest earned on investments and interest credited to policyholders) and persistency. The Company has the ability to mitigate adverse experience through sound underwriting, asset and liability duration matching, sound actuarial practices, adjustments to credited interest rates, policyholder dividends and cost of insurance charges.

Cemetery and Mortuary Operations

Pre-need sales of funeral services and caskets, including revenue and costs associated with the sales of pre-need funeral services and caskets, are deferred until the services are performed or the caskets are delivered.

Pre-need sales of cemetery interment rights (cemetery burial property), including revenue and costs associated with the sales of pre-need cemetery interment rights, are recognized in accordance with the retail land sales provisions of GAAP. Under GAAP, recognition of revenue and associated costs from constructed cemetery property must be deferred until a minimum percentage of the sales price has been collected. Revenues related to the pre-need sale of unconstructed cemetery property will be deferred until such property is constructed and meets the criteria of GAAP, described above.