Notice of Annual Shareholders Meeting and

Proxy Statement 2023

| December 7, 2023 | Virtual Meeting Site: | |||||

| 8:30 a.m. Pacific Time | virtualshareholdermeeting.com/MSFT23 | |||||

|

☐ |

Preliminary Proxy Statement | |

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

☒ |

Definitive Proxy Statement | |

☐ |

Definitive Additional Materials | |

☐ |

Soliciting Material under §240.14a-12 | |

☒ |

No fee required |

☐ |

Fee paid previously with preliminary materials |

☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

Notice of Annual Shareholders Meeting and

Proxy Statement 2023

| December 7, 2023 | Virtual Meeting Site: | |||||

| 8:30 a.m. Pacific Time | virtualshareholdermeeting.com/MSFT23 | |||||

|

|

|

“As a corporation, our purpose and actions must be aligned with addressing the world’s problems, not creating new ones. At our very core, we need to deliver innovation that helps drive broad economic growth. We, as a company, will do well when the world around us does well.”

Satya Nadella, Chairman and CEO

|

Microsoft Corporation (“Company”) works to conduct business in ways that are principled, transparent, and accountable to our shareholders and other key stakeholders. We believe doing so generates long-term value. As we work to help everyone achieve more, we are committed to improving our world and reporting our progress.

Focus for Societal Impact

At Microsoft, we focus on four enduring commitments that are central to meeting our mission and that become even more important in the era of AI:

| Expand opportunity | Earn trust | Protect fundamental rights | Advance sustainability | |||

|

|

|

|

| |||

Note About Forward-Looking Statements

This Proxy Statement includes estimates, projections, statements relating to our business plans, objectives, and expected operating results that are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements may appear throughout this report, including the Proxy Summary and Part 2 – Named Executive Officer Compensation. These forward-looking statements generally are identified by the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “opportunity,” “plan,” “may,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions. Forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties that may cause actual results to differ materially. We describe risks and uncertainties that could cause actual results and events to differ materially in “Risk Factors,” “Quantitative and Qualitative Disclosures about Market Risk,” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of our Forms 10-K and 10-Q. Readers are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date they are made. We undertake no obligation to update or revise publicly any forward-looking statements, whether because of new information, future events, or otherwise.

This Proxy Statement includes several website addresses and references to additional materials found on those websites. These websites and materials are not incorporated by reference herein.

Letter from our Chairman and Chief Executive Officer

October 19, 2023

Dear Shareholder,

On behalf of the Board of Directors, it is our pleasure to invite you to the 2023 Annual Shareholders Meeting of Microsoft Corporation (“Annual Meeting”), on December 7, 2023, beginning at 8:30 a.m. Pacific Time. This year’s Annual Meeting will be held in a virtual format through a live webcast. We will provide the webcast of the Annual Meeting at virtualshareholdermeeting.com/MSFT23. In addition, you will have the option to view the Annual Meeting through Microsoft Teams at microsoft.com/investor. A transcript with video and audio of the entire Annual Meeting will be available on the Microsoft Investor Relations website after the meeting. For more information on how to participate in the meeting, please see Part 5 – Information About the Meeting on page 88 in this Proxy Statement.

The Notice of 2023 Annual Shareholders and this Proxy Statement contain details of the business to be conducted during the Annual Meeting.

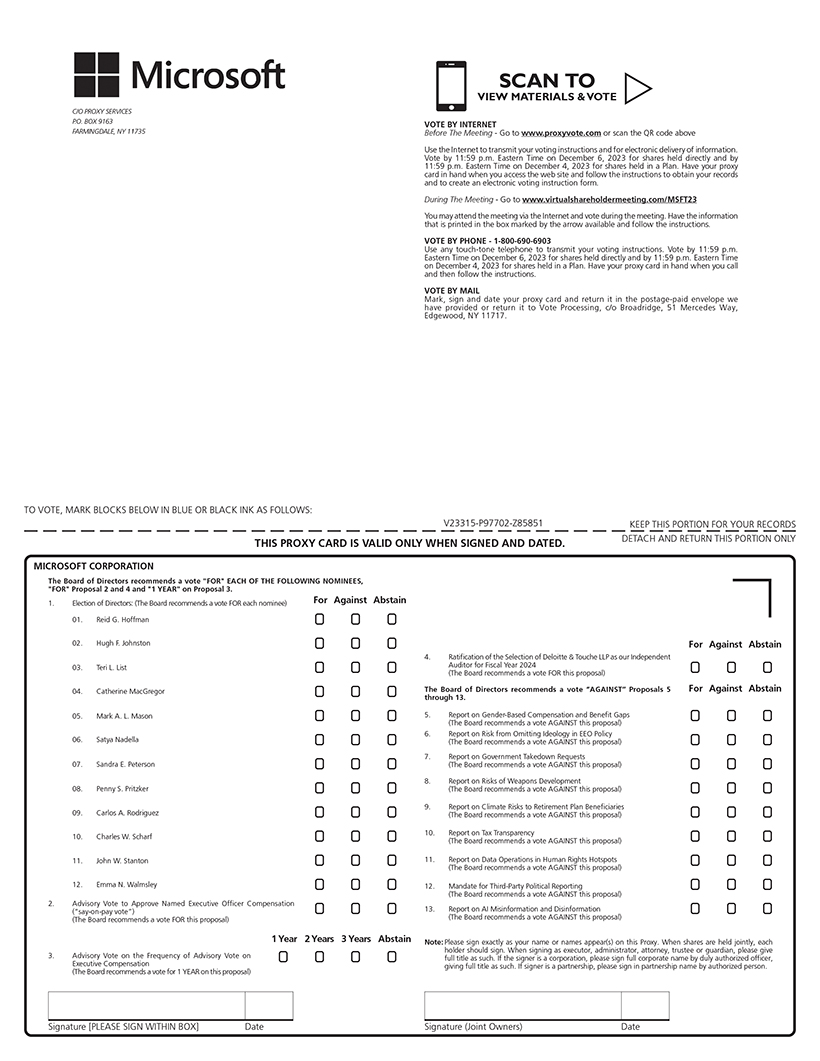

Whether or not you participate in the Annual Meeting, it is important that your shares be represented and voted. We urge you to promptly vote and submit your proxy (1) via the Internet, (2) by phone, or (3) if you received your proxy materials by mail, by signing, dating, and returning the enclosed proxy card or voting instruction form in the envelope provided for your convenience.

This year’s shareholders Q&A session will include an opportunity to submit questions. You may submit a question in advance of the meeting at proxyvote.com after logging in with the control number (“Control Number”) found next to the label for postal mail recipients or within the body of the email sending you the Proxy Statement. Live questions may be submitted online beginning shortly before the start of the Annual Meeting through virtualshareholdermeeting.com/MSFT23.

Thank you for your continued investment in Microsoft.

Sincerely,

Satya Nadella

Chairman and Chief Executive Officer

Letter from the Board of Directors

October 19, 2023

Dear Shareholder,

As we’ve expressed in this letter over the past several years, the Board is incredibly proud of the work Microsoft and its employees have done with our customers and partners to help the world use digital technology to address business and societal challenges around the globe. We are excited by what Microsoft’s advancements in a defining technology of our time, artificial intelligence (“AI”), can and will do for people, industry, and society and the central role AI will play in the Company’s mission to help every person and organization on the planet to achieve more. We also recognize the responsibility to ensure this world-changing technology is used responsibly. Microsoft’s work on AI is guided by a core set of principles: fairness, reliability and safety, privacy and security, inclusiveness, transparency, and accountability.

Amidst global business challenges, Microsoft revenues once again broke records in fiscal year 2023. Microsoft’s leadership and the Company as a whole achieved this through relentless focus on providing technology innovations to make our customers more productive and resilient. As a result, Microsoft delivered strong results for its shareholders, including a return of over $38 billion in the form of share repurchases and dividends. We look forward to more opportunity ahead as we remain committed to the long-term interests of the Company’s shareholders and a broad range of stakeholders critical to the Company’s success, including employees, customers, the communities we operate in, and our partners and suppliers.

With this in mind, Microsoft continued to provide transparency in its progress towards important environmental and social commitments, including our climate goals, our progress towards advancing diversity and inclusion across our workforce, and the Racial Equity Initiative goals we are committed to meet by 2025. For more information on these initiatives and information across a breadth of environmental, social, and governance topics, we encourage you to read the progress reports Microsoft published over the course of the past fiscal year which are available at microsoft.com/transparency and microsoft.com/csr.

This Proxy Statement describes Microsoft’s corporate governance policies and practices that foster the Board’s effective oversight of the Company’s business strategies and practices. A key component to our effective governance is the Board’s commitment to provide oversight and perspectives reflecting a diversity of independent views.

This year’s Board nominees represent a wide range of backgrounds and expertise. We believe our diversity of experiences, perspectives, and skills contributes to the Board’s effectiveness in managing risk and providing guidance that positions Microsoft for long-term success in a dynamically changing business environment. Of the 12 Board nominees, 11 are independent, which includes Sandra Peterson as Lead Independent Director and all committee chairs and members. We are pleased to announce the nominations of Catherine MacGregor and Mark Mason for election to the Board at our December 7, 2023 Annual Meeting. Ms. MacGregor is Group CEO of Engie S.A. (“Engie”) and a member of the Engie board. She is an accomplished leader in the energy business and will bring significant insights and global experience to Microsoft. Mr. Mason is CFO of Citigroup Inc. He brings strategic and operational experience and a deep understanding of how commerce is changing globally.

In addition, two members of the Board have decided not to seek re-election and will end their Board service in December: Padmasree Warrior and John Thompson. Ms. Warrior served on the Board and on the Compensation Committee for nearly eight years and has contributed valuable insights and perspectives in those roles. During his eleven-year tenure, Mr. Thompson served as both Board Chair and Lead Independent Director, led the CEO search and succession process from Steve Ballmer to Satya Nadella, and chaired the Governance and Nominating Committee during a fruitful period of Board refreshment and diversification. We thank them for their many contributions.

The Proxy Statement also includes information about all of the management and shareholder proposals up for a vote at the Company’s Annual Meeting. We value your vote and we encourage you to use one of the options laid out in this proxy to vote your shares whether or not you plan to join us for the Annual Meeting. As we look ahead, we continue to see tremendous opportunities for the Company’s business and shareholder value creation, with the ability to deliver positive impacts at a global scale. We appreciate your investment in Microsoft and thank you for the trust you place in us and the opportunity to serve you and our Company as directors.

Sincerely,

Your Board of Directors

Notice of 2023 Annual Shareholders Meeting

| Date | December 7, 2023 | |||

| Time | 8:30 a.m. Pacific Time | |||

| Virtual Meeting | This year’s meeting is a virtual shareholders meeting at virtualshareholdermeeting.com/MSFT23 | |||

| Record Date | September 29, 2023. Only shareholders of record at the close of business on the record date are entitled to receive notice of, and to vote at, the Annual Meeting. | |||

| Proxy Voting | Make your vote count. Please vote your shares promptly to ensure the presence of a quorum during the Annual Meeting. Voting your shares now via the Internet, by telephone, or by signing, dating, and returning the enclosed proxy card or voting instruction form will save the expense of additional solicitation. If you wish to vote by mail, we have enclosed an addressed envelope with postage prepaid if mailed in the United States. Submitting your proxy now will not prevent you from voting your shares during the Annual Meeting, as your proxy is revocable at your option. We are requesting your vote to: | |||

| Items of Business |

• Elect the 12 director nominees named in this Proxy Statement

• Approve, on a nonbinding advisory basis, the compensation paid to our named executive officers (“say-on-pay vote”) • Vote, on a non-binding advisory basis, on the frequency of holding the say-on-pay vote

• Ratify the selection of Deloitte & Touche LLP as our independent auditor for fiscal year 2024

• Vote on 9 shareholder proposals, if properly presented at the Annual Meeting

• Transact other business that may properly come before the Annual Meeting | |||

| Address of Corporate Headquarters |

One Microsoft Way, Redmond, WA 98052 | |||

| Meeting Details | See Part 5 – Information About the Meeting for details. | |||

Important notice regarding the availability of proxy materials for the Annual Meeting to be held on December 7, 2023. Our 2023 Proxy Statement and Annual Report to Shareholders are available at microsoft.com/investor.

By Order of the Board of Directors

Keith R. Dolliver

Secretary

Redmond, Washington

October 19, 2023

2023 PROXY STATEMENT i

Proxy Statement Table of Contents

|

|

|

1

|

| |||||||||||

| 1 |

|

Governance and |

|

|||||||||||

|

|

9 | |||||||||||||

|

|

11 | |||||||||||||

|

|

18 | |||||||||||||

|

|

19 | |||||||||||||

|

|

20 | |||||||||||||

|

|

|

27

|

| |||||||||||

| 2 |

|

Named Executive |

|

30 | ||||||||||

|

|

31 | |||||||||||||

|

|

31 | |||||||||||||

|

|

35 | |||||||||||||

|

|

37 | |||||||||||||

|

|

39 | |||||||||||||

|

Section 5 – Fiscal Year 2023 Compensation Decisions and Results |

43 | |||||||||||||

| 48 | ||||||||||||||

| 50 | ||||||||||||||

| 51 | ||||||||||||||

| 51 | ||||||||||||||

| 52 | ||||||||||||||

| 53 | ||||||||||||||

| 54 | ||||||||||||||

| 54 | ||||||||||||||

| 55 | ||||||||||||||

| 56 | ||||||||||||||

| 59 | ||||||||||||||

| 59 | ||||||||||||||

|

|

|

60

|

| |||||||||||

| 3 |

|

Audit Committee |

|

|

61 | |||||||||

|

|

63 | |||||||||||||

|

|

64 | |||||||||||||

| ii |

|

| 4 |

|

Proposals to be |

|

|

65 | |||||||||

|

Proposal 2: Advisory Vote to Approve Named Executive Officer Compensation |

66 | |||||||||||||

|

Proposal 3: Advisory Vote on Frequency of Advisory Vote on Executive Compensation |

68 | |||||||||||||

|

|

68 | |||||||||||||

|

|

|

69

|

| |||||||||||

| 5 |

|

Information About |

|

|

88 | |||||||||

|

|

88 | |||||||||||||

|

|

88 | |||||||||||||

|

|

88 | |||||||||||||

|

|

89 | |||||||||||||

|

|

89 | |||||||||||||

|

|

89 | |||||||||||||

| 89 | ||||||||||||||

| 89 | ||||||||||||||

| 90 | ||||||||||||||

| 90 | ||||||||||||||

| 90 | ||||||||||||||

| 90 | ||||||||||||||

| 91 | ||||||||||||||

|

|

|

91

|

| |||||||||||

2023 PROXY STATEMENT iii

Proxy Summary

This summary highlights information contained elsewhere in this Proxy Statement. This summary does not contain all information you should consider. Please read this entire Proxy Statement carefully before voting.

Annual Shareholders Meeting

| Date: December 7, 2023

Time: 8:30 a.m. Pacific Time

Meeting Agenda: The meeting will cover the proposals listed under Voting Matters and Vote Recommendations below, and any other business that may properly come before the meeting.

|

Place: virtualshareholdermeeting.com/MSFT23

| |||

| Record Date: September 29, 2023

Mailing Date: This Proxy Statement was first mailed to shareholders on or about |

Voting: Shareholders as of the record date are entitled to vote. Each share of common stock of Microsoft Corporation (“Company”) is entitled to one vote for each director nominee and one vote for each proposal.

| |||

Vote in Advance of the Meeting

|

Vote your shares at proxyvote.com. Have your Notice of Internet Availability or proxy card for the 16-digit Control Number needed to vote. | |

|

Call toll-free number 1-800-690-6903. | |

|

Sign, date, and return the enclosed proxy card or voting instruction form. | |

Vote Online During the Meeting

|

See page 88 in Part 5 – Information About the Meeting for details on voting your shares during the meeting through proxyvote.com. |

Voting Matters and Vote Recommendations

See Part 4 – Proposals to be Voted on During the Meeting for more information.

| Board Recommends

|

See Page

|

|||||||

|

Management Proposals |

|

|

|

|

|

| ||

|

Election of 12 Directors |

|

FOR |

|

|

65 |

| ||

|

Advisory Vote to Approve Named Executive Officer Compensation (“say-on-pay vote”) |

|

FOR |

|

|

66 |

| ||

|

Advisory Vote on the Frequency of Advisory Vote on Executive Compensation |

|

FOR |

|

|

68 |

| ||

|

Ratification of the Selection of Deloitte & Touche LLP as our Independent Auditor for Fiscal Year 2024 |

|

FOR |

|

|

68 |

| ||

|

Shareholder Proposals |

|

|

|

|

|

| ||

|

Report on Gender-Based Compensation and Benefit Gaps |

|

AGAINST |

|

|

69 |

| ||

|

Report on Risk from Omitting Ideology in EEO Policy |

|

AGAINST |

|

|

71 |

| ||

|

Report on Government Takedown Requests |

|

AGAINST |

|

|

73 |

| ||

|

Report on Risks of Weapons Development |

|

AGAINST |

|

|

75 |

| ||

|

Report on Climate Risks to Retirement Plan Beneficiaries |

|

AGAINST |

|

|

77 |

| ||

|

Report on Tax Transparency |

|

AGAINST |

|

|

79 |

| ||

|

Report on Data Operations in Human Rights Hotspots |

|

AGAINST |

|

|

81 |

| ||

|

Mandate for Third-Party Political Reporting |

|

AGAINST |

|

|

83 |

| ||

|

Report on AI Misinformation and Disinformation |

|

AGAINST |

|

|

85 |

| ||

| 2023 PROXY STATEMENT |

1 |

Our Director Nominees

See Part 1 – Governance and our Board of Directors for more information.

The following table provides summary information about each of the 12 director nominees. Each director is elected annually by a majority of votes cast. John Thompson and Padmasree Warrior are not seeking re-election and their Board service will end on the date of the Annual Meeting. John Thompson currently serves as a member of the Governance and Nominating Committee and a member of the Environmental, Social, and Public Policy Committee. Padmasree Warrior currently serves as a member of the Compensation Committee. The Board has nominated Catherine MacGregor and Mark Mason for election as directors. If elected, their terms will begin on December 7, 2023.

| Name Occupation |

Age | Director Since |

Independent | Other Public Boards | ||||

| Reid G. Hoffman Partner, Greylock Partners |

56 | 2017 | Yes | 2 | ||||

| Hugh F. Johnston Vice Chairman, Executive Vice President, and CFO, PepsiCo, Inc. |

62 | 2017 | Yes | 1 | ||||

| Teri L. List Former Executive Vice President and CFO, The Gap, Inc. |

60 | 2014 | Yes | 3 | ||||

| Catherine MacGregor Group CEO and Director, Engie S.A. |

51 | New Nominee |

Yes | 1 | ||||

| Mark A. L. Mason CFO, Citigroup Inc. |

54 | New Nominee |

Yes | 0 | ||||

| Satya Nadella Chairman and CEO, Microsoft Corporation |

56 | 2014 | No | 1 | ||||

| Sandra E. Peterson Lead Independent Director, Microsoft Corporation; Operating Partner, Clayton, Dubilier & Rice, LLC |

64 | 2015 | Yes | 0 | ||||

| Penny S. Pritzker Founder and Chairman, PSP Partners, LLC |

64 | 2017 | Yes | 0 | ||||

| Carlos A. Rodriguez Executive Chair, Automatic Data Processing, Inc. |

59 | 2021 | Yes | 1 | ||||

| Charles W. Scharf CEO, President, and Director, Wells Fargo & Company |

58 | 2014 | Yes | 1 | ||||

| John W. Stanton Founder and Chairman, Trilogy Partnerships |

68 | 2014 | Yes | 2 | ||||

| Emma N. Walmsley CEO and Director, GSK plc |

54 | 2019 | Yes | 1 | ||||

Committee Memberships

The following table provides current membership for each Board committee.

| Name |

Audit | Compensation | Environmental, Social, and Public Policy |

Governance and Nominating | ||||

| Reid G. Hoffman |

|

|

Member |

| ||||

| Hugh F. Johnston |

Chair, Financial Expert |

|

|

| ||||

| Teri L. List |

Financial Expert and Member |

|

|

Member | ||||

| Satya Nadella |

|

|

|

| ||||

| Sandra E. Peterson |

|

Member |

|

Chair | ||||

| Penny S. Pritzker |

|

|

Chair |

| ||||

| Carlos A. Rodriguez |

Financial Expert and Member |

Chair |

|

| ||||

| Charles W. Scharf |

|

Member |

|

Member | ||||

| John W. Stanton |

Member |

|

Member |

| ||||

| John W. Thompson* |

|

|

Member | Member | ||||

| Emma N. Walmsley |

|

Member | Member |

| ||||

| Padmasree Warrior* |

|

Member |

|

| ||||

| * | Mr. Thompson and Ms. Warrior will not seek re-election at the 2023 Annual Meeting. The Board will consider committee appointments for Ms. MacGregor and Mr. Mason if they are elected to the Board. |

| 2 |

|

Executive Compensation Advisory Vote

Our Board recommends that shareholders vote to approve, on an advisory basis, the compensation paid to the Company’s named executive officers (“Named Executives”) as described in this Proxy Statement (“say-on-pay vote”), for the reasons below.

Pay for Performance

| We have executed on our pay for performance philosophy. | ||

|

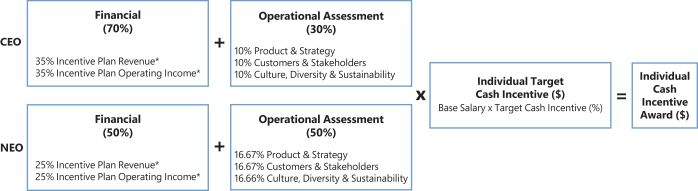

• Over 95% of the annual target compensation opportunity for the CEO is performance-based and over 50% for our other Named Executives

• Cash incentive awards are structured 50% (70% for CEO) based on pre-established goals (balance of growth and profitability goals) and 50% (30% for CEO) based on operational performance as assessed across three performance categories, diversifying the risk associated with any single aspect of performance

• The metrics for our performance stock awards are reviewed annually to ensure they reflect key business developments that drive long-term growth |

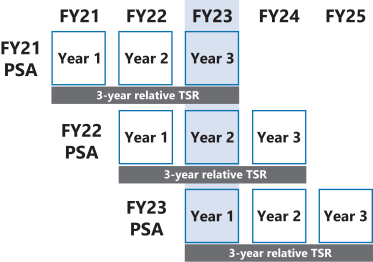

• Our performance stock awards (“PSAs”) include a relative total shareholder return (“TSR”) modifier to reward significant positive outperformance and reduce rewards for underperformance to align executives’ and shareholders’ long-term interests

• At least 70% of target compensation for our Named Executives was equity-based, with average across all Named Executives over 80%, providing incentives to drive long-term business success and direct alignment with returns to shareholders | |

Sound Program Design

| We design our executive compensation program to attract, motivate, and retain the key executives who drive our success and industry leadership, while considering individual and Company performance and alignment with the long-term interests of our shareholders. We achieve our objectives through compensation that:

| ||

| • Provides a competitive total pay opportunity

• Delivers a majority of pay based on performance

• Consists primarily of stock-based compensation |

• Enhances long-term focus through multi-year performance requirements or vesting of stock-based compensation

• Does not encourage unnecessary and excessive risk taking | |

See Part 2 – Named Executive Officer Compensation for more information.

| 2023 PROXY STATEMENT |

3 |

Business Overview

Our Business Performance

In fiscal year 2023, we continued to achieve strong business results, focusing on enabling the success and earning the trust of our customers. We are creating the platforms and tools, powered by artificial intelligence (“AI”), that deliver better, faster, and more effective solutions to support small and large business competitiveness, improve educational and health outcomes, grow public-sector efficiency, and empower human ingenuity. From infrastructure and data, to business applications and collaboration, we provide unique, differentiated value to customers.

Fiscal Year 2023 Business Performance

| Revenue

$211.9 billion |

Operating Income

$88.5 billion |

Net Income

$72.4 billion |

Diluted Earnings per Share

$9.68 |

Selected highlights from fiscal year 2023 include the following metrics. Percentages are year-over-year.

| • | Microsoft Cloud revenue increased 22% to $111.6 billion |

| • | Office Commercial products and cloud services revenue increased 10% |

| • | Office Consumer products and cloud services revenue increased 2% |

| • | Linkedln revenue increased 10% |

| • | Dynamics products and cloud services revenue increased 16% |

| • | Server products and cloud services revenue increased 19% |

| • | Windows Commercial products and cloud services revenue increased 5% |

| • | Search and news advertising revenue excluding traffic acquisition costs increased 11% |

A complete list of our fiscal year 2023 key performance metrics and their definitions is available in our Form 10-K for the fiscal year ended June 30, 2023.

Strong Long-Term Performance

| Total Shareholder Return* through June 30, 2023

|

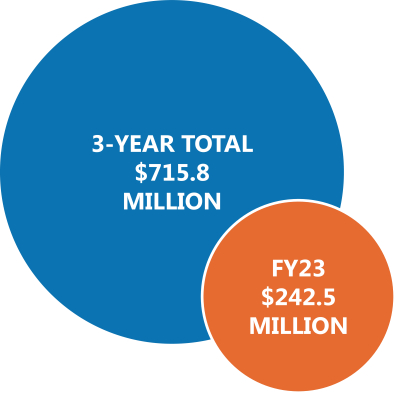

Our total shareholder return and total cash returned to shareholders over the past three years have continued to be strong. |

Total Cash Returned to Shareholders (in billions)

| ||

| * Total shareholder return includes reinvestment of dividends.

| ||||

| 4 |

|

Governance and Board Best Practices

Our mission to empower every person and every organization on the planet to achieve more is ambitious, and we cannot fulfill it with a narrow or short-term focus. Our adoption of leading governance practices fosters our sustained business success over the long term. Strong corporate governance, informed by participation from our shareholders, is essential to achieving our mission. During fiscal year 2023, independent members of our Board and members of management engaged with a cross-section of shareholders owning approximately 50% of our shares and provided shareholder feedback to the Board.

Our Board believes that having a diverse mix of directors with complementary qualifications, expertise, and attributes is essential to meeting its oversight responsibility. Of our 12 Board nominees, 11 are independent. Having an independent Board is a core element of our governance philosophy.

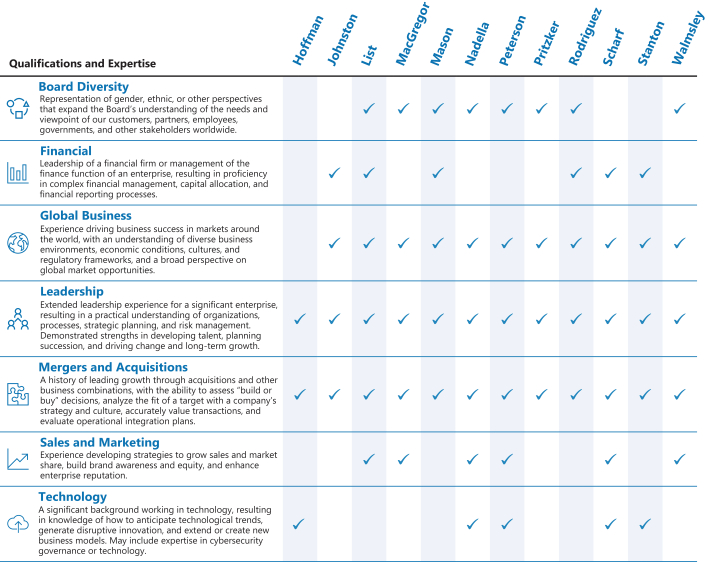

Our Director Nominees

|

|

Board Diversity

|

| ||||||||||||||||||||||||||||||||

| 8

|

||||||||||||||||||||||||||||||||||

|

|

Financial

|

|||||||||||||||||||||||||||||||||

| 6

|

||||||||||||||||||||||||||||||||||

|

|

Global Business

|

|||||||||||||||||||||||||||||||||

| 11

|

||||||||||||||||||||||||||||||||||

|

|

Leadership

|

|||||||||||||||||||||||||||||||||

| 12

|

||||||||||||||||||||||||||||||||||

|

|

Mergers and Acquisitions

|

|||||||||||||||||||||||||||||||||

| 12

|

||||||||||||||||||||||||||||||||||

|

|

Sales and Marketing

|

|||||||||||||||||||||||||||||||||

| 6

|

||||||||||||||||||||||||||||||||||

|

|

Technology

|

|||||||||||||||||||||||||||||||||

| 5

|

||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||

Independent, Effective Board Oversight

| • Lead Independent Director

• 11 of 12 director nominees are independent

• All committee chairs and members are independent

• Board-adopted refreshment commitment to maintain an average tenure of 10 years or less for its independent directors as a group

• The Board is committed to actively seeking highly qualified women and individuals from minority groups to include in the pool of potential Board nominees and CEO candidates |

• Executive sessions provided for all quarterly Board and committee meetings

• Annual Board and committee evaluations, periodically using a third-party facilitator to conduct the evaluations

• Director orientation and continuing education and strategy programs for directors

• All current Audit Committee members meet the Nasdaq Stock Market LLC listing standard of financial sophistication, and three members are “audit committee financial experts” under the Securities and Exchange Commission rules | |

| 2023 PROXY STATEMENT |

5 |

Shareholder Rights

| • | Single class of stock with equal voting rights |

| • | All directors are elected annually |

| • | Directors are elected by majority vote in uncontested elections |

| • | Confidential voting policy |

| • | 15% of outstanding shares can call a special meeting |

| • | Our Bylaws provide for “proxy access” by shareholders |

See Part 1 – Governance and our Board of Directors and Part 5 – Information About the Meeting for more information.

| 6 |

|

| 1 |

GOVERNANCE AND DIRECTORS

|

2 |

NAMED |

3 |

AUDIT |

4 |

PROPOSALS TO |

5 |

INFORMATION | |||||||||

|

|

||||||||||||||||||

1. Governance and our Board of Directors

Earning Trust

Earning the trust of our customers, partners, shareholders, and other stakeholders is the foundation of our business success and is fundamental to realizing Microsoft’s mission to empower every person and every organization on the planet to achieve more. The Board of Directors is committed to building trust through strong corporate governance, effective oversight, and strategic engagement. Together, these ensure accountability and position Microsoft for sustained success in a turbulent world.

Like many in the investor community, the Board and Microsoft’s leaders recognize the interconnections between corporate governance and effective business responses to pressing environmental and social challenges. In considering these challenges, Microsoft and its Board have proactively engaged with investors to learn from their perspectives and to share the Company’s approach, as well as considering best practices from our industry peers, partners, customers, and the broader business community. Microsoft’s Board and management team understand that the work the Company does across a spectrum of environmental and social areas makes an important contribution to the Company’s long-term financial performance and growth. We are committed to building and executing on strategies to help foster a healthy planet and advance a more inclusive global economy that fosters additional growth opportunities for everyone. Microsoft’s management benefits from the oversight and diverse perspectives offered by the Board and its committees, which cover a broad range of environmental, social, and governance (“ESG”) topics, which are described throughout this Proxy Statement.

Microsoft also gains trust from our longstanding commitments to conducting our business in ways that are principled, transparent, and accountable. The foundation of these commitments is expressed in Microsoft’s Standards of Business Conduct (“Trust Code”) at aka.ms/policiesandguidelines which apply to our employees, officers, Board of Directors, and our subsidiaries and controlled affiliates across the globe. The Trust Code requires not only legal compliance, but also broader commitments to address accessibility, diversity and inclusion, human rights, and privacy. In support of the Trust Code, we strive to build a workplace culture that embraces learning and fosters trust – a culture where every employee feels free to ask questions and raise concerns when something doesn’t seem right. We extend our high expectations to suppliers who do business with Microsoft, requiring them to uphold the human rights, labor, health and safety, environmental, and business ethics practices prescribed in our Supplier Code of Conduct at aka.ms/scoc.

Concrete Commitments and Transparent Reporting on Progress

We hold ourselves accountable by publicly reporting on our policies, practices, and performance to provide our stakeholders visibility into how we are meeting our commitments and responsibilities. We believe our position in the world demands it, and we are confident that it is critical to fostering our long-term business success. Our Reports Hub available at microsoft.com/transparency provides a consolidated, comprehensive view of our ESG reporting and data ranging from our carbon footprint to workforce demographics to political donations. We work to align our ESG reporting to commonly used global standards such as those provided by the Task Force on Climate-Related Financial Disclosures (“TCFD”). In addition, we were among the first companies to align our human rights work with the United Nations Guiding Principles on Business and Human Rights and to adopt the United Nations Guiding Principles Reporting Framework.

Recognizing the interest of shareholders in establishing greater transparency about corporate political contributions, we disclose our political contributions to support candidates and ballot measures and how certain of our trade association membership dues are used for political activities. As part of our commitment to transparency, we developed the Principles and Policies for Guiding Microsoft’s Participation in the Public Policy Process in the U.S., which focuses on ensuring compliance with applicable federal and state laws and goes beyond compliance to implement what we consider leading practices in corporate accountability, transparency, integrity, and responsibility. The policy is available at microsoft.com/public-policy-engagement.

The corporate governance policies and practices described throughout this Proxy Statement and the effective, engaged Board oversight they foster provide the foundation for all of our commitments.

| 2023 PROXY STATEMENT |

7 |

| 1 |

GOVERNANCE AND DIRECTORS

|

2 |

NAMED |

3 |

AUDIT |

4 |

PROPOSALS TO |

5 |

INFORMATION | |||||||||

|

|

||||||||||||||||||

Engagement with Environmental and Social Topics

Below are five important initiatives that we know are of interest to many of our shareholders and other stakeholders based on feedback we have received. A wide range of information about other environmental and social topics is available at microsoft.com/csr.

Environmental Sustainability

Our strategy for a sustainable future focuses on addressing carbon emissions, ecosystems, water, and waste. In January 2020, we announced a bold commitment and detailed plan to be carbon negative by 2030, and to remove from the environment by 2050 all the carbon we have emitted since Microsoft’s founding in 1975. This included a commitment to invest $1 billion over four years in new technologies and innovative climate solutions. We built on this pledge by adding commitments to be water positive by 2030, zero waste by 2030, and to protect ecosystems by developing a Planetary Computer. Furthermore, we enhanced transparency by subjecting the data in our annual sustainability report to third-party review and accountability by including progress on sustainability goals as a factor in determining executive pay. We report our progress towards our 2030 goals annually at aka.ms/MSFTsustainabilityreport and the latest information is available at microsoft.com/environment. Microsoft’s Environmental, Social, and Public Policy Committee provides oversight and guidance on Microsoft’s environmental sustainability strategy and commitments.

Responsible Artificial Intelligence (“AI”)

Microsoft’s approach to Responsible AI is guided by the belief that when you create technologies that can change the world, you must also ensure that the technology is used responsibly. We are committed to creating responsible AI by design. Our work is guided by a core set of principles: fairness, reliability and safety, privacy and security, inclusiveness, transparency, and accountability. We are putting those principles into practice across the Company to develop and deploy AI that will have a positive impact on society. We take a cross-Company approach through cutting-edge research, best-of-breed engineering systems, and excellence in policy and governance. More information and resources are available at microsoft.com/ai/our-approach. Microsoft’s Environmental, Social, and Public Policy Committee provides oversight and guidance to management on responsible AI policies and programs.

Human Capital

Microsoft aims to recruit, develop, and retain world-changing talent from a diversity of backgrounds. To foster their and our success, we seek to create an environment where people can thrive and do their best work. We strive to maximize the potential of our human capital resources by creating a respectful, rewarding, and inclusive work environment that enables our global employees to create products and services that further our mission.

Information regarding our diversity and racial equity initiatives is available at microsoft.com/diversity and microsoft.com/racial-equity-initiative, and we detail our approach to human capital management across topics ranging from culture to pay equity to learning and development and more in the “Human Capital Resources” section of our Form 10-K for the fiscal year ended June 30, 2023. Microsoft’s Board and its Compensation Committee provide oversight and guidance to management on workplace and culture.

Privacy and Cybersecurity

Microsoft is committed to integrating privacy and security into product, service, and technology design. As we articulate in our Privacy Principles, we value, protect, and defend privacy and empower people and organizations to control their data and have meaningful choices in how it is used. More information is available at microsoft.com/privacy. Microsoft’s Environmental, Social, and Public Policy Committee provides oversight and guidance on Microsoft’s privacy policies and programs.

Cybersecurity is a central challenge in the digital age and Microsoft is in the midst of a five-year public commitment to invest $20 billion to accelerate efforts to integrate cybersecurity protection by design and deliver advanced enterprise security solutions. Every service and product line at Microsoft has a dedicated security team as well as cross-company researchers, analysts, and other experts supporting our security products and services. We have established specialized groups such as the Microsoft Threat Intelligence Center focused on threat tracking, the Microsoft Digital Crimes Unit, which partners with law enforcement agencies around the world to fight cybercrime, and the Digital Threat Analysis Center, which detects, assesses, and disrupts digital threats to Microsoft, its customers, and democracies worldwide. Microsoft’s Board maintains direct oversight over cybersecurity risk. The

| 8 |

|

| 1 |

GOVERNANCE AND DIRECTORS

|

2 |

NAMED |

3 |

AUDIT |

4 |

PROPOSALS TO |

5 |

INFORMATION | |||||||||

|

|

||||||||||||||||||

Board receives and provides feedback on regular updates from management regarding cybersecurity governance processes, the status of projects to strengthen internal cybersecurity, security features of the products and services we provide our customers, and the results of security breach simulations.

Racial Equity Initiative

We are committed to addressing racial injustice and inequity in the United States for Black and African American communities and helping improve lived experiences at Microsoft, in employees’ communities, and beyond. With input and feedback from employees and community leaders, we developed a set of actions that we believe are meaningful to improve the lived experience at Microsoft as well as drive change in the communities in which we live and work. Our Racial Equity Initiative focuses on three multi-year pillars, each containing actions and progress we expect to make or exceed by 2025. Details on the components of this important initiative and a fact sheet on our progress three years after its launch are available at microsoft.com/racial-equity-initiative. Microsoft’s Board, its Environmental, Social, and Public Policy Committee, and its Compensation Committee provide oversight on many aspects of the Company’s commitments through its Racial Equity Initiative.

Board of Directors Oversight Roles

Shareholders elect our Board to serve their long-term interests and to oversee management. Our Board and its committees work closely with management to provide oversight, review, and counsel related to long-term strategy, risks and opportunities, and feedback from shareholders. Our Board works with management to determine our mission and long-term strategy. It also oversees business affairs, integrity, risk management, CEO succession planning, and performs the annual CEO evaluation. Our Board looks to the expertise of its committees to provide strategic oversight in their areas of focus. Significant oversight areas are provided below.

Strategy

Led by our CEO, senior management develops and executes our business strategy. They manage our operations and work to model our desired culture, create innovative products, establish accountability, and control risk. Our CEO and senior management also align our structure, operations, people, policies, and compliance efforts to our mission and strategy.

Overseeing management’s development and execution of the Company’s strategy is one of our Board’s primary responsibilities. The Board works closely with senior management to respond to a dynamic business environment. Management benefits from the insights and perspectives of a diverse mix of directors with complementary qualifications, expertise, and attributes. Senior management and other leaders from across the Company provide business and strategy updates to our Board through regular strategy-focused meetings. At meetings throughout the year, the Board also assesses the strategic alignment of the Company’s budget and capital plan, business initiatives, and its strategic acquisition and integration process. For major initiatives, such as our approach to AI, the Board engages with management on strategic vision, investments, partnerships, capital requirements, and risks. For large acquisitions such as Activision Blizzard, GitHub, LinkedIn, and Nuance Communications, the Board engages management on a broad range of considerations, such as due diligence findings, valuation, and integration planning.

Risk Oversight

The Board of Directors

Effective risk management is critical to Microsoft’s ability to achieve its mission. The Board exercises direct oversight of strategic risks to the Company and other risk areas not delegated to one of the Board’s committees. For example, the Board maintains direct oversight over cybersecurity risk. The Board receives and provides feedback on regular updates from management regarding cybersecurity governance processes, the status of projects to strengthen internal cybersecurity, security features of the products and services we provide our customers, and the results of security breach simulations. The Board also discusses recent incidents throughout the industry and the emerging threat landscape.

| 2023 PROXY STATEMENT |

9 |

| 1 |

GOVERNANCE AND DIRECTORS

|

2 |

NAMED |

3 |

AUDIT |

4 |

PROPOSALS TO |

5 |

INFORMATION | |||||||||

|

|

||||||||||||||||||

The committees are charged with specific areas of risk oversight, summarized below, and regularly report back to the full Board.

|

Audit |

Compensation |

Environmental, Social, and Public Policy Committee

|

Governance and Nominating Committee

| |||||||||||||||

| Oversees Microsoft’s processes to manage risk. Oversees the Company’s financial statements; compliance with legal and regulatory requirements and corporate policies and controls, including controls over financial reporting, computerized information systems and security; and the independent auditor and internal audit function.

|

Oversees the Company’s compensation and benefits programs; human capital management and diversity and inclusion principles and programs; senior management succession planning and compensation; and advises the Board on CEO compensation. | Oversees key non-financial regulatory risks; management policies and programs relating to key environmental and social matters, including climate change and environmental sustainability, competition and antitrust, privacy, trade, digital safety, responsible AI, accessibility, human rights, and responsible sourcing; and reviews government relations activities and public policy agenda. | Oversees director selection and succession planning; Board effectiveness and independence, committee functions and charters; adherence to our corporate governance framework; and other corporate governance matters. | |||||||||||||||

Company Management

The Board, in consultation with each of its committees, oversees Company management in exercising its responsibility managing risk. The Board relies upon senior management to supervise risk management activities within the Company. Senior management is responsible for developing a continuously improving culture of risk-aware practices to identify and manage the appropriate level of risk in pursuit of our business objectives. On a regular basis, the Board and its committees engage with our senior management, our chief risk executive and chief compliance officer, and other members of management on risk as part of broad strategic and operational discussions which encompass interrelated risks, as well as on a risk-by-risk basis. Senior management is supported in these efforts through the operation of our enterprise risk management program. The program involves the input of management, the enterprise risk organization, a risk management community within our business teams, and subject matter experts from across the Company, and drives the identification, prioritization, and mitigation of the Company’s most significant risks. In addition, risk management is supported by our compliance organization, investigatory teams, internal audit and external audit reviews, and our legal department. Microsoft has also established robust standards of business conduct that apply to all employees globally and provides numerous methods for employees to elevate risk concerns directly to management or through anonymous channels.

Culture and Workplace

Our culture isn’t what we talk or write about; it’s what we live every day. Our senior management holds itself accountable for modeling the culture we strive for. We focus on creating a respectful, rewarding, diverse, and inclusive work environment where people can thrive, where they can do their best work, where they can proudly be their authentic selves, guided by our values, and where they know their needs can be met. Key to this environment is cultivating a growth mindset, where our workforce is focused on learning, listening, and growing.

Our employee listening systems enable us to gather feedback directly from our workforce to inform our programs and employee needs globally. Employees participate in our Employee Signals surveys, which cover a variety of topics such as thriving, inclusion, team culture, wellbeing, and learning and development. We also collect Daily Signals employee survey responses, giving us real-time insights into ways we can support our employees. In addition to Employee Signals and Daily Signals surveys, we gain insights through onboarding, exit surveys, internal Viva Engage channels, employee Q&A sessions, and our internal AskHR Service support. The Board and the Compensation Committee engage with senior management, including Human Resources executives, across a broad range of human capital management topics. Management prepares and reviews with the Board a variety of materials including culture, succession planning and development, compensation, benefits, employee recruiting and retention, and diversity and inclusion. Additionally, each year the Compensation and Audit Committees evaluate management’s annual assessment of risk related to our compensation policies and practices, including reviewing the work of management’s Sales Incentive Compensation Governance Committee.

| 10 |

|

| 1 |

GOVERNANCE AND DIRECTORS

|

2 |

NAMED |

3 |

AUDIT |

4 |

PROPOSALS TO |

5 |

INFORMATION | |||||||||

|

|

||||||||||||||||||

Microsoft Board Review of Sexual Harassment and Gender Discrimination Policies

In early 2022, the Board initiated an independent review of the effectiveness of the Company’s sexual harassment and gender discrimination policies and practices. Recognizing the importance of these issues to employees, shareholders, and other stakeholders, the Board directed that a third-party assessment be conducted to address the full scope of an advisory shareholder resolution approved by shareholders at the 2021 Annual Meeting. Throughout 2022, the law firm ArentFox Schiff LLP has worked to review and assess the Company’s policies and procedures relating to sexual harassment and gender discrimination, including reviewing the Company’s internal documents, interviewing executives and employees, and benchmarking against best practices at other companies. ArentFox provided the Board with a report detailing its findings and recommendations and Microsoft’s management team has prepared an implementation plan that addresses all the recommendations in the ArentFox report. The Board thoroughly reviewed the ArentFox report and approved the specific actions in the implementation plan. Microsoft published a full transparency report from ArentFox containing their findings and recommendations and published Microsoft’s implementation plan. Microsoft has now fully implemented the report’s recommendations and board-approved implementation plan and begun annual reporting of workplace investigations data at www.microsoft.com/transparency.

Our Governance Structure

Framework

We have developed a corporate governance framework designed to ensure our Board has the authority and practices in place to review and evaluate our business operations and to make decisions independent of management. Our goal is to align the interests of directors, management, and shareholders, and comply with or exceed the requirements of the Nasdaq Stock Market LLC (“Nasdaq”) and applicable laws and regulations. This framework establishes the practices our Board follows with respect to, among other things, Board composition and member selection, Board meetings and involvement of senior management, director compensation, CEO performance evaluation, management succession planning, and Board committees. The Board is committed to seeking opportunities for improvements on an ongoing basis. Each summer, the Board updates our corporate governance framework based on shareholder feedback, results from the annual shareholders meeting, the Board and committees’ annual assessments, governance best practices, and regulatory developments. Our Board maintains a variety of documents detailing the directives and procedures associated with corporate governance at Microsoft, listed below. These documents are available on our website at aka.ms/policiesandguidelines.

| • Articles of Incorporation • Bylaws • Corporate Governance Guidelines • Director Independence Guidelines • Microsoft Finance Code of Professional Conduct • Microsoft Standards of Business Conduct (“Trust Code”) • Audit Committee Charter and Responsibilities Calendar

|

• Compensation Committee Charter • Environmental, Social, and Public Policy Committee Charter • Governance and Nominating Committee Charter • Executive Stock Ownership Policy • Executive Compensation Recovery Policy • Compensation Consultant Independence Standards |

Shareholder Rights

Microsoft strives to implement best practices in shareholder rights and to ensure the Company and Board align with the long-term interests of shareholders. We have enhanced our corporate governance framework over time based on input from our Board, shareholders, and other governance experts. Shareholder rights include:

| • | Single class of shares with each share entitled to one vote |

| • | Annual election of all directors (unclassified board) |

| • | Majority voting standard for directors in uncontested elections |

| • | Confidential voting policy |

| • | Shareholders of 15% of outstanding shares have the right to call a special meeting |

| • | Proxy access bylaw allows groups of up to 20 shareholders holding 3% of shares for at least three years to nominate up to two individuals or 20% of the Board (whichever is greater) for inclusion in the proxy statement and ballot for election at an annual shareholders meeting |

| 2023 PROXY STATEMENT |

11 |

| 1 |

GOVERNANCE AND DIRECTORS

|

2 |

NAMED |

3 |

AUDIT |

4 |

PROPOSALS TO |

5 |

INFORMATION | |||||||||

|

|

||||||||||||||||||

Other requirements that align Company and long-term interests of shareholders include:

| • | Significant stock ownership requirements for directors, executive officers, and other senior leaders |

| • | Strong ‘no-fault’ executive compensation recovery (“clawback”) policy that applies to executive officers, other senior leaders, and our chief accounting officer |

| • | Strict hedging and pledging prohibitions against our directors and executive officers hedging their ownership of Microsoft stock, including by trading in options, puts, calls, or other derivative instruments related to Company equity or debt securities. Directors and executive officers are prohibited from purchasing Microsoft stock on margin, borrowing against Microsoft stock held in a margin account, or pledging Microsoft stock as collateral for a loan |

| • | Board tenure policy that seeks to maintain an average tenure of 10 years or less for the Board’s independent directors as a group |

| • | Public company board service guideline that, absent circumstances that enable the director to have sufficient capacity, generally no director should serve on more than three other public company boards. Directors who are current CEOs should not serve on more than one other public company board |

Shareholder Engagement

Effective corporate governance includes regular, constructive conversations with our shareholders to proactively seek shareholder insights and to answer shareholder inquiries. We maintain an active dialogue with shareholders to ensure we thoughtfully consider a diversity of perspectives on issues including strategy, business performance, risk, culture and workplace topics, compensation practices, and a broad range of environmental and social topics. As noted above, the Board updates our corporate governance framework each summer based on a number of inputs, including shareholder feedback.

Our Office of the Corporate Secretary coordinates shareholder engagement with Investor Relations and provides a summary of all relevant feedback to our Board. In fiscal year 2023, members of our Board and management engaged with a cross-section of shareholders owning approximately 50% of Microsoft shares. In addition, throughout the year our Investor Relations group engages with our shareholders, frequently along with Satya Nadella, our Chairman and CEO, and Amy Hood, our CFO.

To communicate broadly with our shareholders, we also seek to transparently share relevant information through our Investor Relations website, our Annual Report, this Proxy Statement, our Reports Hub, and in posts on the Microsoft On the Issues blog.

Board Leadership

The Board’s independent directors elected Satya Nadella to the role of Chairman and CEO. In March 2023, the independent directors elected Sandra Peterson as Lead Independent Director. She succeeds John Thompson, who had served in the roles of Lead Independent Director or Board Chair since 2012.

In his role, Mr. Nadella leverages his deep understanding of the business to elevate the right strategic opportunities and identify key risks and mitigation approaches for the Board’s review. As Lead Independent Director, Ms. Peterson retains significant authority including providing input on behalf of the independent directors on Board agendas and schedules, calling meetings of the independent directors, authorizing retention of outside counsel, advisors, or other consultants, setting agendas for executive sessions, leading performance evaluations of the CEO, and overseeing CEO succession planning. Additional information about the role of the Lead Independent Director is described in this Part 1 under “Board Independence” below.

The Board does not have a policy as to whether the Chairman should be an independent director, an affiliated director, or a member of management. The independent directors annually appoint a Chairman of the Board. To ensure robust independent leadership on the Board, if the individual appointed as Chairman is not an independent director, or when the independent directors determine that it is in the best interests of the Company, the independent directors will also annually appoint a Lead Independent Director. Our Board believes its current leadership structure is appropriate because it effectively allocates authority, responsibility, and oversight between management and the independent members of our Board. It does this by giving primary responsibility for the operational leadership and strategic direction of the Company to our Chairman and Chief Executive Officer, while enabling the Lead Independent Director to facilitate our Board’s independent oversight of management, promote communication between management and our Board, and support our Board’s consideration of key governance matters. The Board believes its programs for overseeing risk, as described in this Part 1 under “Risk Oversight,” would be effective under a variety of leadership frameworks and therefore do not materially affect its choice of structure.

| 12 |

|

| 1 |

GOVERNANCE AND DIRECTORS

|

2 |

NAMED |

3 |

AUDIT |

4 |

PROPOSALS TO |

5 |

INFORMATION | |||||||||

|

|

||||||||||||||||||

CEO Succession

A primary responsibility of the Board is planning for CEO succession and overseeing identification and development of other members of the senior leadership team (“SLT”). The Board and the Compensation Committee work with the CEO and our Chief Human Resources Officer to plan for succession. For the CEO, the succession plan covers identification of internal and external candidates, and professional and leadership development plans for internal candidates. The Board annually reviews the CEO succession plan. The criteria used to assess potential CEO candidates are formulated based on the Company’s business strategies, and include strategic vision, leadership, and operational execution. The Board is committed to actively seeking highly qualified women and individuals from minority groups to include in the pool of potential CEO candidates. The Board maintains an emergency succession contingency plan that is reviewed on an annual basis by the Board and Governance and Nominating Committee. The plan identifies roles and responsibilities of individuals who would act if an unforeseen event prevented the CEO from continuing to serve. The Compensation Committee reviews with the CEO and reports to the Board on development and succession plans for the other members of the SLT. The Board may review development and succession planning more frequently as it deems necessary or desirable.

Annual Board and Committee Evaluation Process

The Board is committed to a rigorous self-evaluation process. The Governance and Nominating Committee annually evaluates the performance of the Board. In fiscal year 2023, the evaluation included utilizing a third-party facilitator to seek feedback from each director on the performance of the Board and each committee. The results were reported to and discussed with the Board and each relevant committee.

Our evaluation process is designed to elicit feedback on the processes, structure, composition, and effectiveness of the Board and each committee. The evaluation results have facilitated increased Board and committee effectiveness, including driving clarity on key areas for the Board’s focus over the coming year, focus on sustainable growth strategies for the Company, and input on management development and succession planning as well as Board and committee composition and recruiting.

Director Attendance

Each quarter, our Board holds two-day meetings comprised of committee and Board meetings. At each quarterly Board meeting, time is set aside for the independent directors to meet without management present. Additional executive sessions are held as needed.

In addition to the quarterly meetings, typically there are other regularly scheduled Board and committee meetings and several special meetings each year. Our Board met nine times during fiscal year 2023. In addition, the Board held periodic meetings dedicated to strategy topics which included presentations and discussions with members of our SLT and other senior management.

Each director nominee attended at least 75% of the aggregate of all fiscal year 2023 meetings of the Board and each committee on which he or she served. In fiscal year 2023, the Board and committees of the Board held a total of 35 meetings. Together, the director nominees attended at least 95% of the combined total meetings of the Board and the committees on which they were members in fiscal year 2023.

Directors are expected to attend the annual shareholders meeting, if practicable. All directors attended the 2022 Annual Meeting.

Director Orientation and Continuing Education

Our orientation programs are designed to familiarize new directors with our businesses, strategies, and policies and assist new directors in developing Company and industry knowledge to optimize their service on the Board.

Regular continuing education programs enhance the skills and knowledge directors use to perform their responsibilities. These programs may include internally developed programs or programs presented by third parties.

Director Stock Ownership Policy

To align the interests of our directors and shareholders, our directors are required to own Microsoft shares equal in value to at least three times the base annual retainer (cash and stock) payable to a director. Each director must retain 50% of all net shares (post-tax) from the retainer until reaching the minimum share ownership requirement. Stock deferred under the Deferred Compensation Plan for Non-Employee Directors counts toward the minimum ownership requirement. Each of our directors complied with our stock ownership policy in fiscal year 2023.

| 2023 PROXY STATEMENT |

13 |

| 1 |

GOVERNANCE AND DIRECTORS

|

2 |

NAMED |

3 |

AUDIT |

4 |

PROPOSALS TO |

5 |

INFORMATION | |||||||||

|

|

||||||||||||||||||

Derivatives Trading, Hedging, and Pledging

Our directors and executive officers are prohibited from trading in options, puts, calls, or other derivative instruments related to Microsoft equity or debt securities. They also are prohibited from purchasing Microsoft common stock on margin, borrowing against Microsoft common stock held in a margin account, or pledging Microsoft common stock as collateral for a loan. Employees, other than executive officers, are generally permitted to engage in transactions designed to hedge or offset market risk.

Board Independence

The Board’s independence enables it to be objective and critical in carrying out its oversight responsibilities. The Corporate Governance Guidelines provide that a substantial majority of our directors will be independent. The independent members of the Board annually appoint a Lead Independent Director to facilitate the Board’s oversight of management, promote communication between management and our Board, engage with shareholders, and lead consideration of key governance matters. Key elements of our Board independence include:

| • | 11 of 12 director nominees are independent. We are committed to maintaining a substantial majority of directors who are independent of the Company and management. Except for our Chairman and CEO, Satya Nadella, all director nominees are independent |

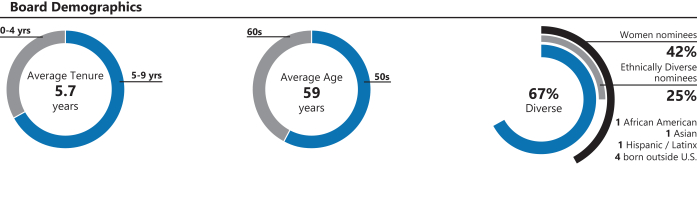

| • | Board tenure. We are committed to board refreshment. To strike a balance between retaining directors with deep knowledge of the Company and adding directors with a fresh perspective, the Board seeks to maintain an average tenure of 10 years or less for its independent directors as a group. The average tenure for our independent director nominees is 5.4 years. The average tenure is 5.7 years if Mr. Nadella is included |

| • | Board diversity. The Board is committed to actively seeking highly qualified women and individuals from minority groups to include in the pool of potential Board nominees and CEO candidates |

| • | Executive sessions of independent directors. At each quarterly Board meeting, time is set aside for the independent directors to meet in executive session without management present. Additional executive sessions are held as needed |

| • | Committee independence. Only independent directors are members of the Board’s committees. Each committee meets regularly in executive session |

| • | Independent compensation consultant. The compensation consultant retained by the Compensation Committee is independent of the Company and management as required by the Compensation Consultant Independence Standards |

| • | Lead Independent Director. The Lead Independent Director has a clearly defined set of responsibilities, significant authority, and provides independent Board leadership. Sandra Peterson was selected by the independent members of the Board to serve as Lead Independent Director. Key responsibilities and authority include: |

| • | Chairs executive sessions and coordinates activities of the independent directors |

| • | Leads the Board’s annual CEO performance evaluation |

| • | Coordinates Board oversight of CEO succession planning, including maintenance of an emergency succession plan |

| • | Chairs the annual shareholders meeting |

| • | Acts as liaison between the independent directors and the Chairman and CEO |

| • | Authorizes retention of outside counsel, advisors, or other consultants who report directly to the Board |

| • | Leads the Board meetings when the Chairman and CEO is not present |

| • | Reviews and approves the agenda and schedule for Board meetings |

| • | Calls meetings of the independent directors |

| • | When requested, represents the Board with internal and external audiences including shareholders |

| 14 |

|

| 1 |

GOVERNANCE AND DIRECTORS

|

2 |

NAMED |

3 |

AUDIT |

4 |

PROPOSALS TO |

5 |

INFORMATION | |||||||||

|

|

||||||||||||||||||

Board Committees

To support effective corporate governance, our Board delegates certain responsibilities to its committees, who report on their activities to the Board. These committees have the authority to engage legal counsel or other advisors or consultants as they deem appropriate to carry out their responsibilities. Our Board has four standing committees: an Audit Committee, a Compensation Committee, an Environmental, Social, and Public Policy Committee, and a Governance and Nominating Committee.

The table below provides current membership for each Board committee, followed by a summary of each committee’s responsibilities. Each committee has a charter describing its specific responsibilities which can be found on our website at aka.ms/ boardcommittees.

| Director |

Audit | Compensation | Environmental, Social, and Public Policy |

Governance and Nominating | ||||

| Reid G. Hoffman |

|

|

Member |

| ||||

| Hugh F. Johnston |

Chair, Financial Expert |

|

|

| ||||

| Teri L. List |

Financial Expert and Member |

|

|

Member | ||||

| Satya Nadella |

|

|

|

| ||||

| Sandra E. Peterson |

|

Member |

|

Chair | ||||

| Penny S. Pritzker |

|

|

Chair |

| ||||

| Carlos A. Rodriguez |

Financial Expert and Member |

Chair |

|

| ||||

| Charles W. Scharf |

|

Member |

|

Member | ||||

| John W. Stanton |

Member |

|

Member |

| ||||

| John W. Thompson* |

|

|

Member | Member | ||||

| Emma N. Walmsley |

|

Member | Member |

| ||||

| Padmasree Warrior* |

|

Member |

|

| ||||

| Number of meetings in fiscal year 2023 |

9 | 6 | 4 | 7 | ||||

| * | Mr. Thompson and Ms. Warrior will not seek re-election at the 2023 Annual Meeting. Catherine MacGregor and Mark Mason are both nominated for election to the Board at the Annual Meeting. The Board will consider committee appointments for Ms. MacGregor and Mr. Mason if they are elected to the Board. |

Audit Committee

| • | Oversee the work of our accounting function and internal control over financial reporting |

| • | Oversee internal auditing processes |

| • | Inquire about significant risks, review our policies for enterprise risk assessment and risk management, and except as to those risks for which oversight has been assigned to other committees of the Board or retained by the Board, assess the steps management has taken to control these risks |

| • | Review with management policies, practices, compliance, and risks relating to our investment portfolio |

| • | Review with management the Company’s business continuity, resiliency, and disaster preparedness planning |

| • | Review compliance with significant applicable legal, ethical, and regulatory requirements, including those relating to regulatory matters that may have a material impact on our consolidated financial statements or internal control over financial reporting |

The Audit Committee is responsible for the compensation, retention, and oversight of the independent auditor engaged to issue audit reports on our consolidated financial statements and internal control over financial reporting. The Audit Committee relies on the expertise and knowledge of management, the internal auditor, and the independent auditor in carrying out its oversight responsibilities.

The Board has determined that each Audit Committee member has sufficient knowledge in financial and auditing matters to serve on the Audit Committee. All current members of the Audit Committee meet the Nasdaq listing standard of financial sophistication and three are “audit committee financial experts” under Securities and Exchange Commission (“SEC”) rules.

As provided in our Corporate Governance Guidelines, members of the Audit Committee ordinarily may not serve on over three public company audit committees (including Microsoft’s). In calculating service on a public company board or audit committee,

| 2023 PROXY STATEMENT |

15 |

| 1 |

GOVERNANCE AND DIRECTORS

|

2 |

NAMED |

3 |

AUDIT |

4 |

PROPOSALS TO |

5 |

INFORMATION | |||||||||

|

|

||||||||||||||||||

service on a board or audit committee of a parent and its substantially-owned subsidiary counts as service on a single board or audit committee. Any Audit Committee member’s service on over three public company audit committees will be subject to the Board’s determination that the member is able to effectively serve on the Company’s Audit Committee. The Governance and Nominating Committee and the Board considered Ms. List’s service on four public company audit committees, including her professional qualifications, former experience as a public company chief financial officer, and the nature of and time involved in her service on other boards. Following such review, the Board determined that Ms. List is able to effectively continue to serve on the Company’s Audit Committee.

Compensation Committee

| • | Assist our Board in establishing the annual goals and objectives of the CEO |

| • | Establish the process for annually reviewing the CEO’s performance |

| • | Recommend our CEO’s compensation to the independent members of our Board for approval |

| • | Approve annual compensation, and in consultation with the CEO, oversee performance evaluations, for the non-CEO members of the SLT |

| • | Review and discuss with the CEO and report to the Board development and corporate succession plans for the non-CEO members of the SLT |

| • | Oversee administration of the Company’s equity-based compensation and retirement plans |

| • | Monitor and evaluate the compensation and benefits structure of Microsoft as the Committee deems appropriate, including policies regarding SLT compensation |

| • | Oversee and advise the Board and management about Company programs for diversity and inclusion and human capital management |

| • | Periodically review the compensation paid to non-employee directors and make recommendations to our Board for any adjustments |

| • | Oversee the process and review the results of investigations of any sexual harassment complaints against senior officers. The Committee will report to the full Board on the conclusions of any investigation that results in a founded determination and the disciplinary and other actions taken |

Our senior executives for Human Resources support the Compensation Committee in its work. The Committee may delegate its authority to subcommittees and to one or more designated members of the Committee. The Committee may delegate to one or more executive officers the authority to make grants of equity-based compensation to eligible individuals who are not executive officers and to administer the Company’s equity-based compensation plans. The Committee has delegated to senior management the authority to make stock award grants to employees who are not members of the SLT or Section 16 officers and to administer the Company’s equity-based compensation plans.

Independent compensation consultant. The Compensation Committee retained Pay Governance LLC as an independent compensation consultant throughout fiscal year 2023. The consultant advises the Committee on marketplace trends in executive compensation, management proposals for compensation programs, and executive officer compensation decisions. The consultant also evaluates compensation for non-employee directors, the next levels of senior management, and equity compensation programs generally. The consultant discusses recommendations to the Board on CEO compensation with the Committee, and is directly accountable to the Committee. To maintain the independence of the consultant’s advice, the firm does not provide services to Microsoft other than those described above. The Committee has adopted Compensation Consultant Independence Standards which can be viewed on our website at aka.ms/policiesandguidelines. These standards require that the Committee annually assess the independence of its compensation consultant. A consultant satisfying the following requirements will be considered independent. The consultant (including each individual employee of the consultant providing services):

| • | Is retained and terminated by, has its compensation fixed by, and reports solely to, the Compensation Committee |

| • | Is independent of the Company |

| • | Will not perform any work for Company management except at the request of the Compensation Committee Chair and in the capacity of the Committee’s agent |

| • | Should not provide any unrelated services or products to the Company and its affiliates or management, except for surveys purchased from the consultant’s firm |

| 16 |

|

| 1 |

GOVERNANCE AND DIRECTORS

|

2 |

NAMED |

3 |

AUDIT |

4 |

PROPOSALS TO |

5 |

INFORMATION | |||||||||

|

|

||||||||||||||||||

In assessing the consultant’s independence, the Compensation Committee considers the nature and amount of work performed for the Committee during the year, the nature of any unrelated services performed for the Company, and the fees paid for those services in relation to the firm’s total revenue. The consultant annually prepares for the Committee an independence letter providing assurances and confirmation of the consultant’s independent status under the standards. The Committee believes that Pay Governance has been independent during its service for the Committee.

Environmental, Social, and Public Policy Committee

| • | Assist the Board in overseeing the Company’s key non-financial regulatory risks that may have a material impact on the Company and its ability to sustain trust with customers, employees, and the public |